Hp 17bII+ Financial Calculator

Edition June January

Printing History

Welcome to the hp17bII+

Welcome to the hp 17bII+

Contents

Saving and Reusing Numbers

Error Messages

Using Parentheses in Calculations

Power Function Exponentiation

Time Value of Money

Interest Rate Conversions

Cash Flow Calculations

11 141 Time, Appointments, and Date Arithmetic

Bonds

Depreciation

10 121 Running Total and Statistics

12 153 The Equation Solver

14 190 Additional Examples

More About Calculations

Assistance, Batteries, Memory, and Service

RPN The Stack

Menu Maps RPN Summary

RPN Selected Examples Error Messages Index

Currency Exchange Calculations

List of Examples

List of Examples

General Business Calculations

Interest Rate Conversions

Running Total and Statistical Calculations

Time, Alarms, and Date Arithmetic

How to Use the Equation Solver

Bonds and Notes

Important Information

Important Information

Getting Started

Power On and Off Continuous Memory

Adjusting the Display Contrast

Getting Started

18 1 Getting Started

Setting the Language

What You See in the Display

Keys for language Key Description

Backspacing and Clearing

Shift Key @

Keys for Clearing

Keys Display Description

20 1 Getting Started

Keys DisplayDescription

Doing Arithmetic

Using the Menu Keys

Keying in Negative Numbers

22 1 Getting Started

Menu Labels Menu Keys

Main Menu

24 1 Getting Started

Main Menu Menu Label Operations Done Covered This Category

Choosing Menus and Reading Menu Maps

Using the MU%C menu

26 1 Getting Started

Displaying the MU%C menu

Calculations Using Menus

Exiting Menus e

Clearing Values in Menus

28 1 Getting Started

= Cost

Solving Your Own Equations Solve

30 1 Getting Started

Typing Words and Characters the ALPHAbetic Menu

Characters

Editing ALPHAbetic Text

Keys

32 1 Getting Started

Calculating the Answer Calc

Alphabetic Editing Operation Label or Key to Press

Keyboard

KeysDisplayDescription

Temporarily SHOWing ALL

Controlling the Display Format

Decimal Places

Internal Precision

Exchanging Periods and Commas in Numbers

Rounding a Number

Double Space. Press

Error Messages

Modes

36 1 Getting Started

Number of bytes Percentage of total Memory still free

Calculator Memory @M

38 2 Arithmetic

Arithmetic

Calculator Line

VDoing Calculations

VUsing Parentheses in Calculations

Keys Display

Arithmetic

VThe Percent Key

Mathematical Functions

40 2 Arithmetic

VThe Power Function Exponentiation

Shifted Math Functions

Key

Description

Math Menu

Math Menu Labels

42 2 Arithmetic

History Stack of Numbers

Saving and Reusing Numbers

VReusing the Last Result @L

VKeys Display

44 2 Arithmetic

VKeys Display Description

Storing and Recalling Numbers

Keys New Register Contents

Doing Arithmetic Inside Registers and Variables

Arithmetic in Registers

Scientific Notation

48 2 Arithmetic

Range of Numbers

Business Percentages BUS Menus Description

Percentage Calculations Business

50 3 Percentage Calculations in Business

Using the BUS Menus

Examples Using the BUS Menus

Percent Change %CHG

Percent of Total %TOTL

Markup as a Percent of Cost MU%C

Markup as a Percent of Price MU%P

