Edition3 Part Number F2223AA-90001

Users guide

Printing History

USA

Edition December June

Contents

Using variables in equations

10-1

10-6

11-9

11-1

11-4

11-8

14-4

13-24

Program constants 13-24 Physical constants 13-25

Introduction 14-1 Storing and recalling variables 14-2

19-1

18-7

18-9

18-30

Service Regulatory information

Function, Polar, Parametric

Preface

Manual conventions

Hewlett Packard’s Calculators web site can be found at

Page

On/off, cancel operations

Getting started

Home

Contrast

To adjust

Display

Parts of the display

Keyboard

Menu keys

Infrared or cable

Aplet views on

Aplet control keys

Aplet library on

Displays the Views menu. See

Button performs

Entry/Edit keys

Shifted keystrokes

Math keys

Helpwith

Inactive keys

Commands

Menus

Program

Input forms

Reset input form values

You use the Modes input form to set the modes for Home

Mode settings

Setting a mode

Press to return to Home

Aplets E-lessons

Another sequence, such as Un 1

Example x = cost and y = sint

Polar

Sequence Sequence functions U in terms of n, or

Quad Explorer aplet

Transformations reflected in the equation

Aplet views

Symbolic view Plot view

Press to display the aplet’s Symbolic view

Aplet library

Select Plot-Table

Select Plot-Detail

Select Overlay Plot

Aplet view configuration

Plot Setup Numeric Setup Symbolic Setup

Sketch view

Entering expressions

Where to start

To save aplet configuration

Mathematical calculations

23 3 EEX

Long results Negative numbers Scientific notation powers

Using

Explicit and implicit multiplication

Entering Calculates Sin 45 + π

Parentheses

Input Output Last input Edit line Last output

Getting started

Storing a value in a variable

Using fractions

Accessing the display history Clearing the display history

Setting Fraction mode

Setting fraction precision

Fraction calculations

Select

Fraction

Converting decimals to fractions

Enter the calculation Evaluate the calculation

Fraction as

This example, the fraction precision is set to

Complex numbers

Catalogs and editors

Aplet views

About the Symbolic view

Defining an expression Symbolic view

Aplets and their views

Independent variable in the expressions is T

Evaluating expressions

Aplets

Select Function

Home

About the Plot view

Setting up the plot Plot view setup

Plot view settings

ΘRNG

ΘSTEP

Exploring the graph

Reset plot settings

To move between relations

Trace a graph

Zoom within a graph

To jump directly to a value To turn trace on/off

Zoom options

Auto Scale

Square

Set

Factors

Now un-zoom

Un-zoom

To box zoom

Views menu options

Other views for scaling and splitting the graph

Pixel=π/24 radian, 7.58, or

Unit. Resets default values for

Split the screen

Making each pixel=1 unit. Not

Trigonometric

Overlay plots

Decimal scaling

Integer scaling

About the numeric view

Setting up the table Numeric view setup

Numeric view settings

Exploring the table of numbers

NUM view menu keys Zoom within a table

Integer Numstart and Numstep

Numtype Build Your Own

Building your own table of numbers

Build a table

Clear data

Example plotting a circle

Build Your Own menu keys

Display the functions in numeric form

Reset the graph setup to the default settings

Function aplet, specify the functions

Function

Page

Open the Function aplet

Function aplet

About the Function aplet

Getting started with the Function aplet

Plot the functions

Define the expressions Set up the plot

Plot the functions

Specify a grid for the graph

Times

Change the scale Trace a graph

Select Auto

Scale

Select Root

Analyse graph with FCN functions

Select Signed area

Select Slope

Select Extremum

To find the extremum of the quadratic

Display the numeric view

Explore the table

Display the table of values

To display

Symbolic definition A column

Display the symbolic definition for the F1 column

Symbolic definition F1 is displayed at Bottom of the screen

Function aplet interactive analysis

Select Plot FCN

Or to choose a variable

Slope

FCN functions

Root

Extremum

Cursor. You need to have at

Symbolic view. Displays

Shading area

Intersection

Plotting a piecewise-defined function

Define the expressions

Parametric aplet

About the Parametric aplet

Getting started with the Parametric aplet

