Edition3 Part Number F2223AA-90001

Users guide

Edition December June

Printing History

USA

Contents

10-6

Using variables in equations

10-1

11-4

11-1

11-8

11-9

Program constants 13-24 Physical constants 13-25

13-24

Introduction 14-1 Storing and recalling variables 14-2

14-4

18-9

18-7

18-30

19-1

Service Regulatory information

Manual conventions

Preface

Hewlett Packard’s Calculators web site can be found at

Function, Polar, Parametric

Page

Home

On/off, cancel operations

Getting started

Display

To adjust

Parts of the display

Contrast

Infrared or cable

Keyboard

Menu keys

Aplet library on

Aplet control keys

Displays the Views menu. See

Aplet views on

Button performs

Entry/Edit keys

Shifted keystrokes

Math keys

Helpwith

Menus

Commands

Program

Inactive keys

Input forms

Reset input form values

You use the Modes input form to set the modes for Home

Mode settings

Setting a mode

Press to return to Home

Aplets E-lessons

Polar

Example x = cost and y = sint

Sequence Sequence functions U in terms of n, or

Another sequence, such as Un 1

Quad Explorer aplet

Transformations reflected in the equation

Press to display the aplet’s Symbolic view

Symbolic view Plot view

Aplet library

Aplet views

Select Overlay Plot

Select Plot-Table

Select Plot-Detail

Sketch view

Aplet view configuration

Plot Setup Numeric Setup Symbolic Setup

To save aplet configuration

Where to start

Mathematical calculations

Entering expressions

Using

Long results Negative numbers Scientific notation powers

Explicit and implicit multiplication

23 3 EEX

Entering Calculates Sin 45 + π

Parentheses

Input Output Last input Edit line Last output

Getting started

Storing a value in a variable

Setting Fraction mode

Using fractions

Accessing the display history Clearing the display history

Setting fraction precision

Fraction

Fraction calculations

Select

Fraction as

Converting decimals to fractions

Enter the calculation Evaluate the calculation

This example, the fraction precision is set to

Complex numbers

Catalogs and editors

Defining an expression Symbolic view

About the Symbolic view

Aplets and their views

Aplet views

Independent variable in the expressions is T

Select Function

Evaluating expressions

Aplets

Home

About the Plot view

Setting up the plot Plot view setup

ΘSTEP

Plot view settings

ΘRNG

Exploring the graph

Reset plot settings

To move between relations

Trace a graph

Zoom options

Zoom within a graph

To jump directly to a value To turn trace on/off

Set

Square

Factors

Auto Scale

Now un-zoom

Un-zoom

To box zoom

Views menu options

Other views for scaling and splitting the graph

Split the screen

Unit. Resets default values for

Making each pixel=1 unit. Not

Pixel=π/24 radian, 7.58, or

Decimal scaling

Overlay plots

Integer scaling

Trigonometric

About the numeric view

Setting up the table Numeric view setup

NUM view menu keys Zoom within a table

Numeric view settings

Exploring the table of numbers

Integer Numstart and Numstep

Build a table

Building your own table of numbers

Clear data

Numtype Build Your Own

Example plotting a circle

Build Your Own menu keys

Function aplet, specify the functions

Reset the graph setup to the default settings

Function

Display the functions in numeric form

Page

About the Function aplet

Function aplet

Getting started with the Function aplet

Open the Function aplet

Plot the functions

Define the expressions Set up the plot

Specify a grid for the graph

Plot the functions

Select Auto

Change the scale Trace a graph

Scale

Times

Select Root

Analyse graph with FCN functions

Select Signed area

Select Slope

Select Extremum

To find the extremum of the quadratic

Display the table of values

Display the numeric view

Explore the table

Display the symbolic definition for the F1 column

Symbolic definition A column

Symbolic definition F1 is displayed at Bottom of the screen

To display

Or to choose a variable

Function aplet interactive analysis

Select Plot FCN

Root

FCN functions

Extremum

Slope

Shading area

Symbolic view. Displays

Intersection

Cursor. You need to have at

Plotting a piecewise-defined function

About the Parametric aplet

Parametric aplet

Getting started with the Parametric aplet

Define the expressions

