Electronic Cash Register Caja Registradora Electronica

For Your Records

Getting Started

Introduction

U T I O N

For Easy Set-up, see

Contents

Auxiliary Function Programming

Correction After Finalizing a Transaction Void mode

External View Front view Rear view

Parts and Their Functions

11 M

Mode Switch and Mode Keys

Keyboard layout

Key names

Operator display Customer display Pop-up type

Machine state symbols

Displays

Drawer Lock Key

Be careful with the paper cutter, so as not to cut yourself

Getting Started

Installing a paper roll

When using the take-up spool using as journal paper

When not using the take-up spool using as receipt paper

Date Time Tax

Starting sales entries

Things you can do for sales entries

Things to do before you start sales entries

Things to do after you close your store

5000

Basic Sales Entry

Basic Sales Entry Example

1500

Clerk assignment

Error Warning

Power Save Mode

Error escape function

Department entries

Item Entries Single item entries

PLU/sub-department entries

Multiplication entries

Repeat entries

Split pricing entries

Displaying Subtotals

Single item cash sale Sics entry

Finalization of Transaction Cash or check tendering

Mixed-tender sale

300 +

Cash or check sale that does not require entry

Charge credit sale

Manual tax

800 50 t

725 515 Ts t Us t

Tax Calculation Automatic tax

1050 TU

25 TUp 400 U

Tax status shift

1345 T

800 + P5 %

Optional Features

Discount and premium entries using the discount key

140 570 10 %

250 f+

575 +

100

675

Auxiliary Payment Treatment Currency conversion

Applying preset conversion rate

Applying manual conversion rate

12345 s 4800 r

Received-on Account and Paid-out Entries

No sale exchange

Automatic Sequence Key akey Entries

600 328

Correction

Correction of the Last Entry direct void

1310 1755 +

Subtotal Void

Date and Time Programming

Procedure for programming

Prior to Programming

Basic Function Programming

1430 s

Tax programming using a tax rate

Time

Tax Programming for Automatic Tax Calculation Function

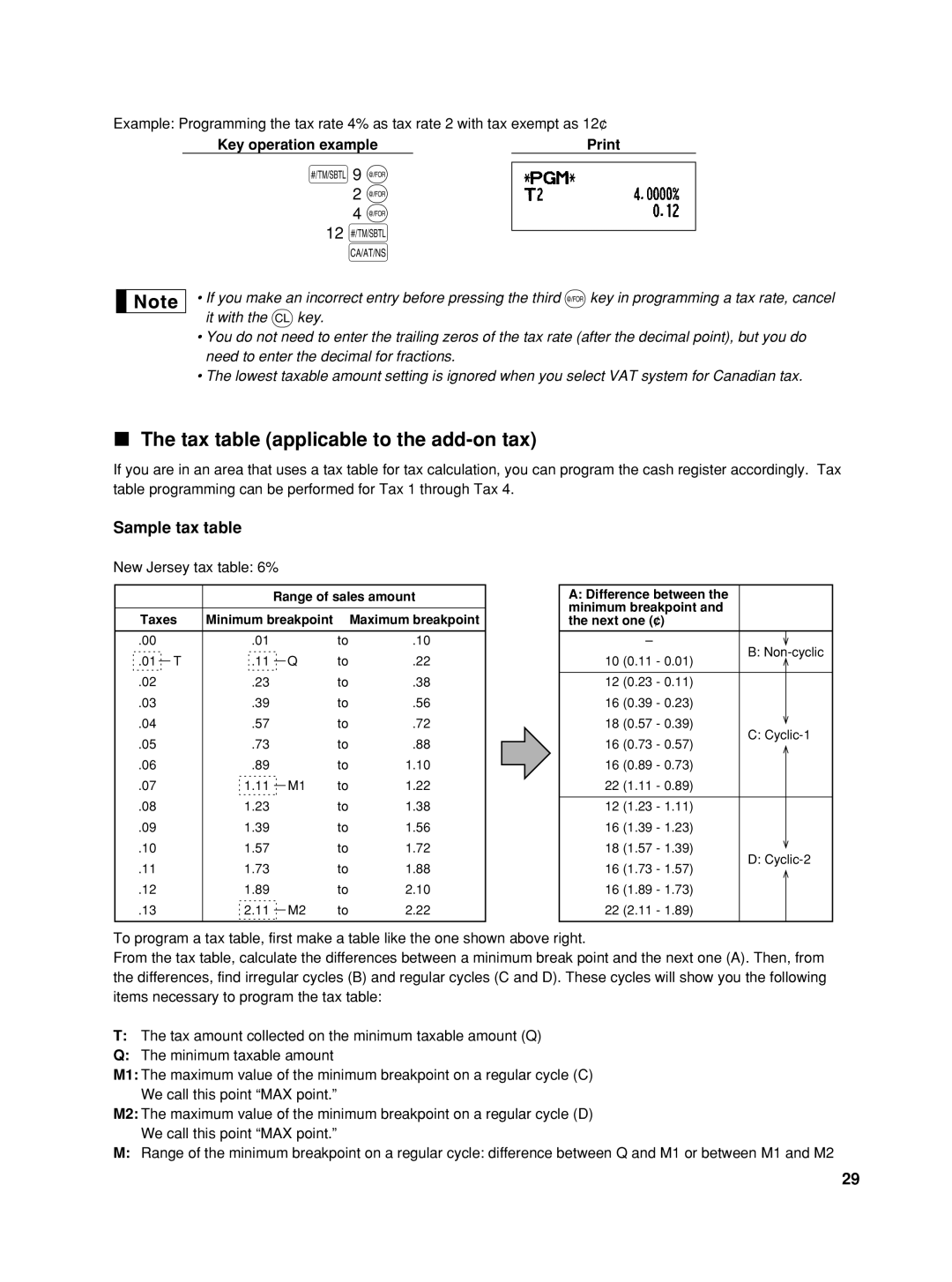

Tax table applicable to the add-on tax

12 s

Sample tax table

Limitations to the entry of minimum breakpoints

100 @ 11 @

111

First figure

19 @

Quantity for doughnut tax exempt for Canadian tax system

Sample tax table Example 8%

Modification of the left tax table

Department status

Auxiliary Function Programming

@ a

Department Programming

1000

Preset unit price

PLU Price Look-Up and Sub-department Programming

00011173 @

PLU/sub-department selection

Unit price and associated department assignment

125 #

Rate for %, &

Miscellaneous Key Programming

10 P 25 % 7674

200

Amount for

Percent rate limitation for %

Function parameters for %, &

+/- sign

Function parameters for

00011006 @

00 @

018 @

Function parameters for C, c and a when using as CA key

Cor c

Entry digit limit for r, R and t

Entering character codes with numeric keys on the keyboard