Select Degrees

Set up the plot Plot the expression

Set angle measure

Set the angle measure to degrees

Overlay plot Display the numbers

Plot a triangle graph over the existing circle graph

120

Page

Select Polar

Polar aplet

Getting started with the Polar aplet

Open the Polar aplet

Display the Plot view menu key labels

Explore the graph Display the numbers

Sequence aplet

About the Sequence aplet

Getting started with the Sequence aplet

Menu keys to assist in the entry of equations

Define the expression Specify plot settings

Open the Sequence aplet

Sequence

Display the . Display the table of values for this example

Plot Setup, set the Seqplot option to Cobweb

Plot the sequence

Select Cobweb

Page

About the Solve aplet

Solve aplet

Select Solve

Getting started with the Solve aplet

Open the Solve aplet

Define the equation Enter known variables

Modes is set to Comma, use instead

Solve the unknown variable Plot the equation

Displays other pages of variables, if

Plot the equation for variable a

Solve aplet’s NUM view keys are

Copies the highlighted value to

Use an initial guess

Interpreting results

Consider the equation of motion for an accelerating body

Plotting to find guesses

Plot the graph

To highlight T

Press until the cursor is at the intersection

Using variables in equations

Solver

Linear Solver aplet

Open the Linear Sequence aplet

Select Linear

Hence we need the three-equation input form

Solver was able to find solutions for x, y, and z as

Linear Solver aplet

Page

About the Triangle Solver aplet

Triangle Solve aplet

Triangle Solver

Open the Triangle Solver aplet

Errors

Addition, you cannot specify only angles and no lengths

Not enough data

Statistics aplet

About the Statistics aplet

Getting started with the Statistics aplet

To move to the next column

Enter data

Select Statistics

Enter the data into the columns

Select a fit in the Symbolic setup view

Choose fit and data columns Explore statistics

Value is

Slope m is 425.875. The y-intercept b is

Setup plot Plot the graph Draw the regression curve

Display the equation for best linear fit

To move to the FIT1 field

Predict values

To highlight

Stat-Two

Statistics aplet’s Numeric view keys are

Entering and editing statistical data

Statistics

Expression

Expression in standard Mathematical form. Press When Done

Copies the column variable or

Variable expression to the edit line

Clear is used

Data sets will need to be selected

Again before re-use

Plot a histogram of the data

Save data Edit a data set

Sort data values

Delete data Insert data

Fit models

Angle Setting

Defining a regression model

To choose the fit

To define your own fit

7,8,15,16,17

Computed statistics

Plotting

Two-variable

Columns for a linear fit only

Plot types

Histogram Box and Whisker Plot

To plot statistical data

Fitting a curve to 2VAR data

Scatter Plot

Correlation coefficient

Setting up the plot Plot setup view

Relative Error

Plotting mark 2VAR Connected points 2VAR

Trouble-shooting a plot

Statistics aplet’s Plot view keys

Erases the plot

Model

Calculating predicted values

Find predicted values

According to the current regression

Statistics aplet 10-21

Page

Open the Inference aplet

Inference aplet

About the Inference aplet

Getting started with the Inference aplet

Inference aplet’s Symb view keys

Table below summarizes the options available Symbolic view

Test 1 μ

Setup-NUM

Select the inferential method Enter data

Select Hypoth Test

Importing sample statistics from the Statistics aplet

Are explained in the feature of this aplet

Produced by the calculator 529 295 952 259 925 592

If the Decimal Mark setting in the Modes input form

Statistics aplet opens in the Numeric view

C1 column, enter the random numbers

Select Conf Interval

Set up the interval calculation

Open Inference aplet

Inference

Display Numeric view Display Plot view

Specify a 90% Confidence interval in the C field

To move to the C field

Inputs

Hypothesis tests

One-Sample Z-Test

Menu name

Results

Two-Sample Z-Test

Measures the strength of the evidence for a selected

One-Proportion Z-Test

Population 2 standard

Test 1π

Two-Proportion Z-Test

One-Sample T-Test

With the α level that you

Sample standard deviation

Pooled?

