Alpha9155sc

Welcome

Table of Contents

Table of Contents

100-101

Page

Unpacking Your Cash Register and SET-UP

Standard Accessories

Initial SET UP

Maintenance of Your Register

BAR Code Scanner

Using this Manual

HOW to GET Started

Getting to Know Your Cash Register

Error Conditions

Security System and Error Conditions

Control Lock System

Keyboard Functions

Keyboard Functions

Keyboard Functions

Keyboard Functions

Customer Display

Display indicators read from left to right as follows

Display Windows

Operator Displays

Description of Part Function

Printer

Installing the Paper Roll for the Receipt

Installing the Paper Rolls

Installing the Paper Roll for the Journal

Installing the Paper Rolls

To Remove the Paper Roll for the Receipt

Removing the Paper Rolls

To Remove the Paper Roll for the Journal

Replacing the Battery

Replacing the Battery

Quick Start

Enter 10152002, then Press #/ST/NS

Quick Start Royal Alpha 9155SC

Enter 55, Press Void

Program Confirmation Reports

After Quick Start

DEPT07 Price Flag

After Quick Start

Before Going to the Register Mode

Advanced Programming

Turn the key to the PRG Program position

Clerk Numbers

To Program Clerk Numbers

To Program a Clerk Name

To USE Clerk Numbers

Clerk Numbers

To USE the Manager Password

Manager Passwords

To Program the X Manager Password

To Program the PRG/ZMANAGER Password

To Program the Machine Number

Date / Time / Machine Number

To Program the Date

To Program the Time

To Program a Single Fixed TAX Rate

TAX Rate

To Program a Second Fixed TAX Rate

To Program a Single TAX Table Rate

TAX Table Rate

To Program a Second TAX Table Rate

To Program a Third TAX Table Rate

To Program a Second VAT TAX Rate

Programming the VAT TAX Rate

Department Programming

Department Programming

$.01 $99,999.99 Standard Setting

= Multiple Item Sale

00 = Non-Taxable used when you do not wish to charge tax

Department Preset Price

Enter 0, Press the Subtotal W/TAX key

To Program Departments AS Taxable

To Program Departments AS NON-TAXABLE

Enter 1, Press the Subtotal W/TAX key

Department Programming for Department 21 to Department

Coupon Discount CPN

Coupon Discount CPN

To Program the Coupon / CPN KEY

Minus Percentage Discount

Presetting the Minus Percentage Rate

Non-Taxable

Plus Percentage

Presetting the Plus Percentage Rate

Enter 1, then Press the PLU key

Price LOOK-UP PLU

Press the CHECK/STUBS key

To Search a Vacant PLU Number

Price LOOK-UP PLU

To Delete PLU Data

Enter 666666, then Press the Amount TEND/TOTAL key

