Hp 12c platinum financial calculator

Printing History

About This Handbook

Introduction

Financial Calculations in the United Kingdom

For More Solutions to Financial Problems

Introduction

Contents

Section

Contents

Part II Programming 103

Part III Solutions 155

227

Appendix E Formulas Used 250

267

Making Financial Calculations Easy

500.00

48.00

21,396.61

14.00

168.00

10,371.79

11,024.82

42.03

Part Problem Solving

Low-Power Indication

Power On and Off

Adjusting the Display Contrast

Getting Started

Keying in Numbers

Getting Started

Digit Separators

Negative Numbers

7814

Keying in Large Numbers

Backspacing

123.63

63+

KeystrokesDisplay ALG mode

Clear Keys

Keys Clears

Undo Operation

RPN mode ALG mode

RPN and ALG Keys

Example

Keystrokes RPN mode Display

Simple Arithmetic Calculations in RPN Mode

13.00

Simple Arithmetic Calculations in ALG Mode

Keystrokes RPN mode

Chain Calculations in RPN Mode

22.95

35.38

10.14 1053+

42.00

30.00

Parentheses Calculations

Chain Calculations in ALG Mode

Storage Registers

Keystrokes ALG mode 8zgØ5 1gÙ Display

Storing and Recalling Numbers

250.00

Later that same day … Keystrokes Display RPN mode

Keystrokes Display 1250?0

500?2

Storage Register Arithmetic

Clearing Storage Registers

58.33

10.14

13.70

053.00

064.54

Percentage and Calendar Functions

Percentages in RPN Mode

Percentage Functions

300

Percentage and Calendar Functions

Percentages in ALG Mode

21,390.00

860.00

283.40

22,673.40

Percent Difference

Keystrokes ALG mode Display

58.50

53.25

29.69

Percent of Total in RPN Mode

Percent of Total in ALG Mode

Date Format

Calendar Functions

Future or Past Dates

11,09,2004

14.05

11.09

Number of Days Between Dates

498.00

491.00

Financial Registers

Basic Financial Functions

Storing Numbers into the Financial Registers

Displaying Numbers in the Financial Registers

Basic Financial Functions

Simple Interest Calculations

Clearing the Financial Registers

450.00

60.00

455.25

455.18

Financial Calculations and the Cash Flow Diagram

Basic Financial Functions

Cash Flow Sign Convention

Payment Mode

Generalized Cash Flow Diagrams

Basic Financial Functions

Calculating the Number of Payments or Compounding Periods

Compound Interest Calculations

35,000.00 Stores PV

Sets the payment mode to End

325.00

27.33

328.00

181.89

143.11

141.87

327.00

466.87

Recalls payment amount

775.00

