MA-1450-1 Series

Page

OPERATOR’S Guide

Page

Table of Contents

Selective Itemizer SI Status Modification

Registering Procedure and Print Format

Other Income Department ENTRY, Other Income PLU Entry

Food Stampable Total READ, Food Stamp Tendering

Paper Roll Replacement and Other Maintenance Operations

To OUR Customers

To OUR Customers

Unpacking

Unpacking

Appearance and Nomenclature

Appearance and Nomenclature

Mode Selector Keys

Mode Lock and Mode Selector Keys

Mode Lock

Mode Lock and Mode Selector Keys

Display

Display

Amount

Operator Display Front Display

Status Lamps

Numeric Display

Triangular Lamps

REG

Outline of Preparation Procedure Before Operating the ECR

Outline of Preparation Procedure Before Operating the ECR

SET MGR

Turn the Mode Lock to the REG position with power on

Installing the RECEIPT/JOURNAL Roll

Installing the Receipt Roll

MGR REG

Outline of Preparation Procedure Before Operating the ECR

Installing the Journal Roll

Setting the Ribbon Cassette

Cashier Signing or Cashier KEY Operations

Code Entry Method

When Signed-OUT

Sign-OFF Mode Changes With Signing Operations

When Signed-ON or Signed-IN

When Signed-OFF

PUSH-ON

Cashier KEY Method Hardware Option

Push-stay Cashier Locks and Keys

PUSH-AND-LOCK

Cashier KEY Method CLK Keys

Training Mode Start and END

Training-ON receipt is issued

Condition

Entries in Training Mode

Keyboard Layout

Salesperson Open Receipt Issue

Keyboard Layout

BTL RTN

Salesperson Receipt CPN GST/M

PR Open Open

Pick UP BAL Code Open SI 1/M, SI 1/TL

Functions of Each KEY

@/FOR

PR Open

LC Open

VND

CHK Check

Txbl

AT/TL

TND Tend

Sales

SI1/M SI2/M TX/M

TX1/M TX4/M

Person RPT

Condition Setting to Start Transaction Entries

Registering Procedure and Print Format

Registering Procedure and Print Format

Mode Lock Insert the REG key and set it to the REG position

Table of Contents

LOG/RECEIPT

RECEIPT-ISSUE/NON-ISSUE Selection

NO-SALE

Loan

Department Entry

Gasoline Entry

Price PLU Preset-Code Key of Preset-PLU

Preset-PLU Code PLU

PLU Entry

Repeat Entry

Preset Dept Same Dept or RPT

Quantity @/FOR Preset Dept

Quantity Extension Multiplication for DEPTs/PLUs

Quantity @/FOR Price PLU Preset-Code Key of Open-PLU

Preset-Dept Code DP#

10-8

PLU

Purchased Q’ty @/FOR Split-Price Type PLU Code PLU

To enter Whole Package Quantity all the items packed

Whole Package Price PLU Preset-code Key

HI-CONE PLUs

Operation Examples of HI-CONE PLUs

MIX & Match M & M Function of SPLIT-PRICE PLUs

Operation Examples of Mix & Match Functions

Length @/FOR Width @/FOR

Length @/FOR Width @/FOR Preset Dept

Triple Multiplication

SINGLE-ITEM Department or SINGLE-ITEM PLU Entry

Unit Price PLU Preset-Code Key of Open-PLU

Unit Price PLU Preset-Code Key of Preset-PLU

Other Income Department ENTRY, Other Income PLU Entry