52 3 Percentage Calculations in Business

Sharing Variables Between Menus

Currency Exchange Calculations

Currx Menu

54 4 Currency Exchange Calculation

Menu Key

Selecting a Set of Currencies

Currx Menu

Currency Exchange Calculation

Currencies

Select CAN$ as currency

United States Conversion Chart in US$

Entering a Rate

Currency Rate

Select HK$ as currency

58 4 Currency Exchange Calculation

Converting Between Two Currencies

Storing and Recalling Sets of Currencies

Example Converting between Hong Kong and U.S Dollars

60 4 Currency Exchange Calculation

Clearing the Currency Variables

Time Value of Money

TVM Menu

Time Value of Money

Second Level of TVM

First Level of TVM

Shortcut for N Multiplies the number in the display by

TVM Menu Labels

First Level

Second Level

64 5 Time Value of Money

Cash Flow Diagrams and Signs of Numbers

FV is

66 5 Time Value of Money

Using the TVM Menu

Loan Calculations

Figures and stores number

68 5 Time Value of Money

@c

Figures and stores

70 5 Time Value of Money

000

Savings Calculations

72 5 Time Value of Money

Figures and stores number

74 5 Time Value of Money

Leasing Calculations

76 5 Time Value of Money

Amortization Amrt

78 5 Time Value of Money

Displaying an Amortization Schedule

Amrt Menu Labels

Label

Time Value of Money

Next successive set of payments authorized

80 5 Time Value of Money

First year

82 5 Time Value of Money

Printing an Amortization Table Table

Calculates and prints

84 6 Interest Rate Conversions

Interest Rate Conversions

Icnv Menu

Converting Interest Rates

Interest Rate Conversions

86 6 Interest Rate Conversions

Compounding Periods Different from Payment Periods

88 6 Interest Rate Conversions

90 6 Interest Rate Conversions

Cash Flow Calculations

Cflo menu

Cash Flow Calculations

92 7 Cash Flow Calculations

Cflo Menu Labels

Cash Flows Ungrouped

94 7 Cash Flow Calculations

Creating a Cash-Flow List

For grouped cash flows The display now shows

Entering Cash Flows

96 7 Cash Flow Calculations

Prompting for #TIMES #T?. When the calculator displays

Display Description

Viewing and Correcting the List

Deleting Cash Flows from List. Pressing

Copying a Number from a List to the Calculator Line

Naming and Renaming a Cash-Flow List

98 7 Cash Flow Calculations

Clearing a Cash-Flow List and Its Name

Starting or GETting Another List

Viewing the Name of the Current List. Press , then e

100 7 Cash Flow Calculations

Cash-Flow Calculations IRR, NPV, NUS, NFV

Calc Menu for Cflo Lists Menu Label

102 7 Cash Flow Calculations

Calculates NPV

104 7 Cash Flow Calculations

Group Number Amount

Prompts for next cash

106 7 Cash Flow Calculations

Doing Other Calculations with Cflo Data

Bonds

Bond Menu

108 8 Bonds

Bond Menu Labels

Menu Description Label

Bonds

Doing Bond Calculations

110 8 Bonds

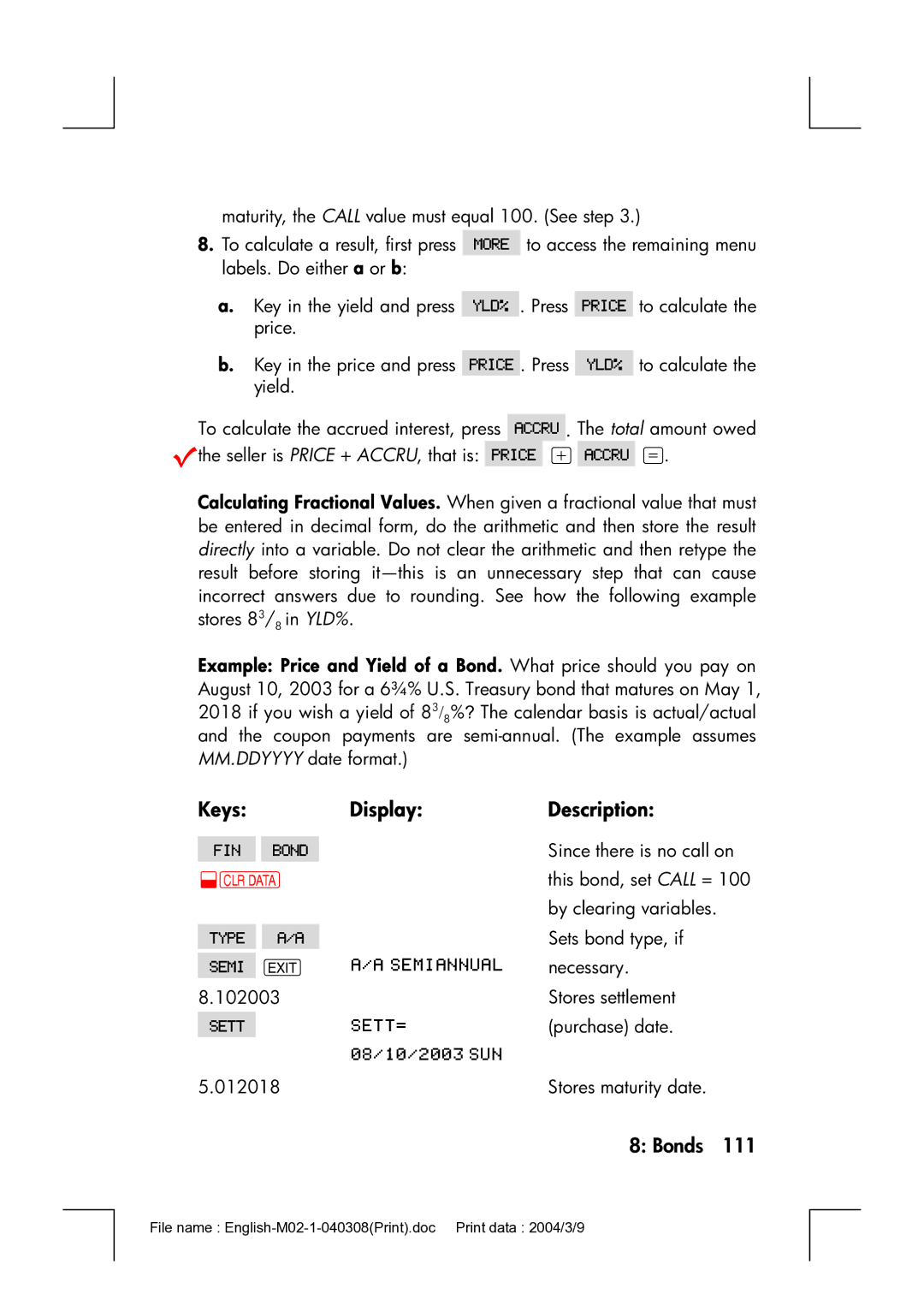

To calculate the price or yield of a bond

Since there is no call on

112 8 Bonds

MM.DDYYYY format

Depreciation

Deprc Menu

114 9 Depreciation

Depreciation

Deprc Menu Labels

To calculate the depreciation for an asset

Doing Depreciation Calculations

DB, SOYD, and SL Methods

116 9 Depreciation

Basis Salv 4,000

