HP Part Number 00015-90001 Edition 2.4, Sep

HP-15C Owner’s Handbook

Legal Notice

Introduction

Contents

Display and Continuous Memory

Contents

Program Branching and Controls

Program Editing

Subroutines

Calculating With Matrices

Indirect Display Control

Calculating With Complex Numbers

Numerical Integration

Appendix E a Detailed Look at f

Contents Appendix a Error Conditions

Appendix C Memory Allocation

Appendix D a Detailed Look at

Subject Index

Contents Appendix F Batteries

Function Summary and Index

Programming Summary and Index

Quick Look at

HP-15C Problem Solver

To Compute Keystrokes Display

Manual Solutions

Keystrokes Display

Programmed Solutions

300.51

KeystrokesDisplay

001-42,21,11

002 003 004 005 006 007 008 009 8313

HP-15C a Problem Solver

Part l HP-15C Fundamentals

Section

Power On and Off

Getting Started

Keyboard Operation

I O m ´ P I l F T s ? t H b

Prefix Keys

Changing Signs

Keying in Exponents

Clear Keys

Clears only the last digit

Display Clearing ` and −

Digit entry not terminated

6532

Calculations

One-Number Functions

Two-Number Functions

78.0000

17 +

26.0000 22.0000 5000

13.0000

Number Alteration Functions

Numeric Functions

General Functions

One-Number Functions

Pressing Calculates

Trigonometric Operations

Time and Angle Conversions

40.5000

Degrees/Radians Conversions

7069

Radians

Hyperbolic Functions

Logarithmic Functions

To Calculate Keystrokes Display

Power Function

Two-Number Functions

Percentages

Polar Conversion. Pressing

Polar and Rectangular Coordinate Conversions

Enters the base number the price

Calculates 3% of $15.76 the tax

Keystrokes Display

Always displayed

Automatic Memory Stack Last X, and Data Storage

Automatic Memory Stack Stack Manipulation

Automatic Memory Stack Registers

Lost

Stack Manipulation Functions

Memory Stack, Last X, and Data Storage

Lost

12.9000

Last X Register and K

287.0000

22.2481

20.6475

Calculator Functions and the Stack

13.9 +

+15 X15

Order of Entry and the v Key

69.0000

Nested Calculations

7 +

65.0000

Arithmetic Calculations With Constants

5 ‛15 Keys

000

Keystrokes Display Growth factor

1000

520.8750

Storage Register Operations

Storing and Recalling Numbers

322.5000

Storage and Recall Arithmetic

Clearing Data Storage Registers

For recall arithmetic

For storage arithmetic

15.0000

Problems

Overflow and Underflow

24 l-0

Memory Stack, Last X, and Data Storage

60.0000

Statistics Functions

Probability Calculations

3422

Random Number Generator

270,725.0000

5764

Registers

Accumulating Statistics

Register Contents

Σy2

20.00 40.00 60.00 80.00 Kg per hectare

Metric tons per Hectare, y

20 z 61v 40 z 7.21 60 z 7.78 80 z l

20 w 20 z

Correcting Accumulated Statistics

40.00

Mean

Standard Deviation

Application

Linear Regression

31.62

Standard deviation about the mean nitrogen

Linear Estimation and Correlation Coefficient

Statistics Functions

70 ´j

Other Applications

Fixed Decimal Display

Display Continuous Memory

Display Control

234567

Scientific Notation Display

Engineering Notation Display

234568

Annunciators

Round-Off Error

Special Displays

Mantissa Display

12.345.6700

Error Display

