EL-9900

For Your Records

Introduction

Their respective holders

Basic Mode

Reversible Keyboard

Advanced Mode Default mode

Contents

Chapter

Chapter Slide Show Feature 115

Chapter Matrix Features 120

Chapter List Features 131

Chapter Financial Features 183

Chapter Solver Feature 194

Chapter Statistics & Regression Calculations 145

Appendix 228

Chapter Programming Features 202

Chapter Option Menu 222

Index

265

Caring for Your Calculator

Getting Started

Before Use

Using the Hard Cover

Adjusting

Calculator OFF Automatic power off function

Display contrast

Part Names and Functions

Main Unit

Power ON/OFF key

Display screen

Reversible Keyboard

Basic Operation keys

Getting Started

Basic Key Operations

Example

Changing the Keyboard

To change Keyboard

Advanced → Basic

Quick Run-through Basic Mode

Basic → Advanced

Set up the calculator before calculation Enter fractions

Change answer 1. Press @ Mode from Fractions to Decimals

How to switch the keyboard

Operating the Graphing Calculator

Basic / Advanced Keyboard

Basic Key Operations Standard Calculation Keys

Entering numbers

Number entry Example

Entering a

Negative value

Cursor Basics

Performing standard math calculations

Method

Editing Entries

Cursor naviga

Tion

About the Insert

Second Function Key

Alpha Key

Math Function keys for Advanced keyboard

Math Function Keys

Math Function keys for Basic keyboard

Common Math Function Keys for both keyboards

Examples

MATH, STAT, and Prgm Menu Keys

Setup Menu

Calculator’s then . configuration

Setup Menu Items

Operating the Graphing Calculator

Precedence of Calculations

Error Messages

10 +

Resetting the Calculator

Using the reset switch

Selecting the Reset within the Option menu

Basic Calculations Basic Keyboard

Try it

Procedure

Concept

Arithmetic Keys

Performing

Addition

Subtraction

When to leave out the ⋅ sign

Entering a number with a negative value

Calculations Using Various Function Keys

Specifying no common factor

Specifying a common factor

Example

RAA E RAB E AA +AB E

Second

Functions

RAC E

Example

Calculations Using Math Menu Items

Degrees

Radians

Calc

NUM

Abs absvalue

Round roundvalue , digit number of decimals

Ipart ipart value

Fpart fpart value

Int int value

Min minlist

Max maxlist

Lcm lcmnatural number, natural number

Gcd gcdnatural number, natural number

Remain natural number remain natural number

Prob

Random random number of trial

RndInt rndIntminimum value, maximum value , number of trial

RndCoin rndCoin number of trial

RndDice rndDice number of trial

Conv

Angle

Basic Graphing Features Basic Keyboard

= 3.5 +

Basic Graphing Features Basic Keyboard

Explanations of Various Graphing Keys

Graph Basics

Zoom

To select a box area to zoom

Factor menu, press Eto activate the setup tool

Power

Factor

EXP

RCL

Trig

STO

Basic Graphing Features Basic Keyboard

Other Useful Graphing Features

Following illustration shows these relationships

Basic Graphing Features Basic Keyboard

Basic Graphing Features Basic Keyboard

Basic Graphing Features Basic Keyboard

Substitution feature

Example

Basic Graphing Features Basic Keyboard

Advanced Calculations Advanced Keyboard

Various Calculation Keys

Example

Calculate arctangent @t1 E

Calculations Using Math Menu

01 log2 log2 value

Fminequation, lower limit of x, upper limit

Fmaxequation, lower limit of x, upper limit

Dxequation, value of x , tolerance

Equation, lower limit, upper limit , tolerance dx

∑ expression, initial value, end value , increment

Sec value

Csc value

Cot value

Tanh-1tanh-1value

Sinh-1sinh-1value

Cosh-1cosh-1value

→dms value degrees →dms

Rectangular/polar coordinate conversion

Xy→r xy→rx coordinate, y coordinate

Xy→θ xy→θx coordinate, y coordinate

Rθ→x rθ→xr coordinate, θ coordinate

Rθ→y rθ→yr coordinate, θ coordinate

Advanced Calculations Advanced Keyboard

Not not value

Value a and value B

Or value a or value B

Neg neg value

Xor value a xor value B

Xnor value a xnor value B

Conj conjcomplex number

Calculations using complex numbers

Real realcomplex number

Image imagecomplex number

Abs abscomplex number

Abs, round, ipart, fpart, int

More Variables Single Value Variables and List Variables

Functions available for complex number calculations

Tool Menu

Advanced Calculations Advanced Keyboard

Setup Menu

Advanced Graphing Features Advanced Keyboard

Un = un-1⋅ 1 0.6 +

Advanced Graphing Features Advanced Keyboard