Using character keys on the keyboard

Hijk N01

Text Programming

Alphanumeric character code table

231

PLU text item label

S1 P

S2 P

Department text

46 @ Card s

List of function texts

Logo print format 6 types

Clerk names

Logo messages

David s

SSS sA

Advanced Programming

S1 @

Electronic Journal EJ Programming

90 @ *A a

S2 @

Consecutive numbers

S68 @ 00100002 sA

PGM mode operation records type

Action when EJ memory area is full

Function parameters for EJ

Job code Selection Entry

Various Function Selection Programming

Function selection for miscellaneous keys

00000100 sA

Printing style

Print format

Receipt print format

Function selection for tax

Compression printing

Other programming

GST

Tax calculation system

Logo message print format

Power save mode

10 @ *ABCD s a

11 @

35 @ 30 sA

Online time out setting

50 @

Thermal printer density

Language selection

Training clerk specification for training mode

88 @

86 @

Auto 2 p100 +

Auto key programming Automatic sequence key

Reading Stored Programs

Key sequence for reading stored program

Programming report

Sample printouts

Auto key programming report

Training Mode

25 L 1000

Programming report Printer density programming report

Summary of Reading X and Resetting Z Reports

Reading X and Resetting Z of Sales Totals

Sample report

Daily Sales Totals Full sales report

Periodic Consolidation Full sales report

Clerk reports

PLU sales report

Hourly report

Sample EJ report

710 @ a

Printing journal data on the way of a transaction

Sample print

Override Entries

Incorrect receipt Cancellation receipt

250

What You Can Do with an SD Memory Card

HOW to USE AN SD Memory Card

List of functions

SD error code table

Case of SD Error

Recommended SD memory cards

Inserting an SD memory card

140 @ s

Inserting and Removing an SD Memory Card

Formatting an SD Memory Card

Saving and Restoring All the Data

144 @ s

148 @ s

145 @ s

Writing and reading all the programming data

141 @ s

147 @ s

650 P @ s

740 @ s

750 P @ s

Printing of electronic journal

Case of a Power Failure

Operator Maintenance

Case of Printer Error

Replacing the Paper Roll

Paper specification

How to set the paper roll

Replacing the Batteries

Installing the receipt paper roll

Installing the paper roll

Removing the paper roll

Installing the journal paper roll

Opening the Drawer by Hand

Cleaning the Printer Print Head / Sensor / Roller

Removing a Paper Jam

Removing the Drawer

Error code table

Before Calling for Service

Specifications

Con facilidad, vea el apartado

Para realizar la configuración

Introduccion

Importante

Programacion DE LAS Funciones Basicas Para el inicio rápido

Indice

Símbolos del estado de la máquina

Partes Y SUS Funciones

Selector de modo y llaves de modo

Visualizadores

Para Empezar

Impresión

Registro Basico DE Ventas

Ejemplo de registro básico de ventas

Ejemplo de operación de teclas

