SE-S6000

Hon-machi 1-chome Shibuya-ku, Tokyo 151-8543, Japan

Introduction & Contents

Introduction & Contents

Introduction

About the icons

Safety Precautions

Power plug and AC outlet

Icon examples

Introduction & Contents

Introduction & Contents Getting Started

Basic Operations and Setups

Introducing the Register

Advanced Operations

Programming department / flat-PLU keys

Check tracking systems

Troubleshooting 122

User Maintenance and Options 126

Specifications 128 Appendix 129 Index 131

To install receipt paper

Getting Started

To install journal paper

Started

11 E

~00

Mode Switch

Getting Started

Programming procedure

Programming special rounding

Programming Australian GST for Australia only

Mode Switch

Programming U.S.tax tables

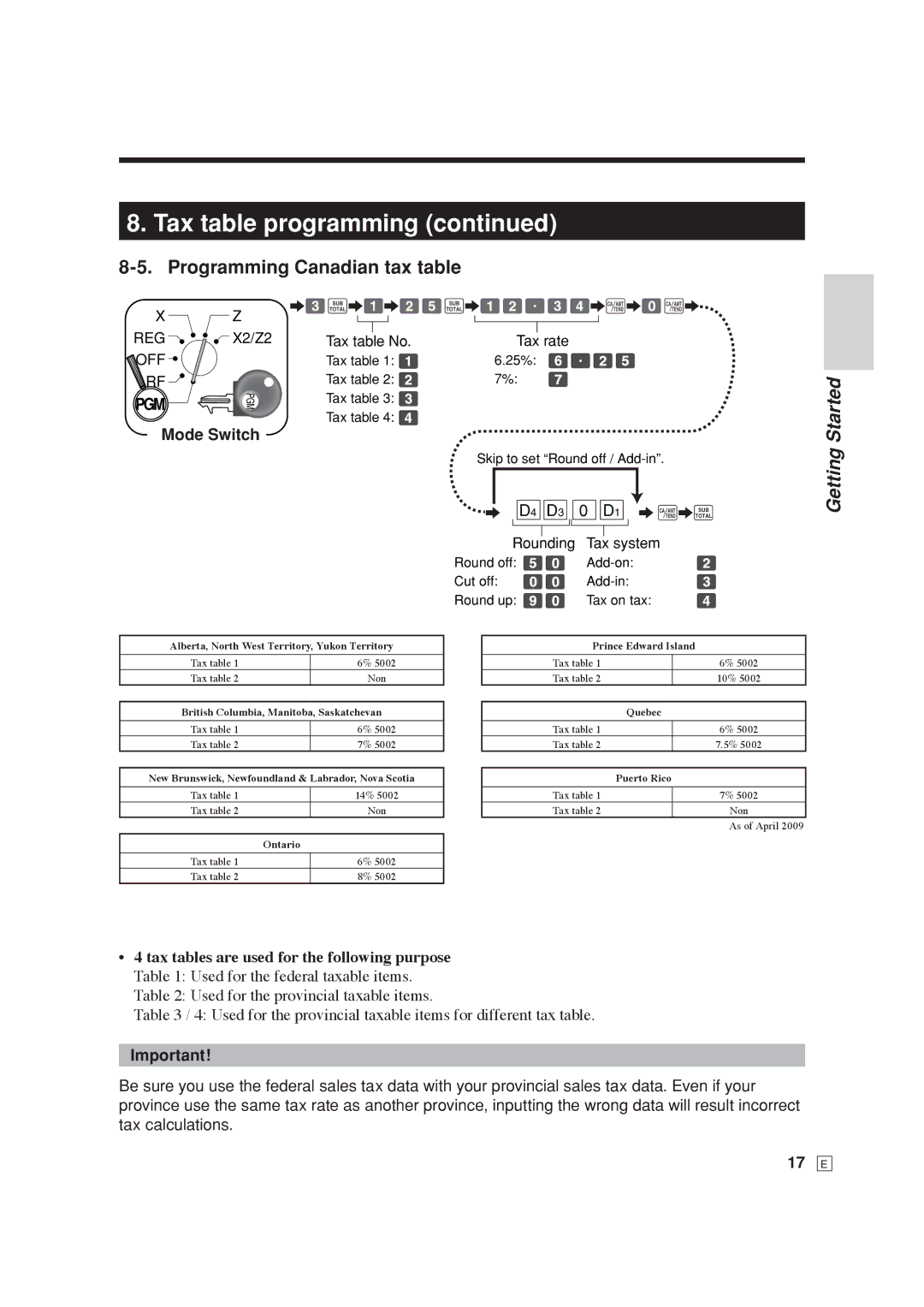

Programming Canadian tax table

Getting

17 E

Discount rate programming

Advanced operations and Setups

19 E

Introducing the Register

General guide

Introducing the Register

How to set the Pop-up display

How to set the menu sheet For SE-C6000 only

X2/Z2

Display

Display panel Main display

Customer display

Displays

Introducing

Keyboard SE-S6000 for Asian, Oceania and other countries

D H I J K L M N O

25 E

New check key N

Keyboard SE-S6000 for US and Canada

E I J K L M N O P

27 E

Keyboard SE-C6000 for Asian, Oceania and other countries

Paper feed key f, j Menu shift key @

29 E

Keyboard SE-C6000 for US and Canada

Receipt on / off key Q Tax shift 1 key t

31 E

Allocatable functions

Add check

For US only

How to read the printouts

Receipt Sample

How to use your cash register

Basic Operations and Setups

Before business hours…

Clerk sign on

Assigning a clerk

Clerk secret number key

Clerk sign off

To display and clear the date / time

Displaying the time and date

Preparing coins for change

Opening the drawer without a sale

1234

Preparing and using department / flat-PLU keys

Registering department / flat-PLU keys

150

10-F

Operations and Setups

20-F

Programming department / flat-PLU keys

D2 D1

PGM 6 3s6 1566s6 ~

Registering department / flat-PLU keys by programming data

1050#

105# s 2-F

To program a unit price for each PLU

Preparing and using PLUs

Programming PLUs

To program tax calculation status for each PLU

PGM 6 3s6 0366s6 PLU No.+6 6 a 6 s

Registering PLUs

14+

PLU single item sale

31+

28+ s 15-F

30+ 3280

Split sales of packaged item

Programming discounts

Preparing and using discounts

Setups

Registering discounts

Registering reductions

Preparing and using reductions

Programming for reductions

45+

75m

Reduction for subtotal

Registering charge and check payments

15-$

55-$ s 30-k 5-F h

Registering returned goods in the REG mode

Registering returned goods in the RF mode

235

Reduction of amounts paid on refund

Registering money received on account

Registering money paid out

15m

15+

Making corrections in a registration

To correct an item you input but not yet registered

10--s

50 p

To correct an item you input and registered

15 +

R220 20- F

To cancel all items in a transaction

No sale registration

Shifting the taxable status of an item For US only

T7-$

Printing the daily sales reset report

57 E

Corr

Basic Operations and Setups

Stock check

Clerk interrupt function

Stock warnings

Single item cash sales

Operations

Addition

Addition plus

Premium %+

10U

Advanced Operations

10p

Tray total

Tray total premium / discount

Multiple item totalling function

Coupon transaction

Coupon registration using Coupon coupon key

Coupon registration using COUPON2 coupon 2 key