Acrs Method

Year Percentage Deductible Keys Display Description

118 9 Depreciation

Partial-Year Depreciation

120 9 Depreciation

Calendar Year Depreciation Value

Running Total and Statistics

Running Total and Statistics

SUM Menu

SUM Menu Labels

122 10 Running Total and Statistics

Entering Numbers and Viewing the Total

Creating a SUM List

124 10 Running Total and Statistics

Date

Amount Date

Transaction

126 10 Running Total and Statistics

Naming and Renaming a SUM List

Doing Statistical Calculations Calc

Clearing a SUM List and Its Name

Calculations with One Variable

Calc Menu for SUM Lists Menu Key

128 10 Running Total and Statistics

Expense

Month Phone

130 10 Running Total and Statistics

Calculations with Two Variables Frcst

Calc Total Mean Medn Stdev Range More MIN MAX Sort Frcst

132 10 Running Total and Statistics

Frcst Menu Labels

Logarithmic Curve Fit

Curve Fitting and Forecasting

To do curve fitting and forecasting

134 10 Running Total and Statistics

Number of Minutes Dollar Sales

Radio

Advertising Values

Minutes

136 10 Running Total and Statistics

Minutes

138 10 Running Total and Statistics

Weighted Mean and Grouped Standard Deviation

Rent

Summation Statistics

140 10 Running Total and Statistics

Doing Other Calculations with SUM Data

Time, Appointments, Date Arithmetic

Viewing the Time and Date

Time, Appointments, and Date Arithmetic

Time Menu

Time Menu Labels

142 11 Time, Appointments, and Date Arithmetic

Or DD.MMYYYY

Setting the Time and Date SET

SET Menu Labels

Menu Label Description

Adjusting the Clock Setting Adjst

Changing the Time and Date Formats SET

144 11 Time, Appointments, and Date Arithmetic

Viewing or Setting an Appointment APT1-APT10

Menu Labels for Setting Appointments Description

Appointments Appt

146 11 Time, Appointments, and Date Arithmetic

To set an appointment or view its current setting

Acknowledging an Appointment

To acknowledge a past-due appointment

Unacknowledged Appointments

Clearing Appointments

148 11 Time, Appointments, and Date Arithmetic

Date Arithmetic Calc

150 11 Time, Appointments, and Date Arithmetic

Determining the Day of the Week for Any Date

Calculating the Number of Days between Dates

Calc Menu Labels for Date Arithmetic

Calculating Past or Future Dates

DATE2

152 11 Time, Appointments, and Date Arithmetic

Equation Solver

Solver Example Sales Forecasts

Equation Solver

Next =OLD

154 12 The Equation Solver

Menu Label

Solve Menu

156 12 The Equation Solver

Keys

Entering Equations

Solve Menu Labels

To make an entry into the Solver list

Calculating Using Solver Menus Calc

To do a calculation using a Solver menu

158 12 The Equation Solver

Rmenu label

Eqty

160 12 The Equation Solver

Naming an Equation

Editing an Equation Edit

162 12 The Equation Solver

Finding an Equation in the Solver List

Shared Variables

Clearing Variables

Deleting a variable is quite different from clearing it

Deleting Variables and Equations

164 12 The Equation Solver

Writing Equations

Deleting One Equation or Its Variables Delet

Deleting All Equations or All Variables in the Solver @c

100

⋅ C

⋅ E

What Can Appear in an Equation

