MEPS − Televisions | April 2005 |

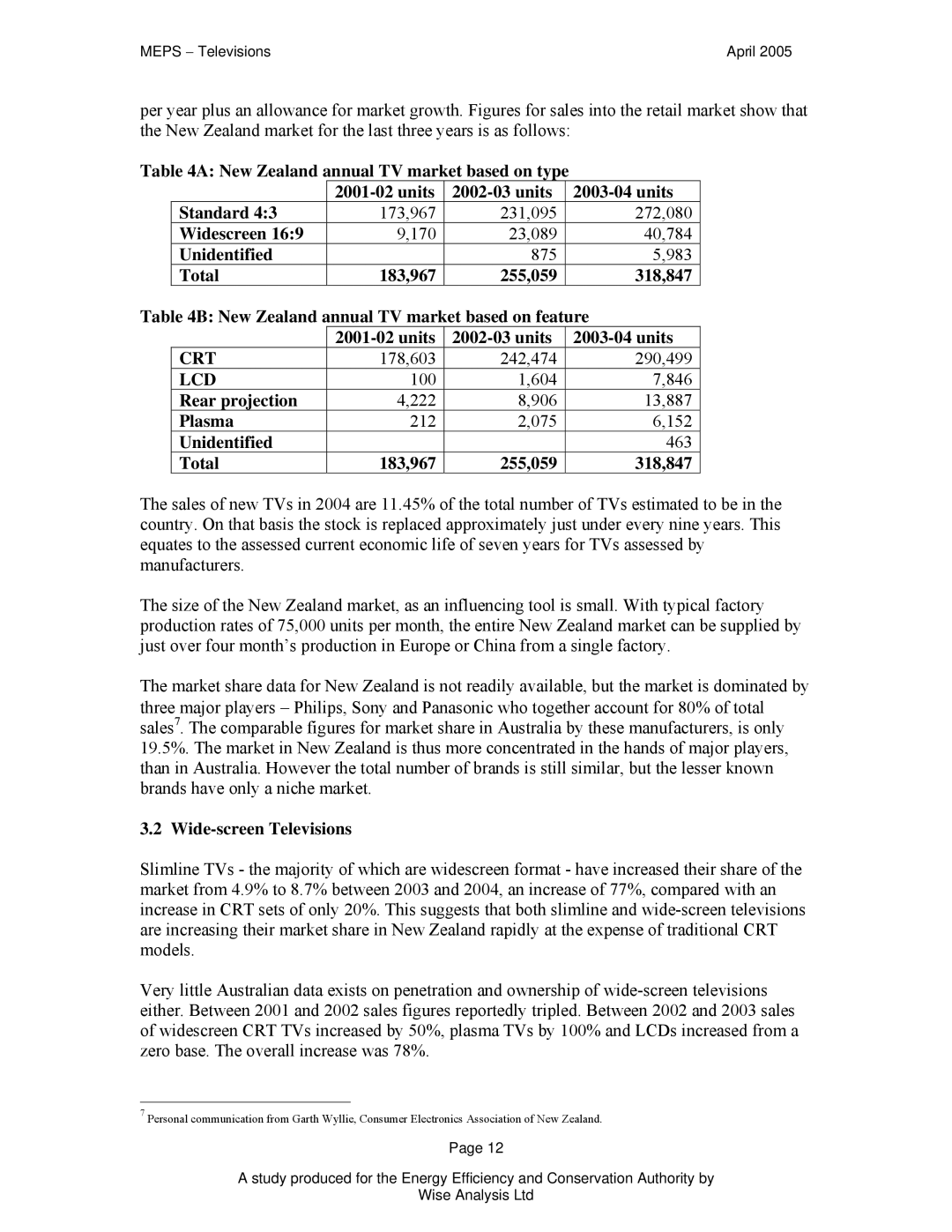

per year plus an allowance for market growth. Figures for sales into the retail market show that the New Zealand market for the last three years is as follows:

Table 4A: New Zealand annual TV market based on type |

| ||||

|

|

|

| ||

| Standard 4:3 | 173,967 | 231,095 |

| 272,080 |

| Widescreen 16:9 | 9,170 | 23,089 |

| 40,784 |

| Unidentified |

| 875 |

| 5,983 |

| Total | 183,967 | 255,059 |

| 318,847 |

Table 4B: New Zealand annual TV market based on feature | |||||

|

|

| |||

| CRT | 178,603 | 242,474 |

| 290,499 |

| LCD | 100 | 1,604 |

| 7,846 |

| Rear projection | 4,222 | 8,906 |

| 13,887 |

| Plasma | 212 | 2,075 |

| 6,152 |

| Unidentified |

|

|

| 463 |

| Total | 183,967 | 255,059 |

| 318,847 |

The sales of new TVs in 2004 are 11.45% of the total number of TVs estimated to be in the country. On that basis the stock is replaced approximately just under every nine years. This equates to the assessed current economic life of seven years for TVs assessed by manufacturers.

The size of the New Zealand market, as an influencing tool is small. With typical factory production rates of 75,000 units per month, the entire New Zealand market can be supplied by just over four month’s production in Europe or China from a single factory.

The market share data for New Zealand is not readily available, but the market is dominated by three major players − Philips, Sony and Panasonic who together account for 80% of total sales7. The comparable figures for market share in Australia by these manufacturers, is only 19.5%. The market in New Zealand is thus more concentrated in the hands of major players, than in Australia. However the total number of brands is still similar, but the lesser known brands have only a niche market.

3.2 Wide-screen Televisions

Slimline TVs - the majority of which are widescreen format - have increased their share of the market from 4.9% to 8.7% between 2003 and 2004, an increase of 77%, compared with an increase in CRT sets of only 20%. This suggests that both slimline and

Very little Australian data exists on penetration and ownership of

7Personal communication from Garth Wyllie, Consumer Electronics Association of New Zealand.

Page 12

A study produced for the Energy Efficiency and Conservation Authority by

Wise Analysis Ltd