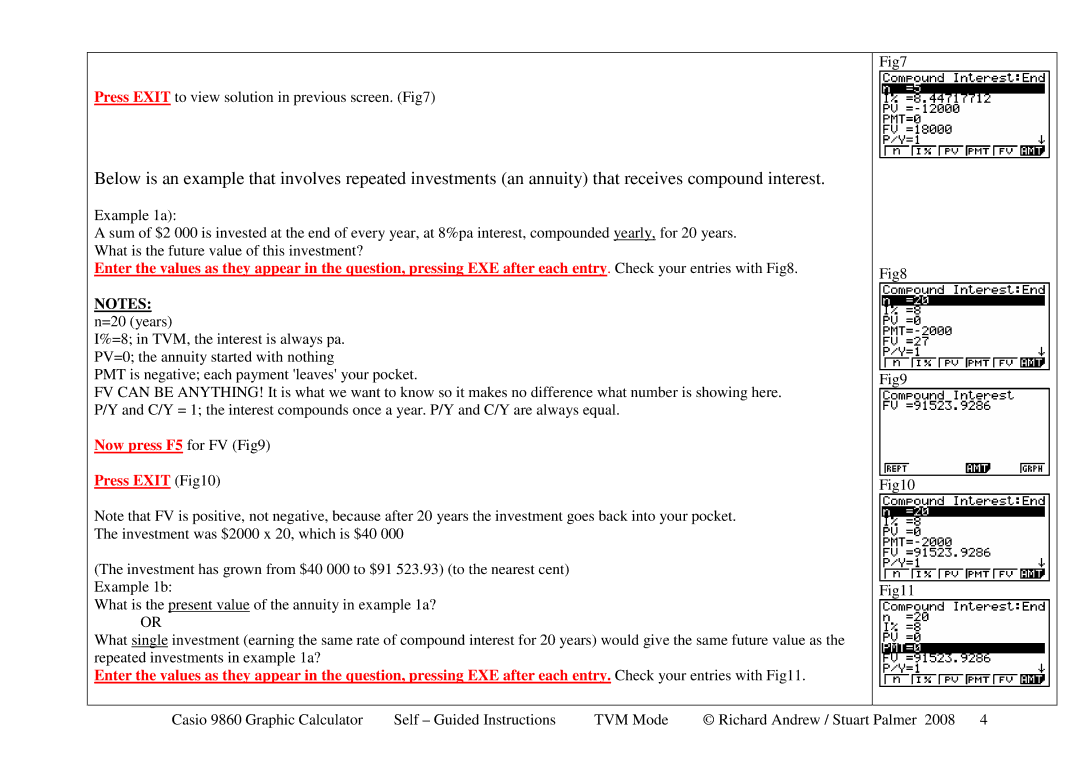

Press EXIT to view solution in previous screen. (Fig7)

Below is an example that involves repeated investments (an annuity) that receives compound interest.

Example 1a):

A sum of $2 000 is invested at the end of every year, at 8%pa interest, compounded yearly, for 20 years. What is the future value of this investment?

Enter the values as they appear in the question, pressing EXE after each entry. Check your entries with Fig8.

NOTES: n=20 (years)

I%=8; in TVM, the interest is always pa. PV=0; the annuity started with nothing

PMT is negative; each payment 'leaves' your pocket.

FV CAN BE ANYTHING! It is what we want to know so it makes no difference what number is showing here. P/Y and C/Y = 1; the interest compounds once a year. P/Y and C/Y are always equal.

Now press F5 for FV (Fig9)

Press EXIT (Fig10)

Note that FV is positive, not negative, because after 20 years the investment goes back into your pocket. The investment was $2000 x 20, which is $40 000

(The investment has grown from $40 000 to $91 523.93) (to the nearest cent) Example 1b:

What is the present value of the annuity in example 1a?

OR

What single investment (earning the same rate of compound interest for 20 years) would give the same future value as the repeated investments in example 1a?

Enter the values as they appear in the question, pressing EXE after each entry. Check your entries with Fig11.

Fig7

Fig8

Fig9

Fig10

Fig11

Casio 9860 Graphic Calculator | Self – Guided Instructions | TVM Mode | © Richard Andrew / Stuart Palmer 2008 4 |