HP Part Number NW239-90001 Edition 1, May

HP 10bII+ Financial Calculator User’s Guide

Legal Notice

HP 10bII+ Financial Calculator

Number

Keyboard Map Legend

Table of Contents

Page

Page

III

JGD

At a Glance

Basics of Key Functions

Boxed Key Functions

Shift Keys

JV§4

Jj7V1

Percentages

Add 15% to

GG¼

JVÀ

DDÃ

Memory Keys

GG4

GV4

J7GV

DSÙ

JG\Í

JYÏ

Time Value of Money TVM

D7VÒ

JyÌ

TVM What if

How much can you borrow at a 9.5% interest rate?

Jæjg

Amortization

Amortize the 1 st through 24 th loan payments

Depreciation

Interest Rate Conversion

Cash Flows, IRR/YR, NPV, and NFV

\½\«

Yj¤

Yy¤

JÆG¤

GD¤

G7GgGJ

VG4

Date and Calendar

Bonds

S7jVÎ

Y7jVÔ

For more information on bond calculations, refer to , Bonds

Break-even

\T \«

\k \«

\h \«

\e \«

YÆd¡

GÆV¡

SÆJS¡

\T\«

7VF

\5V

17GV4

Probability

7SG

Trigonometric Functions

Find Sin θ =.62 in degrees. If RAD is displayed, press

\aJg

Convert the results to radians using Pi

At a Glance

Getting Started

Power On and Off

Manual Conventions and Examples

Displayed text

Item before the / is the alternate

Shift Keys

JdPJG7Sg4

GY7jJ1SG7Yj4

Simple Arithmetic Calculations

Operating Modes

1JJV7V4

Calculations in Chain Mode

S7dPV7DVa

7dJ4

Using Parentheses in Calculations

Calculations in Algebraic Mode

Da\qgVA

JG\n

AD4

JVy

Understanding the Display and Keyboard Cursor

Clearing the Calculator

Annunciators

Clear All

Clearing Messages

INV

Swap Key

Input Key

Statistics Keys

Same as pressing

D7Vj1G7DS\b

Gd7GV\B

Math Functions

One-Number Functions

Getting Started

JVc

\5Y

J1SC

7DVoR

\5G

A7SGoR

YP\

PY7V\2

17VdrC

J7GVrc

Two-Number Functions

In-line Functions

JjÆ

Jj\¨

Gd\¨

