HP Part Number NW238-90001 Edition 1, December

Legal Notice

HP 20b Business Consultant

HP 30b Business Professional

Line, alphanumeric scrolling Common Mathematical

On/Off/Cancel

Functions and Math Math

Program menu

Page

Table of Contents

Amortization Interest Conversion Menu

Cash Flow Example Sample Cash Flow Diagrams Bonds Bond Menu

Canadian Mortgage Example

Black-Scholes Menu

Adjusting the Display Contrast

Basic Features

Welcome to your new HP Financial Calculator

Turning the Calculator On and Off

Cursor

Mode Menu Setting Preferences

Two Line Display

Dd.mmyyyy

Changing the Calculation Mode

Primary, Secondary, and Tertiary Key Functions

Annunciators

Using the Input and Equals Keys

Input Key

Equals Key

Editing and Clearing Entries On/CE Key

Reset Menu

Memory and the Memory Menu

Accessing Menus and Menu Maps

Basic Features

DWN

Fixed Cost Price Profit Quantity

Mathematical Functions

Mathematical Calculations

Number Entry and Display

Mathematical functions are located

Algebraic Mode

Chain Mode

RPN Stack

Reverse Polish Notation RPN Mode

Ior =, followed by an operation key

Last Number

See -2for an example using the last number function

O1c23 I56c

U3I

+ 4 x 5 +

5I6

3I4

Duplicating a Number on the Stack

RPN Stack and the Swap Operation

One-Number Functions and the Math Menu

Math Menu

Random number

DWN

Probability Sub-menu

12I

10I

Binomial Functions

15I3h

Two-Number Functions

Recall Arithmetic

Storing and Recalling Numbers

Storing and Recalling with Time Value of Money TVM Keys

Rounding Numbers

Recalling a Menu Item Value in a Menu

Percentages

Mathematical Calculations

Time Value of Money TVM Keys

Time Value of Money

Stores or calculates the amount of each periodic payment

Calculating Payments on a Loan

1400 00V

360N

Amortization

Principal Interest

Nb Per Start Balance

Creating an Amortization Schedule

10Y

Amortization Example KeysDisplayDescription

To open the Interest Conversion menu IConv press

Interest Conversion Menu

360

Using the Interest Conversion Menu

DWN

Canadian Mortgages TVM Canada

Canadian Mortgage Example

O300 N6Y35 0000

000.00

Cash Flows

Cash Flow Example

5000

8000

4500

4000

00I

1150

Mirr

Analyzing Cash Flows

DWN Mirr Fmrr

Inv. I% Safe I%

Opens the NPV menu

Editing Cash Flows

Displays FMRR%

Sample Cash Flow Diagrams Cash Flows

Sample Cash Flow Diagrams

Set.Date Mat.Date

Bonds

CPN%

Bond Menu

42020

82010

Bond Calculation Example

=L1+

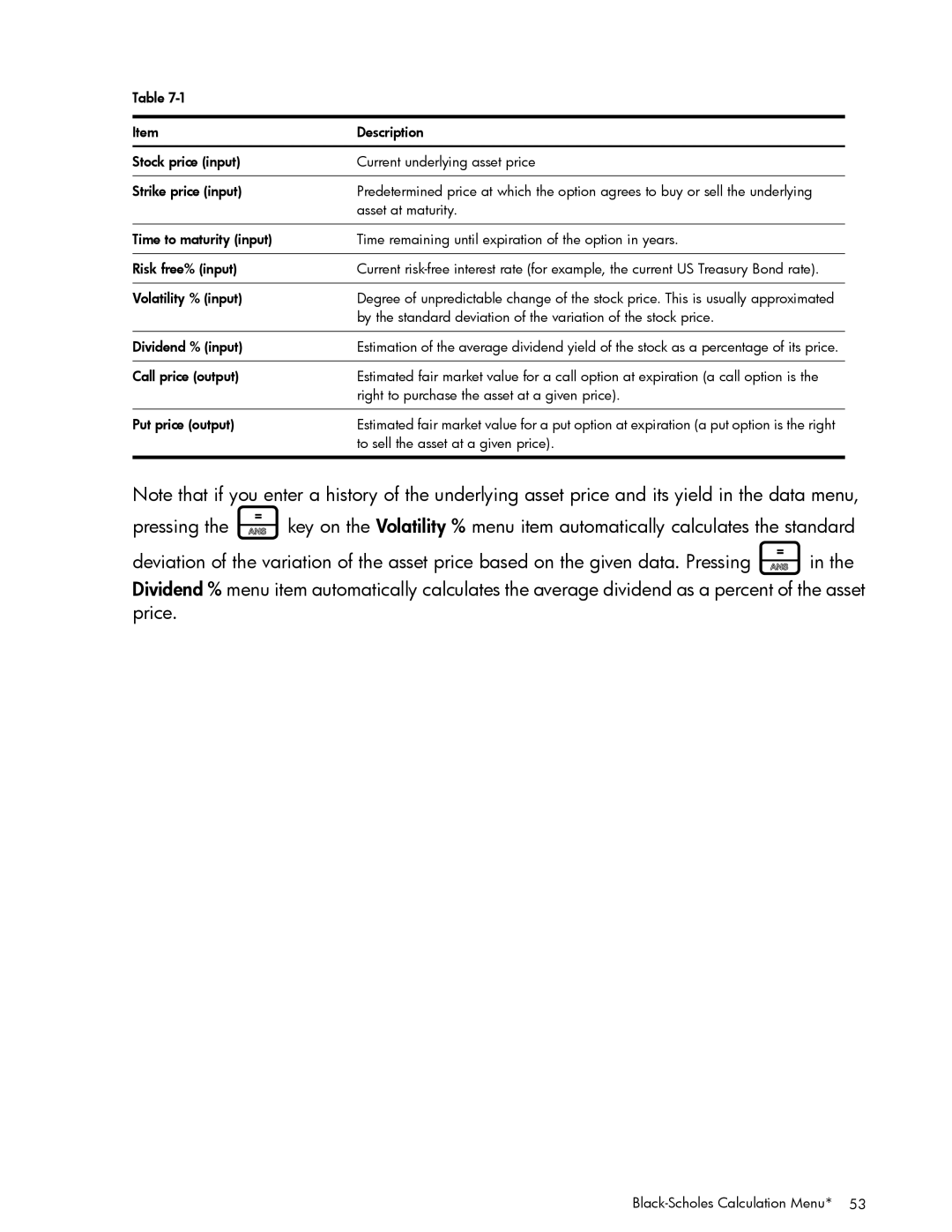

