| Depreciation |

Table | |

|

|

Item | Description |

|

|

Salvage | The salvage value of the asset at the end of its useful life. |

|

|

Factor | The declining balance factor as a percentage. This is used for |

| declining balance and declining balance crossover methods only. |

|

|

Year | Year for which you want to calculate the depreciation. |

|

|

Depreciation | Depreciation in the given year. |

|

|

R.Book Value | Remaining book value at the end of the given year. |

|

|

R.Depreciable Value | Remaining depreciable value at the end of the given year. |

|

|

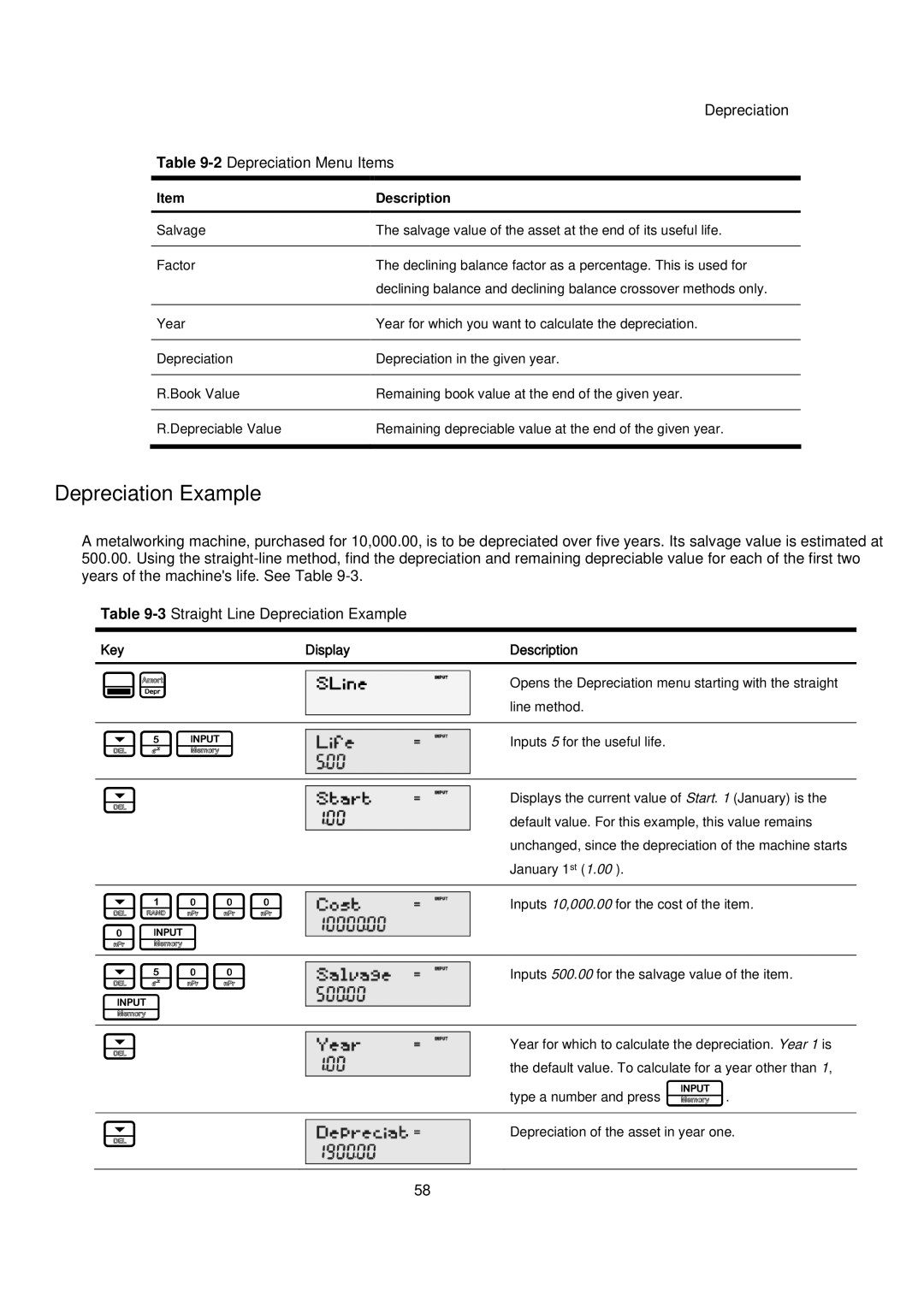

Depreciation Example

A metalworking machine, purchased for 10,000.00, is to be depreciated over five years. Its salvage value is estimated at

500.00.Using the

Table

Key | Display | Description |

|

|

|

:\

Opens the Depreciation menu starting with the straight line method.

<5I

Inputs 5 for the useful life.

<

Displays the current value of Start. 1 (January) is the default value. For this example, this value remains unchanged, since the depreciation of the machine starts January 1st (1.00 ).

<1000

0I

Inputs 10,000.00 for the cost of the item.

<500

I

Inputs 500.00 for the salvage value of the item.

<

<

Year for which to calculate the depreciation. Year 1 is the default value. To calculate for a year other than 1,

type a number and press I.

Depreciation of the asset in year one.

58