Electronic Cash Register Caja Registradora Electronica

For Your Records

For Easy Set-up, see

Introduction

U T I O N

Getting Started

Contents

Correction After Finalizing a Transaction Void mode

Auxiliary Function Programming

Parts and Their Functions

External View Front view Rear view

Key names

Mode Switch and Mode Keys

Keyboard layout

11 M

Drawer Lock Key

Machine state symbols

Displays

Operator display Customer display Pop-up type

Getting Started

Be careful with the paper cutter, so as not to cut yourself

Installing a paper roll

When not using the take-up spool using as receipt paper

When using the take-up spool using as journal paper

Date Time Tax

Starting sales entries

Printing guidance messages

Help Function

Printing the help menu

Key operation Print

Memo

Things to do before you start sales entries

Things you can do for sales entries

Things to do after you close your store

1500

Basic Sales Entry

Basic Sales Entry Example

5000

Error escape function

Error Warning

Power Save Mode

Clerk assignment

Item Entries Single item entries

Department entries

PLU/sub-department entries

Repeat entries

Multiplication entries

Split pricing entries

Single item cash sale Sics entry

Displaying Subtotals

Finalization of Transaction Cash or check tendering

Charge credit sale

300 +

Cash or check sale that does not require entry

Mixed-tender sale

Tax Calculation Automatic tax

800 50 t

725 515 Ts t Us t

Manual tax

1345 T

25 TUp 400 U

Tax status shift

1050 TU

140 570 10 %

Optional Features

Discount and premium entries using the discount key

800 + P5 %

675

575 +

100

250 f+

Applying preset conversion rate

Auxiliary Payment Treatment Currency conversion

Applying manual conversion rate

Automatic Sequence Key akey Entries

Received-on Account and Paid-out Entries

No sale exchange

12345 s 4800 r

Correction

600 328

Correction of the Last Entry direct void

Subtotal Void

1310 1755 +

Basic Function Programming

Procedure for programming

Prior to Programming

Date and Time Programming

Tax Programming for Automatic Tax Calculation Function

Tax programming using a tax rate

Time

1430 s

12 s

Tax table applicable to the add-on tax

Sample tax table

First figure

100 @ 11 @

111

Limitations to the entry of minimum breakpoints

Modification of the left tax table

Quantity for doughnut tax exempt for Canadian tax system

Sample tax table Example 8%

19 @

Department Programming

Auxiliary Function Programming

@ a

Department status

00011173 @

Preset unit price

PLU Price Look-Up and Sub-department Programming

1000

Unit price and associated department assignment

PLU/sub-department selection

125 #

Miscellaneous Key Programming

Rate for %, &

10 P 25 % 7674

Function parameters for %, &

Amount for

Percent rate limitation for %

200

00 @

Function parameters for

00011006 @

+/- sign

Entry digit limit for r, R and t

Function parameters for C, c and a when using as CA key

Cor c

018 @

Text Programming

Using character keys on the keyboard

Hijk N01

Entering character codes with numeric keys on the keyboard