Digit Separators

12,345.67

Status

Low-Power Indication

Continuous Memory

Resetting Continuous Memory

Page

Part ll HP-15C Programming

Loading a Program

Programming Basics

Mechanics

Creating a Program

´b a

Programming Basics

002 003 004 005 006 007 008

Intermediate Program Stops

Running a Program

300.51 300.51 ´A

How to Enter Data

Program Memory

Totals

Radius, r Height, h Base Area Volume Surface Area

010

002

004 005

007-44,40

Or G a

Instruction Coding

Further Information

Program Instructions

Keycode 25 second row, fifth key

Memory Configuration

60 ´ m%

Initial Memory Configuration

19.0000

Program Boundaries

´ m %

19 ´ m%

´bA ´b3 End of memory

Unexpected Program Stops

Abbreviated Key Sequences

LOG %

User Mode

Polynomial Expressions and Horners Method

¤ @ y ∕

12,691.0000

Nonprogrammable Functions

001-42,21,12

002 003 004 005 006 007 008 009 0000

Problems

Moving to a Line in Program Memory

Program Editing

Inserting Program Lines

Examples

Deleting Program Lines

Or use Â

Single-Step Operations

Result

Line Position

Âhold

Release

Initializing Calculator Status

Insertions and Deletions

PV 1 + i n

Interest

+ i n

´bA D ´4 O0 2* O1 2÷ * ´ ´ l0 l1 ´r * n

100 270

Branching

Program Branching Controls

Test

Conditional Tests

n will clear flag number n

Flags

Example Branching and Looping

016-44,40

010-45,20

013-43,30

014

Formula is

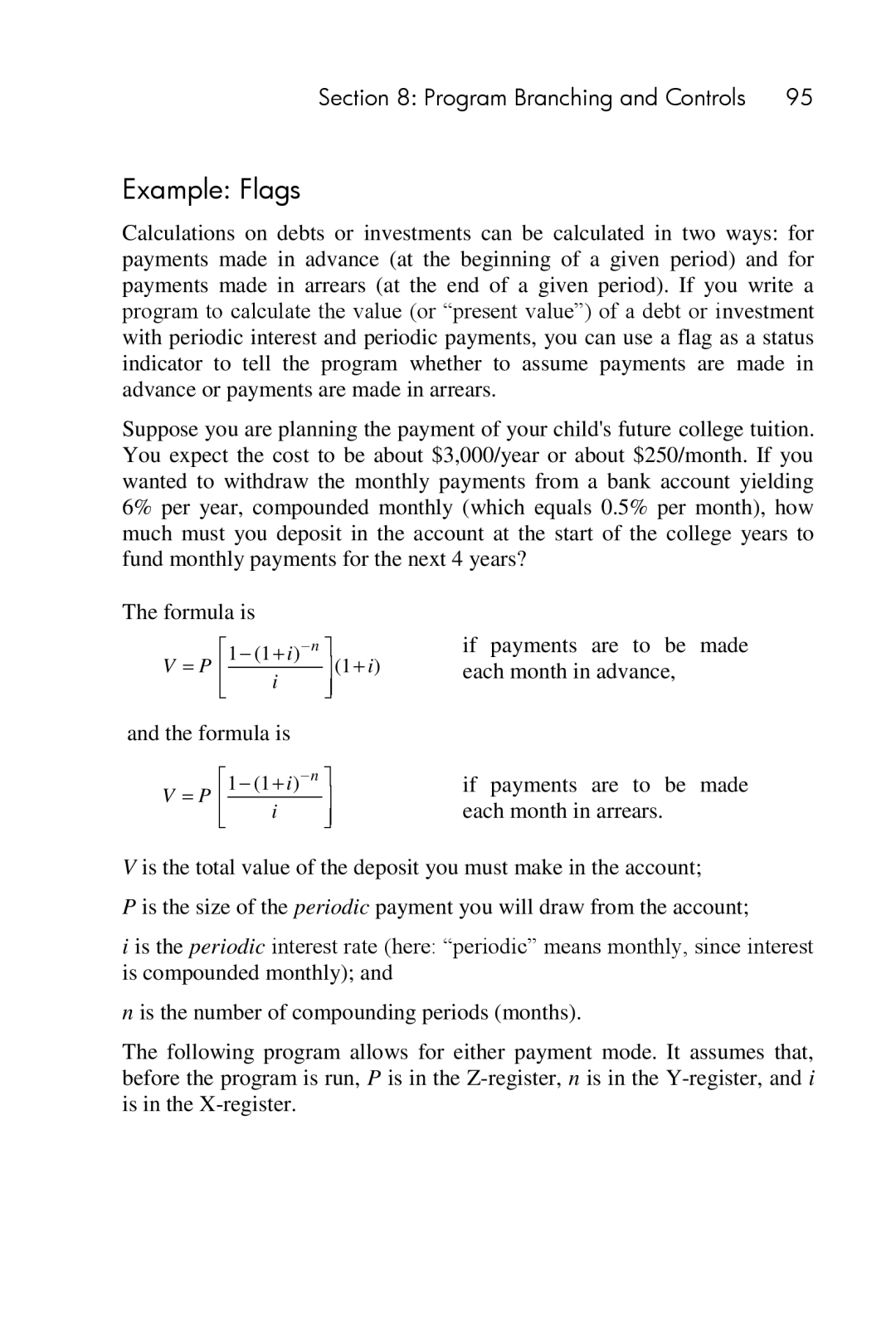

Example Flags

006-42,21

002-43

004-42,21,15

005-43, 4

10,698.3049

Go to

250.0000

48.0000

Conditional Branching

Looping

System Flags Flags 8

Program Branching and Controls

´b.1

Subroutines

Go To Subroutine and Return

Subroutine Execution

Subroutine Limits

004

000 001- ´b9

002- R

003- O0

´b.5

´ b.4

Nested Subroutines

Subroutine Return

106

Index Register Loop Control

V and % Keys

Index Register and Loop Control

Indirect Program Control With the Index Register

Program Loop Control

Index Register Storage and Recall

Indirect Branching With

Index Register Arithmetic

Exchanging the X-Register

Loop Control With Counters I and e

Indirect Flag Control With

Indirect Display Format Control With

Start count at zero Count by twos Count up to

Nnnnn x x x y y 5 0 0

12.3456

Examples Register Operations

Iterations

Storing and Recalling Keystrokes Display

Storage Register Arithmetic

Example Loop Control with e

Exchanging the X-Register

013- 22

Loop control number in R2

−− 011- 42

012-42, 5

64.8420 0000 50.0000

Example Display Format Control

15 O

Index Register Contents

Indirect Display Control

Index Register and Loop Control

118

Part lll HP-15C Advanced Functions

120

Complex Stack and Complex Mode

Calculating With Complex Numbers

Creating the Complex Stack

Entering Complex Numbers

Deactivating Complex Mode

Complex Numbers and the Stack

´ % hold 8.0000 release

Z 8 Y 7 X Keys

Manipulating the Real and Imaginary Stacks

Stack Lift in Complex Mode

Or other operation

Clearing a Complex Number

− 4 v Continue with any operation

Continue with any operation

0000 17.0000 144.0000

Entering Complex Numbers with −. The clearing functions −

´ %hold release

Followed by another number

Entering a Real Number

