MA-1450-1 Series

Page

OPERATOR’S Guide

Page

Table of Contents

Registering Procedure and Print Format

Other Income Department ENTRY, Other Income PLU Entry

Selective Itemizer SI Status Modification

Food Stampable Total READ, Food Stamp Tendering

Paper Roll Replacement and Other Maintenance Operations

To OUR Customers

To OUR Customers

Unpacking

Unpacking

Appearance and Nomenclature

Appearance and Nomenclature

Mode Lock and Mode Selector Keys

Mode Lock and Mode Selector Keys

Mode Lock

Mode Selector Keys

Operator Display Front Display

Display

Amount

Display

Numeric Display

Triangular Lamps

Status Lamps

SET MGR

Outline of Preparation Procedure Before Operating the ECR

Outline of Preparation Procedure Before Operating the ECR

REG

MGR REG

Installing the RECEIPT/JOURNAL Roll

Installing the Receipt Roll

Turn the Mode Lock to the REG position with power on

Outline of Preparation Procedure Before Operating the ECR

Installing the Journal Roll

Setting the Ribbon Cassette

Code Entry Method

Cashier Signing or Cashier KEY Operations

When Signed-OFF

Sign-OFF Mode Changes With Signing Operations

When Signed-ON or Signed-IN

When Signed-OUT

PUSH-AND-LOCK

Cashier KEY Method Hardware Option

Push-stay Cashier Locks and Keys

PUSH-ON

Condition

Training Mode Start and END

Training-ON receipt is issued

Cashier KEY Method CLK Keys

Entries in Training Mode

BTL RTN

Salesperson Open Receipt Issue

Keyboard Layout

Keyboard Layout

PR Open Open

Pick UP BAL Code Open SI 1/M, SI 1/TL

Salesperson Receipt CPN GST/M

Functions of Each KEY

VND

PR Open

LC Open

@/FOR

TND Tend

Txbl

AT/TL

CHK Check

Person RPT

SI1/M SI2/M TX/M

TX1/M TX4/M

Sales

Mode Lock Insert the REG key and set it to the REG position

Registering Procedure and Print Format

Registering Procedure and Print Format

Condition Setting to Start Transaction Entries

Table of Contents

RECEIPT-ISSUE/NON-ISSUE Selection

NO-SALE

LOG/RECEIPT

Department Entry

Loan

PLU Entry

Price PLU Preset-Code Key of Preset-PLU

Preset-PLU Code PLU

Gasoline Entry

Quantity Extension Multiplication for DEPTs/PLUs

Preset Dept Same Dept or RPT

Quantity @/FOR Preset Dept

Repeat Entry

Preset-Dept Code DP#

Quantity @/FOR Price PLU Preset-Code Key of Open-PLU

PLU

Purchased Q’ty @/FOR Split-Price Type PLU Code PLU

10-8

Whole Package Price PLU Preset-code Key

HI-CONE PLUs

To enter Whole Package Quantity all the items packed

Operation Examples of HI-CONE PLUs

Operation Examples of Mix & Match Functions

MIX & Match M & M Function of SPLIT-PRICE PLUs

Length @/FOR Width @/FOR Preset Dept

Triple Multiplication

Length @/FOR Width @/FOR

Other Income Department ENTRY, Other Income PLU Entry

Unit Price PLU Preset-Code Key of Open-PLU

Unit Price PLU Preset-Code Key of Preset-PLU

SINGLE-ITEM Department or SINGLE-ITEM PLU Entry

