TINSZ2602RCZZ, XE-A406 specifications

The Sharp XE-A406 and its model variant, the TINSZ2602RCZZ, represent a significant advancement in the realm of electronic cash registers, tailored for small to medium-sized businesses. Combining robust features with user-friendly technology, this model has garnered acclaim for its efficiency and reliability in a fast-paced retail environment.One of the standout features of the Sharp XE-A406 is its intuitive operating system, designed to facilitate easy use for both seasoned cashiers and new employees. The large, backlit LCD display ensures that users can clearly read transactions, even in low-light conditions. This clarity is further complemented by an efficient keypad layout, which supports swift data entry and minimizes potential errors during busy hours.

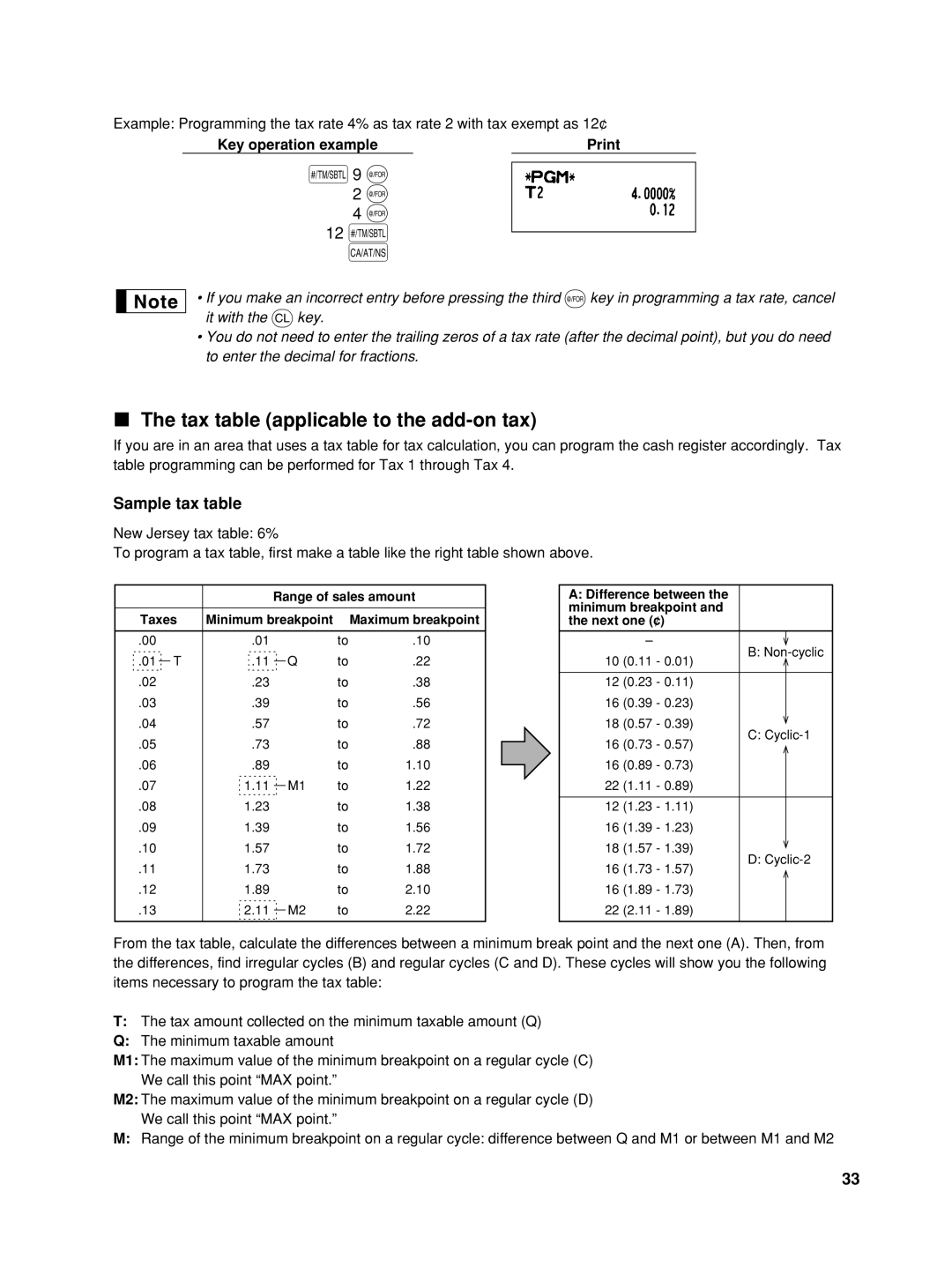

The XE-A406 offers a comprehensive range of functionalities; it includes up to 1,000 PLUs (Price Look-Up codes), which allows businesses to store and quickly access frequently sold items. Additionally, it supports multiple tax rates, making it versatile for various locations and compliance with local tax regulations. The inclusion of a built-in thermal printer allows for high-quality receipt printing, ensuring that customers leave with clear transaction records.

Connectivity is another critical aspect of the XE-A406. It features USB port access, facilitating easy integration with other business management systems. This function allows the register to connect with inventory management software, enabling better stock control and reporting of sales data. Furthermore, the cash register can connect to an external display, enhancing customer engagement and experience during transactions.

In terms of security, the Sharp XE-A406 is equipped with user access codes and programmable security settings, which allow businesses to limit access to sensitive functions. This feature is crucial for maintaining integrity within financial operations and preventing unauthorized use.

The cash register also boasts a sturdy, compact design that fits well in various counter spaces, making it suitable for diverse retail environments. Its reliability is matched by its durability, ensuring it can withstand the rigors of daily use.

Overall, the Sharp XE-A406 and TINSZ2602RCZZ model stand out as reliable solutions for businesses looking to enhance their point-of-sale systems. With a blend of user-friendly features, advanced technology, and comprehensive reporting capabilities, they offer a perfect combination of style and functionality essential for efficient retail operations. The versatility and adaptability of this cash register make it an excellent choice for any business aiming to streamline transactions and improve overall customer satisfaction.