Tax status shift

The machine allows you to shift the programmed tax status of each department or the PLU key by pressing the

Tand/or Ukeys before those keys. After each entry is completed, the programmed tax status of each key is resumed.

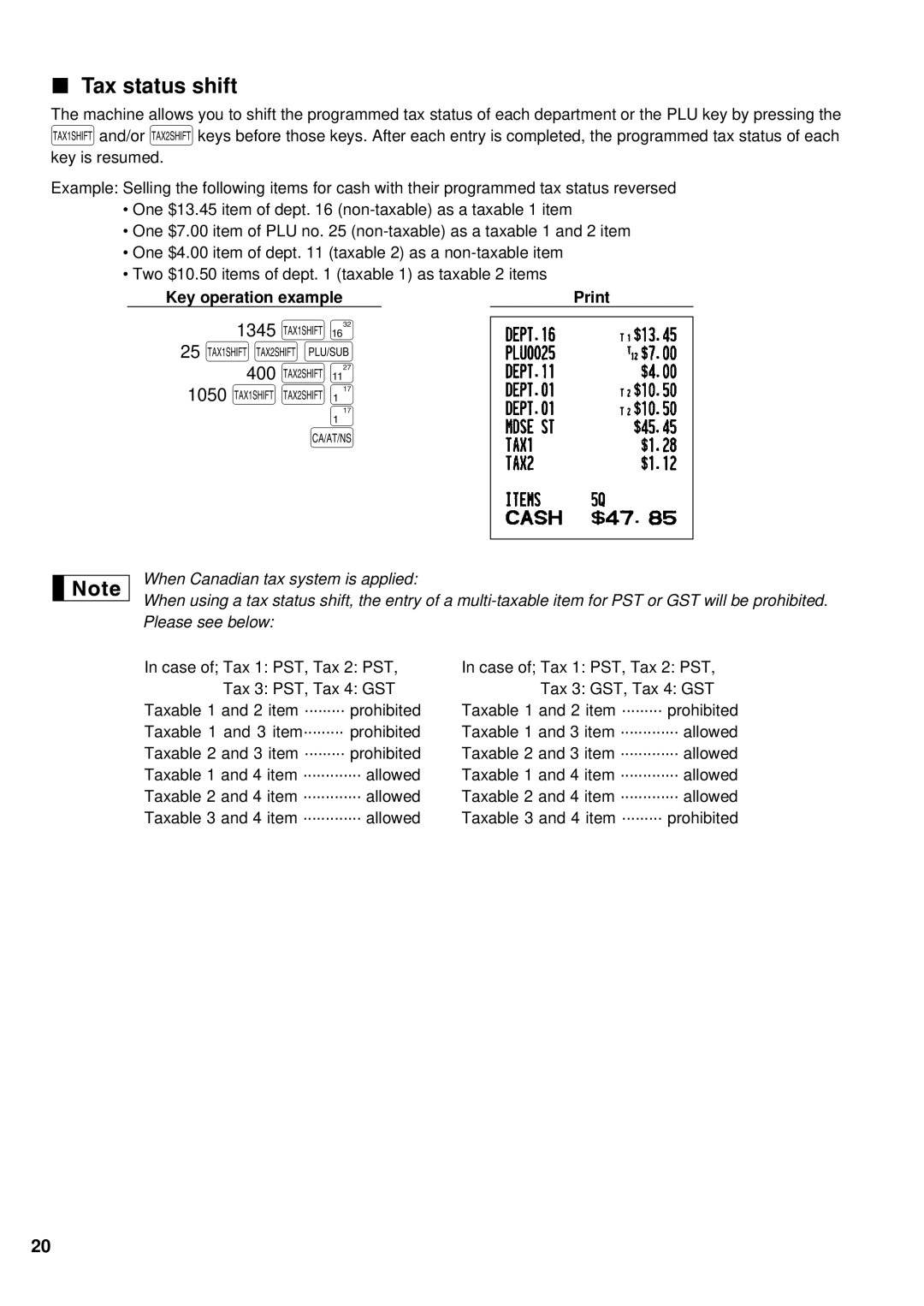

Example: Selling the following items for cash with their programmed tax status reversed

•One $13.45 item of dept. 16

•One $7.00 item of PLU no. 25

•One $4.00 item of dept. 11 (taxable 2) as a

•Two $10.50 items of dept. 1 (taxable 1) as taxable 2 items

Key operation example |

|

1345 T<

25TUp

400U/

1050 TU!

!

A

When Canadian tax system is applied:

When using a tax status shift, the entry of a

In case of; Tax 1: PST, Tax 2: PST, Tax 3: PST, Tax 4: GST

Taxable 1 and 2 item ·········prohibited Taxable 1 and 3 item·········prohibited Taxable 2 and 3 item ·········prohibited Taxable 1 and 4 item ·············allowed Taxable 2 and 4 item ·············allowed Taxable 3 and 4 item ·············allowed

In case of; Tax 1: PST, Tax 2: PST, Tax 3: GST, Tax 4: GST

Taxable 1 and 2 item ·········prohibited Taxable 1 and 3 item ·············allowed Taxable 2 and 3 item ·············allowed Taxable 1 and 4 item ·············allowed Taxable 2 and 4 item ·············allowed Taxable 3 and 4 item ·········prohibited

20