* Sumber tenaga listerlk | Bahasa Indonesia |

Calculator CITIZEN model

Jikalau dalam kira2 7 menit calculator tidak bekerja maka sumber tenaga akan berhenti bekerja otomatis.

- Cara mengganti baterai -

Jikalau baterai perlu diganti, anda harus membuka dulu kotak baterai dan mengeluarkan baterai lama. Sesudah itu anda baru bisa memasukkan baterai yang baru didalam kotak itu. Setelah mengganti baterai, silahkan gunakan obyek metal berbentuk bulat panjang untuk menekan RESET pada PCB.

Jika kalkulator terkunci dan Anda tidak dapat mengoperasikan tombol, tekan

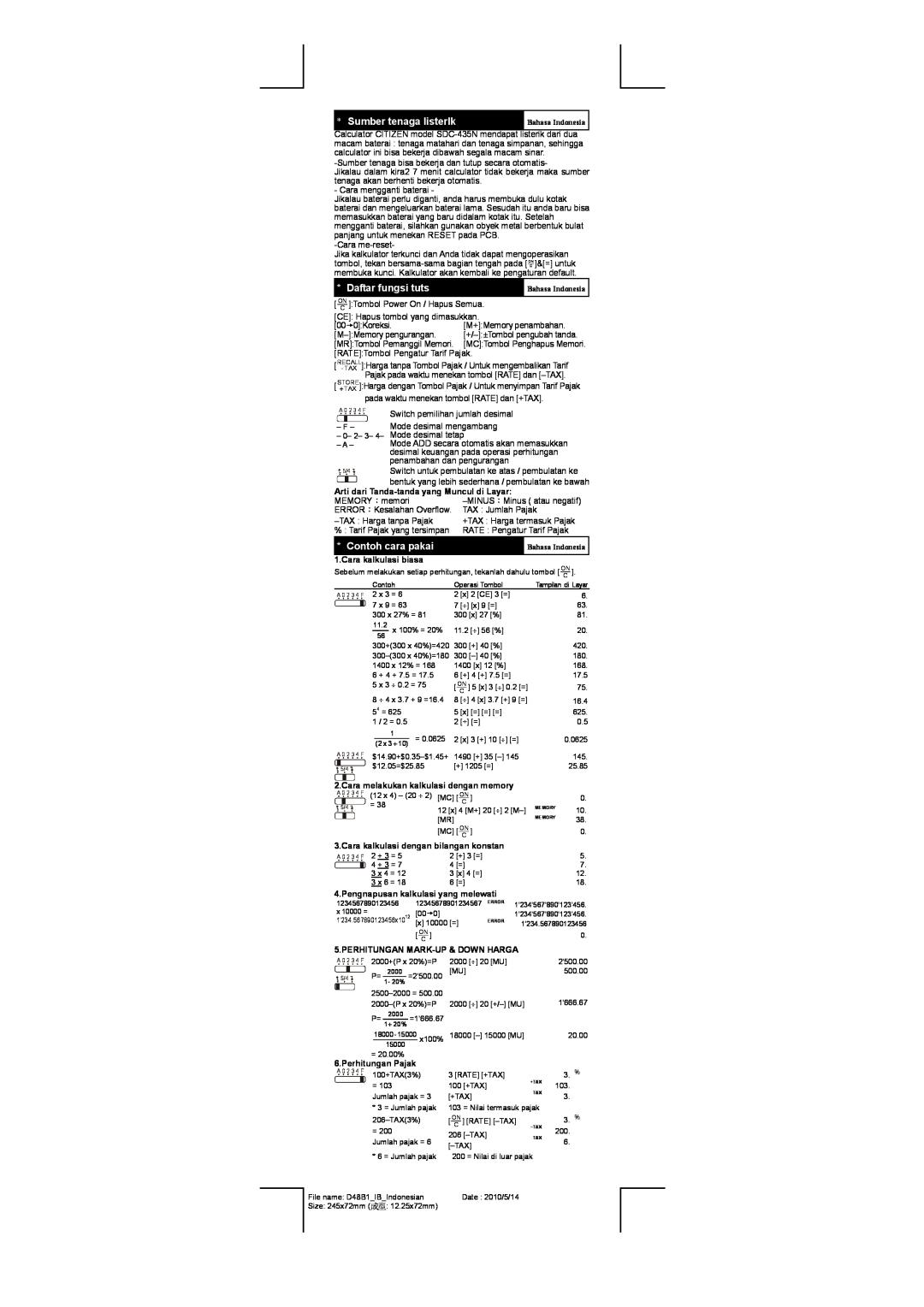

* Daftar fungsi tuts | Bahasa Indonesia |

[ ONC ]:Tombol Power On / Hapus Semua. [CE]: Hapus tombol yang dimasukkan.

[00t0]:Koreksi. | [M+]:Memory penambahan. |

[MR]:Tombol Pemanggil Memori. [MC]:Tombol Penghapus Memori. [RATE]:Tombol Pengatur Tarif Pajak.

[RECAL- TAX L]:Harga tanpa Tombol Pajak / Untuk mengembalikan Tarif Pajak pada waktu menekan tombol [RATE] dan

[STORE+ TAX ]:Harga dengan Tombol Pajak / Untuk menyimpan Tarif Pajak pada waktu menekan tombol [RATE] dan [+TAX].

