EL-738

Page

Contents

Operational Notes

Introduction

Keys

Using the .and

Key Notations in This Manual

Preparing to Use the Calculator

Resetting the Calculator In Case of Difficulty

Resetting the calculator

Key operation keys

Calculator and Display Layout

Calculator layout

2ndF

Display layout

Selecting the display notation and number of decimal places

SET UP Menu

0003

3333333

000

Selecting the angular unit see

Operations available in each mode

Selecting a mode

Operating Modes

Selecting the date format see

343

14000

9000

Basic Calculations

Delete key

⋅ ⋅

Memory clear key

Editing and Correcting an Entry

Cursor keys

Playback function

Memory use in each mode for memory calculations

Errors

500

192

Independent memory M

Temporary memories A-H, X-Z

Last answer memory ANS

TVM variables

Example Key operation

Statistical variables

Memory calculations

Financial calculations

General Information

Variables shared among calculations

Variables used in financial calculations

Listed financial variables

Basic variable operations

TVM variables N, I/Y, PV, PMT, FV

Category Display symbols Descriptions

ENT and Comp symbols

Compound interest

Cash flow diagrams

Variable Corresponding Description Default Variable key

Setting the payment period payment due

TVM Time Value of Money Solver

Variables used in the TVM solver

Calculating basic loan interest

Basic examples for the TVM solver

24000

1200

5600000

44000

8000

400

125586

Calculating basic loan payments

20000

3600

FV=

Calculating future value

2000

100

1000000

376889

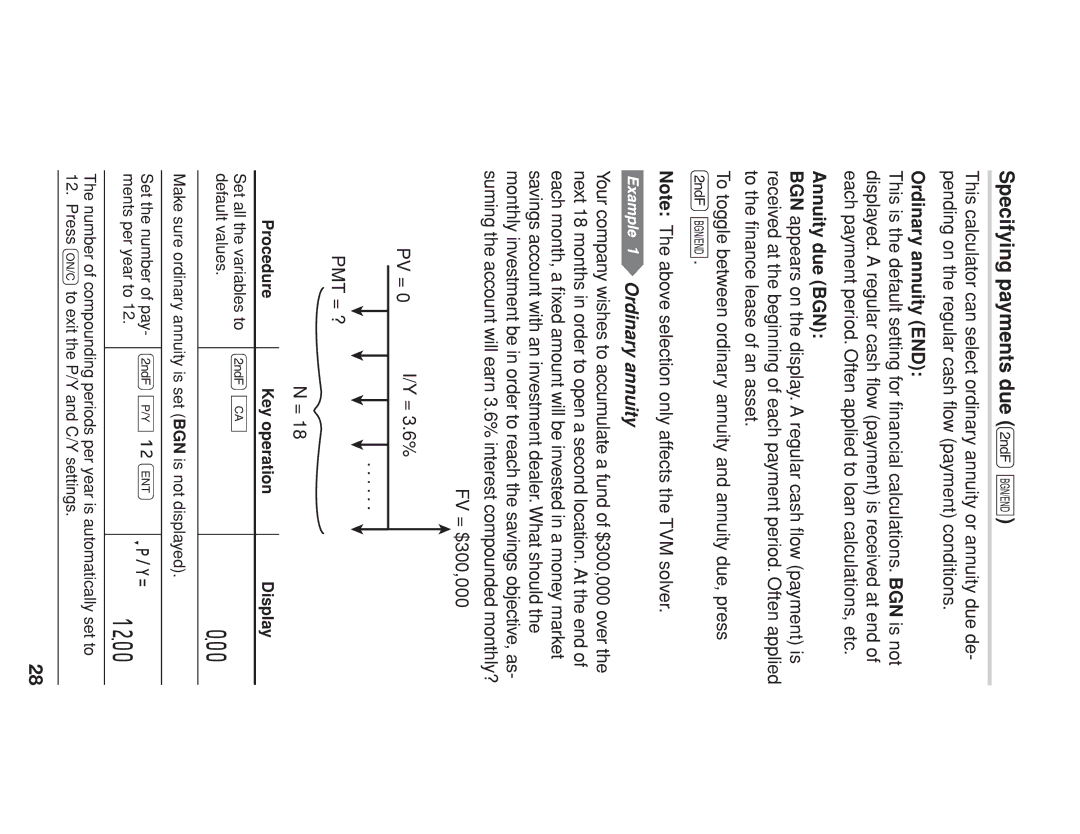

Ordinary annuity END

Specifying payments due

Annuity due BGN

Ordinary annuity

30000000

1800

360

1624570

29950

2400

14500

299500

150000

3400

627995

Calculating down payment and amount to borrow

90000

30000

550

14655892

Variables used in amortization

Variable Description Default value

Amortization Calculations

8895148

61656

203428

104852

600

1700

4800

384457

48275524

1724476

Entering cash flow data

Discounted Cash Flow Analysis

Single cash flows

Repeated cash flows

200

000*2

300

Confirming and editing data

Editing data

2500000

Deleting data

Inserting data

600000

3000000

Variables used in discounted cash flow analysis

NPV and IRR

Play in Normal mode

Procedure Key operation Display Bring up the initial dis

To obtain NPV

To obtain IRR

Calculating the present value of variable cash flows

2314

662752

Variables used in bond calculations

Setting the day-count method

Bond Calculations

To obtain yield to maturity Yield I/Y

To obtain bond price Price PV

10000

650

15-2023

720

Entering dates

9250

728

Depreciation Calculations

Setting the depreciation method

Variables used in depreciation calculations

Key operation Description

Page

Calculating straight-line depreciation

3000

5000000

Conversion between APR and EFF

1956

To change APR to EFF

To change EFF to APR

Variables used in day and date calculations

Day and Date Calculations

22800

10-2009

Calculating number of days

Answer 228 days

Calculate

Procedure Key operation Display Move to the last date

Percent Change/Compound Interest Cal- culations

11600000

7500000

5467

800000

113

980000

Cost/Sell/Margin/Markup Calculations

Variables used in cost/sell/margin/markup calcula- tions

9500

45560

88842

Determining selling price

Calculating the breakeven point

Breakeven Calculations

Variables used in breakeven calculations

7580

1500000

12000

33937

Chain Calculations

Constant Calculations

071

087

5000

4500

Random numbers

Random Functions

Random dice

Random coin

Random integer

532

Modify Function

For a single-variable data set

Entering statistical data

For a two-variable data set x value y value J

Key operation Sub-mode Display

Entering statistical data

1000 2000

Single-variable statistical calculations

Statistical Calculations and Variables

Linear regression calculations

Quadratic regression calculation

Variables Content

Single-variable statistical calculation

53000

17857

Linear regression calculation

Quadratic regression calculation

TVM solver

Financial Calculation Formulas

Amortization calculations

Discounted cash flow analysis

Bond calculations

Day and date calculations

Depreciation calculations

Conversion between APR and EFF

Breakeven calculations

Statistical Calcula- tion Formulas

Cost/Sell/Margin/Markup calculations

Error codes and error types

Errors and Calculation Ranges

Syntax error Error

Calculation error Error

No solution Error

Equation too long Error

Display error Error

Input value error Error

Function Calculation range

Calculation ranges of functions

Integer

When to replace the battery

Battery Replacement

Priority Levels in Calculations

Replacement procedure

Automatic power-off function

Key operation and calculation priority

Specifications

For more information about business/ financial calculators

Index

Formulas, 72-75 FV, 18, 22, 72 GRAD, 8, 9, 61

Memo

1 Ordinary annuity

1 Ordinary annuity