HP 17bII+ Financial Calculator

Printing History

Edition June

Welcome to the HP 17bII+

Welcome to the hp17bII+

Contents

Power Function Exponentiation

Error Messages

Using Parentheses in Calculations

Saving and Reusing Numbers

Time Value of Money

Interest Rate Conversions

Cash Flow Calculations

10 121 Running Total and Statistics

Bonds

Depreciation

11 141 Time, Appointments, and Date Arithmetic

12 153 The Equation Solver

14 190 Additional Examples

Assistance, Batteries, Memory, and Service

More About Calculations

Menu Maps RPN Summary

RPN The Stack

RPN Selected Examples Error Messages Index

General Business Calculations

List of Examples

List of Examples

Currency Exchange Calculations

Interest Rate Conversions

Bonds and Notes

Time, Alarms, and Date Arithmetic

How to Use the Equation Solver

Running Total and Statistical Calculations

Important Information

Important Information

Getting Started

Power On and Off Continuous Memory

Adjusting the Display Contrast

Getting Started

Keys for language Key Description

Setting the Language

What You See in the Display

18 1 Getting Started

Shift Key @

Backspacing and Clearing

Keys for Clearing

Keys Display Description

20 1 Getting Started

Doing Arithmetic

KeysDisplayDescription

Using the Menu Keys

Keying in Negative Numbers

22 1 Getting Started

Main Menu

Menu Labels Menu Keys

Main Menu Menu Label Operations Done Covered This Category

24 1 Getting Started

Choosing Menus and Reading Menu Maps

Using the MU%C menu

26 1 Getting Started

Displaying the MU%C menu

Calculations Using Menus

Exiting Menus e

Clearing Values in Menus

28 1 Getting Started

Solving Your Own Equations Solve

= Cost

Typing Words and Characters the ALPHAbetic Menu

30 1 Getting Started

34 5?