Stock price Strike price Time to maturity Risk-free %

Black-Scholes Calculation Menu

Volatility % Dividend % Call price Put price

Black-Scholes Menu

Volatility % input

Black-Scholes Example

85I

80I

78I

72I

Press to scroll to

Date Calculation Menu

Date Calculation

Date Calculation Example

Date Days Between Actual Cal.360

3120 10I

2010

Break-even Menu

Break-even

Break-even Example

250

1500 00I

300

100 00I

Percent Calculation Menu

Business Problems

Percent Calculation Examples

15I

20I

Is what % of 80?

80I

Press Ito scroll through the options Sline

Depreciation

Book Value Depreciable

Soyd

Depreciation Menu

00I 500

100

Depreciation Example

Depreciation

Ax2+bx+c only

Statistical Operations

Data and Stats Menus

Statistics Menu Items Description Std. Dev

Statistics Example

2I1 65I

1I1 50I

3I1 60I

4I1 75I

Statistical Operations

Programming the HP 30b

Programming

Key Presses for Program Instructions

Hold

Hold

Programming Example

Program Step

Reassigning Menu Functions

Followed by a label number to go

Program Menu and Program Editing

To a specific label

Creates label 03 in your program. You can

Tests and Jump Functions

Use the following keystrokes to enter the program

Sub-Function Call

Long Programs and Battery Life

Other Programming Functions

05003$1

DSE

ISG , followed by 1 digit

Messages

Debugging a Program

Calculates the volume

Saving, Restoring, and Modifying Mode Settings

Solve

L1hL1-L2= Hold

Programming

Error Messages and Calculator Status

Error Messages

Error Messages Status ER Unique solution to IRR Not Found

HP Limited Hardware Warranty and Customer Care

Warranty, Regulatory, and Contact Information

Replacing the Batteries

General Terms

Warranty, Regulatory, and Contact Information

Canadian Notice

Modifications

Avis Canadien

European Union Regulatory Notice

Low Voltage Directive 2006/95/EC EMC Directive 2004/108/EC

Perchlorate Material special handling may apply

Contact Information

Customer Care

香港特別行政區

Martinica

08 5199

Country/Region Contact Vietnam +65-6272-5300 Viêt Nam Zambia

Warranty, Regulatory, and Contact Information

Symbols

Cash flow

Calendar

Checksum 78 Combinations Date

Debugging 85 Decimal

Internal rate of return Investment Rate Key

Insert and delete keys Interest Conversion

Key presses Keyboard map and legend Language

Margin

On HP 30b Parentheses

Math

Percent Calculation

Percentages Permutations

Stop 83 Store

RPN

Thousands separator Time Value of Money