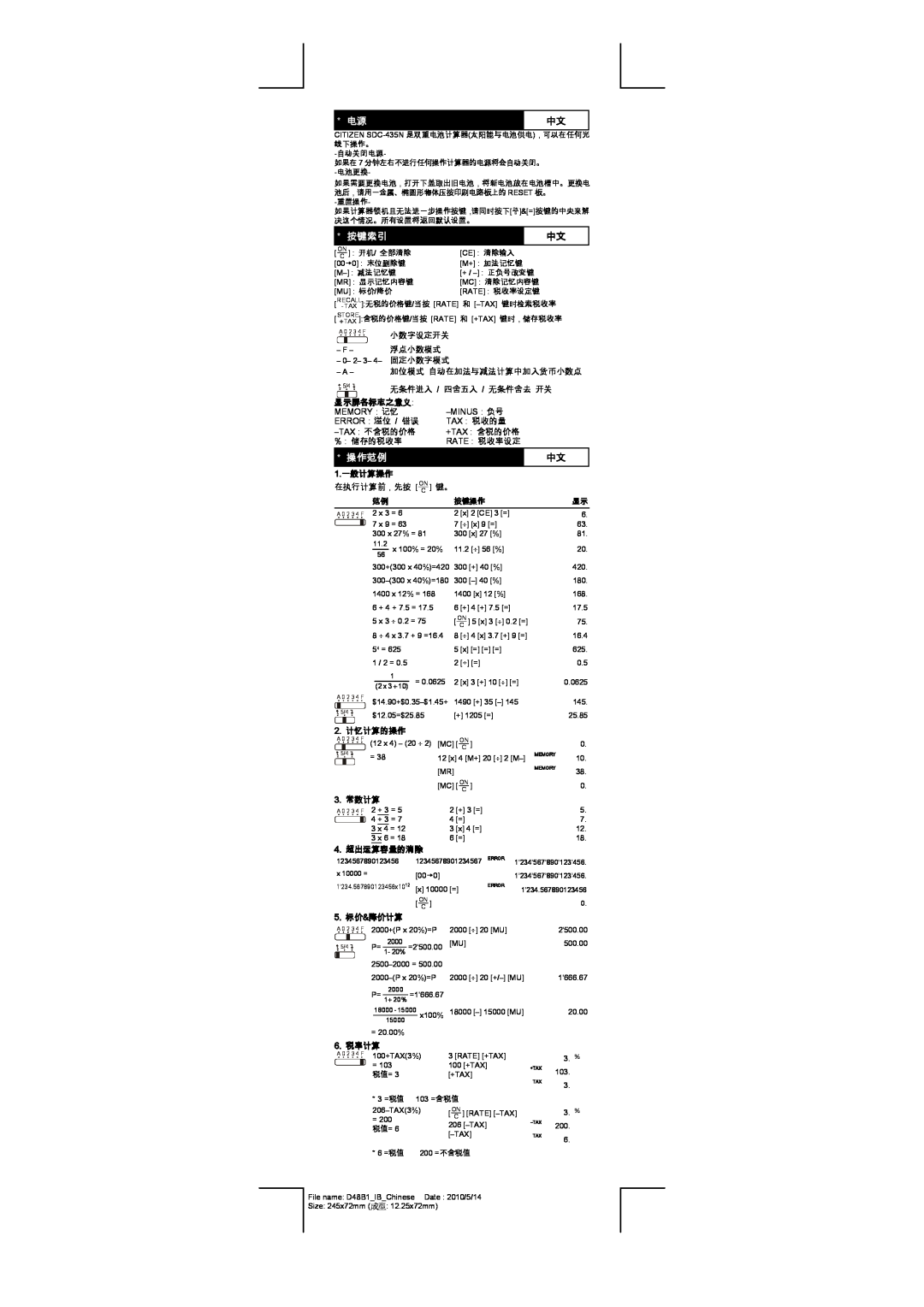

* 电源 | 中文 |

CITIZEN

如果在 7 分钟左右不进行任何操作计算器的电源将会自动关闭。

如果需要更换电池,打开下盖取出旧电池,将新电池放在电池槽中。更换电 池后,请用一金属、椭圆形物体压按印刷电路板上的 RESET 板。

如果计算器锁机且无法进一步操作按键,请同时按下[ ONC ]&[=]按键的中央来解 决这个情况。所有设置将返回默认设置。

*按键索引

中文

[ ONC ] : 开机/ 全部清除 | [CE] : 清除输入 |

[00t0] : 末位删除键 | [M+] : 加法记忆键 |

[+ / | |

[MR] : 显示记忆内容键 | [MC] : 清除记忆内容键 |

[MU] : 标价/降价 | [RATE] : 税收率设定键 |

[RECAL- TAX L]:无税的价格键/当按 [RATE] 和

[STOR+ TAXE]:含税的价格键/当按 [RATE] 和 [+TAX] 键时,储存税收率

A 0 2 3 4 F | 小数字设定开关 |

| |

– F – | 浮点小数模式 |

–0– 2– 3– 4– 固定小数字模式

–A – 加位模式 自动在加法与减法计算中加入货币小数点

5/4 | 无条件进入 / 四舍五入 / 无条件舍去 开关 | |||

|

| 显示屏各标志之意义: | ||

| ||||

MEMORY:记忆 | ||||

ERROR:溢位 / 错误 | TAX : 税收的量 | |||

+TAX : 含税的价格 | ||||

% : 储存的税收率 | RATE : 税收率设定 | |||

*操作范例

中文

1.一般计算操作

在执行计算前,先按 [ ONC ] 键。

|

|

|

| 范例 |

| 按键操作 | 显示 | ||||

A 0 2 3 4 F 2 x 3 = 6 |

| 2 | [x] 2 [CE] 3 [=] | 6. | |||||||

|

|

|

| 7 x 9 = 63 |

| 7 | [⎟] [x] 9 [=] | 63. | |||

|

|

|

|

| |||||||

|

|

|

| 300 x 27% = 81 | 300 [x] 27 [%] | 81. | |||||

|

|

|

|

| 11.2 | x 100% = 20% | 11.2 [⎟] 56 [%] | 20. | |||

|

|

|

| 56 | |||||||

|

|

|

|

|

|

|

|

| |||

|

|

|

| 300+(300 x 40%)=420 | 300 [+] 40 [%] | 420. | |||||

|

|

|

| 300 | 180. | ||||||

|

|

|

| 1400 x 12% = 168 | 1400 [x] 12 [%] | 168. | |||||

|

|

|

| 6 + 4 + 7.5 = 17.5 | 6 | [+] 4 [+] 7.5 [=] | 17.5 | ||||

|

|

|

| 5 x 3 ⎟ 0.2 = 75 | [ ON ] 5 [x] 3 [⎟] 0.2 [=] | 75. | |||||

|

|

|

|

|

|

|

|

|

| C |

|

|

|

|

| 8 ⎟ 4 x 3.7 + 9 =16.4 | 8 | [⎟] 4 [x] 3.7 [+] 9 [=] | 16.4 | ||||

|

|

|

| 54 = 625 |

| 5 | [x] [=] [=] [=] | 625. | |||

|

|

|

| 1 / 2 = 0.5 |

| 2 | [÷] [=] | 0.5 | |||

|

|

|

| 1 | = 0.0625 | 2 | [x] 3 [+] 10 [⎟] [=] | 0.0625 | |||

|

|

|

|

|

| (2 x 3 + 10) | |||||

A 0 2 3 4 F | 1490 [+] 35 | 145. | |||||||||

| 5/4 |

| |||||||||

|

| ||||||||||

|