Editing ALPHAbetic Text

Keys

Characters

Keyboard

Calculating the Answer Calc

Alphabetic Editing Operation Label or Key to Press

32 1 Getting Started

Menu for carpeting

Internal Precision

Controlling the Display Format

Decimal Places

Temporarily SHOWing ALL

Rounding a Number

Exchanging Periods and Commas in Numbers

Error Messages

Modes

36 1 Getting Started

Calculator Memory @M

Memory still free

VDoing Calculations

Arithmetic

Calculator Line

38 2 Arithmetic

Keys Display

VUsing Parentheses in Calculations

456 75 × 18.5

30 x

VThe Percent Key

Mathematical Functions

40 2 Arithmetic

VThe Power Function Exponentiation

Shifted Math Functions

Key

KeysDisplay Description

Math Menu

Math Menu Labels

42 2 Arithmetic

Saving and Reusing Numbers

History Stack of Numbers

VReusing the Last Result @L

VKeys Display

44 2 Arithmetic

Storing and Recalling Numbers

475.6 560.1 + 39.15

VKeys Display Description

Keys New Register Contents

Doing Arithmetic Inside Registers and Variables

Arithmetic in Registers

Scientific Notation

Range of Numbers

48 2 Arithmetic

Menu Description

Percentage Calculations Business

Business Percentages BUS Menus

Percentage Calculations in Business

Percent Change %CHG

Using the BUS Menus

Examples Using the BUS Menus

50 3 Percentage Calculations in Business

Percent of Total %TOTL

Markup as a Percent of Cost MU%C

Markup as a Percent of Price MU%P

52 3 Percentage Calculations in Business

Sharing Variables Between Menus

Cost Price M%C Cost Price M%P

Currency Exchange Calculations

Currx Menu

54 4 Currency Exchange Calculation

Selecting a Set of Currencies

Currx Menu

Currency Exchange Calculation

Currencies

United States Conversion Chart in US$

Entering a Rate

Currency Rate

58 4 Currency Exchange Calculation

Select CAN$ as currency

Select HK$ as currency

Converting Between Two Currencies

Storing and Recalling Sets of Currencies

Example Converting between Hong Kong and U.S Dollars

Clearing the Currency Variables

60 4 Currency Exchange Calculation

Time Value of Money

TVM Menu

Time Value of Money

First Level of TVM

Second Level of TVM

TVM Menu Labels

Menu Label Description First Level

Second Level

Cash Flow Diagrams and Signs of Numbers

64 5 Time Value of Money

PMT

Using the TVM Menu

66 5 Time Value of Money

Loan Calculations

68 5 Time Value of Money

Figures and stores number

11.5

70 5 Time Value of Money

Figures and stores

Savings Calculations

000

72 5 Time Value of Money

15X 12X 359 360

Leasing Calculations

74 5 Time Value of Money

@28#+

76 5 Time Value of Money

Amortization Amrt

Label

Displaying an Amortization Schedule

Amrt Menu Labels

78 5 Time Value of Money

Number of payments

80 5 Time Value of Money

Next successive set of payments authorized

Printing an Amortization Table Table

82 5 Time Value of Money

508 /,%&-$ GO8

Interest Rate Conversions

84 6 Interest Rate Conversions

Icnv Menu

Converting Interest Rates

Interest Rate Conversions

86 6 Interest Rate Conversions

Compounding Periods Different from Payment Periods

88 6 Interest Rate Conversions

Per year

90 6 Interest Rate Conversions

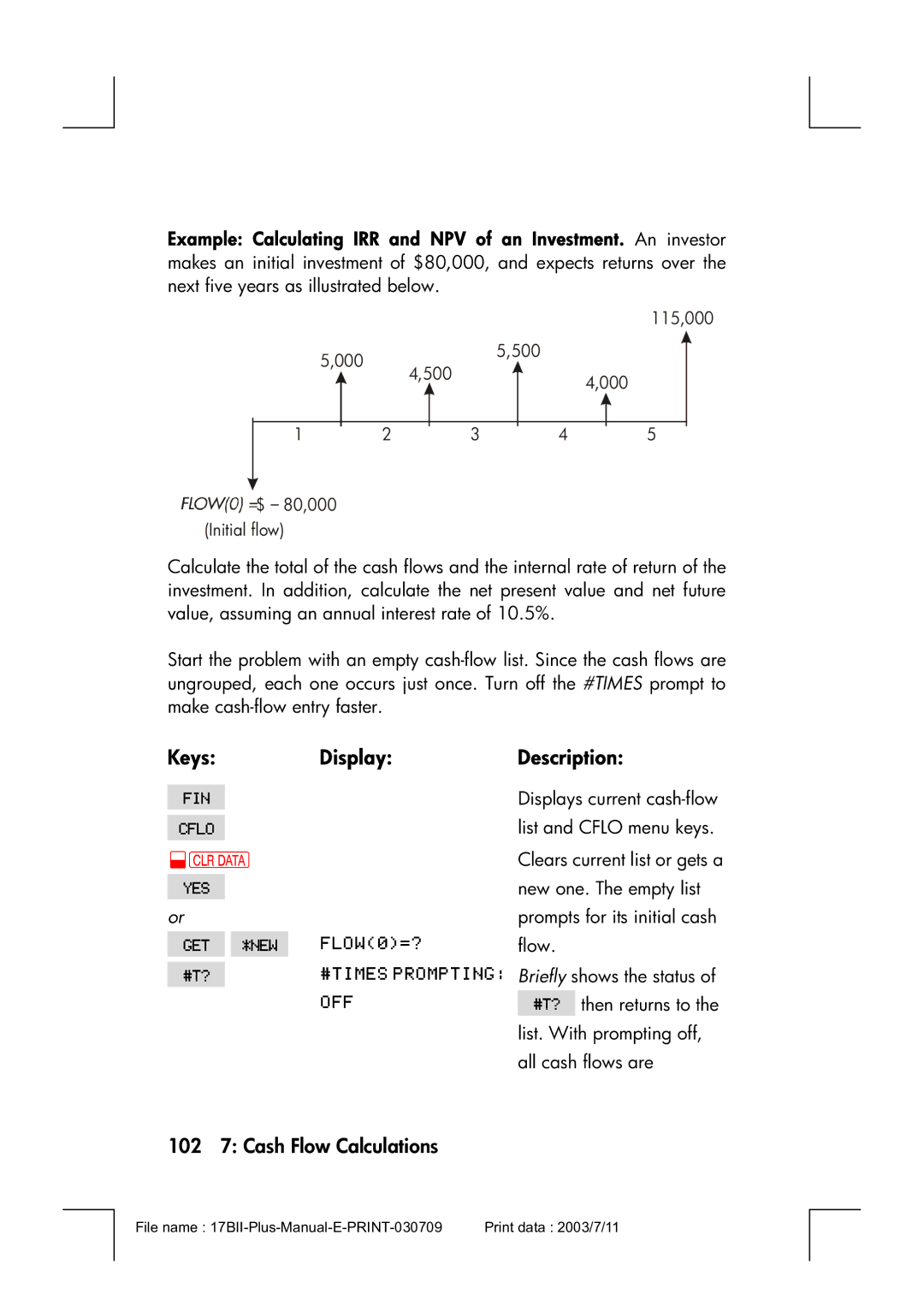

Cash Flow Calculations

Cflo menu

Cash Flow Calculations

Cflo Menu Labels

92 7 Cash Flow Calculations

Cash Flows Ungrouped

Creating a Cash-Flow List

94 7 Cash Flow Calculations

Entering Cash Flows

For grouped cash flows The display now shows

Prompting for #TIMES #T?. When the calculator displays

96 7 Cash Flow Calculations

Viewing and Correcting the List

EGG

98 7 Cash Flow Calculations

Copying a Number from a List to the Calculator Line

Naming and Renaming a Cash-Flow List