Returned Merchandise

SUB-LINK Department Entry

SUB-LINK PLU Entry

RTN Mdse

@/FOR Unit Amount BTL RTN

Bottle Return

Dollar Discount

Amount Doll Disc ST for discount from the sale total

Vendor Coupon

Percent DISCOUNT, Percent Charge

Store Coupon

STR CPN

ALL Void

Item Correct

Void

Item Corr

Allowed any time during a sale or transaction

NON-ADD Number Print

Listing Capacity Open

Number #

Irregular Tax Amount to be Added TAX Receipt Print Format

Selective Itemizer SI Status Modification

TAX Status or Food Stamp Status Modification

Txbl TL

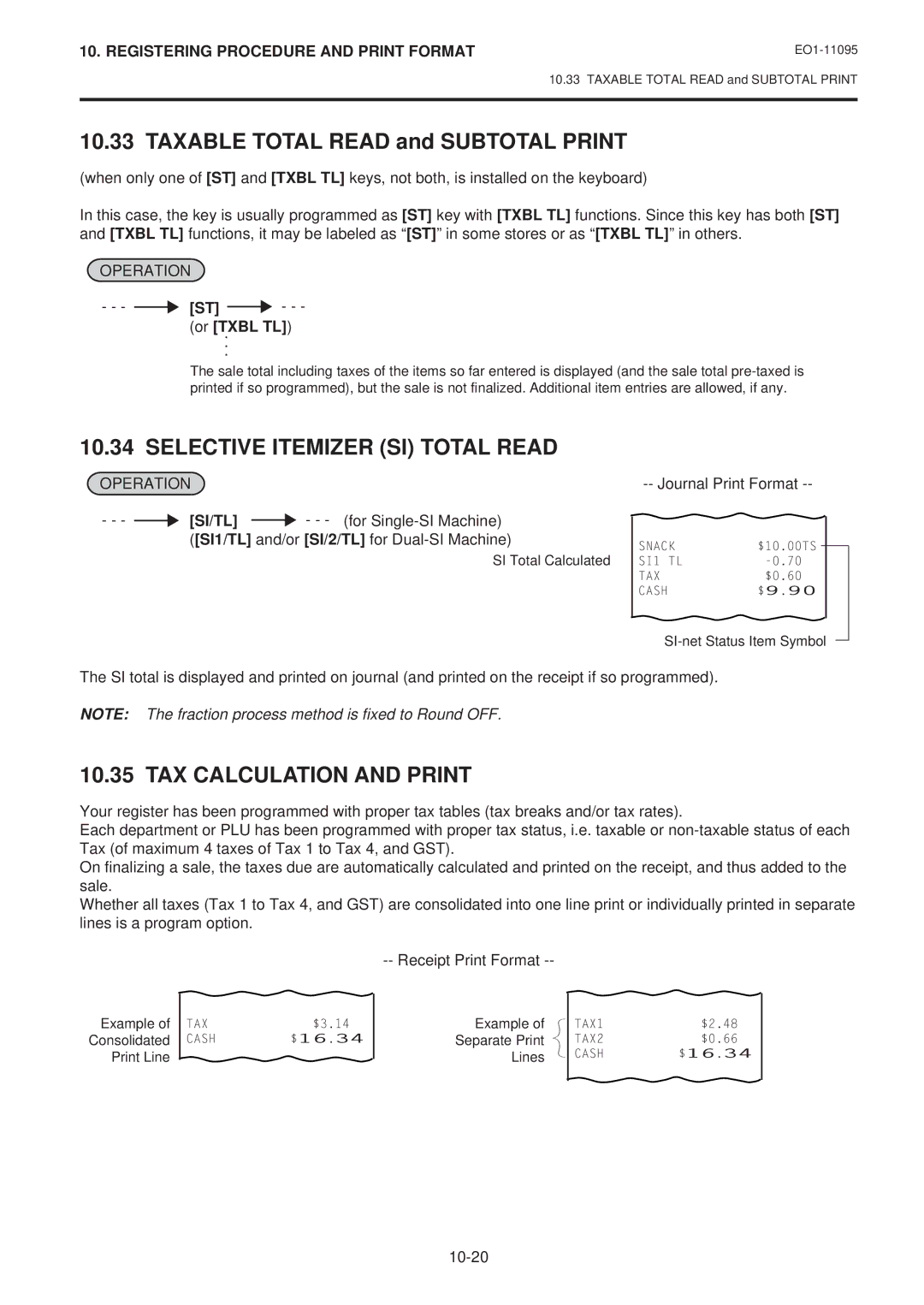

TAX Calculation and Print

Taxable Total Read and Subtotal Print

Selective Itemizer SI Total Read

Or Txbl TL

TAX Exemption

Food Stampable Total READ, Food Stamp Tendering

Txbl TL

Sale Finalization by Media Keys

MULTI-TENDERING

CHK TND

Company Code Card No. Chg ... Check & Credit Card

Split Tendering

Check & Cash

Chg ... Check, Cash, & Charge

Amount Tendered Foreign Currency

Sale Paid in Foreign Currencies

CUR1

NO-SALE Exchange from Foreign Currency to Domestic Currency

NO-SALE Exchange from Domestic Currency to Foreign Currency

Amount to be paid out PO

RECEIVED-ON-ACCOUNT

PAID-OUT

Hold & Recall

HOLD/RECALL

Post-issue Receipt

Receipt POST-ISSUE

Sale is finalized Receipt Issue

Charge Posting Previous Balance Manual Entry Type

PB+

Operation Contents KEY Operation

Txbl ST Chg

Dept

Txbl TL Chg

Charge Posting Customer File Type Check Track Memory Option

New Customer File Code Code Open

Repeatable if necessary

1000 AT/TL

Display Pick UP BAL

498 R/A

00 DP1 ST AT/TL Function key

Function KEY Entry

Validation Print

Validate

Validation Print

Endorsement Print

Receipt Print

Program Options Relating to Remote Slip Control

Remote Slip Printer hardware option Operation

Endorsement Print Sample

10-35

Invoice Print Format

Charge Posting Sale File Print Format PB Manual Entry Type

Sale

When a Power Failure Occurs

Outside a

During a

Journal and Receipt PAPER-END Detector

Journal and Receipt PAPER-END Detector

ECR Printer Motor Lock Detector

ECR Printer Motor Lock Detector

Remote Slip Printer Motor Lock Detector

Remote Slip Printer Motor Lock Detector

Printer Guide Open Detector

Printer Guide Open Detector

Replacing the Receipt Roll

Paper Roll Replacement and Other Maintenance Operations

Paper Roll Replacement and Other Maintenance Operations

Load new paper roll as described in Chapter 15-1

Replacing the Journal Roll

Replacing the Ribbon Cassette

Replenishing INK to the Store Name Stamp

Manual Drawer Releasing

Removing the Drawer

Locking

Unlock the cover using the key, and lift the front end 15-6

CDC Cash Drawer Cover Option Lock

Unlocking

Specifications

Specifications

MANAGER’S Guide

Table of Contents

