HP Part Number NW239-90001 Edition 1, May

HP 10bII+ Financial Calculator User’s Guide

Legal Notice

HP 10bII+ Financial Calculator

Number

Keyboard Map Legend

Table of Contents

Page

Page

III

Basics of Key Functions

JGD

At a Glance

Boxed Key Functions

Shift Keys

Add 15% to

Jj7V1

JV§4

Percentages

Memory Keys

JVÀ

GG¼

DDÃ

J7GV

GG4

GV4

Time Value of Money TVM

JG\Í

DSÙ

JYÏ

How much can you borrow at a 9.5% interest rate?

JyÌ

D7VÒ

TVM What if

Amortize the 1 st through 24 th loan payments

Jæjg

Amortization

Depreciation

Interest Rate Conversion

Cash Flows, IRR/YR, NPV, and NFV

\½\«

GD¤

Yy¤

Yj¤

JÆG¤

Date and Calendar

G7GgGJ

VG4

Bonds

For more information on bond calculations, refer to , Bonds

S7jVÎ

Y7jVÔ

Break-even

\e \«

\k \«

\T \«

\h \«

\T\«

GÆV¡

YÆd¡

SÆJS¡

Probability

\5V

7VF

17GV4

Find Sin θ =.62 in degrees. If RAD is displayed, press

7SG

Trigonometric Functions

\aJg

Convert the results to radians using Pi

At a Glance

Displayed text

Power On and Off

Getting Started

Manual Conventions and Examples

Item before the / is the alternate

Shift Keys

Operating Modes

GY7jJ1SG7Yj4

JdPJG7Sg4

Simple Arithmetic Calculations

7dJ4

Calculations in Chain Mode

1JJV7V4

S7dPV7DVa

JG\n

Calculations in Algebraic Mode

Using Parentheses in Calculations

Da\qgVA

Clearing the Calculator

JVy

AD4

Understanding the Display and Keyboard Cursor

Clearing Messages

Annunciators

Clear All

INV

Same as pressing

Input Key

Swap Key

Statistics Keys

One-Number Functions

Gd7GV\B

D7Vj1G7DS\b

Math Functions

Getting Started

7DVoR

\5Y

JVc

J1SC

PY7V\2

A7SGoR

\5G

YP\

In-line Functions

J7GVrc

17VdrC

Two-Number Functions

Gd1DD

Jj\¨

JjÆ

Gd\¨

-23below lists the two-number functions of the calculator

Arithmetic with One-and Two-number Functions

JGV\QD4

G7V\K

Last Answer

VAJ7GV4

\Qv4

GG1JY\¨

Specifying Displayed Decimal Places

\5D

YV7SP

7JGVS4

\zyJG

Jaj4

\54

Messages

D7gjSVYD

Percent key

GV§

Business Percentages

Business Percentage Keys

Jgpvæ

JGV1j§

GdJ7j\¨

DJS7g4

Margin Calculations

Gvvà

JdÀ

Margin and Markup Calculations

JVÃ

Using Margin and Markup Together

D7SÀ

Number Storage and Storage Register Arithmetic

Using Stored Numbers in Calculations

Using Constants

V1Gª

Example Calculate 23

J1J§ª

\QDª

Example Calculate 10 + 10%, 11 + 10%, and 25 + 10%

YV4

Using the M Register

VV\¨DGª

JS7dVm

Using Numbered Registers

Jjs

JY7GVm

V7Y

YjV7S

\w7Y ADd7JV \wG

VS7J1

\wPD

YV7j \wD

G7V

How to approach a Financial Problem

Picturing Financial Problems

Simple Interest

Signs of Cash Flows

Periods and Cash Flows

Simple and Compound Interest

Compound Interest

Interest Rates

Recognizing a TVM Problem

Two Types of Financial Problems

Cash flow diagram Borrower’s perspective

Recognizing a Cash Flow Problem

Cash flow diagram Investment in a mutual fund

TVM Keys

Using the TVM Application

Time Value of Money Calculations

Loan Calculations

Begin and End Modes

JVÏ

Dpjgù

J7VÒ

Jyva

1JV4

1VÌ

DjVyÌ

1JG4

J7VÒ

DDyÌ

G7gÒ

GV\Ú

JjGVÏ

Savings Calculations

YgÙ

1vÌ4

J7GÒ

GyÏ

GyÌ

GY\Í

YyÏ

S7DÒ

JV\Ú

Lease Calculations

Cash flow diagram Calculate the monthly lease payment

JVÉ

Cash flow diagram Calculate PV of the lease

Step Find the present value of the buy option

YjÙ

GYyÌ

1vÌy4

Step Add the results of ’ ’ and ’ ’