Deleting Cash Flows from a List. Pressing ndeletes both

Clearing a Cash-Flow List and Its Name

Starting or GETting Another List

Viewing the Name of the Current List. Press o, then e

Cash-Flow Calculations IRR, NPV, NUS, NFV

100 7 Cash Flow Calculations

Calc Menu for Cflo Lists Menu Label

102 7 Cash Flow Calculations

115,000 500

G9ECL#T8U

Group Number Amount

104 7 Cash Flow Calculations

G9ECL.T8U

106 7 Cash Flow Calculations

50 50 50

Doing Other Calculations with Cflo Data

Bonds

Bond Menu

108 8 Bonds

Bond Menu Labels

Menu Description Label

Bonds

Doing Bond Calculations

110 8 Bonds

To calculate the price or yield of a bond

Since there is no call on

112 8 Bonds

MM.DDYYYY format

Depreciation

Deprc Menu

114 9 Depreciation

Deprc Menu Labels

Depreciation

116 9 Depreciation

Doing Depreciation Calculations

DB, SOYD, and SL Methods

To calculate the depreciation for an asset

KeysDisplay

Basis Salv 4,000

Acrs Method

Year Percentage Deductible Keys Display Description

118 9 Depreciation

Partial-Year Depreciation

Calendar Year Depreciation Value

120 9 Depreciation

Running Total and Statistics

Running Total and Statistics

SUM Menu

SUM Menu Labels

122 10 Running Total and Statistics

Creating a SUM List

Entering Numbers and Viewing the Total

124 10 Running Total and Statistics

Date

Amount Date

Transaction

Naming and Renaming a SUM List

126 10 Running Total and Statistics

Clearing a SUM List and Its Name

Doing Statistical Calculations Calc

Calculations with One Variable

Calc Menu for SUM Lists Menu Key

128 10 Running Total and Statistics

Month Phone

Expense

Calculations with Two Variables Frcst

130 10 Running Total and Statistics

Calc Total

Frcst Menu Labels

132 10 Running Total and Statistics

Curve Fitting and Forecasting

Logarithmic Curve Fit

134 10 Running Total and Statistics

To do curve fitting and forecasting

Number of Minutes

Radio Dollar Sales Advertising Values

136 10 Running Total and Statistics

Minutes

Minutes

Weighted Mean and Grouped Standard Deviation

138 10 Running Total and Statistics

Summation Statistics

Doing Other Calculations with SUM Data

140 10 Running Total and Statistics

Time, Appointments, Date Arithmetic

Viewing the Time and Date

Time, Appointments, and Date Arithmetic

Menu Label Description

Time Menu

Time Menu Labels

142 11 Time, Appointments, and Date Arithmetic

Or DD.MMYYYY

Setting the Time and Date SET

SET Menu Labels

To set the date

Adjusting the Clock Setting Adjst

Changing the Time and Date Formats SET

144 11 Time, Appointments, and Date Arithmetic

Viewing or Setting an Appointment APT1-APT10

Menu Labels for Setting Appointments Description

Appointments Appt

To set an appointment or view its current setting

146 11 Time, Appointments, and Date Arithmetic

Appointment message optional To set, change, or just view a

Acknowledging an Appointment

148 11 Time, Appointments, and Date Arithmetic

Unacknowledged Appointments

Clearing Appointments

To acknowledge a past-due appointment

Date Arithmetic Calc

Calc Menu Labels for Date Arithmetic

Determining the Day of the Week for Any Date

Calculating the Number of Days between Dates

150 11 Time, Appointments, and Date Arithmetic

Calculating Past or Future Dates

152 11 Time, Appointments, and Date Arithmetic

DATE2

Equation Solver

Solver Example Sales Forecasts

Equation Solver

154 12 The Equation Solver

Next =OLD

Display Description

Menu Label

Solve Menu

156 12 The Equation Solver

Keys

Entering Equations

Solve Menu Labels

To make an entry into the Solver list

Calculating Using Solver Menus Calc

To do a calculation using a Solver menu

