Bonds

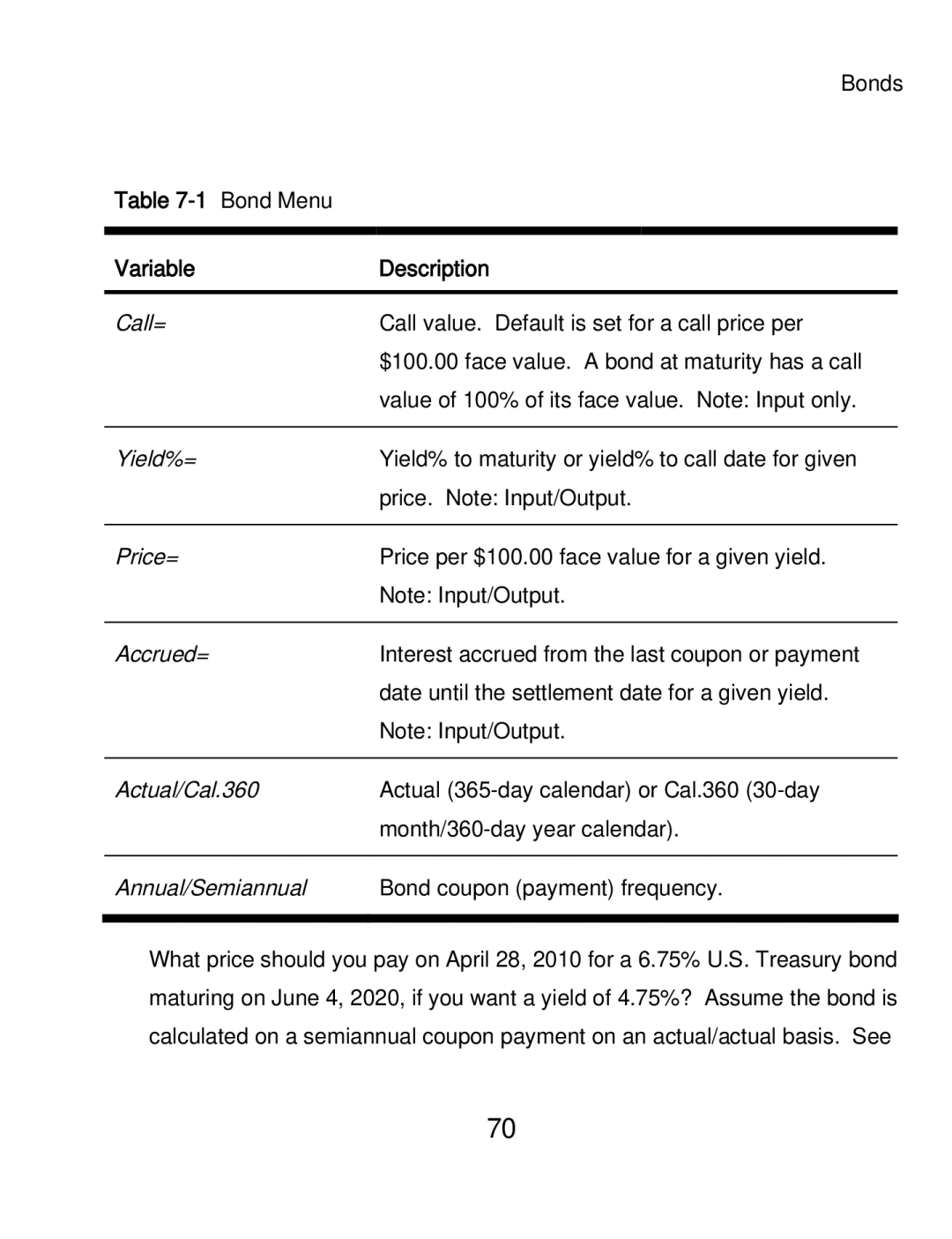

Table 7-1 Bond Menu

Variable | Description |

Call= | Call value. Default is set for a call price per |

| $100.00 face value. A bond at maturity has a call |

| value of 100% of its face value. Note: Input only. |

|

|

Yield%= | Yield% to maturity or yield% to call date for given |

| price. Note: Input/Output. |

|

|

Price= | Price per $100.00 face value for a given yield. |

| Note: Input/Output. |

|

|

Accrued= | Interest accrued from the last coupon or payment |

| date until the settlement date for a given yield. |

| Note: Input/Output. |

|

|

Actual/Cal.360 | Actual |

| |

|

|

Annual/Semiannual | Bond coupon (payment) frequency. |

|

|

What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on June 4, 2020, if you want a yield of 4.75%? Assume the bond is calculated on a semiannual coupon payment on an actual/actual basis. See

70