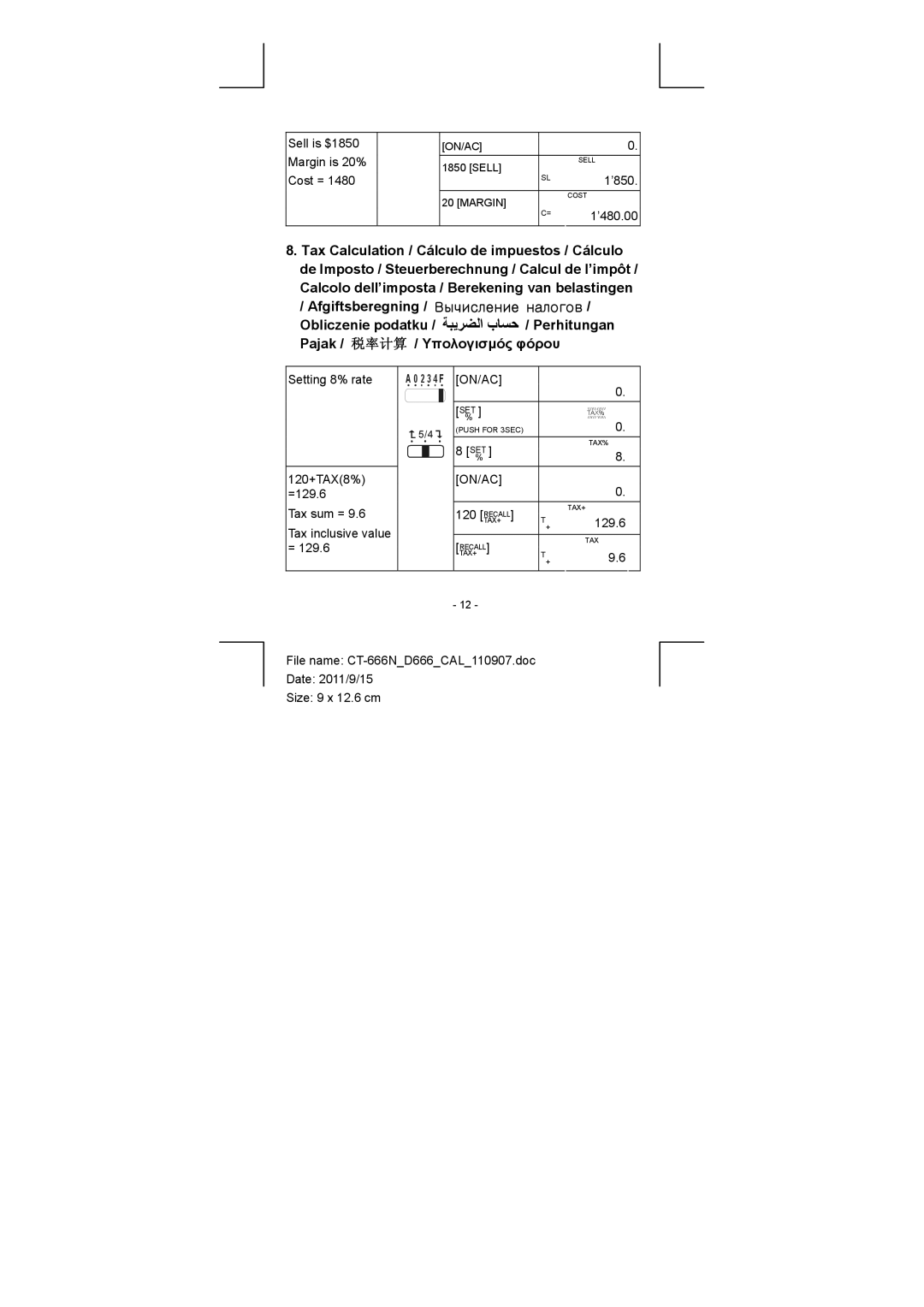

Sell is $1850 Margin is 20% Cost = 1480

[ON/AC] |

| 0. | |

1850 [SELL] |

| SELL | |

SL | 1’850. | ||

| |||

|

| ||

20 [MARGIN] |

| COST | |

C= | 1’480.00 | ||

| |||

|

|

8.Tax Calculation / Cálculo de impuestos / Cálculo de Imposto / Steuerberechnung / Calcul de l’impôt / Calcolo dell’imposta / Berekening van belastingen

/ Afgiftsberegning / Вычисление налогов / Obliczenie podatku / ﺔﺒﻳﺮﻀﻟا بﺎﺴﺣ / Perhitungan Pajak / 税率计算 / Yπολογισμός φόρου

Setting 8% rate

120+TAX(8%)

=129.6

Tax sum = 9.6

Tax inclusive value = 129.6

A 0 2 3 4F | [ON/AC] |

| 0. |

| |

|

|

|

|

| |

|

| [SET ] |

| TAX% | |

|

| % |

| \\\\\///// |

|

|

| ///// \\\\\ |

| ||

|

| (PUSH FOR 3SEC) |

| 0. |

|

|

| 8 [SET ] |

| TAX% | |

|

|

| 8. |

| |

| % |

|

| ||

|

| [ON/AC] |

| 0. |

|

|

|

|

|

| |

|

| 120 [RECALL] |

| TAX+ | |

|

| T+ | 129.6 |

| |

|

| TAX+ |

| ||

|

| [TAX+RECALL] |

| TAX | |

|

| T+ | 9.6 |

| |

|

|

|

| ||

- 12 -

File name:

Date: 2011/9/15

Size: 9 x 12.6 cm