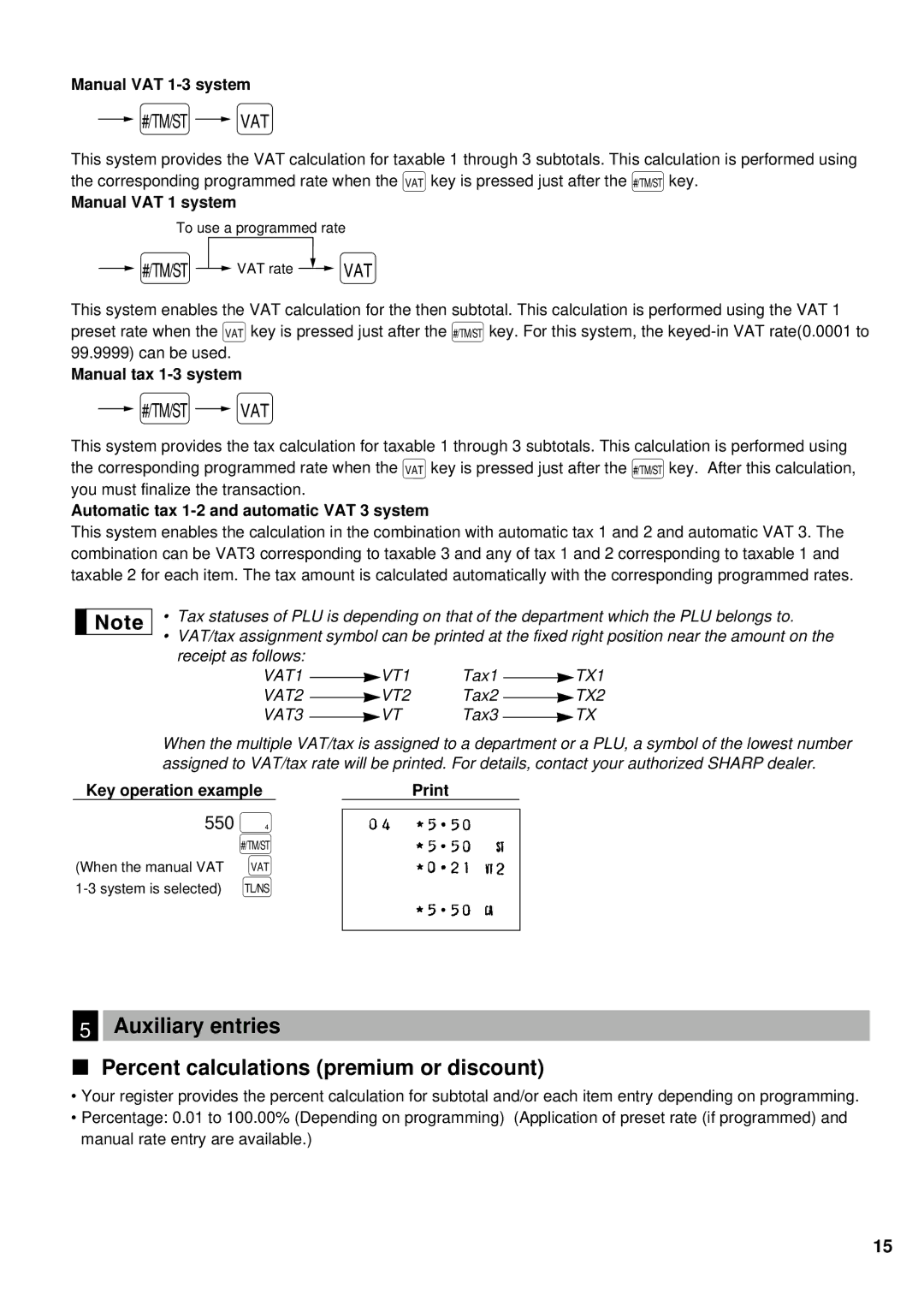

Manual VAT 1-3 system

Ñ◊

This system provides the VAT calculation for taxable 1 through 3 subtotals. This calculation is performed using the corresponding programmed rate when the ◊key is pressed just after the Ñkey.

Manual VAT 1 system

To use a programmed rate

![]() Ñ

Ñ![]() VAT rate

VAT rate ![]() ◊

◊

This system enables the VAT calculation for the then subtotal. This calculation is performed using the VAT 1 preset rate when the ◊key is pressed just after the Ñkey. For this system, the

Manual tax 1-3 system

Ñ◊

This system provides the tax calculation for taxable 1 through 3 subtotals. This calculation is performed using the corresponding programmed rate when the ◊key is pressed just after the Ñkey. After this calculation, you must finalize the transaction.

Automatic tax 1-2 and automatic VAT 3 system

This system enables the calculation in the combination with automatic tax 1 and 2 and automatic VAT 3. The combination can be VAT3 corresponding to taxable 3 and any of tax 1 and 2 corresponding to taxable 1 and taxable 2 for each item. The tax amount is calculated automatically with the corresponding programmed rates.

• Tax statuses of PLU is depending on that of the department which the PLU belongs to.

• VAT/tax assignment symbol can be printed at the fixed right position near the amount on the receipt as follows:

VAT1

VAT2 VAT3

When the multiple VAT/tax is assigned to a department or a PLU, a symbol of the lowest number assigned to VAT/tax rate will be printed. For details, contact your authorized SHARP dealer.

Key operation example |

|

550ù

| Ñ |

(When the manual VAT | ◊ |

É |

5Auxiliary entries

Percent calculations (premium or discount)

•Your register provides the percent calculation for subtotal and/or each item entry depending on programming.

•Percentage: 0.01 to 100.00% (Depending on programming) (Application of preset rate (if programmed) and manual rate entry are available.)

15