|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quick Start Guide | Press /for more information Visit http://casio4business.com/ecr | ||||

|

|

| ||||||

|

|

| Casio Model Number | |||||

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

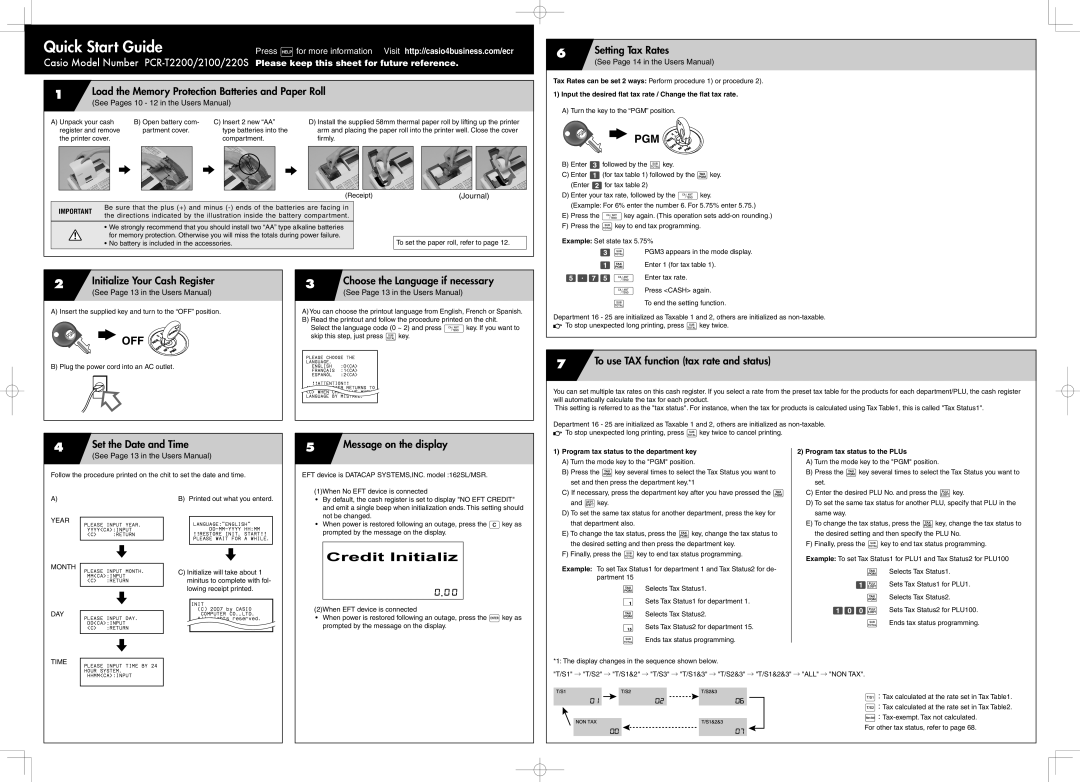

| 1 | Load the Memory Protection Batteries and Paper Roll | |||

|

|

|

|

| (See Pages 10 - 12 in the Users Manual) |

| ||

|

|

|

| A) Unpack your cash | B) Open battery com- | C) Insert 2 new “AA” | D) Install the supplied 58mm thermal paper roll by lifting up the printer | |

|

|

|

| register and remove | partment cover. | type batteries into the | arm and placing the paper roll into the printer well. Close the cover | |

|

|

|

| the printer cover. |

| compartment. | firmly. | |

6 | Setting Tax Rates |

| (See Page 14 in the Users Manual) |

|

|

Tax Rates can be set 2 ways: Perform procedure 1) or procedure 2).

1)Input the desired flat tax rate / Change the flat tax rate.

A)Turn the key to the “PGM” position.

PGM

PGM

|

| 6 | 6 |

| 6 |

|

|

| ||

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| (Receipt) | ||

|

|

|

|

|

|

|

|

| ||

Important | Be sure that the plus (+) and minus |

|

| |||||||

the directions indicated by the illustration inside the battery compartment. |

|

| ||||||||

|

|

|

| |||||||

|

|

|

|

|

|

|

|

| ||

|

| • We strongly recommend that you should install two “AA” type alkaline batteries |

|

| ||||||

|

| for memory protection. Otherwise you will miss the totals during power failure. |

|

| ||||||

|

| • No battery is included in the accessories. |

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

(Journal)

To set the paper roll, refer to page 12.

B)Enter 3followed by the skey.

C)Enter 1(for tax table 1) followed by the ~key. (Enter 2for tax table 2)

D)Enter your tax rate, followed by the Fkey.

(Example: For 6% enter the number 6. For 5.75% enter 5.75.)

E)Press the Fkey again. (This operation sets

F)Press the skey to end tax programming.

Example: Set state tax 5.75%

3 s PGM3 appears in the mode display.