Two-Sample T-Test

One-Sample Z-Interval

Confidence intervals

Two-Sample Z-Interval

Two-Proportion Z-Interval

One-Proportion Z-Interval

One-Sample T-Interval

Pooled

Two-Sample T-Interval

Critical T Critical value for T

Background

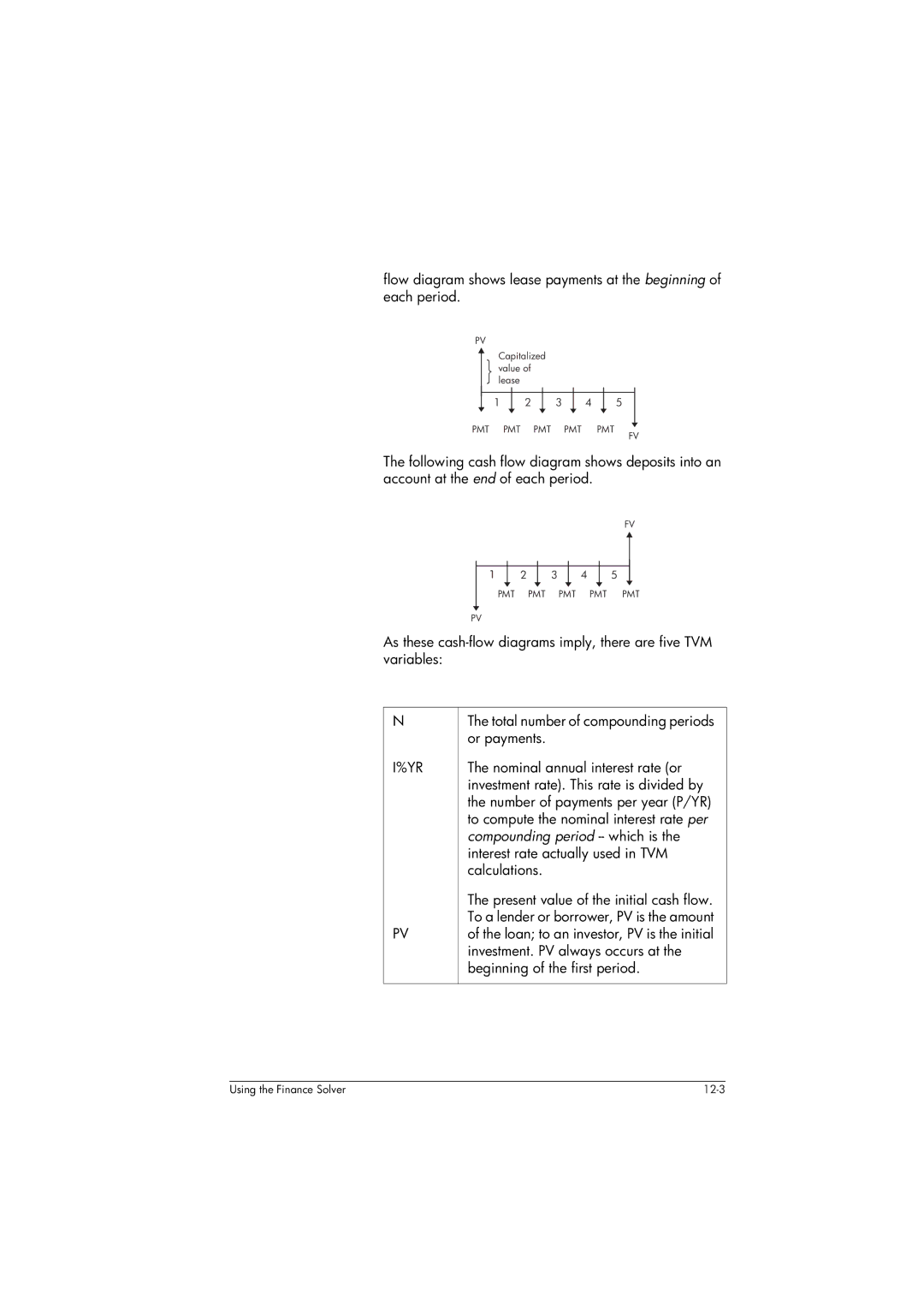

Using the Finance Solver

3 4

Compounding period -- which is

PMT

Performing TVM calculations

Example 1 Loan calculations

Example 2 Mortgage with balloon payment

To continue amortizing the loan

Calculating Amortizations

To calculate amortizations

Example 3 Amortization for home mortgage

Example 4 Amortization for home mortgage

Name. Note You do not need to press first

Using mathematical functions

Math functions

Math menu

Functions common to keyboard and menus

Math functions by category

Function categories

Syntax

E5 returns

Keyboard functions

Value1+ value2 , etc

Evalue

LOG100 returns

Returns

ABS1,2 returns

S1,2*X+3,X

Calculus functions

Nthroot 8 returns

∂ s1s1 2+3*s1 returns 2*s1+3

Conj

Complex number functions

Taylor

ARG

Minreal

Constants

Conversions

Maxreal

Hyperbolic trigonometry

Loop functions

List functions

Polyeval

Matrix functions

Polynomial functions

Polycoef

Perm

Probability functions

Polyroot

Comb

Real-number functions

Frac

DEG→RAD

Floor

Fnroot

MIN

INT

Mant

MAX

Sign

Total

RAD→DEG

Round

Isolate

Symbolic functions

Two-variable statistics

Xpon

QUADX-12-7,X returns

Test functions

Quad

Quote

XOR

Trigonometry functions

Ifte

Not

Symbolic calculations

To find derivatives in Home

Finding derivatives

To find derivatives in the Function aplet’s Symbolic view

Evaluate the function Show the result

Select F2X and evaluate it

To find the indefinite integral using formal variables

You could also just define

For example, to find the indefinite integral

Program constants

Program constants and physical constants

Physical constants

13-26

Introduction

Variables and memory management

Storing and recalling variables

To use variables

Calculations

To clear a variable

Vars menu

Open the Vars menu

Press

Result in another list variable

Add the contents of two list variables, and to store

Names or values of variables into programs

Example

14-6

That you can configure using

To store into a graphics variable on

17-5 for more information on

Aplet variables on page R-7

To access an aplet

X0, Y0 to X9, Y9 Symbolic view. See

Variable

To delete variables in a category

Memory Manager

Line, press and press

Details of variables within the category

Page

Matrix Variables

Matrices

Vectors

Matrices

Creating and storing matrices

Matrix Catalog keys

POLYROOT1,0,-1,0 M1

To create a matrix in the Matrix Catalog

To transmit a matrix

Working with matrices

Moves to the first row, last row, first

Deletes the highlighted cells, row

Or column you are prompted to

Make a choice

Matrix arithmetic

To store one element