GÂ n Keystrokes ALG mode

50.00

Stores FV

29.00

58.00

50.00 977.27

4000

22.73

Keystrokes Display ALG mode 4000

Calculating the Periodic and Annual Interest Rates

10,000.00 Stores FV

Calculating the Present Value

Keystrokes RPN mode Keystrokes ALG mode

9gC 450ÞP 1500+

17,500.00

12.00

540,000.00

369,494.09

243,400.00 Stores PV

60,000.00

200.00

717.44

Calculating the Future Value

5gA

Sets payment mode to End

243400$ 243,400.00 1363.29ÞP -1,363.29

222,975.98 Amount of balloon payment

281.34

24.00

32,000.00

28,346.96

Odd-Period Calculations

Basic Financial Functions

135.17

012004

5gC

Z30+

120.00

950.00

GÒ z30+

§12

Basic Financial Functions

250,000.00

Amortization

Keystrokes Display FCLEAR G Enters 25 gC 250000 $

970.91

498.12

245,029.09

238.26

404.37

093.75

360.00

380.51

Discounted Cash Flow Analysis NPV and IRR

Additional Financial Functions

Calculating Net Present Value NPV

Additional Financial Functions

Negative cash flow

212.18

130,000.00

Year Cash Flow

14,000.00

79,000.00

11,000.00

10,000.00

13.72

Calculating Internal Rate of Return IRR

Reviewing Cash Flow Entries

Changing Cash Flow Entries

100,000.00 500.00 14,000.00 79,000.00

857.21

644.75

Bond Price

Bond Calculations

042018

120.38

122.13

Bond Yield

Total price, including accrued

400.00

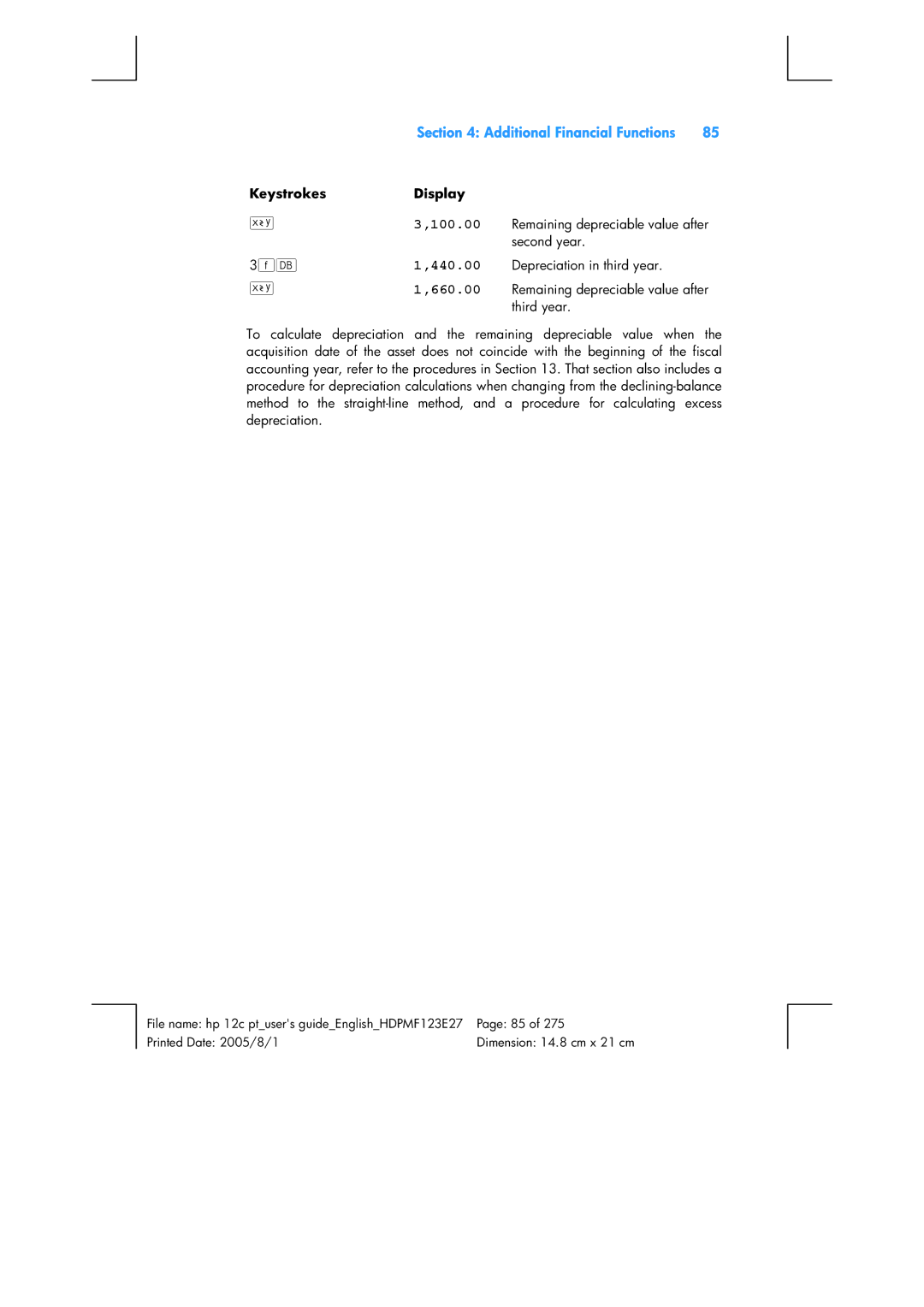

Depreciation Calculations

1f#

2f#

660.00

440.00

3f#

Continuous Memory

Additional Operating Features

Status Indicators

Additional Operating Features

Display

Number Display Formats

Scientific Notation Display Format

14.8746 14.9 14.87456320

1487456320

487456

Special Displays

Key in RPN Mode

Arithmetic Calculations With Constants

429,000.00

Recovering From Errors in Digit Entry

Accumulating Statistics

Statistics Functions

Mean

Correcting Accumulated Statistics

Statistics Functions

Register Statistic

40.00

32.00

38.00

35.00

820.59

Standard Deviation

463.00

28,818.93

Linear Estimation

Keystrokes Display 48 gQ

Estimated sales for a 48 hour

Keystrokes ALG mode 0gR 1gR~d-~ Display

Keystrokes RPN mode 0gR Display

001

GR~d~

Weighted Mean

One-Number Functions

Mathematics Number-Alteration Functions

100

258

Mathematics and Number-Alteration Functions

3880000000

Power Function in ALG Mode

Power Function in RPN Mode

Keystrokes To CalculateDisplay ALG mode

Part Programming

Programming Basics

Why Use Programs?