RTN Mdse

SUB-LINK Department Entry

SUB-LINK PLU Entry

Returned Merchandise

Amount Doll Disc ST for discount from the sale total

Bottle Return

Dollar Discount

@/FOR Unit Amount BTL RTN

STR CPN

Percent DISCOUNT, Percent Charge

Store Coupon

Vendor Coupon

Item Corr

Item Correct

Void

ALL Void

Number #

NON-ADD Number Print

Listing Capacity Open

Allowed any time during a sale or transaction

Txbl TL

Selective Itemizer SI Status Modification

TAX Status or Food Stamp Status Modification

Irregular Tax Amount to be Added TAX Receipt Print Format

Or Txbl TL

Taxable Total Read and Subtotal Print

Selective Itemizer SI Total Read

TAX Calculation and Print

Food Stampable Total READ, Food Stamp Tendering

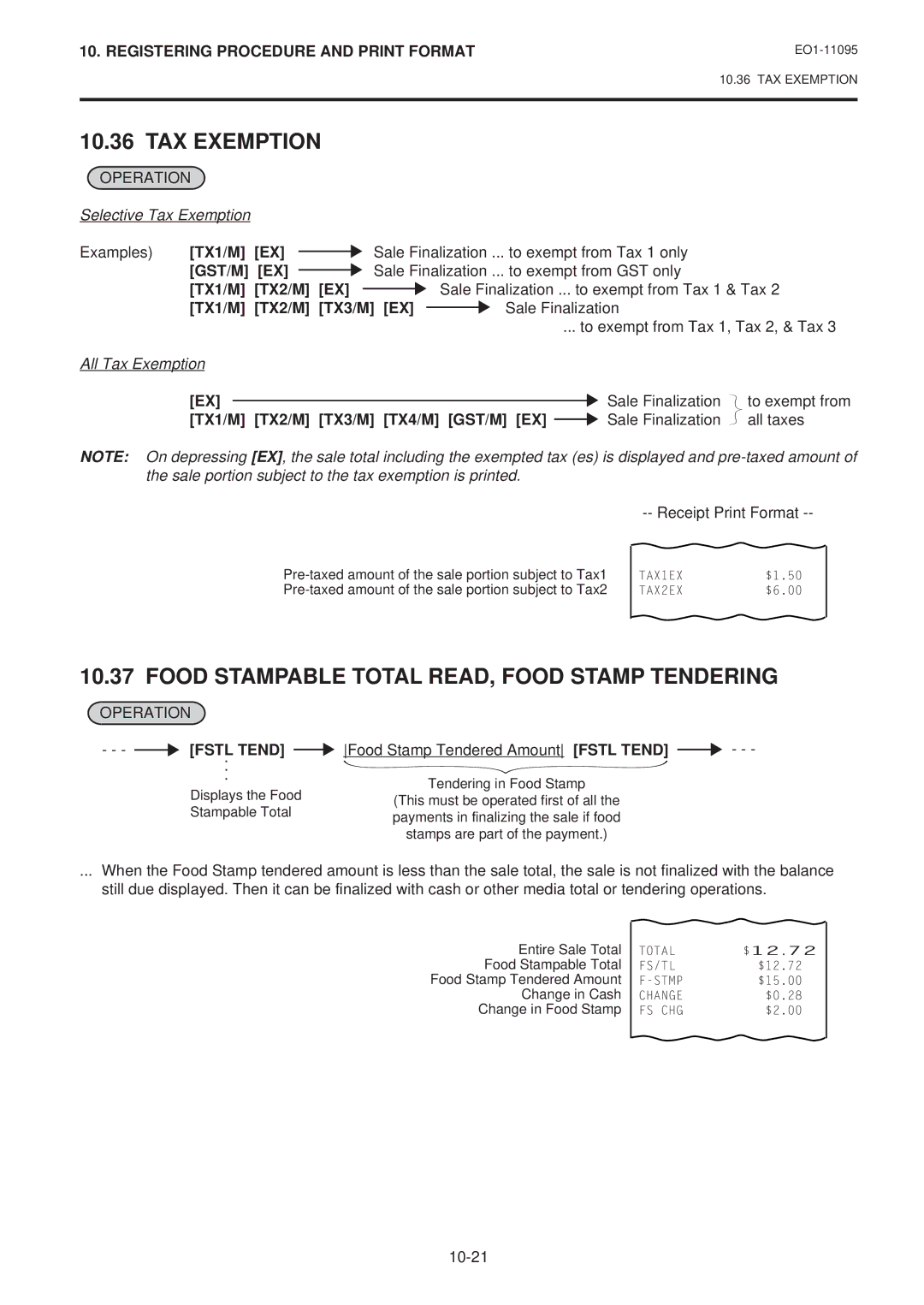

TAX Exemption

CHK TND

Sale Finalization by Media Keys

MULTI-TENDERING

Txbl TL

Chg ... Check, Cash, & Charge

Split Tendering

Check & Cash

Company Code Card No. Chg ... Check & Credit Card

Sale Paid in Foreign Currencies

CUR1

Amount Tendered Foreign Currency

NO-SALE Exchange from Domestic Currency to Foreign Currency

NO-SALE Exchange from Foreign Currency to Domestic Currency

RECEIVED-ON-ACCOUNT

PAID-OUT

Amount to be paid out PO

HOLD/RECALL

Hold & Recall

Charge Posting Previous Balance Manual Entry Type

Receipt POST-ISSUE

Sale is finalized Receipt Issue

Post-issue Receipt

Dept

Operation Contents KEY Operation

Txbl ST Chg

PB+

Repeatable if necessary

Charge Posting Customer File Type Check Track Memory Option

New Customer File Code Code Open

Txbl TL Chg

Display Pick UP BAL

498 R/A

1000 AT/TL

Validate

Function KEY Entry

Validation Print

00 DP1 ST AT/TL Function key

Endorsement Print

Receipt Print

Validation Print

Remote Slip Printer hardware option Operation

Endorsement Print Sample

Program Options Relating to Remote Slip Control

Invoice Print Format

Charge Posting Sale File Print Format PB Manual Entry Type

10-35

During a

When a Power Failure Occurs

Outside a

Sale

Journal and Receipt PAPER-END Detector

Journal and Receipt PAPER-END Detector

ECR Printer Motor Lock Detector

ECR Printer Motor Lock Detector

Remote Slip Printer Motor Lock Detector

Remote Slip Printer Motor Lock Detector

Printer Guide Open Detector

Printer Guide Open Detector

Load new paper roll as described in Chapter 15-1

Paper Roll Replacement and Other Maintenance Operations

Paper Roll Replacement and Other Maintenance Operations

Replacing the Receipt Roll

Replacing the Journal Roll

Replacing the Ribbon Cassette

Replenishing INK to the Store Name Stamp

Removing the Drawer

Manual Drawer Releasing

Unlocking

Unlock the cover using the key, and lift the front end 15-6

CDC Cash Drawer Cover Option Lock

Locking

Specifications

Specifications

MANAGER’S Guide

Table of Contents

Foreign Currency Exchange Rate Setting

