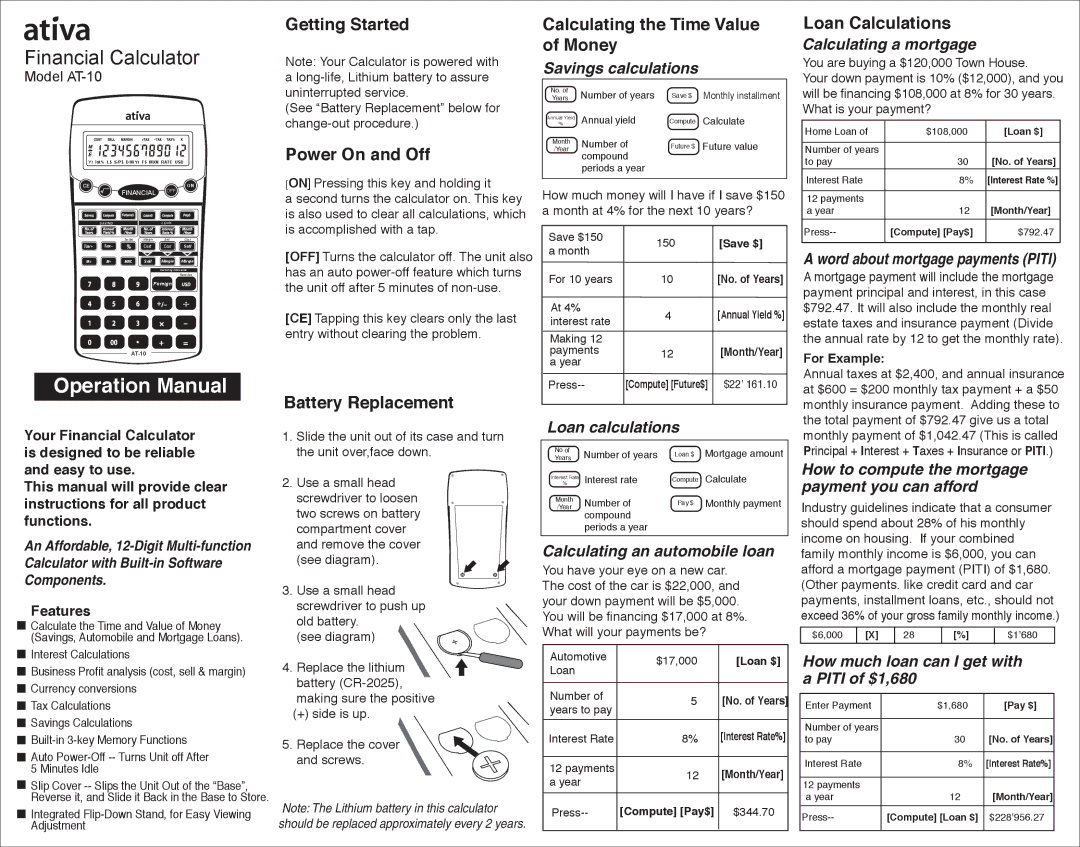

Financial Calculator

Model AT-10

Yr Int% L$ S/P$ D/M Yr F$ MXN RATE USD

|

|

|

|

|

| OFF | ON |

| FINA | N | CIAL | ||||

|

| ||||||

|

|

| |||||

$ | $ | $ |

| $ | |||

|

|

|

|

|

|

|

|

| SAVING |

|

|

|

| LOAN |

|

| Tax Set |

|

| Margin | Sell | Cost | |

Tax | Tax |

|

| Cost | Cost | Sell | |

|

|

|

|

|

|

|

|

|

|

|

| Sell | Margin | Margin | |

|

|

|

|

|

|

| |

|

|

|

|

|

| Currency Converter | |

|

|

|

|

|

|

| Rate Set |

Foreign

Operation Manual

Getting Started

Note: Your Calculator is powered with a

(See “Battery Replacement” below for

Power On and Off

[ON] Pressing this key and holding it

a second turns the calculator on. This key is also used to clear all calculations, which is accomplished with a tap.

[OFF] Turns the calculator off. The unit also has an auto

[CE] Tapping this key clears only the last entry without clearing the problem.

