Time Value of Money

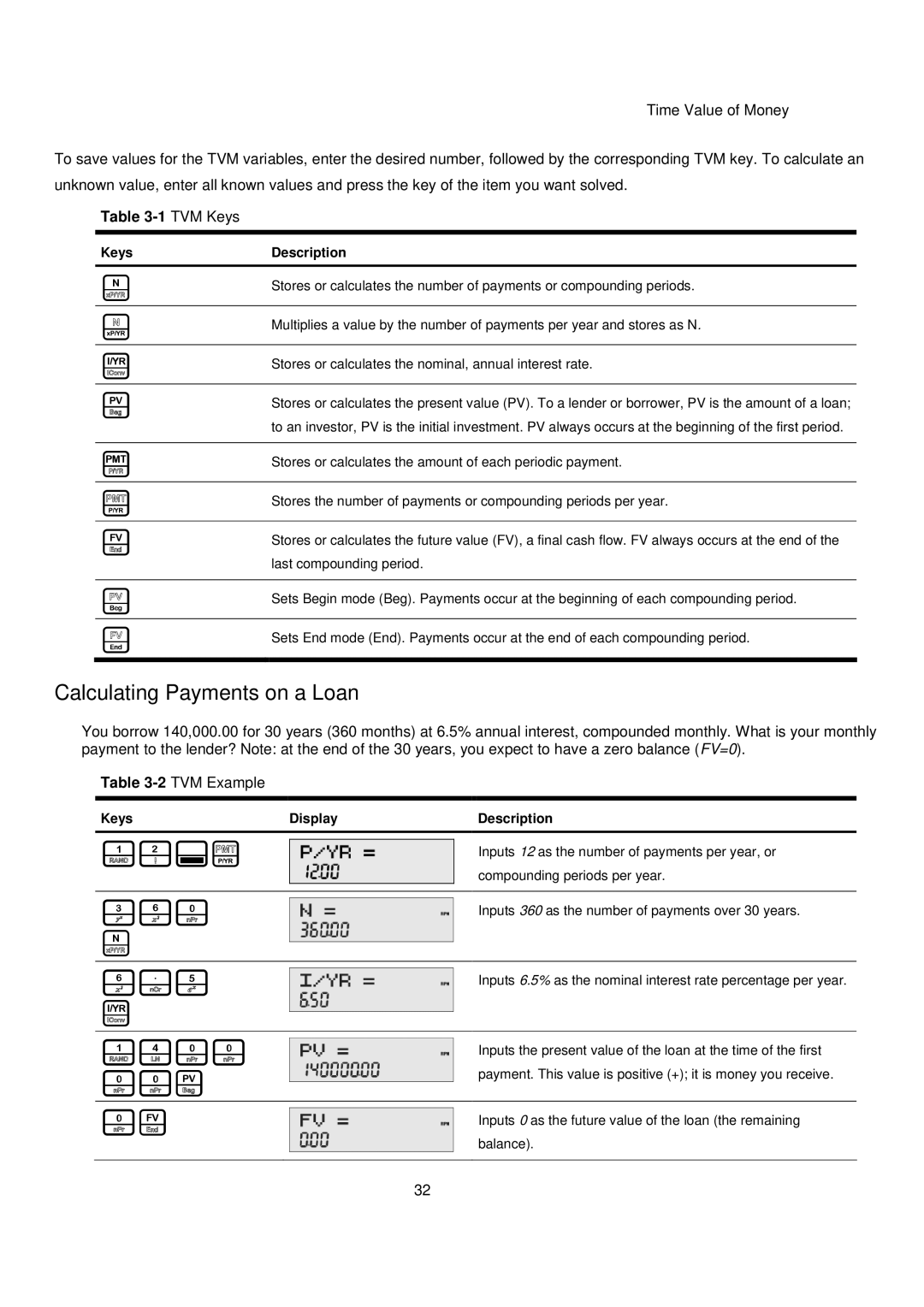

To save values for the TVM variables, enter the desired number, followed by the corresponding TVM key. To calculate an unknown value, enter all known values and press the key of the item you want solved.

Table 3-1 TVM Keys

KeysDescription

N

^

Y

V

Stores or calculates the number of payments or compounding periods.

Multiplies a value by the number of payments per year and stores as N.

Stores or calculates the nominal, annual interest rate.

Stores or calculates the present value (PV). To a lender or borrower, PV is the amount of a loan; to an investor, PV is the initial investment. PV always occurs at the beginning of the first period.

M

[

F

Stores or calculates the amount of each periodic payment.

Stores the number of payments or compounding periods per year.

Stores or calculates the future value (FV), a final cash flow. FV always occurs at the end of the last compounding period.

?

]

Sets Begin mode (Beg). Payments occur at the beginning of each compounding period.

Sets End mode (End). Payments occur at the end of each compounding period.

Calculating Payments on a Loan

You borrow 140,000.00 for 30 years (360 months) at 6.5% annual interest, compounded monthly. What is your monthly payment to the lender? Note: at the end of the 30 years, you expect to have a zero balance (FV=0).

Table

Keys | Display | Description |

12:[

Inputs 12 as the number of payments per year, or compounding periods per year.

360 N

Inputs 360 as the number of payments over 30 years.

6.5 Y

Inputs 6.5% as the nominal interest rate percentage per year.

1400 |

| Inputs the present value of the loan at the time of the first |

00V |

| payment. This value is positive (+); it is money you receive. |

|

| |

|

|

|

0F |

| Inputs 0 as the future value of the loan (the remaining |

| ||

|

| balance). |

|

|

|

32