´ Continue with any operation

Entering a Pure Imaginary Number

L 2 ´

Operations With Complex Numbers

Storing and Recalling Complex Numbers

´ O

+ * ÷ y

¤x N o ∕ @ a

0491

2000

7000

0428

´ % hold Release1.5708

Polar and Rectangular Coordinate Conversions

Complex Results from Real Numbers

5708

Cos θ + i sin θ = re iθ Polar + ib = ∠ θ

+ 3.1434

8452

2981

4721

352.0000

872.0000

2361

For Further Information

138

Calculating With Matrices

= A-1B

Keystrokes Display Deactivates Complex Mode

2496

Matrix Dimensions

Running

11.2887

Number Rows Columns

Dimensioning a Matrix

Keystrokes l B Display

Displaying Matrix Dimensions

Changing Matrix Dimensions

´mA

Storing and Recalling All Elements in Order

Storing and Recalling Matrix Elements

⎡ a

Checking and Changing Matrix Elements Individually

Keystrokes Display

Matrix Descriptors

Matrix Operations

Storing a Number in All Elements of a Matrix

Result Matrix

One-Matrix Operations

Copying a Matrix

Calculating with Matrices

LB b

Scalar Operations

LA a

Elements of Result Matrix

LB b 2 LA a 2

Arithmetic Operations

Keystrokes Display Subtracts 1 from the elements

Matrix Multiplication

Keystrokes Display l a a

= AT B

Solving the Equation AX = B

8600

24 OA

2400

86 OA

274 OB 233 OB 331 OB 120.32 OB 112.96 OB 151.36 OB ´Á

Week Cabbage kg 186 141 215 Broccoli kg 116

Calculating the Residual

Calculations With Complex Matrices

Using Matrices in LU Form

Then Z can be represented in the calculator by

Storing the Elements of a Complex Matrix

Pressing Transforms Into

LA a

= ⎢

Complex Transformations Between ZP and Z

Inverting a Complex Matrix

´ a

Multiplying Complex Matrices

´U lC LC lC lC lC lC lC lC ´U

Keystrokes lA lB Display Displays descriptor of matrix a

ZZ −1

Solving the Complex Equation AX = B

AX = B

170.0000

200.0000

1543

0372

1311

0437

Calculating with Matrices

Miscellaneous Operations Involving Matrices

Using a Matrix Element With Register Operations

Using Matrix Descriptors in the Index Register

Conditional Tests on Matrix Descriptors

Stack Operation for Matrix Calculations

Calculating with Matrices

Using Matrix Operations in a Program

´m a

Summary of Matrix Functions

Keystrokes Results

Calculates residual in result matrix

For Further Information

180

Using

Finding the Roots An Equation

Clear program memory

Finding the Roots of an Equation

005 006 007

´b0

001-42,21

002 003

Desired root

Finding the Roots of an Equation

003 004

Keystrokes ¥

´ bA

000 001-42,21,11

200 t

5000 1 e t

Brings another t-value

Into X-register

000 001-42,21 002 003 004 005

When No Root Is Found

Error

Choosing Initial Estimates

Label

6 x + 8

003 004 005 007

X + 8

008 009

Finding the Roots of an Equation

Using in a Program

Memory Requirements

Restriction on the Use

194

Using f

Numerical Integration

002 003 004

1416 7652

4040

Begin subroutine with a label

4401

3825

$ ÷

6054

Accuracy of f

´ i ´ f

7091

8826

382

Using f in a Program

Memory Requirements

205

Error Conditions

Error 0 Improper Mathematics Operation

Appendix a

Error 2 Improper Statistics Operation

Error 1 Improper Matrix Operation

Error 6 Improper Flag Number