Training Mode

To Turn on the Training Mode

To Shut OFF the Training Mode

To SET the Grand Total to Zero

Grand Total Preset

To Assign a Value to the Grand Total

To Program the Transaction Number

Transaction Number Preset

Enter 1, 1000, then Press the PO key

To Program the Rounding for Finalizing Amount

Rounding Method for Finalizing Amount

Enter 3, 0098, then Press the Return key

X1 and X2 Counter Preset

To Program the X1 Counter Number

To Program the X2 Counter Number

Enter 1, 0050, then Press the Return key

Z1 and Z2 Counter Preset

To Program the Z1 Counter Number

To Program the Z2 Counter Number

Alpha Keyboard To Input Characters

Programming Alphanumeric Descriptions

Special Language Characters

Alphanumeric Code Chart

Programming Alphanumeric Descriptions

Character Code Number

Commercial Message

Wide Characters

Store Logo Worksheet

Program Store LOGO/COMMERCIAL Message

Printed Result Example of programmed Store Logo

Tuesday is 10% OFF DAY Stock UP and Save

Commercial Message

To Program a Message

Scroll Messages

Settings 01 99 Default=05 , 00 No message wil l scroll

Scroll Message Settings

Settings 1 9 Default=2 0 = No message will sc roll

Scroll Message Patterns

Default Scroll Messages

Some Examples of Messages That can be Programmed to Scroll

Transaction Words English

To Program the Transaction Words

To Program the Transaction Words

Cash TD

FS Sales

Flag Options

Flag Options

Lines Feed Count After Receipt Issue

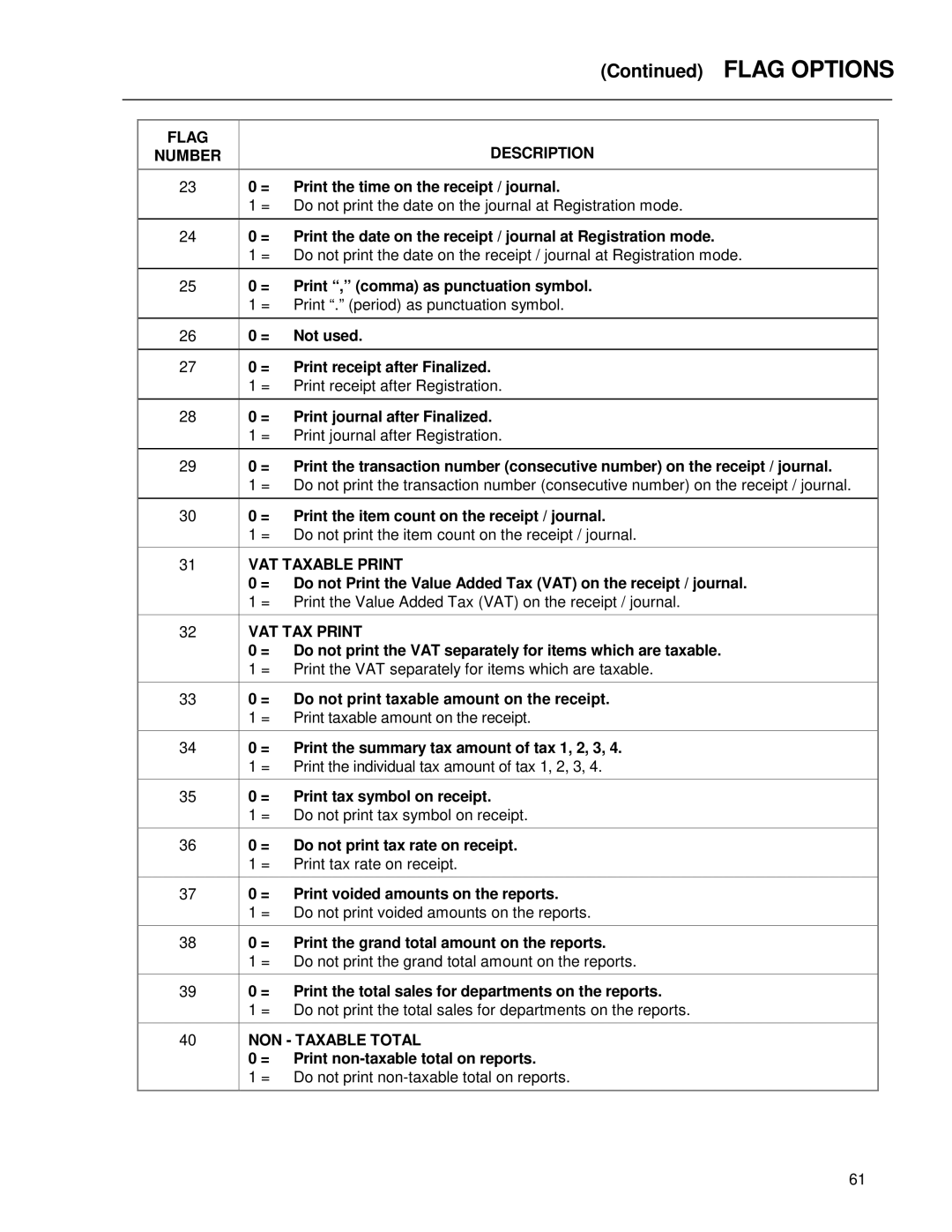

Flag Description Number

VAT TAX Print

VAT Taxable Print

NON Taxable Total

X2 Periodical Report #

Flag Description Number Print in Drawer

Skip Zero Sale Transaction on Reports

X1 Report #

Enable issuing a stub receipt printed total only

REG mode

Enable using RA PO key in the REG Regist er position

= Disable using RA PO key in the REG Register position

Bit

Print on journal at Training Mode

SI/O 1 Speed 9600bps Fix

= 1 stop bit

To Take a Flag Report

Press 999999, then Press the Amount TEND/TOTAL key

To Take a Program Confirmation Basic Preset Report

Program Confirmation Report

Turn the key to the PRG position as desired

To Take a Clerk Confirmation Report

Program Confirmation Report

Press PLU/DEPT ALT , then Press the Clerk key

To Take a Department Report

Press PLU/DEPT ALT, then Press the PLU key

PLU Confirmation Report

To Take a PLU Confirmation Report

To Take a PLU Range Report

Sample Receipt

Transaction Examples for Operating the Cash Register

Enter 300 , then Press the PLU/DEPT ALT 21DEPT key

