| Bonds |

Table |

|

|

|

Variable | Description |

|

|

Call | Call value. Default is set for a call price per 100.00 face value. A bond at maturity |

| has a call value of 100% of its face value. Note: input only. |

|

|

Yield% | Yield% to maturity or yield% to call date for given price. Note: input/output. |

|

|

Price | Price per 100.00 face value for a given yield. Note: input/output. |

|

|

Accrued | Interest accrued from the last coupon or payment date until the settlement date for |

| a given yield. Note: this item is |

|

|

Actual/Cal.360 | Actual |

| Press Ito toggle between these options. |

|

|

Annual/Semiannual | Bond coupon (payment) frequency. Press Ito toggle between these |

| options. |

|

|

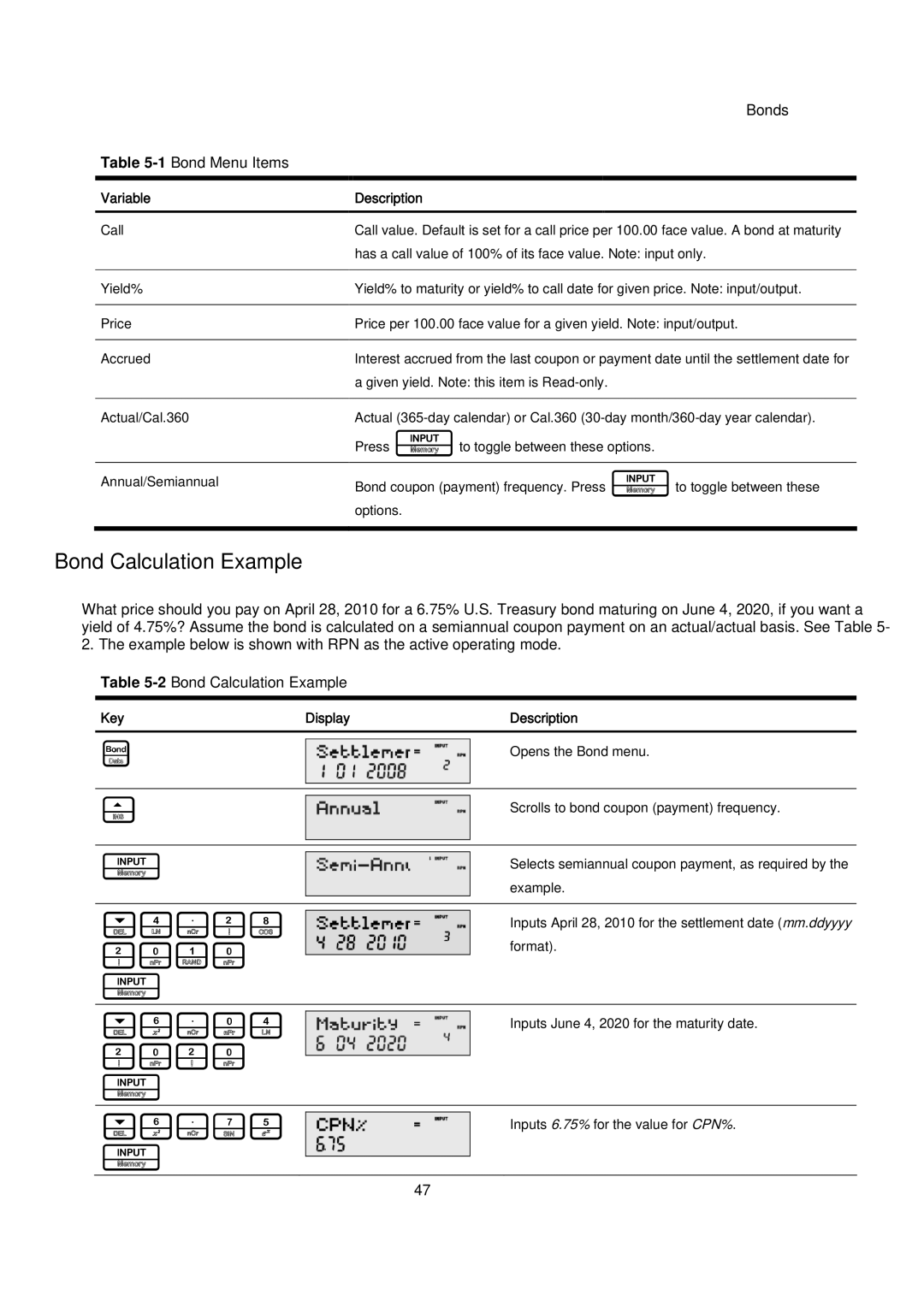

Bond Calculation Example

What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on June 4, 2020, if you want a yield of 4.75%? Assume the bond is calculated on a semiannual coupon payment on an actual/actual basis. See Table 5- 2. The example below is shown with RPN as the active operating mode.

Table

Key | Display | Description |

|

|

|

B

Opens the Bond menu.

>

Scrolls to bond coupon (payment) frequency.

I

Selects semiannual coupon payment, as required by the example.

<4.28

2010 I

Inputs April 28, 2010 for the settlement date (mm.ddyyyy format).

<6.04

2020 I

Inputs June 4, 2020 for the maturity date.

<6.75

I

Inputs 6.75% for the value for CPN%.

47