166 12 The Equation Solver

+ 5 ⋅ E

Using the Alpha Menu

Using a Typing Aid

Solver Functions

168 12 The Equation Solver

DDAYSd1d2cal

Solver Functions for Equations Description

Svariable name

170 12 The Equation Solver

HH.MMSS format

IFcond expr 1 expr

#TCFLO-listnameflow#

Cfr c 1 c 2 s expr

SIZECCFLO-listname

SIZESSUM-listname

172 12 The Equation Solver

Days

Conditional Expressions with if

OperatorKeys

≥ = ≤ = ≠ 174 12 The Equation Solver

Percent Salary Increase

Rating

Examples of Conditional Equations

VALUE=FIRST+1 ⎟ FIRST. If FIRST=0, then VALUE=FIRST

176 12 The Equation Solver

Summation Function ∑

Accessing Cflo and SUM Lists from the Solver

178 12 The Equation Solver

Creating Menus for Multiple Equations S Function

How the Solver Works

180 12 The Equation Solver

Halting and Restarting the Iterative Search

Entering Guesses

182 12 The Equation Solver

184 13 Printing

Printing

Printing

Printer’s Power Source

Double-Space Printing

Printing the DisplayP

186 13 Printing

Printing Other Information @p

Printing Variables, Lists, and Appointments List

Printer Menu Labels

Printing Descriptive Messages MSG

Trace Printing Trace

188 13 Printing

Keys Print-out

How to Interrupt the Printer

190 14 Additional Examples

Additional Examples

Loans

Simple Annual Interest

Additional Examples

Yield of a Discounted or Premium Mortgage

Figures and stores total

192 14 Additional Examples

See appendix F for RPN keystrokes for the next two examples

Annual Percentage Rate for a Loan with Fees

194 14 Additional Examples

11.5

Loan with an Odd Partial First Period

@c e

Solver Equation for Odd-Period Calculations

196 14 Additional Examples

Canadian Mortgages

Solver Equation for Canadian Mortgages

198 14 Additional Examples

Solver Equation for Advance Payments

Advance Payments Leasing

Savings

Value of a Fund with Regular Withdrawals

200 14 Additional Examples

Displays periodic

202 14 Additional Examples

Deposits Needed for a Child’s College Account

Additional Examples

204 14 Additional Examples

Flow of Withdrawals

For FLOW1

206 14 Additional Examples

Value of a Tax-Free Account

35

208 14 Additional Examples

Value of a Taxable Retirement Account

Modified Internal Rate of Return

Group No. of Months Cash Flow, $ Flow no

210 14 Additional Examples

V8 /12

180000

FLOW0

200000 I

V13 /12

212 14 Additional Examples

Solver Equation for Insurance Price

Price of an Insurance Policy

214 14 Additional Examples

Bonds

216 14 Additional Examples

Discounted Notes

Moving Average

Statistics

Solver Equation for Moving Averages

218 14 Additional Examples

Chi-Squared χ2 Statistics

Use

If necessary

If the expected values vary

220 14 Additional Examples

Number

Keystroke Display Description

Obtaining Help in Operating the Calculator

Assistance, Batteries Memory, and Service

Assistance, Batteries, Memory, and Service

Answers to Common Questions

Assistance, Batteries, Memory, and Service

Power and Batteries

Low-Power Indications

Do not use rechargeable batteries

Installing Batteries

Assistance, Batteries, Memory, and Service

Managing Calculator Memory

Reset hole

Resetting the Calculator