Battery Replacement

Calculating the Time Value of Money

Savings calculations

No. of | Number of years | Save $ | Monthly installment |

Years | |||

% | Annual yield | Compute | Calculate |

Annual Yield |

|

|

|

/Year | Number of | Future $ | Future value |

Month |

|

|

|

| compound |

|

|

| periods a year |

|

|

How much money will I have if I save $150 a month at 4% for the next 10 years?

Save $150 | 150 | [Save $] | |

a month | |||

|

| ||

For 10 years | 10 | [No. of Years] | |

At 4% | 4 | [Annual Yield %] | |

interest rate | |||

|

| ||

Making 12 | 12 | [Month/Year] | |

payments | |||

a year |

|

| |

[Compute] [Future$] | $22’ 161.10 | ||

|

|

|

Loan Calculations

Calculating a mortgage

You are buying a $120,000 Town House.

Your down payment is 10% ($12,000), and you will be financing $108,000 at 8% for 30 years. What is your payment?

Home Loan of | $108,000 | [Loan $] |

|

|

|

Number of years | 30 | [No. of Years] |

to pay | ||

Interest Rate | 8% | [Interest Rate %] |

|

|

|

12 payments | 12 | [Month/Year] |

a year | ||

[Compute] [Pay$] | $792.47 | |

|

|

|

A word about mortgage payments (PITI)

A mortgage payment will include the mortgage payment principal and interest, in this case $792.47. It will also include the monthly real estate taxes and insurance payment (Divide the annual rate by 12 to get the monthly rate).

For Example:

Annual taxes at $2,400, and annual insurance at $600 = $200 monthly tax payment + a $50 monthly insurance payment. Adding these to the total payment of $792.47 give us a total

Your Financial Calculator is designed to be reliable and easy to use.

This manual will provide clear instructions for all product functions.

An Affordable,

Features

Calculate the Time and Value of Money (Savings, Automobile and Mortgage Loans).

![]() Interest Calculations

Interest Calculations

![]() Business Profit analysis (cost, sell & margin)

Business Profit analysis (cost, sell & margin)

![]() Currency conversions

Currency conversions

![]() Tax Calculations

Tax Calculations ![]() Savings Calculations

Savings Calculations

![]()

Slip Cover

1.Slide the unit out of its case and turn the unit over,face down.

2.Use a small head screwdriver to loosen two screws on battery compartment cover and remove the cover (see diagram).

3.Use a small head screwdriver to push up old battery.

(see diagram) ![]()

4. Replace the lithium battery

(+) side is up.

5. Replace the cover and screws.

Note: The Lithium battery in this calculator should be replaced approximately every 2 years.

Loan calculations

No of | Number of years | Loan $ | Mortgage amount |

Years | |||

% | Interest rate | Compute | Calculate |

Interest Rate |

|

|

|

Month | Number of | Pay $ | Monthly payment |

/Year | |||

| compound |

|

|

| periods a year |

|

|

Calculating an automobile loan

You have your eye on a new car. The cost of the car is $22,000, and your down payment will be $5,000. You will be financing $17,000 at 8%. What will your payments be?

Automotive | $17,000 | [Loan $] | |

Loan |

|

| |

Number of | 5 | [No. of Years] | |

years to pay |

|

| |

Interest Rate | 8% | [Interest Rate%] | |

|

|

| |

12 payments | 12 | [Month/Year] | |

a year | |||

|

| ||

[Compute] [Pay$] | $344.70 | ||

|

|

|

monthly payment of $1,042.47 (This is called Principal + Interest + Taxes + Insurance or PITI.)

How to compute the mortgage payment you can afford

Industry guidelines indicate that a consumer should spend about 28% of his monthly income on housing. If your combined family monthly income is $6,000, you can afford a mortgage payment (PITI) of $1,680. (Other payments. like credit card and car payments, installment loans, etc., should not exceed 36% of your gross family monthly income.)

$6,000 | [X] | 28 | [%] | $1’680 |

How much loan can I get with a PITI of $1,680

Enter Payment | $1,680 | [Pay $] |

|

|

|

Number of years | 30 | [No. of Years] |

to pay | ||

|

|

|

Interest Rate | 8% | [Interest Rate%] |

|

|

|

12 payments | 12 | [Month/Year] |

a year | ||

[Compute] [Loan $] | $228’956.27 | |

|

|

|