Advanced Graphing Features Advanced Keyboard

Use 3 in or 4 OUT of the a Zoom to adjust the drawing size

Graphing Parametric Equations

Polar Graphing

Draw a graph r = 16cosθsinθ

Graphing Sequences

Based Time

Example 1 n-based Graphing Time

Phase-based uv, uw, or vw

Based Web

Example 2 Phase-based Graphing uv

Example 3 n-1-based Graphing Web

Calc Function

Advanced

Specific sub Menus Inflec

Format Setting

Advanced keyboard specific sub-menus

Zoom Functions

Specific sub Menu items Menus

HYP

Setting a Window

Rectangular coordinate system

Parametric coordinate system

Polar coordinate system

Tables

Setting a table

101

Draw Function

Line

Draw menu

104

Hline

Vline

HLine y-value

HLine Example

Tline

VLine Example

Tlineequation, x-value

Tline Example

Draw

Draw equation

Shade

Shadeequation1, equation2 , lower value, upper

DrawInv DrawInv equation

Circle Example

Text Textcolumn, row, strings

Column and row definitions for text input

PntON PntONx-coordinate, y-coordinate

PntOFFx-coordinate, y-coordinate

PntCHGx-coordinate, y-coordinate

PxlONcolumn, row

DrawOFF DrawOFF equation number 1, .... or DrawOFF

PxlTST PxlTSTcolumn, row

DrawON DrawON equation number 1, .... or DrawON

StoGD StoGD number 0-9Saves the graph data Example

RclGD RclGD number

StoPict StoPict number 0-9Saves the pixel data Example

Substitution Feature

Slide Show

Slide Show Feature

Create a new

Enter x 3x 1x + 2 at the first equation

Rearranging the captured images

Select a file Select an image

Playing back the newly created Slide Show

Slide Show menu

Specify

Insertion point

Move

DEL

Rename

Matrix Features

3x + 2y + z = 2x + 3y + z = 34 x + 2y + 3z =

Dimensions

Problem

Select a matrix

To edit

Entering and Viewing a Matrix

Matrix

Editing keys and functions

Enter elements

Normal Matrix Operations

Matrix + Matrix Matrix Matrix Matrix ⋅ Matrix Square

Calculations using OPE menus

Special Matrix Operations

Dim dimmatrix name

Fill fillvalue, matrix name

Identity identity dimension value

Cumul cumul matrix name

Augment augmentmatrix name, matrix name

Rndmat rndmatnumber of row, number of column

Rowmult rowmultmultiplied number, matrix name, row number

Rowswap rowswapmatrix name, row number, row number

Rowplus rowplusmatrix name, row number, row number

List→mat list→matlist 1, .... list n, matrix name

Mat→listmatrix name, list name 1, ..., list name n

Mat→listmatrix name, column number, list name

Calculations using Math menus

Det det matrix name

Trans trans matrix name

RowEF rowEF matrix name

Use of menus

An expression

Enter each speed value in the list

List Features

Concept Procedure

Enter

Equation using

Store the list

Creating a list

Normal List Operations

Calculate Press @+@ Root of L2

Calculations using the OPE menu functions

Special List Operations

SortA sortAlist name

SortD sortDlist name

Fill fillvalue, list

Dim dimlist

Natural number ⇒ dimlist name

Cumul cumul list

Dflist dflist list

Augment augmentlist 1, list

List→mat list→matlist 1, ..., list n, matrix name

Mean meanlist , frequency list

Prod prodlist , start number, end number

Median medianlist , frequency list

Sum sumlist , start number, end number

Drawing multiple graphs using the list function

Standard deviation and variance

StdDv stdDvlist , frequency list

Varian varianlist , frequency list

Using Ldata functions

StoLD StoLD natural number

RclLD RclLD natural number

Using List Table to Enter or Edit Lists

How to enter the list

How to edit the list

Data

Statistics & Regression Calculations

Opening the list Press S Table to enter

Statistics & Regression Calculations

Setting

Graph drawing

Selecting

Whether

148

Statistics Features

Stat menus

Statistical evaluations available under the C Calc menu

Statistical calculations using the Sunday data L2

Statistical calculations using the Monday data L3

152

Statistical graph types overview chart

Graphing the statistical data

Graph Types

Histogram

Normal probability plot N.P Normal distribution plot N.D

Box plot Box Modified box plot MBox

Pie chart PIE Scatter diagram S.D XY Line Xyline

Press DD Limit and press 22 LimON

Specifying statistical graph and graph functions

Statistical plotting on/off function

Graph

Trace function of statistical graphs

Tracing

Data list operations

SortA sortAlist

SortD sortDlist

SetList SetList list name 1 , list name

Regression Calculations

161

162

16 y’ value or list y’