Create the second matrix

Matrices 15-7

Open the Matrix catalog and create a vector

Solving systems of linear equations

Select Real matrix

About functions

Matrix functions and commands

About commands

Argument conventions

DOT

Cond

Cross

DET

Rref

Makemat

Rank

Rownorm

Examples

Transposing a Matrix Reduced-Row Echelon Form

Matrices 15-15

Page

You can create, edit, delete, send, and receive named

Lists

List catalog keys

List edit keys

Create a list

Element

Displaying and editing lists

To display a list

To display one

148 L12

A list

To insert an element 1. Open the List catalog

Press , and press

To delete a list

List functions

Deleting lists

Transmitting lists

ΔLISTlist1

2,3 returns 5,10,15

CONCATlist1,list2

CONCAT1,2,3,4 returns 1,2,3,4

23 27 Calculates the product of all elements in list

ΠLISTlist

ΠLIST2,3,4 returns

Finding statistical values for list elements

16-10

Or to exit the Notes view

Aplet note view

To write a note in Note view

Your work is automatically saved. Press any view key

Alpha-lock for letter entry

Contents of variables

Commands

Space key for text entry

Aplet sketch view

Sketch keys

To draw a line

Draw keys

To draw a box

Press to continue drawing, or press

Mynote

Another HP 39gs or PC

Opens the selected note for

Begins a new note, and asks

For a name

Press instead

Programming

Contents of a Program Structured Programming

Programs that perform smaller tasks

Program catalog

Open Program Catalog

Be simple-or it can be divided further into other

Program catalog keys

Creating and editing programs

Create a new program

Press Progrm to open the Program catalog

On the left, use or to highlight a command

Press to paste the command into the program editor

Edit a program 1. Press Progrm to

Editing keys

Run a program Debug a program Stop a program

Using programs

Transmit a program

Customizing an aplet

Example

Aplet naming convention

Save the aplet

Configuring the Setviews menu option programs

’’ ’’’’EXP.SV’’0

Setviews ’’’’ ’’’’18

’’My Entry1’’’’EXP.ME1’’1

’’My Entry2’’’’EXP.ME2’’3

Programming commands

’’’’’’EXP.ANG’’0

’’Start’’’’EXP.S’’7

Setviews

Aplet commands

Check

Select

Auto-run programs

Associating programs with your aplet

ProgramName

ViewNumber

Including standard menu options

Uncheck n

Branch commands

Uncheck

IF...THEN...END

If A==1

IF... THEN... Else

END CASE...END Iferr Then ELSE…

END

Drawing commands

RUN

Stop

Line

BOX

Erase

Freeze

Graphic commands

→PLOT

Grobxor

Makegrob

PLOT→

Loop commands

Matrix commands

Scaleadd

Randmat

Redim

Scale

Prompt commands

Print commands

Disp 3A is 2+2

Clrvar

Disp

Dispxy

Disptime

51.52HELLO

Editmat matrixname

Getkey

Input

Msgbox

Stat-One and Stat-Two commands

Stat-One commands

Stat-Two commands

Storing and retrieving variables in programs

Plot-view variables

InvCross

Grid

Hmin/Hmax

Indep

Root