Registros de artículos Registros de un solo artículo

Aviso de error

Registros de sección

Registros de PLU/subsecciones

Registros repetidos

Registros de multiplicación

Registros de precios divididos

~ s 950 a c

800 50 t a

Caracteristicas Opcionales

800 +7 P5 %A

~ m10 % a

675 *-A

Correccion

Programación de la fecha y de la hora Fecha

Programacion DE LAS

Hora

@2 @4 @12 sA

Tabla de impuestos aplicable al impuesto añadido

Tabla de impuestos de muestra

Limitaciones para el registro de puntos de división mínimos

Programación de secciones

Estado de sección

Primer número 1 ó Segundo número 1 a

Programación de PLU codificación de precios y subsección

Precio unitario preajustado

Asignación de precios unitarios y de secciones asociadas

Límite de tasa porcentual para % y

Selección de PLU/subsección

Programación de teclas misceláneas Tasa para %, & y

Importe para

Parámetros de función para

Parámetros de función para %, & y

Límite de dígitos de entrada para r, R y t

Impresión de pie del recibo

Programación de texto

Empleo de las teclas de caracteres del teclado

1Elemento Selección Registro

Texto de PLU etiqueta de artículo

Texto de sección

P!FRUTA sA

Lista de textos de función

Texto de función

Mensajes de membrete

Nombres de dependiente

Símbolo de divisas

Programacion Avanzada

Acción cuando el área de memoria de EJ está llena

Programación 1 de selección de diversas funciones

Impresión temporal de EJ durante una transacción

Tipo de registros de operación en el modo PGM

Código de tarea Elemento Selección Registro

Selección de función para teclas misceláneas

Formato de impresión

Formato de impresión de recibos

Otras programaciones

Selección de función para impuestos

Sistema de cálculo de impuestos

Impresión comprimida

Densidad de impresora térmica

11 @ *A s a

Formato de impresión del mensaje del membrete

Ajuste de fin de intervalo en línea

Programación de la tecla Auto Tecla de secuencia automática

Modo DE Instruccion

Lectura de programas almacenados

Resumen de informes de lectura X y reposición Z

Lectura X Y Reposicion Z DE LOS Totales DE Ventas

@ a 7 P @ a

Lectura Y Reposicion DE Informes EJ

Inserción de una tarjeta de memoria SD

Registros DE Anulacion

Como Emplear UNA Tarjeta DE Memoria SD

Inserción y extracción de una tarjeta de memoria SD

Memorización y restauración de todos los datos

140

145 @ s 1 a

Formateo de una tarjeta de memoria SD

740 @ s 1 a

141

147 @ s 1 a

750 P @ s 1 a

Reemplazo de las pilas

En el caso de error de impresora

En caso de corte de la alimentación

Precauciones al manejar la impresora

Forma de colocar el rollo de papel

Reemplazo del rollo de papel

Extracción del rollo de papel

Instalación del rollo de papel

Manera

Extracción del papel atascado

Abertura manual del cajón

Extracción del cajón

Antes de solicitar el servicio de un técnico

Tabla de códigos de error

END-USER Limited Warranty

Sharp Plaza, Mahwah, New Jersey BE-SHARP

Sharp Electronics Corporation