Using Regression Functions

15 x’ value or list x’

Press #CSD0404 Rgx2

Statistical Hypothesis Testing

About

Residual list

Start a statisti Cal test Press see Test

Zint1prop and 15 Zint2prop

167

168

169

170

171

172

Ztest1prop Tests the success probability P0 of a population

174

175

176

Distribution functions

InvNorm InvNormprobability , mean, standard deviation

CdfT cdfTlower limit, upper limit, degree of freedom

07 cdfχ2 cdfχ2lower limit, upper limit, degree of freedom

Freedom of denominator

181

Cdfpoi cdfpoimean, value

Cdfgeo cdfgeosuccess probability, value

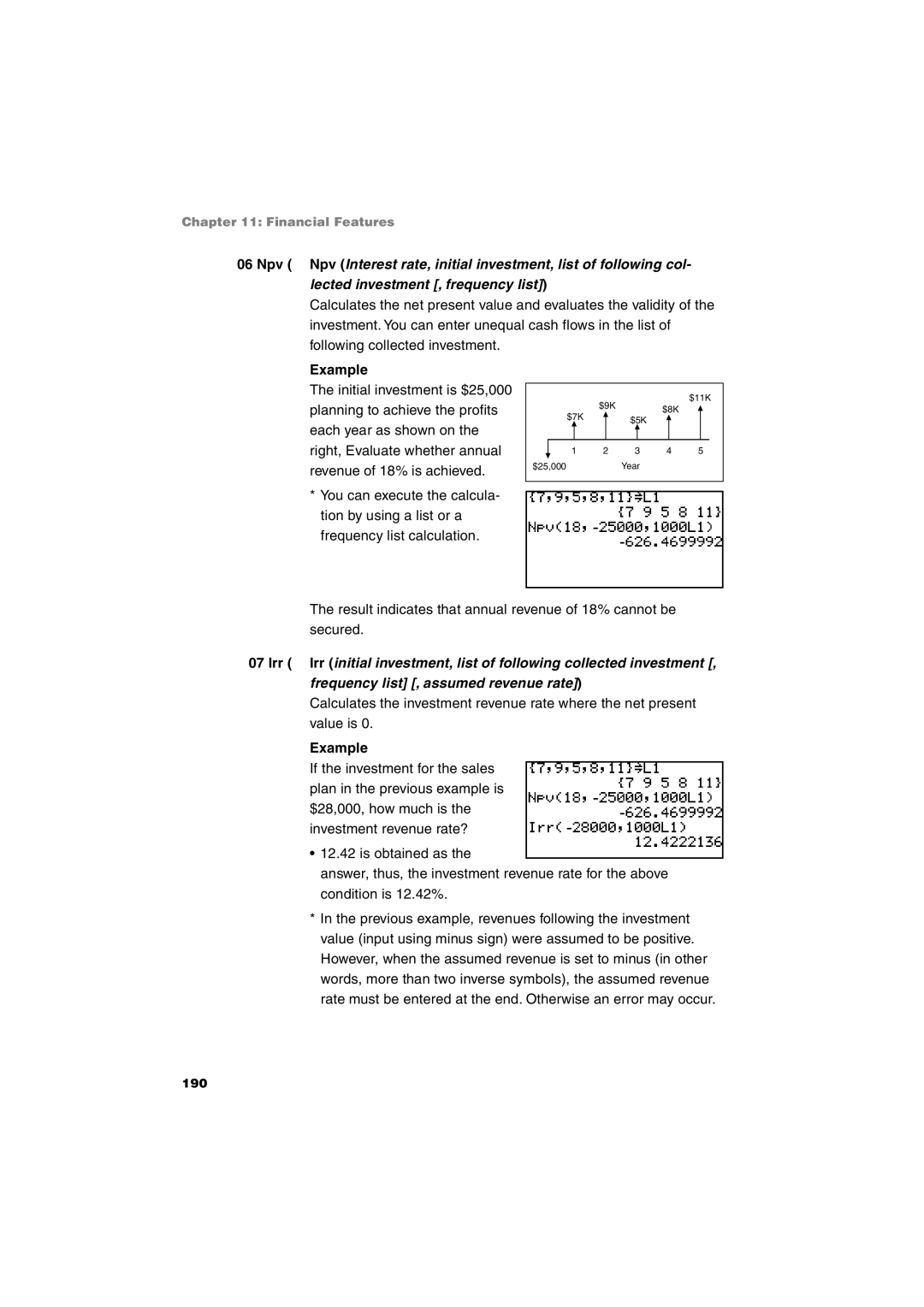

Financial Features

Flow diagram on

Draw a cash

Paper

Payment due at the end of the period

Payment due at the beginning of the period

Setting the payment due time

Press CC Period Press 11 PmtEnd and press E

Simple interest and compound interest

Set the TAB FSE 2 and FIX Respectively

188

Calc functions

Solvpmt N, I%, PV, FV, P/Y, C/Y

SlvI% N, PV, PMT, FV, P/Y, C/Y

SlvPV N, I%, PMT, FV, P/Y, C/Y

190

Example using the 08 Calculations

Bal Bal number of payments , decimal place to round

12 →Eff →Eff nominal interest rate, number of settlements

Conversion functions

11 →Apr →Apr effective interest rate, number of settlements

Vars Menu

Equation

Solver Feature

Three Analysis Methods Equation, Newton, and Graphic

Solver Feature

Newton’s

197

198

199

Saving/Renaming Equations for Later Use

Recalling a Previously Saved Equation

Programming Features

Creating a new

Program

Exec

Programming Features

Programming Hints

Command or

Storing a

Program line by

Blank line

Setting a variable

Variables

Operands

Comparison operands

Programming commands

Command strings

Prgm menu PA

Print character strings

Rem Rem comments

Key variable

Is set to the corresponding numeric value as specified

Following table

O menu PD

Brnch menu PB

Scrn menu PC

Setup menu PE

06 Y’ OFF Y’OFF

Format menu PF

Tab integer 0 to

212

Splot menu PG

Plt1graph type, X list name , Y list name, frequency list

Flow control tools

If If conditional statements Goto label name

Next