Customer File Code Check Track NO. and Name Setting

Foreign Currency Exchange Rate Setting

CASHIER’S Operations

Daily Operation Flow

Daily Operation Flow

MANAGER’S Operations or Assistance

Manager Intervention

Manager Intervention

Items Programmed to Require Manager Interventions

STR CPN BTL RTN

Doll Disc

VND CPN

RTN Mdse Void

Negative Amount KEY Amount Limit Read

Other Operations Requiring Manager Interventions

Function Keys Amount Limit Read

Pick UP Operation

MANAGER’S OWN Operations in MGR Mode

MANAGER’S OWN Operations in MGR Mode

Or VND CPN

Cashier Code and Name Read

Enforced SIGN-OFF of a Cashier Code Entry Method

LOG/RECEIPT or LOG

Operations in Mode

Operations in Mode

Ordinary Operations in Mode

Operation and Receipt Sample

Receipt AT Return

Entries of the purchased items*** Txbl TL Chg

Receipt AT Purchase

NO-SALE Cashing of Cheque or Other NON-CASH Medias

Prohibitive Operations in Mode

NO-SALE NS

Daily Reports

Read X and Reset Z Reports

Read X and Reset Z Reports

Then 4 # AT/TL

13 AT/TL

AT/TL to end

11 AT/TL

24 AT/TL

206 AT/TL

GT Reports -- to be taken on weekly or monthly basis

Then 204 # AT/TL

208 AT/TL

Report Name Available Reports

Combination Reports

General Notes on Report Takings

GTX GTZ

Reset Report Format Sample

Financial Read or Reset Daily or GT

Read Report Relevant Reset Report

Financial Read or Reset

Installed

Cashier Read or Reset Daily or GT

Reset Report Sample

Credit Card Company Sales Read or Reset Daily or GT

Read only Mode Lock X, enter 12, depress AT/TL

All Salespersons

Read only Mode Lock X, enter 9, depress AT/TL

Department Group Read Daily or GT

Mode Lock X for read Z for reset Enter 10, depress

Daily Hourly Range Read or Reset

Department Read or Reset

Individual Department Read Daily or GT

All Department Read or Reset Daily or GT

Department Data ↓

Individual PLU Read Daily or GT

PLU PLU Sales Data Read or Reset

Zone PLU Read or Reset Daily or GT

Prints data in order from lower to larger numbered PLU Code

Individual Files Read

All Files with balance remaining Read

Zone Files Read

Zero-balance Files Read

PLU Group Sales Read or Reset Daily or GT

PLU Group

⎯⎯⎯⎯→

Submode No

Programming Operations

Programming Operations

AT/TL Used to end the entire program Submode sequence

Basic Key Functions

Keyboard Variations in Programming operations

Character Entries

Character Code Standard Characters Column Code Row

Character Setting Operations

Character Code Entry Method

407 # 502 # 415 # 505 # 500 #

Direct Character Entry Method

All Double-sized Declaration

Sftlock Omato AT/TL

Space

Line No. ST

Mode Lock SET

Condition Required for Programming Operations

Character Entries

Rubber Stamp

405 # E 403 # C

Condition Operation

Cashier Code and Name Programming Submode

Programming

CLK key