Set angle measure

Set up the plot Plot the expression

Set the angle measure to degrees

Select Degrees

120

Overlay plot Display the numbers

Plot a triangle graph over the existing circle graph

Page

Getting started with the Polar aplet

Polar aplet

Open the Polar aplet

Select Polar

Display the Plot view menu key labels

Explore the graph Display the numbers

Getting started with the Sequence aplet

Sequence aplet

About the Sequence aplet

Open the Sequence aplet

Define the expression Specify plot settings

Sequence

Menu keys to assist in the entry of equations

Plot the sequence

Plot Setup, set the Seqplot option to Cobweb

Select Cobweb

Display the . Display the table of values for this example

Page

About the Solve aplet

Solve aplet

Open the Solve aplet

Getting started with the Solve aplet

Define the equation Enter known variables

Select Solve

Modes is set to Comma, use instead

Solve the unknown variable Plot the equation

Solve aplet’s NUM view keys are

Plot the equation for variable a

Copies the highlighted value to

Displays other pages of variables, if

Use an initial guess

Interpreting results

Consider the equation of motion for an accelerating body

Plotting to find guesses

Plot the graph

To highlight T

Press until the cursor is at the intersection

Using variables in equations

Open the Linear Sequence aplet

Linear Solver aplet

Select Linear

Solver

Hence we need the three-equation input form

Solver was able to find solutions for x, y, and z as

Linear Solver aplet

Page

About the Triangle Solver aplet

Triangle Solve aplet

Triangle Solver

Open the Triangle Solver aplet

Errors

Addition, you cannot specify only angles and no lengths

Not enough data

Getting started with the Statistics aplet

Statistics aplet

About the Statistics aplet

Select Statistics

Enter data

Enter the data into the columns

To move to the next column

Value is

Select a fit in the Symbolic setup view

Choose fit and data columns Explore statistics

Display the equation for best linear fit

Setup plot Plot the graph Draw the regression curve

To move to the FIT1 field

Slope m is 425.875. The y-intercept b is

Stat-Two

Predict values

To highlight

Statistics aplet’s Numeric view keys are

Entering and editing statistical data

Statistics

Copies the column variable or

Expression in standard Mathematical form. Press When Done

Variable expression to the edit line

Expression

Again before re-use

Clear is used

Data sets will need to be selected

Plot a histogram of the data

Save data Edit a data set

Sort data values

Delete data Insert data

Defining a regression model

Angle Setting

To choose the fit

Fit models

To define your own fit

7,8,15,16,17

Computed statistics

Columns for a linear fit only

Plotting

Two-variable

To plot statistical data

Plot types

Histogram Box and Whisker Plot

Correlation coefficient

Fitting a curve to 2VAR data

Scatter Plot

Plotting mark 2VAR Connected points 2VAR

Setting up the plot Plot setup view

Relative Error

Erases the plot

Trouble-shooting a plot

Statistics aplet’s Plot view keys

Find predicted values

Calculating predicted values

According to the current regression

Model

Statistics aplet 10-21

Page

About the Inference aplet

Inference aplet

Getting started with the Inference aplet

Open the Inference aplet

Inference aplet’s Symb view keys

Table below summarizes the options available Symbolic view

Select the inferential method Enter data

Setup-NUM

Select Hypoth Test

Test 1 μ

Importing sample statistics from the Statistics aplet

Are explained in the feature of this aplet

Statistics aplet opens in the Numeric view

If the Decimal Mark setting in the Modes input form

C1 column, enter the random numbers

Produced by the calculator 529 295 952 259 925 592

Open Inference aplet

Set up the interval calculation

Inference

Select Conf Interval

To move to the C field

Display Numeric view Display Plot view

Specify a 90% Confidence interval in the C field

One-Sample Z-Test

Hypothesis tests

Menu name

Inputs

Results

Two-Sample Z-Test

Population 2 standard

One-Proportion Z-Test

Test 1π

Measures the strength of the evidence for a selected

Two-Proportion Z-Test

One-Sample T-Test

With the α level that you

Sample standard deviation

Pooled?