WEnd

Other menus convenient for programming

Copy menu PH

Vars menu

Value

Debugging

Matfill

When an infinite Loop occurs

Sample programs

221

Accessing the Option Menu

Adjusting the screen contrast

Option Menu

Checking the memory usage

Created

Deleting files

Linking to another EL-9900 or PC

225

226

Reset function

Transmission between the EL

Handling

Appendix

Replacing Batteries

Operation

Procedures for

Replacing unit

230

Troubleshooting Guide

Calculator’s power won’t turn on

Saved calculator configurations are not retained

Graph cannot be seen

Screen images cannot be stored Slide Show

Specifications

Substitution features

Slide Show features

Program features

Power supply

Error Codes and Error Messages

Break

Error Conditions Relating to Specific Tasks

Financial

% calculation

PV calculation

FV calculation

PMT calculation

Error conditions during financial calculations

Distribution function

Df = However Γs = 0 x s 1 e x dx Df Degree of freedom

Function calculation

Calculation Range

Arithmetic calculation

Function Calculation range ⋅ 10-99≤ x 1 ⋅ Ln x = loge Log

Xy → θ = tan-1

Function Calculation range Σx 1 ⋅

Complex number calculation

Catalog Feature

Mcalc

List of Menu/Sub-menu Items

Math menus

Mnum

Mprob

Mconv

Mangle

List menus

Mineq

Mlogic

Mcomplex

@lMATH

@lLDATA

Sreg

SEDIT/OPE

Scalc

Stest

Sdistri

PLOT1/PLOT2/PLOT3/LIMIT/ON/OFF

Stat Plot mode HIST/B.L./N.P./N.D./BOX/PIE/S.D./XYLINE

Stat Plot menus

Draw menus

@dDRAW

Zoom menus

@dPOINT

@dON/OFF/LINE/GDATA/PICT/SHADE

Zzoom

FACTOR/POWER

@kCALC

Calc menus

ZHYP/STO/RCL

Pin the Prgramming mode Prgm

Pin the Prgramming mode Brnch

Slide Show menus

Prgm menus

Pin the Prgramming mode Setup

Pin the Prgramming mode Scrn

Pin the Prgramming mode I/O

Pin the Prgramming mode Format

Pin the Prgramming mode Splot

Pin the Prgramming mode Copy

Matrix menus

@mNAME

@mEDIT

@gSOLVER/CALC

Finance menus

@mMATH

Tool menus

@gPERIOD

@gVARS

@VN BASE/SYSTEM/POLY

@in the Solver mode METHOD/EQTN/SAVE/RENAME

Solver menus

Index

266

267

268

269

270

271

272

Europe

Sharp Corporation