Isect

Labels

Recenter

Slope

S1mark-S5mark

SeqPlot

Simult

Tracing

Umin/Umax

Ustep

Tmin / Tmax

Ytick

Tstep

Xcross

Ycross

Yzoom

Ymin / Ymax

Symbolic-view variables

Cubic S2fit

S1fit...S5fit

Format

Numeric-view variables

C1...C9, C0

Digits

NumRow

NumCol

NumFont

NumIndep

StatMode

NumStep

NumType

NumZoom

Graphicname

Sketch variables

PageNum

Following aplet variable is available in Note view

Creating new aplets based on existing aplets

Extending aplets

Open the Solve aplet and save it under the new name

Solve

Degrees

Resetting an aplet

Using a customized aplet

Choose the sine formula in E1

Downloading e-lessons from the web

Sending and receiving aplets

Hewlett-Packard’s Calculators web site can be found at

To transmit an aplet

To sort the aplet list To delete an aplet

Sorting items in the aplet library menu list

Cross matrix1,matrix2

Reference information

Glossary

Expression line#

Set to Comma and enclosed

Editor and catalog Matrix Two-dimensional array of values

Record using the Program editor

Vector One-dimensional array of values

Resetting the HP 39gs

To erase all memory and reset defaults

To reset using the keyboard

Operating details

If the calculator does not turn on

Batteries

To install the main batteries To install the backup battery

Home variables

Variables

Function aplet variables

Area Root Extremum Slope Isect

Angle

Parametric aplet variables are Category Available name Plot

Parametric aplet variables

Polar aplet variables are Category Available names Plot

Polar aplet variables

Sequence aplet variables are Category Available name Plot

Sequence aplet variables

Solve aplet variables

Solve aplet variables are Category Available name Plot

Digits NumCol Format NumRow

Statistics aplet variables

Hyperb

Math menu categories

Math functions

Math functions are Category Available name Calculus

Polynom

Category Available name Matrix

Stat1Var Stat2Var

Degrees Grads Radians

Standard Sci Fixed Eng Fraction

Cobweb Stairstep

Wavelength, λc

Compt w... Compton

Print

Program commands

Program commands are Category Command Aplet

Branch

Status messages

Category Command Stat-Two

Function value, root, extremum

Also be correct. Look up

Function name in the index to

Find its proper syntax

Page

HP 39gs Graphing Calculator Warranty period 12 months

Limited Warranty

Page

Service

Rotc = Rest of the country

Canada 905 206-4663 or

Regulatory information

This marking is valid for EU

Xxxx

Page

Page

Branch structures 18-17 build your own table

Index

Contrast

Freeze 18-20 Line 18-20 Pixoff 18-20 Pixon 18-20 Tline

Acosh Alog Asinh Atanh Cosh EXP

Grobor

Page

Page

Angle measure 1-10 decimal mark 1-11 number format

Trigonometric scaling 2-14 two-variablestatistics

Sending and receiving 18-8 structured

Menu lists 1-8 speed searches

Navigate around 3-8 numeric values 3-7 numeric view setup

Page