| $12.05=$25.85 | [+] 1205 [=] | 25.85 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

2.计忆计算的操作

A 0 2 3 4 F | (12 x 4) – (20 ⎟ 2) | [MC] [ ON ] |

| 0. | |||

|

|

|

|

| C |

|

|

| 5/4 |

| = 38 | 12 [x] 4 [M+] 20 [⎟] 2 | MEMORY | 10. | |

|

|

| MEMORY | ||||

|

|

|

| [MR] |

| 38. | |

|

|

|

|

|

| ||

|

|

|

| [MC] [ ON ] |

| 0. | |

|

|

|

|

| C |

|

|

3. 常数计算 |

|

|

|

| |||

A 0 2 3 4 F | 2 + 3 = 5 | 2 | [+] 3 [=] |

| 5. | ||

|

|

| 4 + 3 = 7 | 4 | [=] |

| 7. |

|

|

|

| ||||

|

|

| 3 x 4 = 12 | 3 | [x] 4 [=] |

| 12. |

|

|

| 3 x 6 = 18 | 6 | [=] |

| 18. |

4.超出运算容量的消除

1234567890123456 | 12345678901234567 | ERROR | 1’234’567’890’123’456. |

x 10000 = | [00t0] |

| 1’234’567’890’123’456. |

1'234.567890123456x1012 | [x] 10000 [=] | ERROR | 1’234.567890123456 |

| [ ONC ] |

| 0. |

5.标价&降价计算

A 0 2 3 4 F 2000+(P x 20%)=P | 2000 [⎟] 20 [MU] | 2'500.00 | |||||||

| P= | 2000 | =2'500.00 | [MU] | 500.00 | ||||

5/4 | |||||||||

1- 20% |

|

| |||||||

|

| ||||||||

|

|

| |||||||

|

|

| |||||||

|

|

| |||||||

| 2000 [⎟] 20 | 1'666.67 | |||||||

| P= | 2000 | =1'666.67 |

|

| ||||

| 1+ 20% |

|

| ||||||

|

|

|

|

|

|

| |||

|

| 18000 - 15000 | x100% | 18000 | 20.00 | ||||

|

|

| 15000 |

|

|

|

|

| |

=20.00%

6.税率计算

A 0 2 3 4 F | 100+TAX(3%) | 3 [RATE] [+TAX] |

| 3. | % | ||

|

|

|

|

|

| ||

|

| = 103 |

| 100 [+TAX] | +TAX | 103. |

|

|

|

|

| ||||

|

| 税值= 3 |

| [+TAX] |

|

| |

|

|

| TAX |

|

| ||

|

|

|

|

| 3. |

| |

|

|

|

|

|

|

| |

|

| * 3 =税值 | 103 =含税值 |

|

|

| |

|

| [ ON ] [RATE] |

| 3. | % | ||

|

| = 200 |

| C |

|

| |

|

|

| 206 | 200. |

| ||

|

| 税值= 6 |

|

|

| ||

|

|

| TAX |

|

| ||

|

|

|

| 6. |

| ||

|

|

|

|

|

|

| |

|

| * 6 =税值 | 200 =不含税值 |

|

|

| |

File name: D48B1_IB_Chinese |

| Date : 2010/5/14 |

|

|

| ||

Size: 245x72mm (成型: 12.25x72mm) |

|

|

| ||||