10+

Preset tender amount

Registering loan amounts

50L 10L a

Registering pick up amounts

Changing media in drawer

67 E

Bottle returns

Bottle link operation

30-F

Bottle return key

Advanced

Arrangement key registrations

Set menu

69 E

50-E

Currency exchange function

Registering foreign currency

Full amount tender in foreign currency

10-!5 20-5 20-E

Partial tender in a foreign currency

71 E

Tips

Inputting the number of customers

Text recall

Temporarily releasing compulsion

10-k

Printing slip

Printing slips

To perform auto batch printing

Check tracking systems

Check tracking system

About the maximum number of slip lines

30-#

Opening a check

1234BNEW

Adding to a check

Issuing a guest receipt

Closing a check memory

150- F

3456

New / old check key operation

3456Z

31- F

1550B

Table transfer

33B

1750B

Add check

1234B

81 E

Separate check

3456BNEW

Condiment / preparation PLUs

11+ 12+ 13+

20+

VAT breakdown printing

Deposit registrations

Deposit from customer

Use deposit as a part of payment in sales transaction

Bill copy

18062010BILL

35-F

32+

Actual stock quantity inquiry

Unit price inquiry

87 E

Previous item void using review

123 456BO R

Scanning PLU

Item registration

100

0503 1991BAGE

Age verification For US only

Food stamp function For US only

Food stamp registration

Mixed food stamp / cash change

K2- K3-#

Mixed food stamp / cash change …

50$

Food stamp registration Illinois rule

No change due Example

93 E

No change due …

Dept $1.50

120

30#

250

Electronic benefits transfer

About mixed EBT card tenders

97 E

Change due

Programming trainee status

Programming to clerk

Programming clerk number

Programming commission rate

Programming descriptors and messages

Programming receipt message, machine No. and clerk name

100

Address Contents Initial character Yours Code

101 E

Programming department / transaction key descriptor

102

SE-S6000 for Asia, Oceania and other countries

SE-S6000 for US and Canada

103 E

SE-C6000 for Asia, Oceania and other countries

SE-C6000 for US and Canada

104

Using character keyboard For SE-S6000

Entering characters

105

Using character keyboard For SE-C6000

106

Character code list

Entering characters by code

107

Editing characters

0101s

Daily sales reset report Z mode

Printing read / reset reports

Daily sales read report X mode

To print the individual department, PLU read report

To print the individual clerk read / reset report

To print the financial read report

110

To print the daily sales read / reset report

111 E

112

To print the PLU read / reset report

To print the hourly sales read / reset report

113

To print the monthly sales read / reset report

To print the group read / reset report

114

To print the periodic 1/2 sales read / reset reports

Periodic sales read report X2 mode

Periodic sales reset report Z2 mode

115 E

ModeZ modeX2/Z2 mode

116

Report / command code list

To print other sales read / reset reports

Procedure

117

Reading the cash registers program

118

119

To print the PLU program

120

121

When an error occurs

122

123

E051

When the register does not operate at all

Clearing a machine lock up

124

Case of power failure

Troubleshooting

125

To replace journal paper

126

Options

User Maintenance and Options

To replace receipt paper

5880T roll paper

Specifications

128

Example 1, Without rate tax Preparation

Tax table programming for US tax table

Appendix

129

Example 2, With rate tax Preparation

130

Index

131

132

133

D3

D3

0

0

D1

D1