Customer File Code Check Track NO. and Name Setting

MANAGER’S Operations or Assistance

Daily Operation Flow

Daily Operation Flow

CASHIER’S Operations

Manager Intervention

Items Programmed to Require Manager Interventions

Manager Intervention

RTN Mdse Void

Doll Disc

VND CPN

STR CPN BTL RTN

Other Operations Requiring Manager Interventions

Function Keys Amount Limit Read

Negative Amount KEY Amount Limit Read

Or VND CPN

MANAGER’S OWN Operations in MGR Mode

MANAGER’S OWN Operations in MGR Mode

Pick UP Operation

Enforced SIGN-OFF of a Cashier Code Entry Method

LOG/RECEIPT or LOG

Cashier Code and Name Read

Operation and Receipt Sample

Operations in Mode

Ordinary Operations in Mode

Operations in Mode

Entries of the purchased items*** Txbl TL Chg

Receipt AT Purchase

Receipt AT Return

Prohibitive Operations in Mode

NO-SALE NS

NO-SALE Cashing of Cheque or Other NON-CASH Medias

Then 4 # AT/TL

Read X and Reset Z Reports

Read X and Reset Z Reports

Daily Reports

24 AT/TL

AT/TL to end

11 AT/TL

13 AT/TL

208 AT/TL

GT Reports -- to be taken on weekly or monthly basis

Then 204 # AT/TL

206 AT/TL

GTX GTZ

Combination Reports

General Notes on Report Takings

Report Name Available Reports

Financial Read or Reset Daily or GT

Read Report Relevant Reset Report

Reset Report Format Sample

Installed

Financial Read or Reset

Cashier Read or Reset Daily or GT

All Salespersons

Credit Card Company Sales Read or Reset Daily or GT

Read only Mode Lock X, enter 12, depress AT/TL

Reset Report Sample

Department Group Read Daily or GT

Read only Mode Lock X, enter 9, depress AT/TL

Individual Department Read Daily or GT

Daily Hourly Range Read or Reset

Department Read or Reset

Mode Lock X for read Z for reset Enter 10, depress

Department Data ↓

All Department Read or Reset Daily or GT

PLU PLU Sales Data Read or Reset

Zone PLU Read or Reset Daily or GT

Individual PLU Read Daily or GT

Prints data in order from lower to larger numbered PLU Code

Zero-balance Files Read

All Files with balance remaining Read

Zone Files Read

Individual Files Read

PLU Group

PLU Group Sales Read or Reset Daily or GT

⎯⎯⎯⎯→

Programming Operations

Programming Operations

Submode No

Basic Key Functions

Keyboard Variations in Programming operations

AT/TL Used to end the entire program Submode sequence

Character Entries

407 # 502 # 415 # 505 # 500 #

Character Setting Operations

Character Code Entry Method

Character Code Standard Characters Column Code Row

All Double-sized Declaration

Direct Character Entry Method

Sftlock Omato AT/TL

Space

Character Entries

Mode Lock SET

Condition Required for Programming Operations

Line No. ST

Rubber Stamp

405 # E 403 # C

CLK key

Cashier Code and Name Programming Submode

Programming

Condition Operation

Depress AT/TL to end this submode

Item Corr Cashier Code NS AT/TL or

