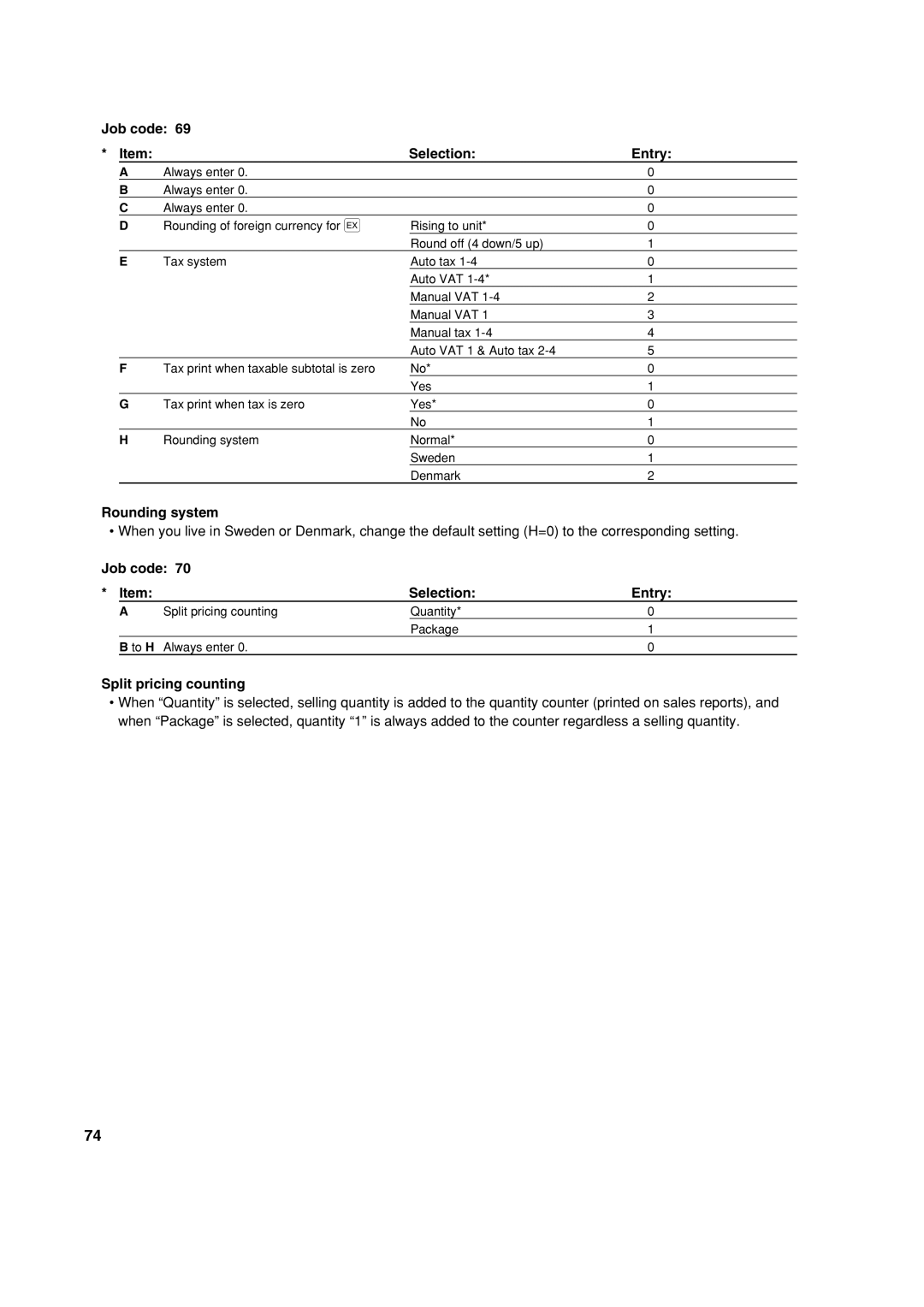

Job code: 69 |

|

| ||

* Item: |

| Selection: | Entry: | |

| A | Always enter 0. |

| 0 |

| B | Always enter 0. |

| 0 |

| C | Always enter 0. |

| 0 |

| D | Rounding of foreign currency for V | Rising to unit* | 0 |

|

|

| Round off (4 down/5 up) | 1 |

| E | Tax system | Auto tax | 0 |

|

|

| Auto VAT | 1 |

|

|

| Manual VAT | 2 |

|

|

| Manual VAT 1 | 3 |

|

|

| Manual tax | 4 |

|

|

| Auto VAT 1 & Auto tax | 5 |

| F | Tax print when taxable subtotal is zero | No* | 0 |

|

|

| Yes | 1 |

| G | Tax print when tax is zero | Yes* | 0 |

|

|

| No | 1 |

| H | Rounding system | Normal* | 0 |

|

|

| Sweden | 1 |

|

|

| Denmark | 2 |

Rounding system

•When you live in Sweden or Denmark, change the default setting (H=0) to the corresponding setting.

Job code: 70 |

|

| ||

* Item: |

| Selection: | Entry: | |

| A | Split pricing counting | Quantity* | 0 |

|

|

| Package | 1 |

| B to H Always enter 0. |

| 0 | |

Split pricing counting

•When “Quantity” is selected, selling quantity is added to the quantity counter (printed on sales reports), and when “Package” is selected, quantity “1” is always added to the counter regardless a selling quantity.

74