158 12 The Equation Solver

Rmenu label

160 12 The Equation Solver

Eqty

Editing an Equation Edit

Naming an Equation

Clearing Variables

Finding an Equation in the Solver List

Shared Variables

162 12 The Equation Solver

Deleting Variables and Equations

Deleting a variable is quite different from clearing it

Deleting All Equations or All Variables in the Solver @c

Writing Equations

Deleting One Equation or Its Variables Delet

164 12 The Equation Solver

100

× C Could be entered as

× E

What Can Appear in an Equation

166 12 The Equation Solver

Using the Alpha Menu

Using a Typing Aid

Solver Functions

168 12 The Equation Solver

Solver Functions for Equations Description

DDAYSd1d2cal

IFcond expr 1 expr

170 12 The Equation Solver

HH.MMSS format

ITEMSUM-listnameitem#

SIZESSUM-listname

Σcfr c 1 c 2 s expr

SIZECCFLO-listname

#TCFLO-listnameflow#

172 12 The Equation Solver

Days

≥ ³=

Conditional Expressions with if

OperatorKeys

174 12 The Equation Solver

Examples of Conditional Equations

VALUE=FIRST+1 ÷ FIRST. If FIRST=0, then VALUE=FIRST

Rating Percent Salary Increase

Summation Function ∑

176 12 The Equation Solver

HC8E9AL#GL28#I&%IGL28$I&I&#TTT

Accessing Cflo and SUM Lists from the Solver

Creating Menus for Multiple Equations S Function

178 12 The Equation Solver

How the Solver Works

Halting and Restarting the Iterative Search

180 12 The Equation Solver

Entering Guesses

182 12 The Equation Solver

52EG8527H Y@/O127EF Y@/GX7EF Keys

@I$&/Solves for QTY iteratively

Printing

184 13 Printing

Printing the DisplayP

Printer’s Power Source

Double Space Printing

Printing

Printer Menu Labels

Printing Other Information @p

Printing Variables, Lists, and Appointments List

186 13 Printing

Except IRR%. Instead, press tPto print the value for IRR%

Printing Descriptive Messages MSG

Trace Printing Trace

188 13 Printing

How to Interrupt the Printer

KeysPrint-out

Simple Annual Interest

Additional Examples

Loans

190 14 Additional Examples

Yield of a Discounted or Premium Mortgage

Additional Examples

192 14 Additional Examples

Figures and stores total

Annual Percentage Rate for a Loan with Fees

See appendix F for RPN keystrokes for the next two examples

194 14 Additional Examples

@c e

Loan with an Odd Partial First Period

196 14 Additional Examples

Solver Equation for Odd-Period Calculations

Canadian Mortgages

198 14 Additional Examples

Solver Equation for Canadian Mortgages

Advance Payments Leasing

Solver Equation for Advance Payments

Savings

Value of a Fund with Regular Withdrawals

200 14 Additional Examples

Displays periodic

Deposits Needed for a Child’s College Account

202 14 Additional Examples

Additional Examples

Flow of Withdrawals

204 14 Additional Examples

For FLOW1

Value of a Tax-Free Account

206 14 Additional Examples

# 5?@2 JH= 0EAH

Value of a Taxable Retirement Account

208 14 Additional Examples

Modified Internal Rate of Return

210 14 Additional Examples

Group No. of Months Cash Flow, $ Flow no

V8 /12

100000

200000

V13 /12

212 14 Additional Examples

Price of an Insurance Policy

Solver Equation for Insurance Price

214 14 Additional Examples

Bonds

Discounted Notes

216 14 Additional Examples

Statistics

Moving Average

218 14 Additional Examples

Solver Equation for Moving Averages

Chi-Squared χ2 Statistics

If necessary

220 14 Additional Examples

If the expected values vary

Keystroke Display Description

Number

Use

Answers to Common Questions

Assistance, Batteries Memory, and Service

Assistance, Batteries, Memory, and Service

Obtaining Help in Operating the Calculator

Assistance, Batteries, Memory, and Service

Power and Batteries