Deletion

Programming or Changing

PLU Table Programming Submode

Address No Description of Programming Contents

Address No Description of Programming Contents

Remarks

HEAD-LINK PLU SUB-LINK PLU

Programming Operations

Ex. To program the following PLUs

Additional Notes

101301 PLU

90601 PLU

10 ST

# Link-PLU Table No

All PLU Deletion

To delete a PLU with sales data of not zero After PLU Reset

Individual PLU Deletion

@/FOR Item Corr PLU Code PLU or

After PLU Reset

PLU Programmed Data Copying

Any time outside a sale except the following case

Day-of-Week Code Month

Time Setting or Adjustment Submode

Date Setting or Adjustment Submode

Hour Minute

12 ST

Amount Limit Setting for Function Keys Submode

CHK TND

11 ST

Void AT/TL

Customer File Code Check Track NO. and Name Setting Submode

Deletion of Individual Customer File Codes

Deletion of All Customer File Codes

405 # 414 # # 502 # 405 # 405 # 404 # ST

Code Name James Haily Helen Reed

Name James Haily

ST Customer File Code 408 # 405 # 412 #

Code Name

Salesperson Code and Name Programming Submode

20 @/FOR

ST AT/TL

25 @/FOR

LINK-PLU Table Programming Submode

20 @/FOR Item Corr Salesperson Code ST or

Item Corr 3 ST AT/TL

25 @/FOR Item Corr Link-PLU Table No. ST or

PLU PRESET-CODE KEY Setting Submode

Deletion of Link-PLU Tables

ST 101301 PLU AT/TL

50322

27 @/FOR

50321

Required key

142 102 107 114 121

136 139 105 111 118 125

137 140 100 112 119 126

138 141 101 106 113 120 127

35 @/FOR ST 1000 #

Negative Amount KEY Limit Amount Setting Submode

35 @/FOR

KEY Code and KEY Table

By the second operation pattern 13 DP# 140 # 14 DP# 210 #

Department Preset Price Setting or Changing

New Preset Price Dept

Using the DP# Key Dept Code DP# New Preset Price #

Setting or Changing Preset Price

155 #

65 #

20 %+ and %- Preset Rate Setting

Preset Rate %+ For Percent Charge Preset Rate

PLU 6 ST 125 # AT/TL

ST1/TL

Preset Rate Setting for Selective Itemizers SI1 and SI2

SI1/TL or SI/TL

SI2/TL

Receipt/Journal Print

Selective Itemizer Functions and Applications

Domestic

Foreign Currency Exchange Rate Setting

Foreign Currency Exchange Rate Calculation

CUR

Resetting a Foreign Currency Rate Once Set

After Financial Daily Reset

TAX Table Programming

TX1/M ST TAX Rate AT/TL

Max.amount non-taxable TX1/M Max.amount for 1¢ tax levied

TX1/M

Max.amount for 2¢ tax levied

TX2/M 29 TX2/M 59 TX2/M 84 TX2/M 112 TX2/M

Ex TAX 2 Combination of NON-CYCLIC Breaks and % Rate

12 GST/M

GST Rate Setting

STORE/REGISTER NO. Setting

TX3/M

STORE/REGISTER NO. Setting

0 AT/TL

Verification of Programmed Data

Verification of Programmed Data

1 AT/TL

TAX Calculation Test

Enter any amount

Depress Txbl TL

[FSTL TEND]

[FSTL TEND] Food Stamp Tendered Amount [FSTL TEND]

Food Stamp Tendered Amount [FSTL TEND]  - - -

- - -