Depreciation

Table

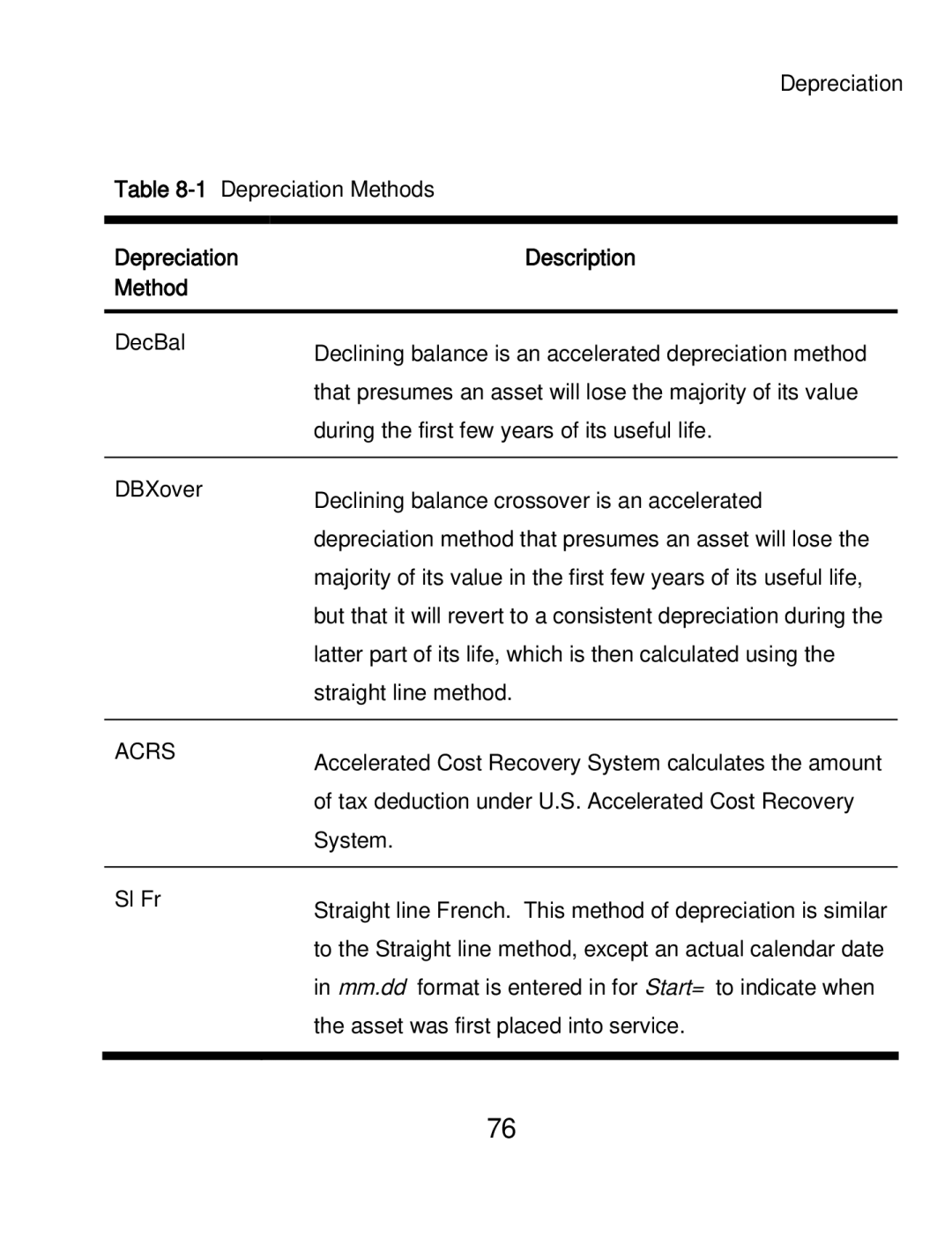

Depreciation | Description |

Method |

|

|

|

DecBal | Declining balance is an accelerated depreciation method |

| |

| that presumes an asset will lose the majority of its value |

| during the first few years of its useful life. |

|

|

DBXover | Declining balance crossover is an accelerated |

| |

| depreciation method that presumes an asset will lose the |

| majority of its value in the first few years of its useful life, |

| but that it will revert to a consistent depreciation during the |

| latter part of its life, which is then calculated using the |

| straight line method. |

|

|

ACRS | Accelerated Cost Recovery System calculates the amount |

| |

| of tax deduction under U.S. Accelerated Cost Recovery |

| System. |

|

|

Sl Fr | Straight line French. This method of depreciation is similar |

| |

| to the Straight line method, except an actual calendar date |

| in mm.dd format is entered in for Start= to indicate when |

| the asset was first placed into service. |

|

|

76