Depress AT/TL to end this submode

Deletion

Item Corr Cashier Code NS AT/TL or

PLU Table Programming Submode

Programming or Changing

Address No Description of Programming Contents

Address No Description of Programming Contents

HEAD-LINK PLU SUB-LINK PLU

Remarks

Programming Operations

Additional Notes

Ex. To program the following PLUs

# Link-PLU Table No

90601 PLU

10 ST

101301 PLU

@/FOR Item Corr PLU Code PLU or

To delete a PLU with sales data of not zero After PLU Reset

Individual PLU Deletion

All PLU Deletion

Any time outside a sale except the following case

After PLU Reset

PLU Programmed Data Copying

Hour Minute

Time Setting or Adjustment Submode

Date Setting or Adjustment Submode

Day-of-Week Code Month

11 ST

Amount Limit Setting for Function Keys Submode

CHK TND

12 ST

Deletion of All Customer File Codes

Customer File Code Check Track NO. and Name Setting Submode

Deletion of Individual Customer File Codes

Void AT/TL

ST Customer File Code 408 # 405 # 412 #

Code Name James Haily Helen Reed

Name James Haily

405 # 414 # # 502 # 405 # 405 # 404 # ST

ST AT/TL

Salesperson Code and Name Programming Submode

20 @/FOR

Code Name

Item Corr 3 ST AT/TL

LINK-PLU Table Programming Submode

20 @/FOR Item Corr Salesperson Code ST or

25 @/FOR

ST 101301 PLU AT/TL

PLU PRESET-CODE KEY Setting Submode

Deletion of Link-PLU Tables

25 @/FOR Item Corr Link-PLU Table No. ST or

Required key

27 @/FOR

50321

50322

138 141 101 106 113 120 127

136 139 105 111 118 125

137 140 100 112 119 126

142 102 107 114 121

KEY Code and KEY Table

Negative Amount KEY Limit Amount Setting Submode

35 @/FOR

35 @/FOR ST 1000 #

Using the DP# Key Dept Code DP# New Preset Price #

Department Preset Price Setting or Changing

New Preset Price Dept

By the second operation pattern 13 DP# 140 # 14 DP# 210 #

65 #

Setting or Changing Preset Price

155 #

PLU 6 ST 125 # AT/TL

20 %+ and %- Preset Rate Setting

Preset Rate %+ For Percent Charge Preset Rate

SI2/TL

Preset Rate Setting for Selective Itemizers SI1 and SI2

SI1/TL or SI/TL

ST1/TL

Selective Itemizer Functions and Applications

Receipt/Journal Print

CUR

Foreign Currency Exchange Rate Setting

Foreign Currency Exchange Rate Calculation

Domestic

TAX Table Programming

Resetting a Foreign Currency Rate Once Set

After Financial Daily Reset

Max.amount for 2¢ tax levied

Max.amount non-taxable TX1/M Max.amount for 1¢ tax levied

TX1/M

TX1/M ST TAX Rate AT/TL

Ex TAX 2 Combination of NON-CYCLIC Breaks and % Rate

TX2/M 29 TX2/M 59 TX2/M 84 TX2/M 112 TX2/M

TX3/M

GST Rate Setting

STORE/REGISTER NO. Setting

12 GST/M

STORE/REGISTER NO. Setting

1 AT/TL

Verification of Programmed Data

Verification of Programmed Data

0 AT/TL

Depress Txbl TL

TAX Calculation Test

Enter any amount

![]() [SI/TL]

[SI/TL] ![]() - - - (for

- - - (for