Gd1DD

-23below lists the two-number functions of the calculator

Arithmetic with One-and Two-number Functions

JGV\QD4

G7V\K

\Qv4

VAJ7GV4

GG1JY\¨

Last Answer

YV7SP

\5D

7JGVS4

Specifying Displayed Decimal Places

Jaj4

\54

\zyJG

Messages

D7gjSVYD

Business Percentages

GV§

Business Percentage Keys

Percent key

GdJ7j\¨

JGV1j§

DJS7g4

Jgpvæ

JdÀ

Gvvà

Margin and Markup Calculations

Margin Calculations

Using Margin and Markup Together

D7SÀ

JVÃ

Using Constants

Using Stored Numbers in Calculations

V1Gª

Number Storage and Storage Register Arithmetic

\QDª

J1J§ª

Example Calculate 10 + 10%, 11 + 10%, and 25 + 10%

Example Calculate 23

Using the M Register

VV\¨DGª

YV4

Jjs

Using Numbered Registers

JY7GVm

JS7dVm

\w7Y ADd7JV \wG

YjV7S

VS7J1

V7Y

YV7j \wD

G7V

\wPD

How to approach a Financial Problem

Picturing Financial Problems

Periods and Cash Flows

Signs of Cash Flows

Simple and Compound Interest

Simple Interest

Compound Interest

Interest Rates

Recognizing a TVM Problem

Two Types of Financial Problems

Cash flow diagram Borrower’s perspective

Recognizing a Cash Flow Problem

Cash flow diagram Investment in a mutual fund

Using the TVM Application

Time Value of Money Calculations

TVM Keys

Loan Calculations

Begin and End Modes

J7VÒ

Dpjgù

Jyva

JVÏ

1VÌ

DjVyÌ

1JV4

J7VÒ

DDyÌ

1JG4

GV\Ú

JjGVÏ

G7gÒ

YgÙ

1vÌ4

Savings Calculations

J7GÒ

GyÏ

GyÌ

GY\Í

S7DÒ

JV\Ú

YyÏ

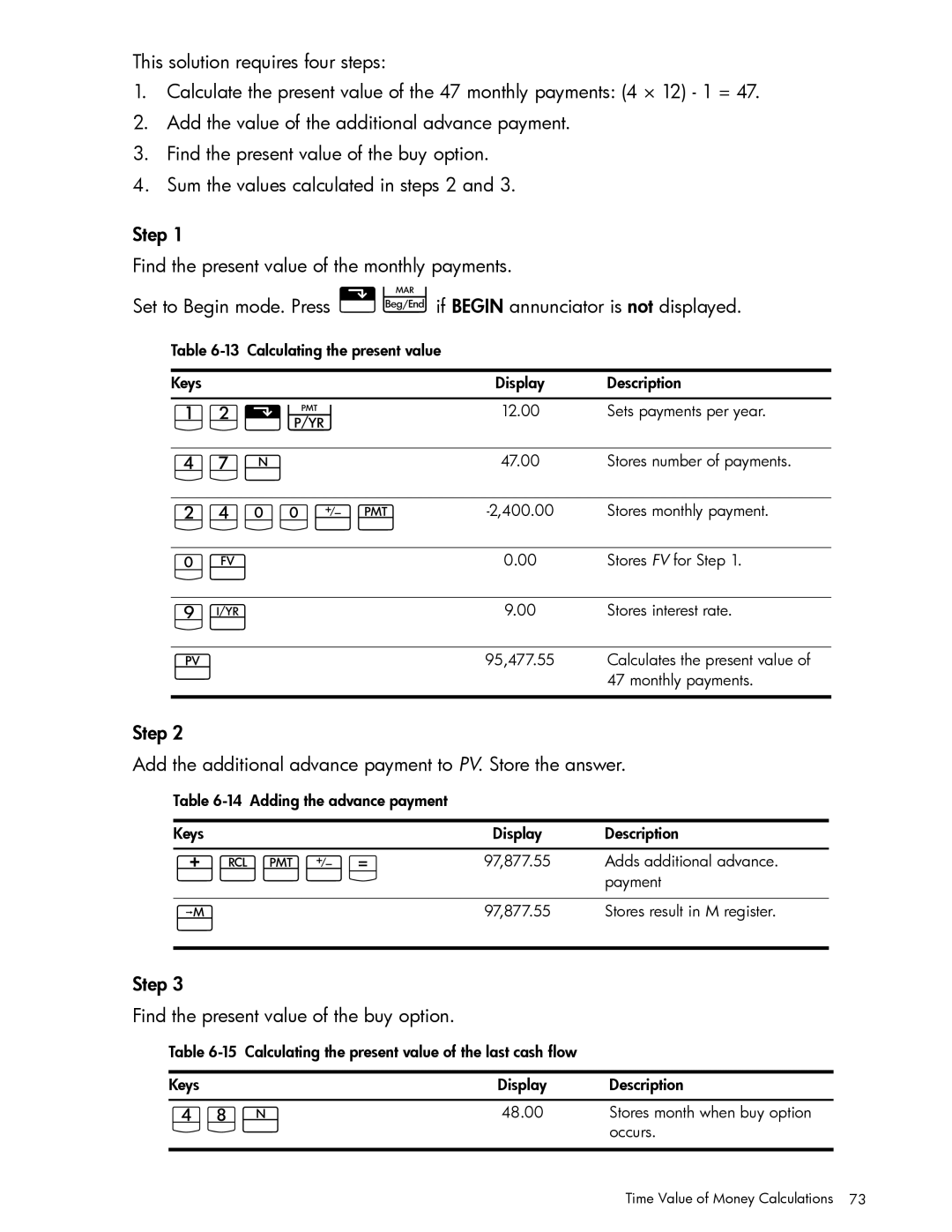

Lease Calculations

Cash flow diagram Calculate the monthly lease payment

JVÉ

Cash flow diagram Calculate PV of the lease

GYyÌ

YjÙ

1vÌy4

Step Find the present value of the buy option

JVyÉ

1p4

Step Add the results of ’ ’ and ’ ’