Two-Sample T-Test

One-Sample Z-Interval

Confidence intervals

Two-Sample Z-Interval

Two-Proportion Z-Interval

One-Proportion Z-Interval

One-Sample T-Interval

Pooled

Two-Sample T-Interval

Critical T Critical value for T

Background

Using the Finance Solver

3 4

Compounding period -- which is

PMT

Performing TVM calculations

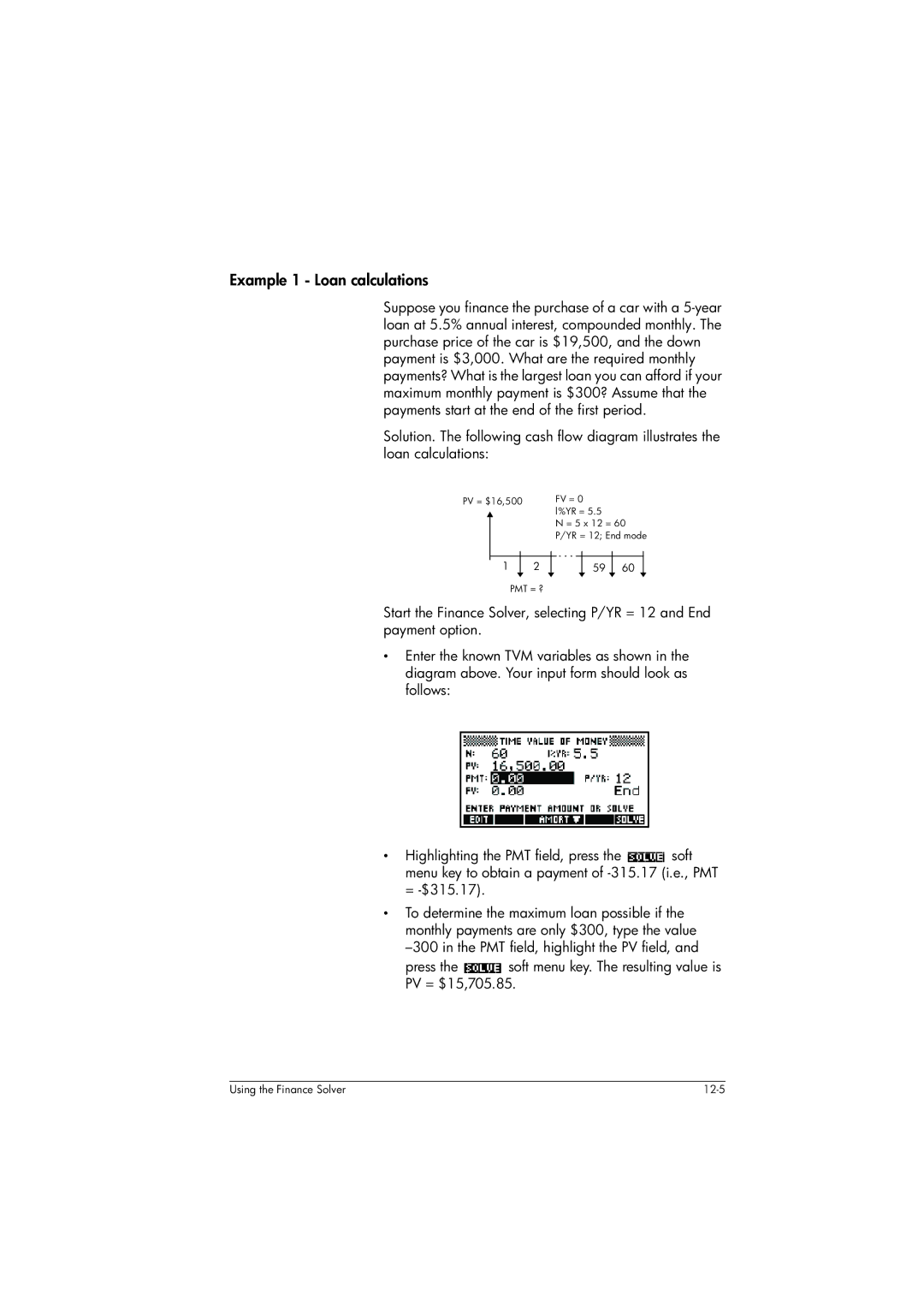

Example 1 Loan calculations

Example 2 Mortgage with balloon payment

To calculate amortizations

Calculating Amortizations

Example 3 Amortization for home mortgage

To continue amortizing the loan

Example 4 Amortization for home mortgage

Math functions

Using mathematical functions

Math menu

Name. Note You do not need to press first

Function categories

Math functions by category

Syntax

Functions common to keyboard and menus

Value1+ value2 , etc

Keyboard functions

Evalue

E5 returns

LOG100 returns

Returns

ABS1,2 returns

Nthroot 8 returns

Calculus functions

∂ s1s1 2+3*s1 returns 2*s1+3

S1,2*X+3,X

Taylor

Complex number functions

ARG

Conj

Conversions

Constants

Maxreal

Minreal

Hyperbolic trigonometry

Loop functions

List functions

Polynomial functions

Matrix functions

Polycoef

Polyeval

Polyroot

Probability functions

Comb

Perm

Real-number functions

Floor

DEG→RAD

Fnroot

Frac

Mant

INT

MAX

MIN

RAD→DEG

Total

Round

Sign

Two-variable statistics

Symbolic functions

Xpon

Isolate

Quad

Test functions

Quote

QUADX-12-7,X returns

Ifte

Trigonometry functions

Not

XOR

Symbolic calculations

To find derivatives in Home

Finding derivatives

Select F2X and evaluate it

To find derivatives in the Function aplet’s Symbolic view

Evaluate the function Show the result

For example, to find the indefinite integral

To find the indefinite integral using formal variables

You could also just define

Program constants

Program constants and physical constants

Physical constants

13-26

Introduction

Variables and memory management

Storing and recalling variables

To clear a variable

To use variables

Calculations

Press

Vars menu

Open the Vars menu

Names or values of variables into programs

Add the contents of two list variables, and to store

Example

Result in another list variable

14-6

17-5 for more information on

That you can configure using

To store into a graphics variable on

X0, Y0 to X9, Y9 Symbolic view. See

To access an aplet

Variable

Aplet variables on page R-7

Line, press and press

Memory Manager

Details of variables within the category

To delete variables in a category

Page

Vectors

Matrices

Matrices

Matrix Variables

POLYROOT1,0,-1,0 M1

Creating and storing matrices

Matrix Catalog keys

To create a matrix in the Matrix Catalog

To transmit a matrix

Working with matrices

Or column you are prompted to

Deletes the highlighted cells, row

Make a choice

Moves to the first row, last row, first

Create the second matrix

Matrix arithmetic

To store one element

Matrices 15-7

Open the Matrix catalog and create a vector