Creating a Program

104

200

Programming Basics

150.00

155.00

001 002 003 004 005 006 007

Running a Program

473.75

625

159

124.25

Identifying Instructions in Program Lines

Program Memory

Nnn,43,33,000

Nnn Nnn, 44

Displaying Program Lines

Instruction Keycode

Pressing gÜdoes the reverse Keystrokes Display RPN mode

Mode and displays current line

Sets calculator to Program

Program memory

Keystrokes Display 008,43,33,000 Program line

Expanding Program Memory

000 Instruction and Program Line

Programming Basics

Executing a Program One Line at a Time

Setting the Calculator to a Particular Program Line

Program line 003

Program line 002

Program line 004 b

Program line 006

Program line 005 +

Interrupting Program Execution

Pausing During Program Execution

68.5

119

Keystrokes RPN mode ?+1 ?+2 ?+3 Keystrokes ALG mode

?+1 ?+2 ?+3

004 005 006

001 002

008

001 002 003 004

950.61

012, 44 40

890.50

60.11

370.52

402.82

Stopping Program Execution

003,44 004 005 006

FCLEAR² 13\68.5 18\72.9 24\85

Fourth item

Simple Branching

Branching and Looping

125

Branching and Looping

Looping

150,000.00

007,43,33,002

782.47

593.75 005

593.75

188.72

188.72 007,43,33,002

592.25

Conditional Branching

190.22

Branching and Looping

Recalls test value into X-register

006,43,33,008

004,43,33,007

Stores income into register R9

008,43,33,010

006,43,33,009

010

20,000.00

15,000.00 004,43,33,007

15,000.00

15,000.00 007

20,000

25,000

20,000.00 007

25,000.00

25,000.00 005

15,000.00 005

15,000

15,000.00 006,43,33,009

15,000.00 009

005, 43 34 Line 005 go 20,000.00

012,43,33,000 Line 012 gi000 000.00

20,000.00 009

Line 009

25.00 010

25,000.00 007

Changing the Instruction in a Program Line

Program Editing

139

Adding Instructions at the End of a Program

Keystrokes RPN mode Keystrokes ALG mode Fs gi.006 Display

Program Editing

012

12,000.00

013

014

Adding Instructions within a Program

Adding Instructions by Replacement

Fs 15000t

Adding Instructions by Branching

016

001,43,33,012

Keystrokes RPN mode Fs gi.000

011,43,33,000

Gi.010

014 015,43,33,000 016

012 013

017,43,33,002

018 019

017,43,33,000

020 021,43,33,000 022

Program Editing

Storing Another Program

Multiple Programs

149

019 020 021 022

018,43,33,000

023 024 025 026

027,43,33,019

029 030 031 032

025 026 027 028

033,43,33,025

032 033 034,43,33,029

028 029 030 031

034 035 036 037

038 039 040,43 33,035

Running Another Program

Page

Part Solutions

Annual Percentage Rate Calculations With Fees

Real Estate and Lending

156

160,000.00

Real Estate and Lending

908.46

156,800.00

156,050.00

159,250.00

Keystrokes Display RPN mode ALG mode FCLEARG

Keystrokes Display RPN mode ALG mode 12§ §12³

Price of a Mortgage Traded at a Discount or Premium

72.00

777.61

137.17

312.00

657.97

252.00

Yield of a Mortgage Traded at a Discount or Premium

300,000.00

210.00

096.57

258,377.24

Rent or Buy Decision

18.00

12.11

008 009 010 011 012 013 014 015 016 017 018 019 020 021

000 001 002 003 004,44 005 006 007

RPN mode

Registers

Real Estate and Lending

700.00

165.00

900.00

270,000.00

Deferred Annuities

Keystrokes Display RPN mode ALG mode Yield

46,048.61

15,218.35

750.00

600.00

12,831.75

Partial-Year Depreciation

Investment Analysis

Straight-Line Depreciation

000 001 002 003 004 005 006 007 008 009 010 011

025,43 026 027 028 029 030 031

012 013 014 015 016 017 018 019 020 021 022 023 024

032,44

033,44

041,43,33

036 037 038 039 040

036,44

037,43,33

Investment Analysis

666.67

125,000.00

123,333.33

118,333.33

504.75

730.00

Declining-Balance Depreciation

000 001 002 003 004 005 006 007 008 009

021,43 022 023 024 025 026 027

010 011 012 013 014 015 016 017 018 019 020

028,44

029,44

034 035 036 037 038 039 040

034 035 036

50,000.00

Sum-of-the-Years-Digits Depreciation

11,458.33

025,43,33

018 019 020 021 022 023 024

026 027 028 029 030 031

035 036 037 038 039 040

042 043 044

500M

Keystrokes Display RPN mode ALG mode FCLEARG 12000$

25n

Full- and Partial-Year Depreciation with Crossover

008 009 010 011 012 013 014

008 009 010 011