1 ~ Enter 1 (for tax table 1).

2 | Initialize Your Cash Register |

| (See Page 13 in the Users Manual) |

|

|

A) Insert the supplied key and turn to the “OFF” position.

OFF

OFF

B) Plug the power cord into an AC outlet.

3 | Choose the Language if necessary |

| (See Page 13 in the Users Manual) |

|

|

A)You can choose the printout language from English, French or Spanish.

B)Read the printout and follow the procedure printed on the chit. Select the language code (0 ~ 2) and press Fkey. If you want to skip this step, just press skey.

PLEASE CHOOSE THE

LANGUAGE.

ENGLISH :0<CA>

FRANÇAIS :1<CA>

ESPANÕL :2<CA>

!!ATTENTION!!

ALL CHARACTER RETURNS TO <C> WHEN CHANVALUE WHEN LANGUAGE BY MISTAKE.

5^75 F Enter tax rate.

FPress <CASH> again.

sTo end the setting function.

Department 16 - 25 are initialized as Taxable 1 and 2, others are initialized as

![]()

![]() To stop unexpected long printing, press skey twice.

To stop unexpected long printing, press skey twice.

7To use TAX function (tax rate and status)

You can set multiple tax rates on this cash register. If you select a rate from the preset tax table for the products for each department/PLU, the cash register will automatically calculate the tax for each product.

This setting is referred to as the "tax status". For instance, when the tax for products is calculated using Tax Table1, this is called "Tax Status1".

Department 16 - 25 are initialized as Taxable 1 and 2, others are initialized as

![]()

![]() To stop unexpected long printing, press skey twice to cancel printing.

To stop unexpected long printing, press skey twice to cancel printing.

4 | Set the Date and Time |

| (See Page 13 in the Users Manual) |

Follow the procedure printed on the chit to set the date and time.

5Message on the display

EFT device is DATACAP SYSTEMS,INC. model :162SL/MSR.

(1)When No EFT device is connected

1) Program tax status to the department key | 2) Program tax status to the PLUs |

A) Turn the mode key to the "PGM" position. | A) Turn the mode key to the "PGM" position. |

B) Press the ~key several times to select the Tax Status you want to | B) Press the ~key several times to select the Tax Status you want to |

set and then press the department key.*1 | set. |

C) If necessary, press the department key after you have pressed the ~ | C) Enter the desired PLU No. and press the *key. |

A)

YEAR

PLEASE INPUT YEAR. YYYY<CA>:INPUT

<C> :RETURN

8

MONTH

PLEASE INPUT MONTH.

MM<CA>:INPUT

B) Printed out what you enterd.

LANGUAGE:"ENGLISH"

!!RESTORE INIT. START!!

PLEASE WAIT FOR A WHILE.

8

C) Initialize will take about 1 |

•By default, the cash register is set to display "NO EFT CREDIT" and emit a single beep when initialization ends. This setting should not be changed.

•When power is restored following an outage, press the Ckey as prompted by the message on the display.

and Dkey. | D) To set the same tax status for another PLU, specify that PLU in the |

D) To set the same tax status for another department, press the key for | same way. |

that department also. | E) To change the tax status, press the ~key, change the tax status to |

E) To change the tax status, press the ~key, change the tax status to | the desired setting and then specify the PLU No. |

the desired setting and then press the department key. | F) Finally, press the skey to end tax status programming. |

F) Finally, press the skey to end tax status programming. | Example: To set Tax Status1 for PLU1 and Tax Status2 for PLU100 |

| |

Example: To set Tax Status1 for department 1 and Tax Status2 for de- | ~ Selects Tax Status1. |

partment 15 |

DAY

<C> :RETURN

8

PLEASE INPUT DAY. DD<CA>:INPUT <C> :RETURN

minitus to complete with fol- |

lowing receipt printed. |

INIT

(C)2007 by CASIO COMPUTER CO.,LTD.

All rights reserved.

(2)When EFT device is connected

•When power is restored following an outage, press the ¥key as prompted by the message on the display.

~ Selects Tax Status1. | 1* Sets Tax Status1 for PLU1. | ||

~ Selects Tax Status2. | |||

! Sets Tax Status1 for department 1. | |||

100* Sets Tax Status2 for PLU100. | |||

~ Selects Tax Status2. | |||

s Ends tax status programming. | |||

15 | Sets Tax Status2 for department 15. | ||

| |||

TIME

8

PLEASE INPUT TIME BY 24 HOUR SYSTEM.

HHMM<CA>:INPUT

s Ends tax status programming. |

*1: The display changes in the sequence shown below.

"T/S1" → "T/S2" → "T/S1&2" → "T/S3" → "T/S1&3" → "T/S2&3" → "T/S1&2&3" → "ALL" → "NON TAX".

t:Tax calculated at the rate set in Tax Table1.

T:Tax calculated at the rate set in Tax Table2.