Programming Tax

Most sales taxes can be programmed by entering a tax percentage rate. However, in some cases you may find that tax that is entered as a percentage does not follow exactly the tax chart that applies in your area. If this is the case, you must enter your tax using tax table programming. This method will match tax collection exactly to the break points of your tax table. See “Tax Table Programming” on page 54.

Important Note: After you have entered your tax program, test for accuracy by entering several transactions of different dollar amounts. Carefully check to make sure the tax charged by the cash register matches the tax amounts on the printed tax chart for your area. As a merchant, you are responsible for accurate tax collection. If the cash register is not calculating tax accurately, or if you cannot program your tax properly from the information in this manual, contact the CRS, Inc. Service Center at

Programming a Tax Rate Percentage

1.Turn the control lock to the PGM position.

2.Enter the rate, with a decimal.

3.Enter 00.

4.Enter:

1 to set tax rate 1

2 to set tax rate 2

3 to set tax rate 3

4 to set tax rate 4

5.Press the TAX SHIFT key.

6.Press the CASH/TEND key to end programming.

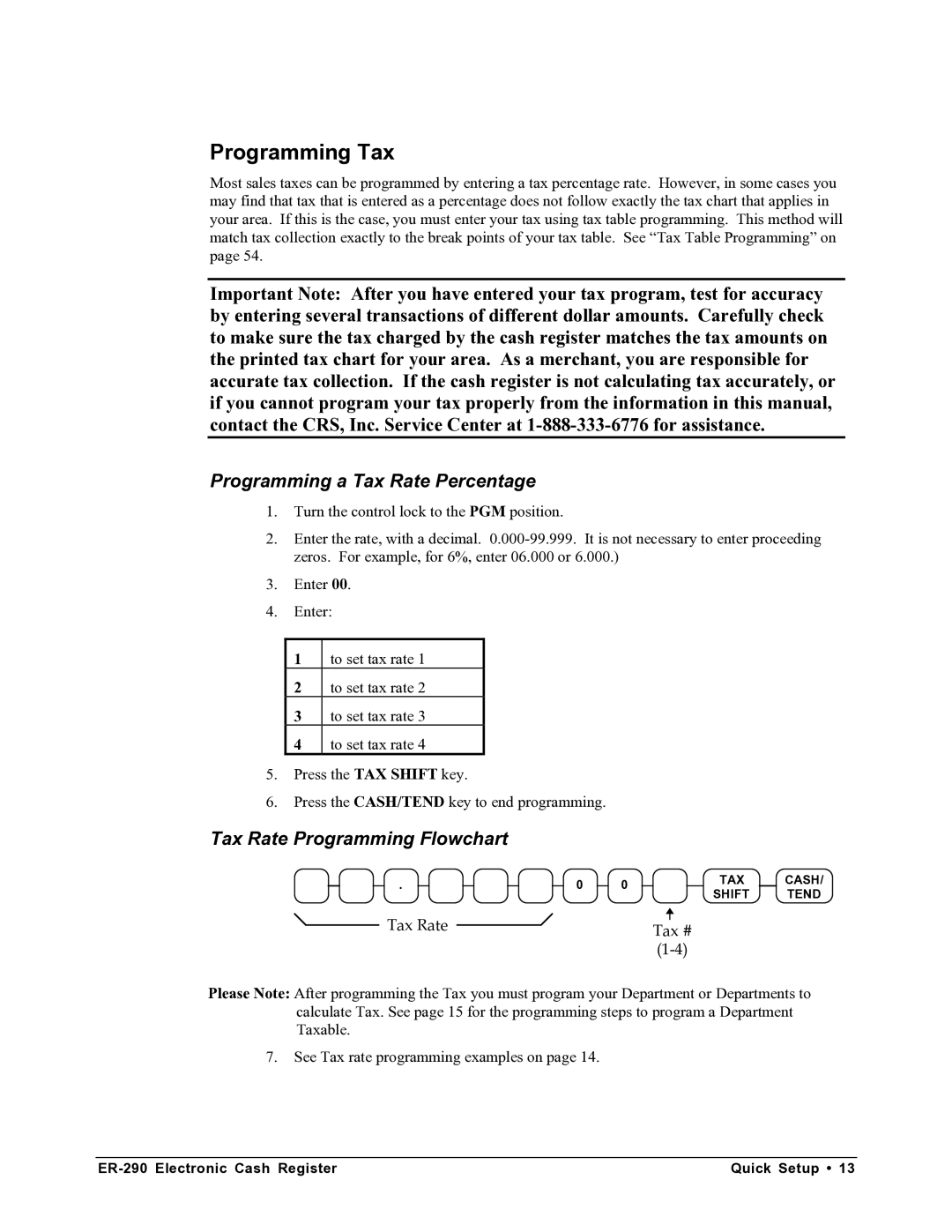

Tax Rate Programming Flowchart

. | 0 | 0 | TAX | CASH/ | |

SHIFT | TEND | ||||

|

|

| |||

Tax Rate |

|

| Tax # |

| |

|

|

|

|

Please Note: After programming the Tax you must program your Department or Departments to calculate Tax. See page 15 for the programming steps to program a Department Taxable.

7.See Tax rate programming examples on page 14.

| Quick Setup • 13 |