Programming the VAT(Value Added Tax) rate

If you program the VAT/tax rate, your cash register can calculate the sales tax. In the VAT system, the tax is included in the price you enter in the register, and the tax amount is calculated when tendered according to the VAT rate programmed. In the tax system, the tax is calculated when tendered according to the tax rate programmed, and added to the price. Your cash register can provide totally 6 kinds of tax system and 3 kinds of rates.

In the factory setting, the VAT/tax system is set to "Automatic VAT

In the current VAT/tax system, you can also use VAT 2 and VAT 3 rates when you need more than one VAT rate. Refer to "Programming the VAT/tax rate" to program multiple VAT rates, and "Programming for departments" to allocate the taxable status to departments.

If you make nontaxable for some goods, program a department as nontaxable for all VAT rates. (Please note that all the goods belonging to that department are subjected to nontaxable.)

If you need other types of VAT/tax system, refer to "Computation of VAT/tax" on page 14, and consult your dealer for the change of your VAT/tax system.

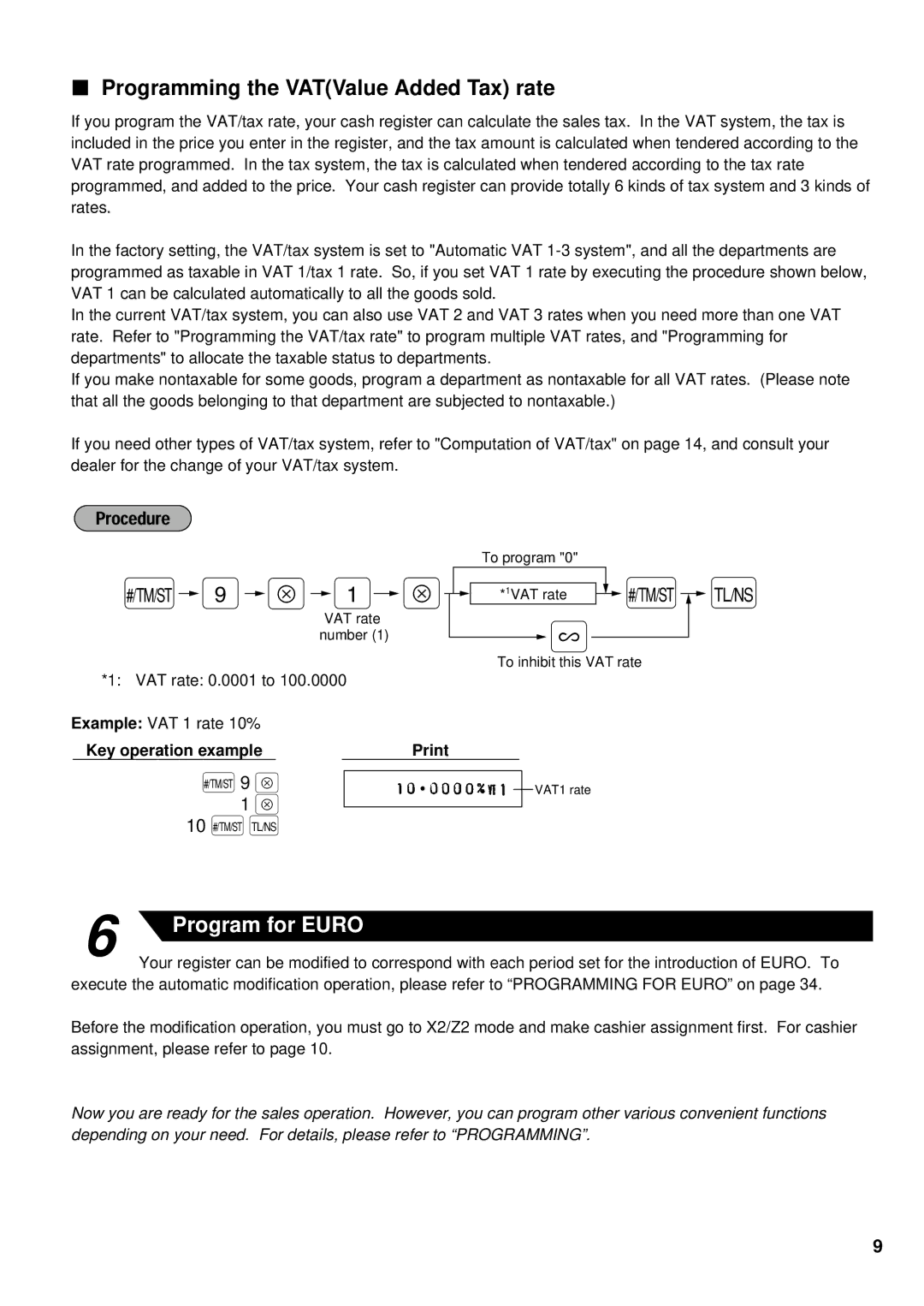

To program "0"

Ñ![]() 9

9![]() ≈

≈![]() 1

1![]() ≈

≈![]()

![]() *1VAT rate

*1VAT rate ![]() Ñ

Ñ![]() É

É

VAT rate | ? | |

number (1) | ||

|

To inhibit this VAT rate

*1: VAT rate: 0.0001 to 100.0000

Example: VAT 1 rate 10%

Key operation example |

|

Ñ9 ≈

1 ≈

10ÑÉ

6 | Program for EURO |

|

VAT1 rate

Your register can be modified to correspond with each period set for the introduction of EURO. To execute the automatic modification operation, please refer to “PROGRAMMING FOR EURO” on page 34.

Before the modification operation, you must go to X2/Z2 mode and make cashier assignment first. For cashier assignment, please refer to page 10.

Now you are ready for the sales operation. However, you can program other various convenient functions depending on your need. For details, please refer to “PROGRAMMING”.

9