Amort key on the HP 10bII+ allows you to calculate

To Amortize

J7jVÒ

Jdægy

JJ7VÒ

Jygvï

GVÆ

VYÆ

Amortize the 1st, 25th, and 54th payments

Interest Rate Conversions

S7j\Ó

Investments With Different Compounding Periods

First Bank

S7SD\Ó

S7SV\Ó

DS\Í

Compounding and Payment Periods Differ

GVyÌ

DSV\Í

Resetting the TVM Keys

Depreciation Keys

Depreciation

Item in the selected format

Inputs 5 for the expected useful life

Depreciation example using Declining Balance Keys

Cash Flow Calculations

How to Use the Cash Flow Application

Number1 ¤

Clearing the Cash Flow Memory

Cash Flow Calculations

Vy¤

Gy¤

Calculating Internal Rate of Return

AJG

JJjSV7Gd¤

NPV and IRR/YR Discounting Cash Flows

Organizing Cash Flows

Initial cash flow and cash flow groups

JJy¤

Viewing and Editing Cash Flows

11GÆ

JVÆ1GÆ

1JGyÆ1G

Calculating Net Present Value and Net Future Value

ÆY¤

VÆJ¤

VÆG¤

Æd¤

JVÆJ¤

JÆJ¤

JVÒ

Automatic Storage of IRR/YR and NPV

Cash flow diagram Calculates NPV

Calendar Formats and Date Calculations

Calendar Format

Date Format

Using the Input key

Date Calculation

Date Calculations and Number of Days

JG7JgGJJ

To enter the data for this example using the Ækey

\ÇJ4

ÆJ\Ç

Y7SGJ\Ä

\5S

DJ7JGJ4

J7JjGJG

Using the Ækey

J7JjGJGÆ

S7YGJV\Ä

Bond Keys

Bonds

Y7GgGJ

V7VÎ

S7YGG

JYË

JJÑ

Resetting the bond keys

J7JVGG

Y7JVGJG

Break-even Keys

Break-even

Break-even example

Calculating the projected maximum fixed cost

Resetting the Break-even keys

\h\«

\k\«

\e\«

\Z\«

Entering Statistical Data

Clearing Statistical Data

One-Variable Statistics

Two-Variable Statistics and Weighted Mean

Viewing and Editing Statistical Data

DGÆYJV¡

DVÆVJV¡

YD\W\5G

YDÆJGD¡

DjÆSgV¡

YV\W

Summary of Statistical Calculations

D7GV¡

Y7V¡

D7V¡

D7jV¡

JgGÆgJ¡

JdDÆd¡

JjjÆgD¡

JgVÆjj¡

400

JÆdG¡

GÆJY¡

DÆJJ¡ VÆGGSV¡

VÆGgd¡

Weighted Mean

VVÆDG¡

VÆVY¡

VJÆgg¡

VJSÆdG¡

Probability Calculations

Factorial

Permutations

VÆD

VD4

V9D4

VÆD9

Advanced Probability Distributions

YG\w6

Normal Lower Tail Probability

J7jyF

Inverse of Normal Lower Tail Probability

7GVoF

GIJ7gSy4

GÆJ7gSyI

Students T Probability Lower Tail

GSoI7V4

GSÆ7VoI

Inverse of Student’s t Probability Lower Tail

Conversions from Lower Tail

Y1J4

PG4

J7GyF

Returns desired value of z

Statistical Calculations

\qJ1\q GaJ4

Setting a Sales Price

Additional Examples

Business Applications

GÆJJGJ¡

JÆJ¡

DÆJDS¡

YÆJSjV¡ VÆGVd¡

\q\qJ AG\n

Gpdspj

\qDA

YVsPJ§

Jg§

AJPJ4

YVjG7gy

Yield of a Discounted or Premium Mortgage

JdyÏ

VÙAYGÙ

G7VÒ

Annual Percentage Rate for a Loan With Fees

AG§Ï

JSÏ

JGÒ

AD§Ï

JSaDP

AJGP

YV\Ǥ4

1YVÏ

D7VÒ

Jgvï

PvÙ4

Jjvï

JDÏ

JG\Ó

ÉD\Ú

Canadian Mortgages

JJ7GÒ

DVVVyÌ

What if … TVM Calculations

PvÙ1

GS\Í

VÏ4

Savings

Stores effective rate as annual

Gains That Go Untaxed Until Withdrawal

Jyyù

DVÙ

PJV§4

Yòìï

DyÌ

G7JjVAGg

Cash Flow Examples

Wrap-Around Mortgages

GGVJ7GG

Cash flow diagram Wrap-around mortgage

VÌyAjVY

DVy¤

GG\¥

VÌy¤

Low Power Annunciator

Power and Batteries

Installing Batteries

Appendix a Batteries and Answers to Common Questions

Resetting the calculator

Determining if the Calculator Requires Service

Calculator won’t turn on

Erasing the calculator’s memory

Answers to Common Questions

See Determining If the Calculator Requires Service

Environmental Limits

Appendix B More About Calculations

IRR/YR Calculations

Equations

Time Value of Money TVM

Payment Mode Factor S = 0 for End mode 1 for Begin mode

Amortization

Interest Rate Conversions

Cash-Flow Calculations

For more than one coupon period to redemption

Bonds

Statistics

Depreciation

Forecasting

Memory has been erased Ch

Appendix C Messages

Cashflow memory was cleared

Tvm registers were cleared

Statistical memory and registers were cleared

Bond registers were cleared

HP Limited Hardware Warranty and Customer Care

Warranty, Regulatory, and Contact Information

Limited Hardware Warranty Period

Replacing the Batteries

Exclusions

General Terms

Modifications

Canadian Notice

Avis Canadien

European Union Regulatory Notice

Germany

Customer Care Contact Information

Perchlorate Material special handling may apply

香港特別行

Tobago Tunisia Turkey Türkiye Turks 01-800-711-2884

ไทย

Warranty, Regulatory, and Contact Information

Warranty, Regulatory, and Contact Information

Battery

Advance payments Algebraic mode

Chain mode

Error messages Factorial

Interest rate conversions Investments

In-line functions Interest

Keyboard

Keys

Warranty

Trigonometric functions Troubleshooting

Modes

Operating modes Parentheses