?-0

033 034 035 036 037 038 039

032,43,33

040,44

041,44 042

058 059 060 061 062

057,43,33

063,44

064,43,33

085,43,33

080,44 081 082 083 084

086 087 088 089 090 091 092 093

094,43,33

Keystrokes Display RPN mode ALG mode FCLEAR H 11000 $

125.00

375.00

406.25

804.69

10,500.00

Excess Depreciation

312.50

531.25

Modified Internal Rate of Return

200,000.00

Group # of Months Cash Flow $

657,152.37

775,797.83

Black-Scholes Formula for Valuing European Options

Keystrokes Display

Keystrokes Display

071,43,33,077

065 066 067 068 069 070

073,44 074

075,44 076 077 078

092,44 093 094 095

089 090 091

096,44 097 098 099

089,44 090

113 114,44 115 116 117

199

118,43,33

Program Instructions

20.54

52.00

14.22

71.15

20.00

10.00

Advance Payments

Leasing

Solving for Payment

202

11.64

Leasing

64.45

000 001

008 009 010 011 012 013 014 015 016 017 018 019

008 009 010 011 012 013 014 015 016 017

66.86

65.43

57.00

Solving for Yield

23,200.00

600 P

002 003 004 005 006 007 008 009 010 011 012 013 014 015 016

17.33

Annual yield as a

Percentage

017,45,43

Keystrokes ALG mode

19.48

? t

Advance Payments With Residual

018 019 020 021 022 023 024 025 026 027 028 029 030

22,000.00

15.00

487.29

520.81

34.00

710.00

18.10

Savings

Keystrokes Display RPN mode ALG mode FCLEARG 25\ 25z 4nz¼

Nominal Rate Converted to Effective Rate

213

002 003 004 005 006 007 008

Savings

002 003 004 005 006 007 008 009 010

³ÞM¼

Effective Rate Converted to Nominal Rate

Continuous Rate Converted to Effective Rate

Keystrokes Display RPN mode ALG mode FCLEAR G N100 $

105.35

35 +Þ +5.35 ³Þ

30/360 Day Basis Bonds

Bonds

001 002 003 004 005 006 007 008 009 010 011 012 013

217

029 030 031 032 033 034 035 036 037

014 015 016 017 018 019 020 021 022 023 024 025 026 027

038,43,33

014 015 016 017 018 019 020 021 022 023 024 025 026 027 028

Bonds 219

039 040 041 042 043 044 045 046

040,43,33

041 042 043 044 045 046 047 048 049

102.55

104.74

103.41

Annual Coupon Bonds

223

20 ?0

94.75

12.01

Page

Appendices

228

RPN and the Stack

Appendix a RPN and the Stack

Getting Numbers Into the Stack The Key

Termination of Digit Entry

Rearranging Numbers in the Stack

Stack Lift

Key

Two-Number Functions and the Stack

One-Number Functions and the Stack

Mathematics Functions

Percentage Functions

Register

Calendar and Financial Functions

Last X Register and the Key

+ 5 6 +

Arithmetic Calculations with Constants

168,000.00

84,000

336,000.00

672,000.00

237

Algebraic Mode ALG

Keying in Negative Numbers

Appendix B Algebraic Mode ALG

532.50

History Stack in ALG Mode

Key in ALG Mode

400.43 737.07

18.5 §

8zgØ

1250+7b

To Calculate Keystrokes Display ALG mode

Power Function

Percent of Total

243

More About L

Appendix C More About L

Error 0 Mathematics

Error Conditions

245

Error 2 Statistics

Error 1 Storage Register Overflow

Error 3 IRR

Error 4 Memory

OperationCondition

Error 5 Compound Interest

Error 7 IRR

Error 6 Storage Registers

Operation Condition

Error 9 Service

Error 8 Calendar

Pr Error

Percentage

Formulas Used

Interest

Simple Interest

Compound Interest

Appendix E Formulas Used

Calendar

Discounted Cash Flow Analysis

200

Bonds

Depreciation

DPN J

Finite Compounding

Interest Rate Conversions

Continuous Compounding

Statistics

Weighted Mean

Linear Estimation

Standard Deviation

Rent or Buy Decision

Battery

Battery, Warranty, Service Information

Low-Power Indication

259

Installing a New Battery

Appendix F Battery, Warranty, and Service Information

Verifying Proper Operation Self-Tests

Appendix F Battery, Warranty, and Service Information

Warranty

Service

USA

Regulatory Information

Noise Declaration

Temperature Specifications

Canada

Japan

Mortgages

United Kingdom Calculations

267

Appendix G United Kingdom Calculations

Annual Percentage Rate APR Calculations

269

Financial

Function Key Index

Statistics

Mathematics

Modes

Number Alteration

Stack Rearrangement

272

Programming Key Index

Run Mode Active Keys

Pressed from Keyboard

274

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index