231

Alphanumeric character code table

Department text

S1 P

S2 P

PLU text item label

List of function texts

46 @ Card s

David s

Clerk names

Logo messages

Logo print format 6 types

Advanced Programming

SSS sA

S1 @

Consecutive numbers

90 @ *A a

S2 @

Electronic Journal EJ Programming

Function parameters for EJ

PGM mode operation records type

Action when EJ memory area is full

S68 @ 00100002 sA

00000100 sA

Various Function Selection Programming

Function selection for miscellaneous keys

Job code Selection Entry

Function selection for tax

Print format

Receipt print format

Printing style

Other programming

Compression printing

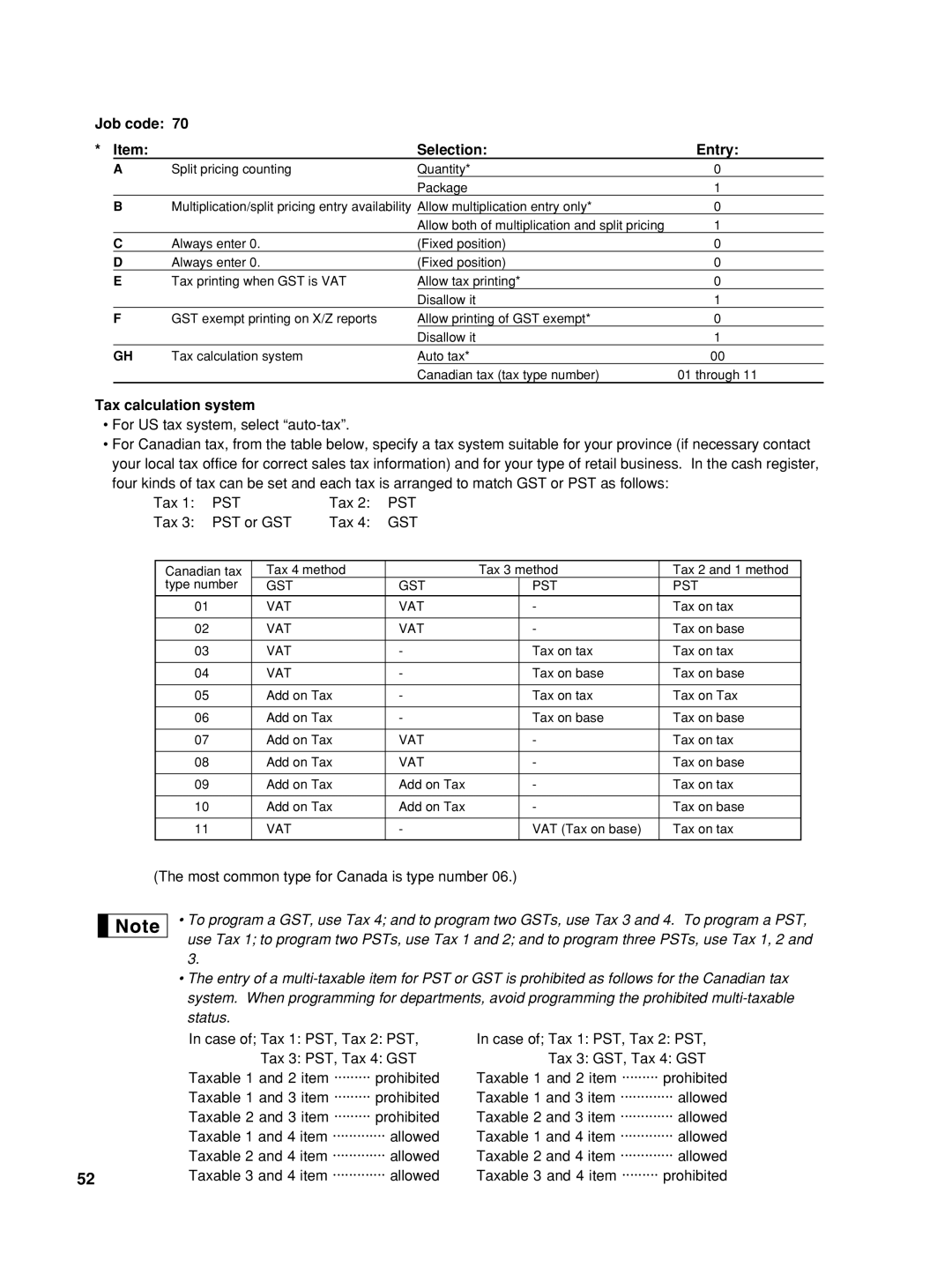

Tax calculation system

GST

11 @

Power save mode

10 @ *ABCD s a

Logo message print format

Thermal printer density

Online time out setting

50 @

35 @ 30 sA

86 @

Training clerk specification for training mode

88 @

Language selection

Key sequence for reading stored program

Auto key programming Automatic sequence key

Reading Stored Programs

Auto 2 p100 +

Sample printouts

Programming report

Programming report Printer density programming report

Training Mode

25 L 1000

Auto key programming report

Reading X and Resetting Z of Sales Totals

Summary of Reading X and Resetting Z Reports

Daily Sales Totals Full sales report

Sample report

Hourly report

Clerk reports

PLU sales report

Periodic Consolidation Full sales report

Sample print

710 @ a

Printing journal data on the way of a transaction

Sample EJ report

Incorrect receipt Cancellation receipt

Override Entries

250

HOW to USE AN SD Memory Card

What You Can Do with an SD Memory Card

List of functions

Case of SD Error

SD error code table

Recommended SD memory cards

Formatting an SD Memory Card

140 @ s

Inserting and Removing an SD Memory Card

Inserting an SD memory card

145 @ s

144 @ s

148 @ s

Saving and Restoring All the Data

650 P @ s

141 @ s

147 @ s

Writing and reading all the programming data

750 P @ s

740 @ s

Printing of electronic journal

Operator Maintenance

Case of a Power Failure

Case of Printer Error

Replacing the Batteries

Paper specification

How to set the paper roll

Replacing the Paper Roll

Installing the paper roll

Installing the receipt paper roll

Removing the paper roll

Installing the journal paper roll

Removing the Drawer

Cleaning the Printer Print Head / Sensor / Roller

Removing a Paper Jam

Opening the Drawer by Hand

Before Calling for Service

Error code table

Specifications

XE-A22S

Importante

Para realizar la configuración

Introduccion

Con facilidad, vea el apartado

Indice

Programacion DE LAS Funciones Basicas Para el inicio rápido

Visualizadores

Partes Y SUS Funciones

Selector de modo y llaves de modo

Símbolos del estado de la máquina

Para Empezar

Impresión de mensajes de guía

Funcion DE Ayuda

Impresión del menú de ayuda

Operación de teclas Impresión

Registro Basico DE Ventas

Ejemplo de registro básico de ventas

Ejemplo de operación de teclas

Aviso de error

