| Cash Flows |

Table | |

|

|

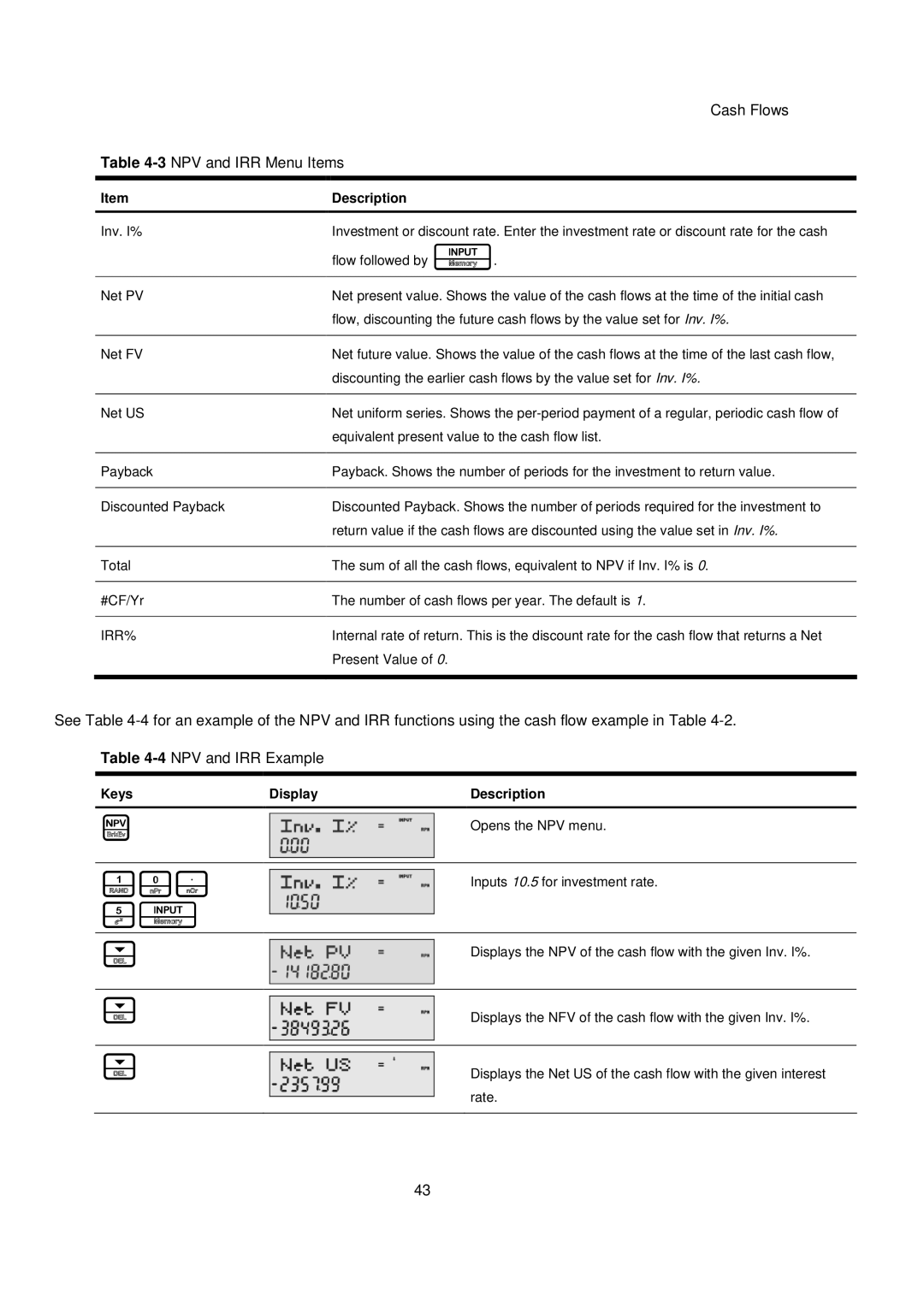

Item | Description |

|

|

Inv. I% | Investment or discount rate. Enter the investment rate or discount rate for the cash |

| flow followed by I. |

|

|

Net PV | Net present value. Shows the value of the cash flows at the time of the initial cash |

| flow, discounting the future cash flows by the value set for Inv. I%. |

|

|

Net FV | Net future value. Shows the value of the cash flows at the time of the last cash flow, |

| discounting the earlier cash flows by the value set for Inv. I%. |

|

|

Net US | Net uniform series. Shows the |

| equivalent present value to the cash flow list. |

|

|

Payback | Payback. Shows the number of periods for the investment to return value. |

|

|

Discounted Payback | Discounted Payback. Shows the number of periods required for the investment to |

| return value if the cash flows are discounted using the value set in Inv. I%. |

|

|

Total | The sum of all the cash flows, equivalent to NPV if Inv. I% is 0. |

|

|

#CF/Yr | The number of cash flows per year. The default is 1. |

|

|

IRR% | Internal rate of return. This is the discount rate for the cash flow that returns a Net |

| Present Value of 0. |

|

|

See Table

Table

Keys | Display | Description |

|

|

|

P

Opens the NPV menu.

10.

5I

Inputs 10.5 for investment rate.

<

<

<

Displays the NPV of the cash flow with the given Inv. I%.

Displays the NFV of the cash flow with the given Inv. I%.

Displays the Net US of the cash flow with the given interest rate.

43