Low-Power Indications

Do not use rechargeable batteries

Installing Batteries

Assistance, Batteries, Memory, and Service

Managing Calculator Memory

Resetting the Calculator

Reset hole

For selecting English language

For English language

Erasing Continuous Memory

For selecting the other languages

For the other languages

Determining If the Calculator Requires Service

Clock Accuracy

Environmental Limits

Confirming Calculator Operation Self-Test

If the calculator won’t turn on

If the calculator doesn’t respond to keystrokes

Warranty

Assistance, Batteries, Memory, and Service

Europe Country Telephone numbers

Regulatory information

Asia Pacific Country Telephone numbers

America Country Telephone numbers

Canada

Japan

Possible Outcomes of Calculating IRR%

More About Calculations

IRR% Calculations

More About Calculations

Halting and Restarting the IRR% Calculation

Storing a Guess for IRR%

O F I T = P R I C E - C O S T

Direct Solutions

Solver Calculations

S T = P R I C E - P R O F I T

E a =L x W

= a R E a ÷ W

Iterative Solutions

Case 1a Case 1b Is exactly Is not exactly

More About Calculations

J1A =4HFFHFI

- n

Equations Used by Built-in Menus

Actuarial Functions

100

Percentage Calculations in Business BUS

Time Value of Money TVM

Amortization

NOM % P

Interest Rate Conversions

Cash-Flow Calculations

NPV = CF0 + ∑CFj x Uspv i% nj x Sppv i% Nj

Bond Calculations

NUS = Uspv i% N Total = ∑nj × CFj

Depreciation Calculations

DB = Basis × Fact % /100

Sum and Statistics

Forecasting

Model Transformation

SX 2 × SY

Equations Used in Chapter

SXY = Σ

PV = − PMT

Odd-Period Calculations

Advance Payments

Modified Internal Rate of Return

Menu Maps

Menu Maps

Figure C-2. Currx Menu

Figure C-3. FIN Menu

Figure C-3 . FIN Menu

Figure C-4. SUM Menu

Figure C-5. Time Menu

Figure C-6. Solve Menu

About RPN on the HP 17bII+

RPN Summary

About RPN

RPN Summary

Setting RPN Mode

To select RPN mode Press @

~ same as

Where the RPN Functions Are

Function Definition Key to Use Name

Same as

Arithmetic Topics Affected by RPN Mode

Doing Calculations in RPN

Simple Arithmetic

27 %

To Calculate Press Display

RPN Mode ALG Mode

Calculations with STO and RCL

Chain Calculations-No Parentheses

+ 5 E 6 +

RPN The Stack

What the Stack Is

RPN The Stack

Reviewing the Stack Roll Down

Exchanging the X- and Y-Registers in the Stack

Arithmetic-How the Stack Does It

How Enter Works

+ 6 :

Clearing Numbers

Reusing Numbers

Last X Register

Retrieving Numbers from Last

Chain Calculations

Solution 23 @w13 E9 *-7@t+

Exercises

RPN Selected Examples

RPN Selected Examples

RPN Selected Examples

#$ 5?@2 HA 0EAH 10 @ Stores total number Payments 1000000 E

For E, press =, not

#TIMES1 for FLOW1

I11 I G9ECLT8U

# 5?@2 JH=

# 5?@2 JH= Begin mode

Error Messages

Error Messages

H22E2I EOH2G9EC

Error Messages

Error Messages

EOH2G9EC

Error Messages

Index

Index

#Special Characters

143 2, 42 -,150

169

147

156

166 56 ›, 132 a, 78 Z

=, F

74-75

31-32

174-76

85-87

115 ?, 32 ª, 150 «, 150 ¬

145

149

116

144

162-64

64 I

181-83

133

168-71

138-39

72-73

213-15

239

132 , 109 +, 49, 53 6, 52, 128 ‘, 128

132 k, 186 o, 42 3, 42 L

132-34

\, 143 N

Memory. See also Continuous Memory

146

143-44

101 w, 101 x, 101 /, 157 @, 56 B, 56 J, 56 4, 42 j

92-94

175

56 5, 42 , 18 @p, 186 P

85-86

PMT. See also Payments in TVM, 63 rounded amortization

80-81

115

128

Using

56 Q, 56 l, 186 ¡

146-47

243-46

176

171

148

178

132 L

109 ‹, 115 M

This regulation applies only to The Netherlands

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() $ _ 80,000 (Initial flow)

$ _ 80,000 (Initial flow)