Erasing Continuous Memory

For English language

For the other languages

„ If the calculator won’t turn on

Determining If the Calculator Requires Service

Clock Accuracy

Environmental Limits

Assistance, Batteries, Memory, and Service

Confirming Calculator Operation Self-Test

Warranty

Assistance, Batteries, Memory, and Service

America Country Telephone numbers

Service

Europe Country Telephone numbers

Asia Pacific Country Telephone numbers

HP Invent

Regulatory information

Canada

Japan

More About Calculations

More About Calculations

IRR% Calculations

Possible Outcomes of Calculating IRR%

Storing a Guess for IRR%

Halting and Restarting the IRR% Calculation

S T = P R I C E - P R O F I T

Direct Solutions

Solver Calculations

O F I T = P R I C E - C O S T

= a R E a ⎟ W

E a = L x W

Iterative Solutions

More About Calculations

More About Calculations

More About Calculations

Actuarial Functions

Equations Used by Built-in Menus

Percentage Calculations in Business BUS

Time Value of Money TVM

Amortization

NPV = CF0 + ∑CFj x Uspv i% nj x Sppv i% Nj

Interest Rate Conversions

Cash-Flow Calculations

NOM % P

NUS = Uspv i% N Total = ∑nj ⋅ CFj

Bond Calculations

DB = Basis ⋅ Fact % /100

Depreciation Calculations

Sum and Statistics

Forecasting

Model Transformation

SX 2 ⋅ SY

Equations Used in Chapter

SXY = Σ X

− M

Odd-Period Calculations

Advance Payments

Modified Internal Rate of Return

Menu Maps

Menu Maps

Figure C-2. Currx Menu

Figure C-3. FIN Menu

Figure C-3 . FIN Menu

Figure C-4. SUM Menu

Figure C-5. Time Menu

Figure C-6. Solve Menu

RPN Summary

RPN Summary

About RPN

About RPN on the hp 17bII+

To select RPN mode Press @

Setting RPN Mode

Same as

Where the RPN Functions Are

Function Definition Key to Use Name

~ same as

↓. Except in Cflo and SUM lists, Efunction and the key also

Arithmetic Topics Affected by RPN Mode

Doing Calculations in RPN

Simple Arithmetic

To Calculate Press Display

27 %

RPN Mode ALG Mode

Calculations with STO and RCL

Chain Calculations-No Parentheses

Display

To Calculate Press

RPN The Stack

What the Stack Is

RPN The Stack

Exchanging the X- and Y-Registers in the Stack

Reviewing the Stack Roll Down

Arithmetic-How the Stack Does It

Lost

How Enter Works

Clearing Numbers

Reusing Numbers

Last X Register

Retrieving Numbers from Last

Chain Calculations

Exercises

Solution 23 @w13 E9 *-7@t+

RPN Selected Examples

RPN Selected Examples

KeysDisplay

Calculates annual interest

#TIMES1 for FLOW1

For E, press =, not

I11 I

Annual payment deposit

Error Messages

Error Messages

Error Messages

Error Messages

Error Messages

Index

Special Characters

Index

147

169

166

156

,

174-76

31-32

145

149

144

116

162-64

133

181-83

229

Examples

138-39

168-71

239

,

72-73

213-15

, 132 , 109 , 49, 53 , 52, 128 , 128 , 128 , 128

242-46

143-44

Memory. See also Continuous Memory

164-67

, 101 , 101 , 101 , 157 , 56 , 56 , 56 , 42

92-94

175

, 56 , 42 , 18 @p, 186 P

PMT. See also Payments in TVM, 63 rounded amortization

Repeating appointments past-due, 148 setting

Using

128

146-47

176

243-46

171

178

148

133-34

This regulation applies only to The Netherlands