Registros de artículos Registros de un solo artículo

Registros de sección

Registros de precios divididos

Registros repetidos

Registros de multiplicación

Registros de PLU/subsecciones

~ s 950 a c

Caracteristicas Opcionales

800 50 t a

~ m10 % a

800 +7 P5 %A

675 *-A

Correccion

Programacion DE LAS

Programación de la fecha y de la hora Fecha

Hora

Tabla de impuestos aplicable al impuesto añadido

@2 @4 @12 sA

Tabla de impuestos de muestra

Primer número 1 ó Segundo número 1 a

Programación de secciones

Estado de sección

Limitaciones para el registro de puntos de división mínimos

Precio unitario preajustado

Programación de PLU codificación de precios y subsección

Asignación de precios unitarios y de secciones asociadas

Importe para

Selección de PLU/subsección

Programación de teclas misceláneas Tasa para %, &y

Límite de tasa porcentual para %y

Parámetros de función para %, &y

Parámetros de función para

Límite de dígitos de entrada para r, Ry t

1Elemento Selección Registro

Programación de texto

Empleo de las teclas de caracteres del teclado

Impresión de pie del recibo

Texto de sección

Texto de PLU etiqueta de artículo

P!FRUTA sA

Texto de función

Lista de textos de función

Nombres de dependiente

Mensajes de membrete

Símbolo de divisas

Programacion Avanzada

Tipo de registros de operación en el modo PGM

Programación 1 de selección de diversas funciones

Impresión temporal de EJ durante una transacción

Acción cuando el área de memoria de EJ está llena

Formato de impresión de recibos

Selección de función para teclas misceláneas

Formato de impresión

Código de tarea Elemento Selección Registro

Selección de función para impuestos

Otras programaciones

Impresión comprimida

Sistema de cálculo de impuestos

Ajuste de fin de intervalo en línea

11 @ *A s a

Formato de impresión del mensaje del membrete

Densidad de impresora térmica

Modo DE Instruccion

Programación de la tecla Auto Tecla de secuencia automática

Lectura de programas almacenados

Lectura X Y Reposicion Z DE LOS Totales DE Ventas

Resumen de informes de lectura X y reposición Z

Lectura Y Reposicion DE Informes EJ

@ a 7 P @ a

Inserción y extracción de una tarjeta de memoria SD

Registros DE Anulacion

Como Emplear UNA Tarjeta DE Memoria SD

Inserción de una tarjeta de memoria SD

Formateo de una tarjeta de memoria SD

140

145 @ s 1 a

Memorización y restauración de todos los datos

Escritura de registro diario electrónico

Escritura y lectura de todos los datos de programación

Escritura de datos de ventas

Impresión de registro diario electrónico

Precauciones al manejar la impresora

En el caso de error de impresora

En caso de corte de la alimentación

Reemplazo de las pilas

Instalación del rollo de papel

Reemplazo del rollo de papel

Extracción del rollo de papel

Forma de colocar el rollo de papel

Extracción del papel atascado

Manera

Extracción del cajón

Abertura manual del cajón

Antes de solicitar el servicio de un técnico

Tabla de códigos de error

Memo

END-USER Limited Warranty

Sharp Electronics Corporation

Sharp Plaza, Mahwah, New Jersey BE-SHARP