Error 3 Improper Register Number or Matrix Element

Error 4 Improper Line Number or Label Call

Error 5 Subroutine Level Too Deep

Pr Error Power Error

Appendix B

Stack Lift Last X Register

Digit Entry Termination

Stack Lift

Enabling Operations

Disabling Operations

Nnn Clear u ¥

Stack Stack Enabled. disabled 53.1301 No stack Lift

Neutral Operations

Appendix B Stack Lift and the Last X Register Keys

\ k + H ∆ \ h ÷ À P* q r c ‘ / N z ∕ P\ o j

Last X Register

Registers

Memory Allocation

Memory Space

Appendix C

Appendix C Memory Allocation

M % Function

Memory Reallocation

Memory Status W

19 ´ m

Restrictions on Reallocation

´m% 1.0000 Whold 1 64

Automatic Program Memory Reallocation

Program Memory

Together

Memory Requirements for the Advanced Functions

Two-Byte Program Instructions

If executed

Appendix C Memory Allocation

220

Detailed Look at

How Works

Appendix D

Appendix D a Detailed Look at

Accuracy of the Root

X4 =

000

006 007 008 009 010-43,30 011 012-43,30 013

1718

0681

Interpreting Results

´ v B

− 45 For 0 x

End subroutine

Test for x range

Branch for x ≥

3x 45x 2 +

Possible root

000.0000

Initial estimates

1358

Appendix D a Detailed Look at

013 014 015 016

´ b.0 001-42,21,.0 002 003 004 005

Bring x-value into X-register

007 008 009 010

10 v ´ ‛ 20

017 018

Finding Several Roots

Error 0000 1250 5626

002 003 004 005 006 007

Fx = xx a3 =

6667

Deflated function value

Same initial estimates

Second root

Stores root for deflation

Deflation for third root

Limiting the Estimation Time

Specifying a Tolerance

For Advanced Information

Counting Iterations

240

Detailed Look at f

How f Works

Appendix E

X = π1 0π cos4θ − x sinθ dθ

Accuracy, Uncertainty, and Calculation Time

´ i ´ f

0000 1416

´ f ´ Clear u hold

Keystrokes Display Return approximation to

´ Clear u Hold

Keystrokes ´ i Display

7807

7858

Uncertainty and the Display Format

Functions values for example

Δx = 0.5×10−n ×10m

= aδx dxb = ab 0.5×10−n + m x dx

Conditions That Could Cause Incorrect Results

∞ xe− xdx

001-42,21 002- 1 003 004 005

Appendix E a Detailed Look at f

Appendix E a Detailed Look at f

Conditions That Prolong Calculation Time

Uncertainty

Keys lower limit into

Keys upper limit into

Approximation to integral

Appendix E a Detailed Look at f

Obtaining the Current Approximation to an Integral

For Advanced Information

Batteries

Low-Power Indication

Installing New Batteries

Batteries

Appendix F Batteries

2.C 3.H

Verifying Proper Operation Self-Tests

Digit Entry

Function Summary and Index

Complex Functions

Conversions

Mantissa. Pressing

Display Control

Index Register Control

Logarithmic Exponential Functions

146

Mathematics

Matrix Functions

To XT

Number Alteration

To ZP page164

Clear u

Percentage

Probability

Stack Manipulation

Storage

Statistics

Trigonometry

269

Programming Summary and Index

Programming Summary and Index

271

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Subject Index

Modifications

Product Regulatory Environment Information

Federal Communications Commission Notice

Avis Canadien

Canadian Notice

Body number is inserted between CE

European Union Regulatory Notice