Depreciation

Note: pressing <on the last item of a

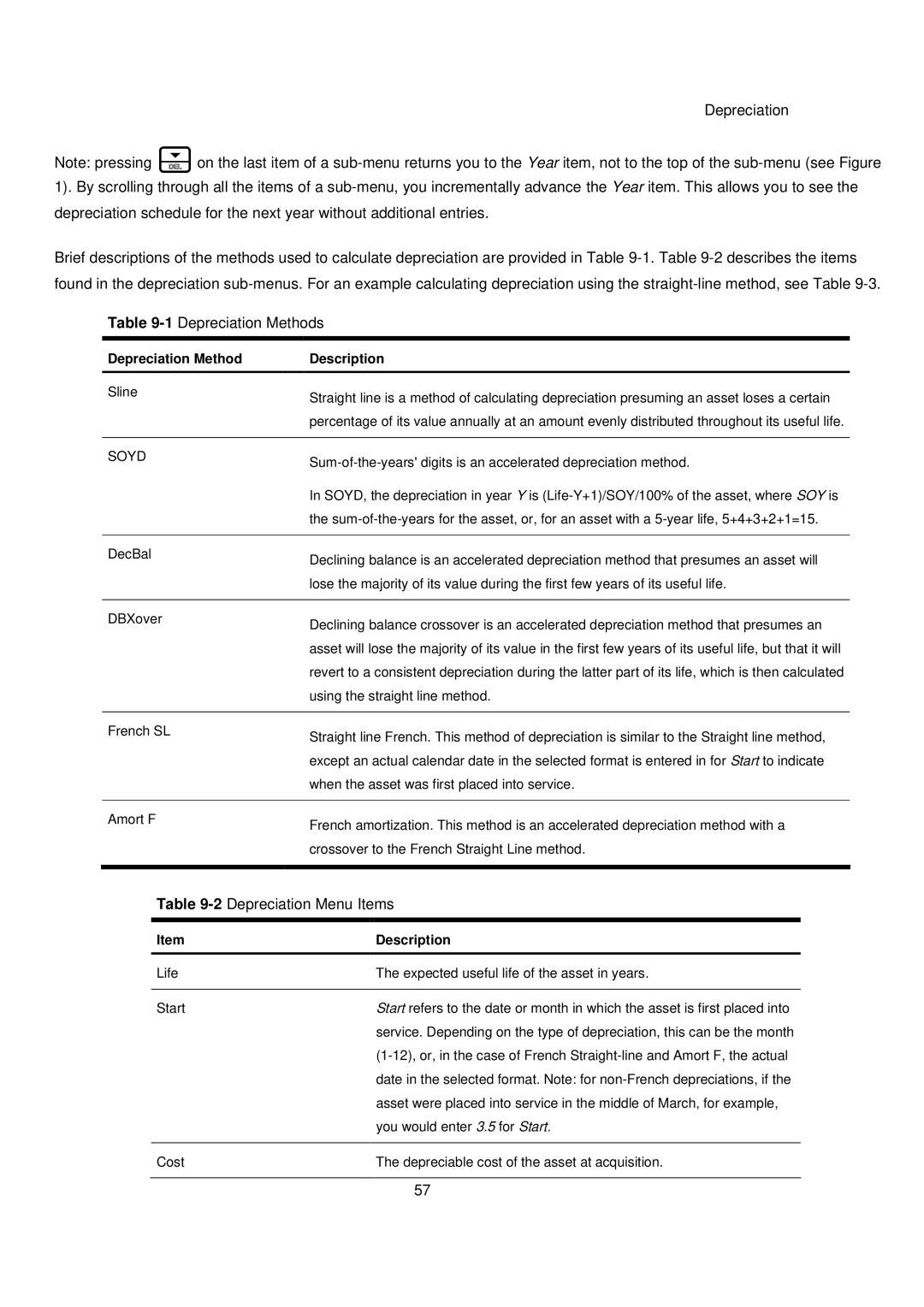

Brief descriptions of the methods used to calculate depreciation are provided in Table

Table 9-1 Depreciation Methods

Depreciation Method | Description |

Sline | Straight line is a method of calculating depreciation presuming an asset loses a certain |

| |

| percentage of its value annually at an amount evenly distributed throughout its useful life. |

|

|

SOYD

DecBal

In SOYD, the depreciation in year Y is

Declining balance is an accelerated depreciation method that presumes an asset will lose the majority of its value during the first few years of its useful life.

DBXover | Declining balance crossover is an accelerated depreciation method that presumes an |

| |

| asset will lose the majority of its value in the first few years of its useful life, but that it will |

| revert to a consistent depreciation during the latter part of its life, which is then calculated |

| using the straight line method. |

|

|

French SL

Amort F

Straight line French. This method of depreciation is similar to the Straight line method, except an actual calendar date in the selected format is entered in for Start to indicate when the asset was first placed into service.

French amortization. This method is an accelerated depreciation method with a crossover to the French Straight Line method.

Table 9-2 Depreciation Menu Items

Item | Description |

Life | The expected useful life of the asset in years. |

|

|

Start | Start refers to the date or month in which the asset is first placed into |

| service. Depending on the type of depreciation, this can be the month |

| |

| date in the selected format. Note: for |

| asset were placed into service in the middle of March, for example, |

| you would enter 3.5 for Start. |

|

|

Cost | The depreciable cost of the asset at acquisition. |

57