PROGRAMMING

3-2. DECIMAL POINT & TAX INFORMATION

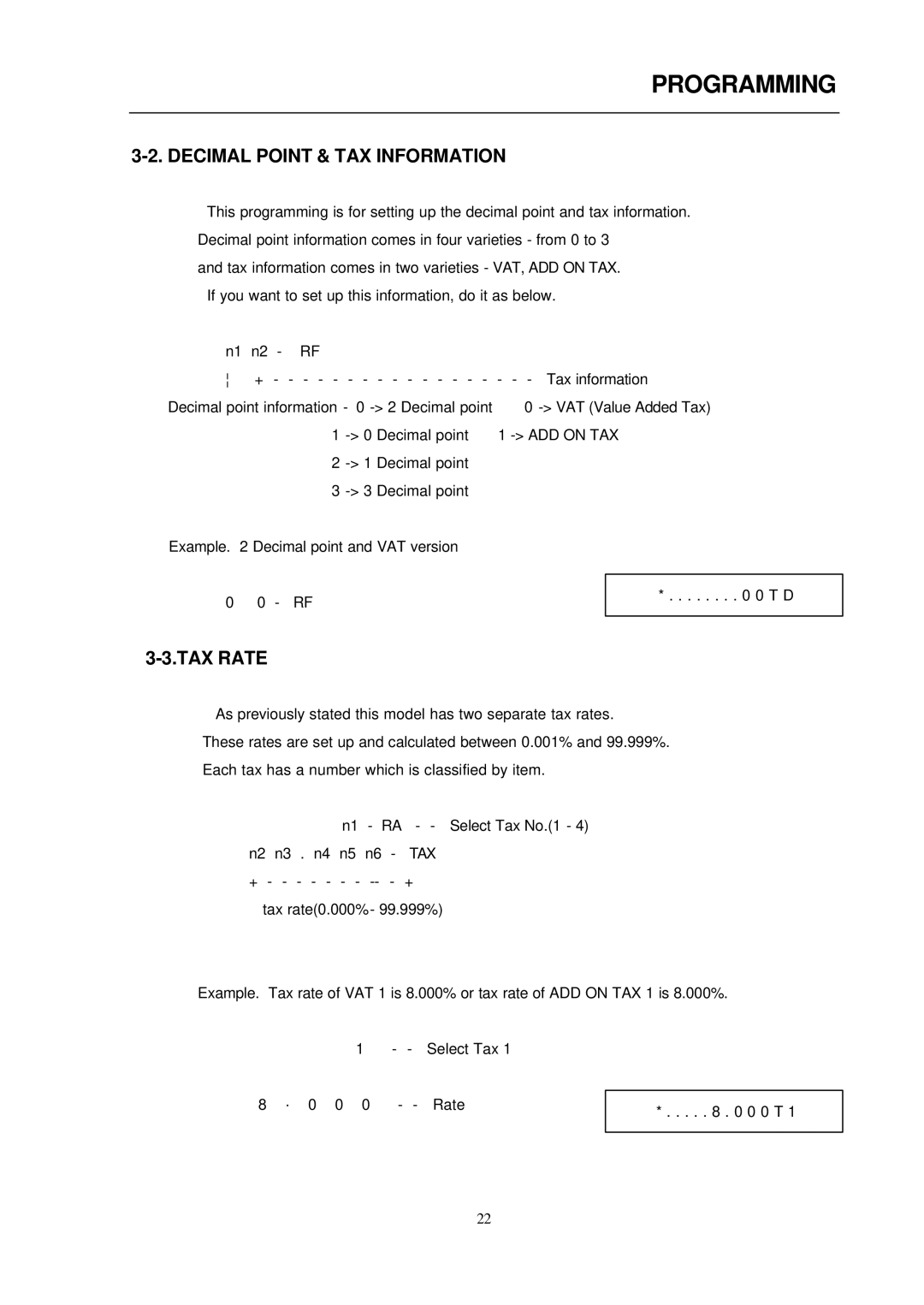

This programming is for setting up the decimal point and tax information.

Decimal point information comes in four varieties - from 0 to 3

and tax information comes in two varieties - VAT, ADD ON TAX. If you want to set up this information, do it as below.

n1 n2 - RF

¦+ - - - - - - - - - - - - - - - - - - Tax information

Decimal point information - 0 | 0 |

1 | 1 |

2 |

|

3 |

|

Example. 2 Decimal point and VAT version |

|

0 0 - RF

* . . . . . . . . 0 0 T D

3-3.TAX RATE

As previously stated this model has two separate tax rates.

These rates are set up and calculated between 0.001% and 99.999%. Each tax has a number which is classified by item.

n1 - RA | - - Select Tax No.(1 - 4) | |

n2 n3 . n4 n5 n6 - | TAX | |

+ - - - - - - - | ||

tax rate(0.000% | - 99.999%) | |

Example. Tax rate of VAT 1 is 8.000% or tax rate of ADD ON TAX 1 is 8.000%.

1 - - Select Tax 1

8 · 0 0 0 | - - Rate |

* . . . . . 8 . 0 0 0 T 1

22