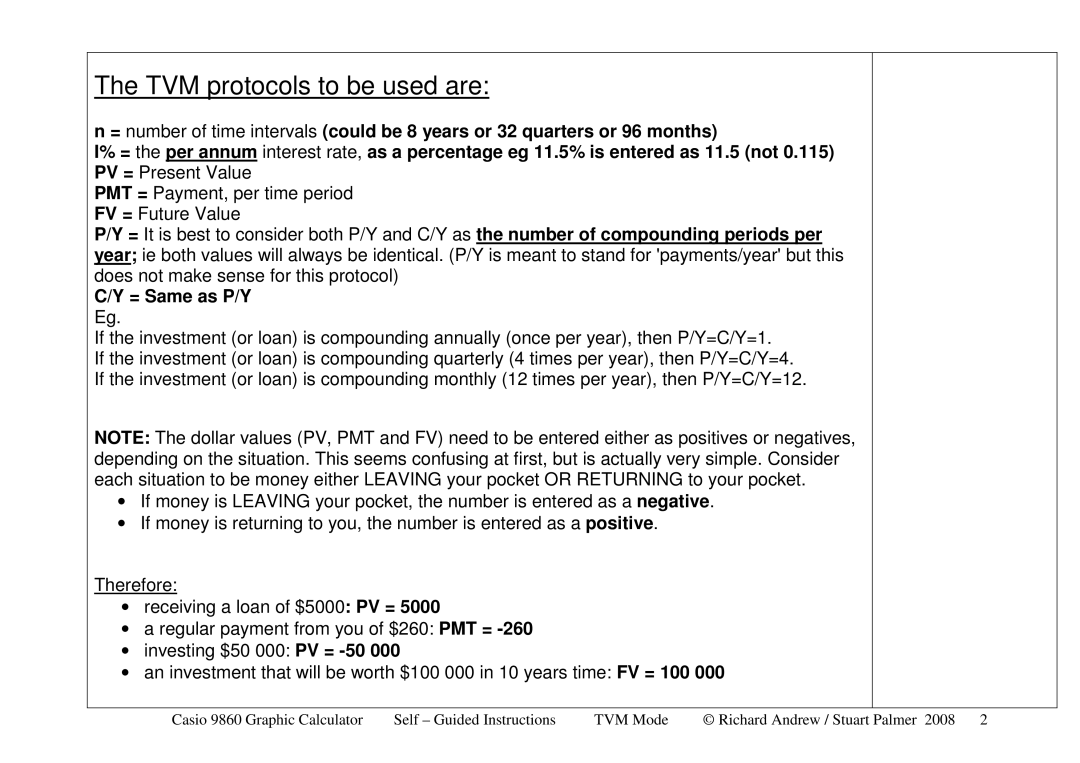

The TVM protocols to be used are:

n = number of time intervals (could be 8 years or 32 quarters or 96 months)

I% = the per annum interest rate, as a percentage eg 11.5% is entered as 11.5 (not 0.115) PV = Present Value

PMT = Payment, per time period FV = Future Value

P/Y = It is best to consider both P/Y and C/Y as the number of compounding periods per year; ie both values will always be identical. (P/Y is meant to stand for 'payments/year' but this does not make sense for this protocol)

C/Y = Same as P/Y

Eg.

If the investment (or loan) is compounding annually (once per year), then P/Y=C/Y=1.

If the investment (or loan) is compounding quarterly (4 times per year), then P/Y=C/Y=4. If the investment (or loan) is compounding monthly (12 times per year), then P/Y=C/Y=12.

NOTE: The dollar values (PV, PMT and FV) need to be entered either as positives or negatives, depending on the situation. This seems confusing at first, but is actually very simple. Consider each situation to be money either LEAVING your pocket OR RETURNING to your pocket.

•If money is LEAVING your pocket, the number is entered as a negative.

•If money is returning to you, the number is entered as a positive.

Therefore:

•receiving a loan of $5000: PV = 5000

•a regular payment from you of $260: PMT =

•investing $50 000: PV =

•an investment that will be worth $100 000 in 10 years time: FV = 100 000

Casio 9860 Graphic Calculator | Self – Guided Instructions | TVM Mode | © Richard Andrew / Stuart Palmer 2008 2 |