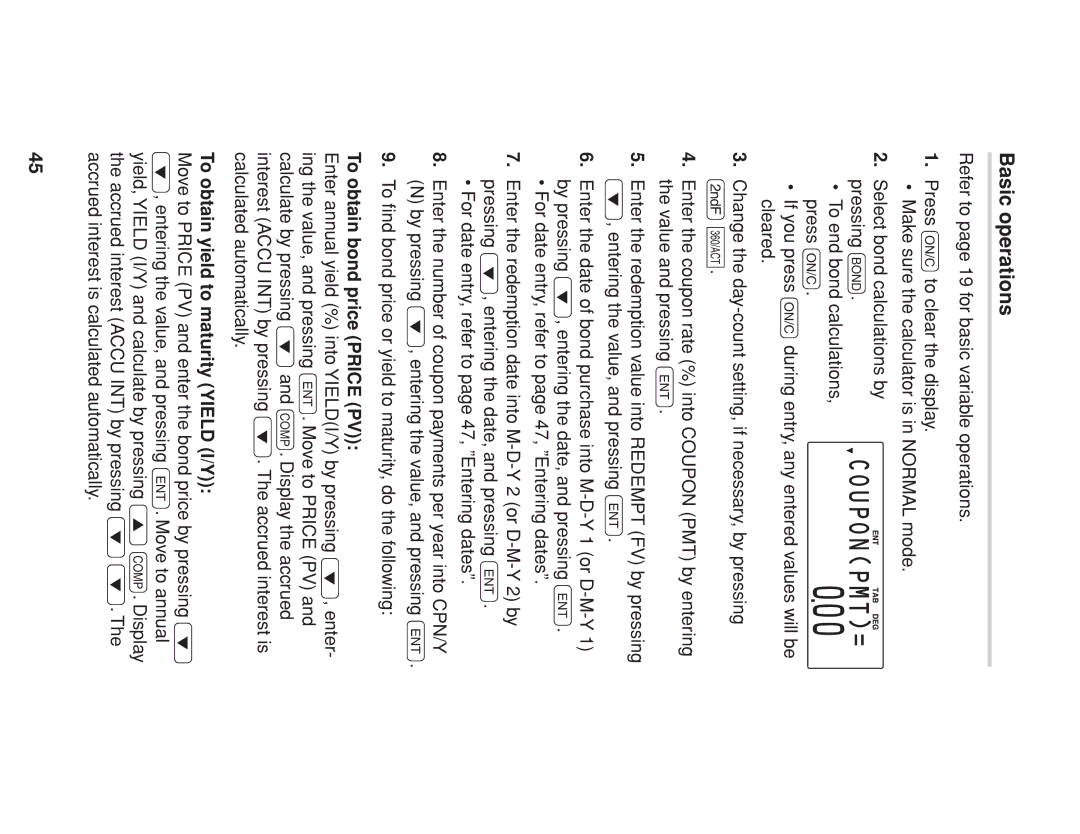

Basic operations

Refer to page 19 for basic variable operations.

1. Press sto clear the display.

• Make sure the calculator is in NORMAL mode.

2. Select bond calculations by pressing #.

• To end bond calculations, press s.

•If you press sduring entry, any entered values will be cleared.

3.Change the

.&.

4.Enter the coupon rate (%) into COUPON (PMT) by entering the value and pressing Q.

5.Enter the redemption value into REDEMPT (FV) by pressing i, entering the value, and pressing Q.

6.Enter the date of bond purchase into

•For date entry, refer to page 47, ”Entering dates”.

7.Enter the redemption date into

•For date entry, refer to page 47, ”Entering dates”.

8.Enter the number of coupon payments per year into CPN/Y

(N) by pressing i, entering the value, and pressing Q.

9.To find bond price or yield to maturity, do the following:

To obtain bond price (PRICE (PV)):

Enter annual yield (%) into YIELD(I/Y) by pressing i, enter- ing the value, and pressing Q. Move to PRICE (PV) and calculate by pressing iand @. Display the accrued interest (ACCU INT) by pressing i. The accrued interest is calculated automatically.

To obtain yield to maturity (YIELD (I/Y)):

Move to PRICE (PV) and enter the bond price by pressing i i, entering the value, and pressing Q. Move to annual yield, YIELD (I/Y) and calculate by pressing z@. Display the accrued interest (ACCU INT) by pressing ii. The accrued interest is calculated automatically.

45