TRANZ 460 specifications

The VeriFone TRANZ 460 is an advanced point-of-sale (POS) terminal designed to facilitate seamless transactions for businesses of all sizes. Known for its reliability and user-friendly interface, the TRANZ 460 incorporates numerous features and technologies that enhance the payment processing experience for both merchants and customers.At the heart of the TRANZ 460 is its robust processing power, which allows for rapid transaction times. Merchants can process credit and debit card payments quickly, ensuring a smooth checkout experience. The device supports multiple payment types, including EMV chip cards, magstripe cards, and NFC (Near Field Communication) payments such as Apple Pay and Google Wallet. This versatility makes the TRANZ 460 suitable for various retail environments, catering to diverse customer preferences.

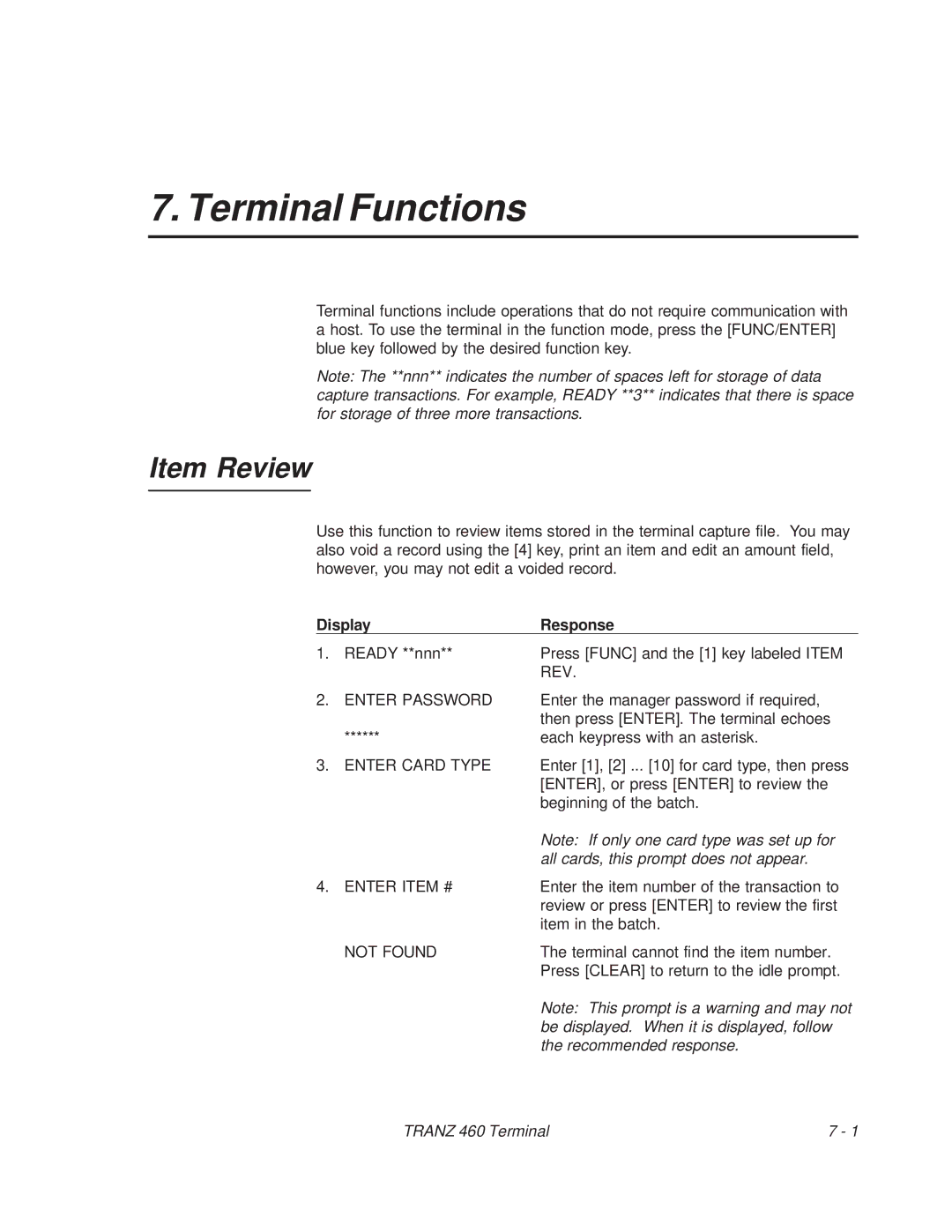

One of the standout characteristics of the TRANZ 460 is its large, bright display. The terminal features a user-friendly interface, enabling merchants to navigate easily through different functions and transaction types. The touchscreen functionality further aids in simplifying the payment process, allowing for quick and efficient operation.

Security is paramount in the world of payment processing, and the TRANZ 460 is equipped with advanced encryption and tokenization technologies. These features work to protect sensitive customer data during transactions, providing peace of mind for both merchants and consumers. The device is compliant with PCI DSS (Payment Card Industry Data Security Standard), ensuring that it meets the highest security standards in the industry.

The TRANZ 460 also boasts a compact and ergonomic design, making it easy to integrate into any retail setup. Its durable construction ensures longevity, even in high-traffic environments. The terminal can be connected to peripherals such as printers and barcode scanners, further enhancing its functionality in a comprehensive POS system.

In conclusion, the VeriFone TRANZ 460 stands out as a reliable and feature-rich POS terminal. With its fast processing speeds, multi-payment acceptance, intuitive display, and strong security measures, it is an excellent choice for businesses looking to streamline their payment processing and improve customer experience. Whether in retail, hospitality, or service industries, the TRANZ 460 is equipped to meet the demands of modern payment solutions.