Solving systems of linear equations

Select Real matrix

About commands

Matrix functions and commands

Argument conventions

About functions

Cross

Cond

DET

DOT

Rank

Makemat

Rownorm

Rref

Examples

Transposing a Matrix Reduced-Row Echelon Form

Matrices 15-15

Page

You can create, edit, delete, send, and receive named

Lists

List catalog keys

List edit keys

Create a list

To display a list

Displaying and editing lists

To display one

Element

To insert an element 1. Open the List catalog

A list

Press , and press

148 L12

Deleting lists

List functions

Transmitting lists

To delete a list

CONCATlist1,list2

2,3 returns 5,10,15

CONCAT1,2,3,4 returns 1,2,3,4

ΔLISTlist1

ΠLIST2,3,4 returns

23 27 Calculates the product of all elements in list

ΠLISTlist

Finding statistical values for list elements

16-10

To write a note in Note view

Aplet note view

Your work is automatically saved. Press any view key

Or to exit the Notes view

Commands

Contents of variables

Space key for text entry

Alpha-lock for letter entry

To draw a line

Aplet sketch view

Sketch keys

Draw keys

To draw a box

Press to continue drawing, or press

Mynote

Begins a new note, and asks

Opens the selected note for

For a name

Another HP 39gs or PC

Press instead

Programming

Contents of a Program Structured Programming

Open Program Catalog

Program catalog

Be simple-or it can be divided further into other

Programs that perform smaller tasks

Program catalog keys

Press Progrm to open the Program catalog

Creating and editing programs

Create a new program

Edit a program 1. Press Progrm to

On the left, use or to highlight a command

Press to paste the command into the program editor

Editing keys

Run a program Debug a program Stop a program

Using programs

Transmit a program

Customizing an aplet

Example

Aplet naming convention

Save the aplet

Configuring the Setviews menu option programs

’’My Entry1’’’’EXP.ME1’’1

Setviews ’’’’ ’’’’18

’’My Entry2’’’’EXP.ME2’’3

’’ ’’’’EXP.SV’’0

’’Start’’’’EXP.S’’7

Programming commands

’’’’’’EXP.ANG’’0

Check

Aplet commands

Select

Setviews

Auto-run programs

Associating programs with your aplet

Including standard menu options

ProgramName

ViewNumber

Uncheck

Branch commands

IF...THEN...END

Uncheck n

END CASE...END Iferr Then ELSE…

IF... THEN... Else

END

If A==1

Stop

Drawing commands

RUN

Erase

BOX

Freeze

Line

Graphic commands

Makegrob

Grobxor

PLOT→

→PLOT

Loop commands

Matrix commands

Redim

Randmat

Scale

Scaleadd

Prompt commands

Print commands

Disp

Clrvar

Dispxy

Disp 3A is 2+2

Editmat matrixname

Disptime

51.52HELLO

Msgbox

Getkey

Input

Stat-Two commands

Stat-One and Stat-Two commands

Stat-One commands

Storing and retrieving variables in programs

Plot-view variables

Hmin/Hmax

Grid

Indep

InvCross

Labels

Isect

Recenter

Root

SeqPlot

S1mark-S5mark

Simult

Slope

Ustep

Umin/Umax

Tmin / Tmax

Tracing

Xcross

Tstep

Ycross

Ytick

