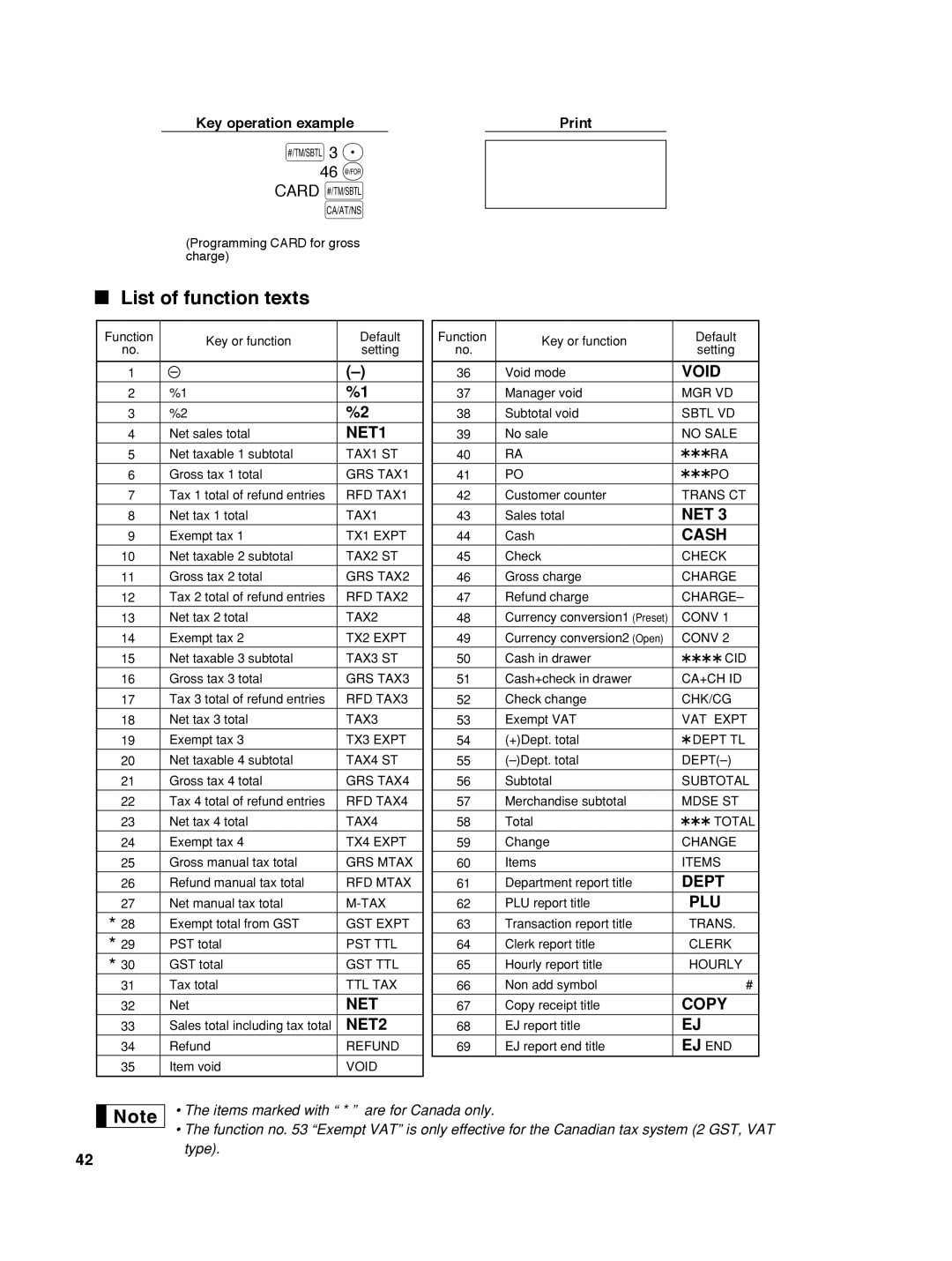

Key operation example |

s3 P

46 @

CARD s

A

(Programming CARD for gross charge)

List of function texts

Function | Key or function | Default | |

no. | setting | ||

|

1 |

|

|

| |

|

|

| ||

2 | %1 | %1 | ||

3 | %2 | %2 | ||

4 | Net sales total | NET1 | ||

5 | Net taxable 1 subtotal | TAX1 ST | ||

6 | Gross tax 1 total | GRS TAX1 | ||

7 | Tax 1 total of refund entries | RFD TAX1 | ||

8 | Net tax 1 total | TAX1 | ||

9 | Exempt tax 1 | TX1 EXPT | ||

10 | Net taxable 2 subtotal | TAX2 ST | ||

11 | Gross tax 2 total | GRS TAX2 | ||

12 | Tax 2 total of refund entries | RFD TAX2 | ||

13 | Net tax 2 total | TAX2 | ||

14 | Exempt tax 2 | TX2 EXPT | ||

15 | Net taxable 3 subtotal | TAX3 ST | ||

16 | Gross tax 3 total | GRS TAX3 | ||

17 | Tax 3 total of refund entries | RFD TAX3 | ||

18 | Net tax 3 total | TAX3 | ||

19 | Exempt tax 3 | TX3 EXPT | ||

20 | Net taxable 4 subtotal | TAX4 ST | ||

21 | Gross tax 4 total | GRS TAX4 | ||

22 | Tax 4 total of refund entries | RFD TAX4 | ||

23 | Net tax 4 total | TAX4 | ||

24 | Exempt tax 4 | TX4 EXPT | ||

25 | Gross manual tax total | GRS MTAX | ||

26 | Refund manual tax total | RFD MTAX | ||

27 | Net manual tax total | |||

* 28 | Exempt total from GST | GST EXPT | ||

* 29 | PST total | PST TTL | ||

* 30 | GST total | GST TTL | ||

31 | Tax total | TTL TAX | ||

32 | Net | NET | ||

33 | Sales total including tax total | NET2 | ||

34 | Refund | REFUND | ||

35 | Item void | VOID | ||

Function | Key or function | Default | |

no. | setting | ||

| |||

|

|

| |

36 | Void mode | VOID | |

37 | Manager void | MGR VD | |

38 | Subtotal void | SBTL VD | |

39 | No sale | NO SALE | |

40 | RA | RA | |

41 | PO | PO | |

42 | Customer counter | TRANS CT | |

43 | Sales total | NET 3 | |

44 | Cash | CASH | |

45 | Check | CHECK | |

46 | Gross charge | CHARGE | |

47 | Refund charge | CHARGE– | |

48 | Currency conversion1 (Preset) | CONV 1 | |

49 | Currency conversion2 (Open) | CONV 2 | |

50 | Cash in drawer | CID | |

51 | Cash+check in drawer | CA+CH ID | |

52 | Check change | CHK/CG | |

53 | Exempt VAT | VAT EXPT | |

54 | (+)Dept. total | DEPT TL | |

55 | |||

56 | Subtotal | SUBTOTAL | |

57 | Merchandise subtotal | MDSE ST | |

58 | Total | TOTAL | |

59 | Change | CHANGE | |

60 | Items | ITEMS | |

61 | Department report title | DEPT | |

62 | PLU report title | PLU | |

63 | Transaction report title | TRANS. | |

64 | Clerk report title | CLERK | |

65 | Hourly report title | HOURLY | |

66 | Non add symbol | # | |

67 | Copy receipt title | COPY | |

68 | EJ report title | EJ | |

69 | EJ report end title | EJ END |

• The items marked with “ * ” are for Canada only.

• The function no. 53 “Exempt VAT” is only effective for the Canadian tax system (2 GST, VAT

42

type).