A 0 2 3 4 F

– F –

–0– 2– 3– 4–

–A –

![]() 5/4

5/4 ![]()

Switch pemilihan jumlah desimal

Mode desimal mengambang Mode desimal tetap

Mode ADD secara otomatis akan memasukkan desimal keuangan pada operasi perhitungan penambahan dan pengurangan

Switch untuk pembulatan ke atas / pembulatan ke

bentuk yang lebih sederhana / pembulatan ke bawah

Arti dari Tanda-tanda yang Muncul di Layar:

MEMORY:memori | ||

ERROR:Kesalahan Overflow. | TAX : Jumlah Pajak | |

+TAX : Harga termasuk Pajak | ||

% : Tarif Pajak yang tersimpan | RATE : Pengatur Tarif Pajak | |

* Contoh cara pakai |

| Bahasa Indonesia |

1.Cara kalkulasi biasa

Sebelum melakukan setiap perhitungan, tekanlah dahulu tombol [ ONC ].

|

| Contoh | Operasi Tombol | Tampilan di Layar | |||

A 0 2 3 4 F 2 x 3 | = 6 | 2 | [x] 2 [CE] 3 [=] | 6. | |||

|

| 7 x 9 | = 63 | 7 | [⎟] [x] 9 [=] | 63. | |

|

| ||||||

|

| 300 x 27% = 81 | 300 [x] 27 [%] | 81. | |||

| 11.2 | x 100% = 20% | 11.2 [⎟] 56 [%] | 20. | |||

56 | |||||||

|

|

|

| ||||

A 0 2 3 4 F

![]() 5/4

5/4 ![]()

300+(300 x 40%)=420 | 300 [+] 40 [%] | 420. | |||

300 | 180. | ||||

1400 x 12% = 168 | 1400 [x] 12 [%] | 168. | |||

6 + 4 + 7.5 = 17.5 | 6 | [+] 4 [+] 7.5 [=] | 17.5 | ||

5 x 3 ⎟ 0.2 = 75 | [ ONC ] 5 [x] 3 [⎟] 0.2 [=] | 75. | |||

8 ⎟ 4 x 3.7 + 9 =16.4 | 8 | [⎟] 4 [x] 3.7 [+] 9 [=] | 16.4 | ||

54 = 625 |

| 5 | [x] [=] [=] [=] | 625. | |

1 / 2 = 0.5 |

| 2 | [÷] [=] | 0.5 | |

1 | = 0.0625 | 2 | [x] 3 [+] 10 [⎟] [=] | 0.0625 | |

| (2 x 3 + 10) | ||||

1490 [+] 35 | 145. | ||||

$12.05=$25.85 | [+] 1205 [=] | 25.85 | |||

2.Cara melakukan kalkulasi dengan memory

A 0 2 3 4 F | (12 x 4) – (20 ⎟ 2) [MC] [ ON ] |

| 0. | ||

|

| = 38 | C |

|

|

| 5/4 | 12 [x] 4 [M+] 20 [⎟] 2 | MEMORY | 10. | |

|

|

| [MR] | MEMORY | 38. |

|

|

|

| ||

|

|

| [MC] [ ON ] |

| 0. |

|

|

| C |

|

|

3.Cara kalkulasi dengan bilangan konstan

A 0 2 3 4 F 2 + 3 = 5 | 2 | [+] 3 [=] | 5. | ||

|

| 4 + 3 = 7 | 4 | [=] | 7. |

| |||||

|

| 3 x 4 = 12 | 3 | [x] 4 [=] | 12. |

|

| 3 x 6 = 18 | 6 | [=] | 18. |

4.Pengnapusan kalkulasi yang melewati

1234567890123456 |

| 12345678901234567 | ERROR | 1’234’567’890’123’456. |

x 10000 = | 12 | [00t0] |

| 1’234’567’890’123’456. |

1'234.567890123456x10 |

| [x] 10000 [=] | ERROR | 1’234.567890123456 |

|

| [ ON ] |

| 0. |

|

| C |

|

|

5.PERHITUNGAN MARK-UP & DOWN HARGA

| A 0 2 3 4 F | 2000+(P x 20%)=P | 2000 [⎟] 20 [MU] |

| 2'500.00 | ||||||||

|

|

|

| P= | 2000 | =2'500.00 | [MU] |

| 500.00 | ||||

5/4 |

|

|

| ||||||||||

1- 20% |

|

|

|

| |||||||||

|

|

|

| 2000 [⎟] 20 |

| 1'666.67 | |||||||

|

|

|

|

| |||||||||

|

|

|

|

| |||||||||

|

|

|

| P= | 2000 | =1'666.67 |

|

|

|

| |||

|

|

|

| 1+ 20% |

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

| 18000 - 15000 | x100% | 18000 |

| 20.00 | ||||

|

|

|

|

|

| 15000 |

|

|

|

|

|

|

|

|

|

|

| = 20.00% |

|

|

|

|

|

|

| ||

6.Perhitungan Pajak |

|

|

|

| |||||||||

| A 0 2 3 4 F | 100+TAX(3%) | 3 [RATE] [+TAX] |

| 3. | % | |||||||

|

|

|

| = 103 |

|

|

| 100 [+TAX] | +TAX | 103. |

| ||

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

| TAX |

| |||||

|

|

|

| Jumlah pajak = 3 | [+TAX] | 3. |

| ||||||

|

|

|

|

|

| ||||||||

|

|

|

| * 3 = Jumlah pajak | 103 = Nilai termasuk pajak |

|

| ||||||

|

|

|

| [ ON ] [RATE] |

| 3. | % | ||||||

|

|

|

| = 200 |

|

|

| C | 200. |

| |||

|

|

|

|

|

|

| 206 | TAX |

| ||||

|

|

|

| Jumlah pajak = 6 | 6. |

| |||||||

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

| * 6 = Jumlah pajak | 200 = Nilai di luar pajak |

|

| ||||||

File name: D48B1_IB_Indonesian | Date : 2010/5/14 |

|

|

| |||||||||

Size: 245x72mm (成型: 12.25x72mm) |

|

|

|

| |||||||||