Yzoom

Ymin / Ymax

Symbolic-view variables

Cubic S2fit

S1fit...S5fit

C1...C9, C0

Numeric-view variables

Digits

Format

NumFont

NumCol

NumIndep

NumRow

NumType

NumStep

NumZoom

StatMode

PageNum

Sketch variables

Following aplet variable is available in Note view

Graphicname

Creating new aplets based on existing aplets

Extending aplets

Degrees

Open the Solve aplet and save it under the new name

Solve

Choose the sine formula in E1

Resetting an aplet

Using a customized aplet

Hewlett-Packard’s Calculators web site can be found at

Downloading e-lessons from the web

Sending and receiving aplets

To transmit an aplet

To sort the aplet list To delete an aplet

Sorting items in the aplet library menu list

Glossary

Reference information

Expression line#

Cross matrix1,matrix2

Record using the Program editor

Editor and catalog Matrix Two-dimensional array of values

Vector One-dimensional array of values

Set to Comma and enclosed

To reset using the keyboard

Resetting the HP 39gs

To erase all memory and reset defaults

Batteries

Operating details

If the calculator does not turn on

To install the main batteries To install the backup battery

Home variables

Variables

Angle

Function aplet variables

Area Root Extremum Slope Isect

Parametric aplet variables are Category Available name Plot

Parametric aplet variables

Polar aplet variables are Category Available names Plot

Polar aplet variables

Sequence aplet variables are Category Available name Plot

Sequence aplet variables

Digits NumCol Format NumRow

Solve aplet variables

Solve aplet variables are Category Available name Plot

Statistics aplet variables

Math functions

Math menu categories

Math functions are Category Available name Calculus

Hyperb

Polynom

Category Available name Matrix

Standard Sci Fixed Eng Fraction

Degrees Grads Radians

Cobweb Stairstep

Stat1Var Stat2Var

Wavelength, λc

Compt w... Compton

Program commands are Category Command Aplet

Program commands

Branch

Print

Status messages

Category Command Stat-Two

Function name in the index to

Also be correct. Look up

Find its proper syntax

Function value, root, extremum

Page

HP 39gs Graphing Calculator Warranty period 12 months

Limited Warranty

Page

Service

Rotc = Rest of the country

Canada 905 206-4663 or

Regulatory information

This marking is valid for EU

Xxxx

Page

Page

Branch structures 18-17 build your own table

Index

Contrast

Freeze 18-20 Line 18-20 Pixoff 18-20 Pixon 18-20 Tline

Acosh Alog Asinh Atanh Cosh EXP

Grobor

Page

Page

Angle measure 1-10 decimal mark 1-11 number format

Trigonometric scaling 2-14 two-variablestatistics

Sending and receiving 18-8 structured

Menu lists 1-8 speed searches

Navigate around 3-8 numeric values 3-7 numeric view setup

Page

![]() soft menu key to obtain a payment of

soft menu key to obtain a payment of ![]() soft menu key. The resulting value is PV = $15,705.85.

soft menu key. The resulting value is PV = $15,705.85.