Enter 100, then Press the Department 1 key

Enter 100 , and then Press the Department 1 key

Enter 200 , then Press the Department 2 key

Enter 500 , then Press the Amount TEND/TOTAL key

Enter 1500 , then Press the Department 1 key

Press the Charge key

Enter 12345678 , Press the #/ST/NS key

Press the #/ST/NS key

Enter 100 , Press the Department 1 key

Press the Department 1 key Press the Amount TEND/TOTAL key

DEPT99 Item CT Cash

Clerk key before ringing up a sale

Reminder

Example 19 Coupon Discount Sale

Example 20 Minus Percentage Discount Sale

Example 21 Plus Percentage Sale

Example 22 USE of the ERROR-CORRECT EC KEY

Void Coupon N Ⅰ Item CT TAX Cash

DEPT02 Void

Coupon N Ⅰ DEPT02 Void

Enter 1 , Press the Void key, then Press

Enter 1, then Press the PLU key Press the +% key

Machine Will Duplicate Receipt of ANY Sale Completed

Position Reading

Management Reports

Management Reports Available

Summary of Management Reports

Management Reports

To Display Press The Following Keys in the X Position

Management Reports

Turn the key to the X or Z positions as desired

To Take a CASH-IN-DRAWER/CHECK-IN-DRAWER Report

To Take AN Hourly Report

Turn the key to the X position

To Take Clerk Report

To Take a Department Range Report

Press PLU/DEPT ALT , then Press the PLU key

To Take AN Individual Clerk Report

To Take a PLU Report

Turn the key to the X or Z position as desired

Turn the key to the Z position

To Take a Cash Declaration Report

Press Dept key

To Take a Department Group Report

To Take a Group Report

Turn the key to the X position as desired

See Illustration of a Full Report on the Next

To Take a Full Report

Press PO, then Press the Amount TEND/TOTAL key

Nosale CLERK02 NET TL TAX

Z1 Reading Full Report Illustration

Media Balance

System Balance

Interface and Software

PC Interface and Software

Troubleshooting

Specifications and Safety

Safety Notice

Specifications and Safety

Royal Electronic Cash Register Limited Warranty

Limited Warranty

Item Description Part Number

Accessories Order Form

States TAX Codes

State TAX Table Codes

Appendix

State TAX Table Codes

State TAX Table Codes

State TAX Table Codes

State TAX Table Codes

Program Example Tax

Calculating State TAX Table Codes

Calculating Breakpoints

Entering the Program Code

TAX2 key

Program Example

Calculating State TAX Table Codes

Step E

Program Example

Worksheet

Method

GST/PST System for Canada

PRG + 30 + TAX1 + 80000 + TAX2 + 0 + NON TAX

Appendix Link Tax 1 7% GST to the desired Department key

Page

ALPHA9155SCIM303A