JVyÉ

1p4

Amort key on the HP 10bII+ allows you to calculate

To Amortize

J7jVÒ

Jygvï

Jdægy

JJ7VÒ

Amortize the 1st, 25th, and 54th payments

GVÆ

VYÆ

First Bank

S7j\Ó

Interest Rate Conversions

Investments With Different Compounding Periods

Compounding and Payment Periods Differ

S7SV\Ó

S7SD\Ó

DS\Í

GVyÌ

DSV\Í

Resetting the TVM Keys

Depreciation Keys

Depreciation

Item in the selected format

Inputs 5 for the expected useful life

Depreciation example using Declining Balance Keys

Cash Flow Calculations

How to Use the Cash Flow Application

Number1 ¤

Clearing the Cash Flow Memory

Cash Flow Calculations

Calculating Internal Rate of Return

Vy¤

Gy¤

Organizing Cash Flows

JJjSV7Gd¤

AJG

NPV and IRR/YR Discounting Cash Flows

Initial cash flow and cash flow groups

JJy¤

Viewing and Editing Cash Flows

11GÆ

Calculating Net Present Value and Net Future Value

JVÆ1GÆ

1JGyÆ1G

VÆG¤

ÆY¤

VÆJ¤

JVÒ

JVÆJ¤

Æd¤

JÆJ¤

Automatic Storage of IRR/YR and NPV

Cash flow diagram Calculates NPV

Date Format

Calendar Formats and Date Calculations

Calendar Format

Using the Input key

Date Calculation

Date Calculations and Number of Days

ÆJ\Ç

To enter the data for this example using the Ækey

JG7JgGJJ

\ÇJ4

J7JjGJG

\5S

Y7SGJ\Ä

DJ7JGJ4

S7YGJV\Ä

Using the Ækey

J7JjGJGÆ

Bond Keys

Bonds

Y7GgGJ

JJÑ

S7YGG

V7VÎ

JYË

Y7JVGJG

Resetting the bond keys

J7JVGG

Break-even Keys

Break-even

Break-even example

Calculating the projected maximum fixed cost

Resetting the Break-even keys

\Z\«

\k\«

\h\«

\e\«

Entering Statistical Data

Clearing Statistical Data

One-Variable Statistics

Two-Variable Statistics and Weighted Mean

Viewing and Editing Statistical Data

YD\W\5G

DGÆYJV¡

DVÆVJV¡

YV\W

YDÆJGD¡

DjÆSgV¡

Summary of Statistical Calculations

D7jV¡

Y7V¡

D7GV¡

D7V¡

JgVÆjj¡

JdDÆd¡

JgGÆgJ¡

JjjÆgD¡

400

VÆGgd¡

GÆJY¡

JÆdG¡

DÆJJ¡ VÆGGSV¡

Weighted Mean

VJSÆdG¡

VÆVY¡

VVÆDG¡

VJÆgg¡

Permutations

Probability Calculations

Factorial

VÆD9

VD4

VÆD

V9D4

Advanced Probability Distributions

YG\w6

Normal Lower Tail Probability

J7jyF

Inverse of Normal Lower Tail Probability

7GVoF

Students T Probability Lower Tail

GIJ7gSy4

GÆJ7gSyI

Inverse of Student’s t Probability Lower Tail

GSoI7V4

GSÆ7VoI

Conversions from Lower Tail

Y1J4

PG4

J7GyF

Returns desired value of z

Statistical Calculations

Business Applications

Setting a Sales Price

\qJ1\q GaJ4

Additional Examples

YÆJSjV¡ VÆGVd¡

JÆJ¡

GÆJJGJ¡

DÆJDS¡

YVsPJ§

Gpdspj

\q\qJ AG\n

\qDA

YVjG7gy

Jg§

AJPJ4

Yield of a Discounted or Premium Mortgage

Annual Percentage Rate for a Loan With Fees

VÙAYGÙ

JdyÏ

G7VÒ

AD§Ï

JSÏ

AG§Ï

JGÒ

1YVÏ

AJGP

JSaDP

YV\Ǥ4

Jjvï

Jgvï

D7VÒ

PvÙ4

Canadian Mortgages

JG\Ó

JDÏ

ÉD\Ú

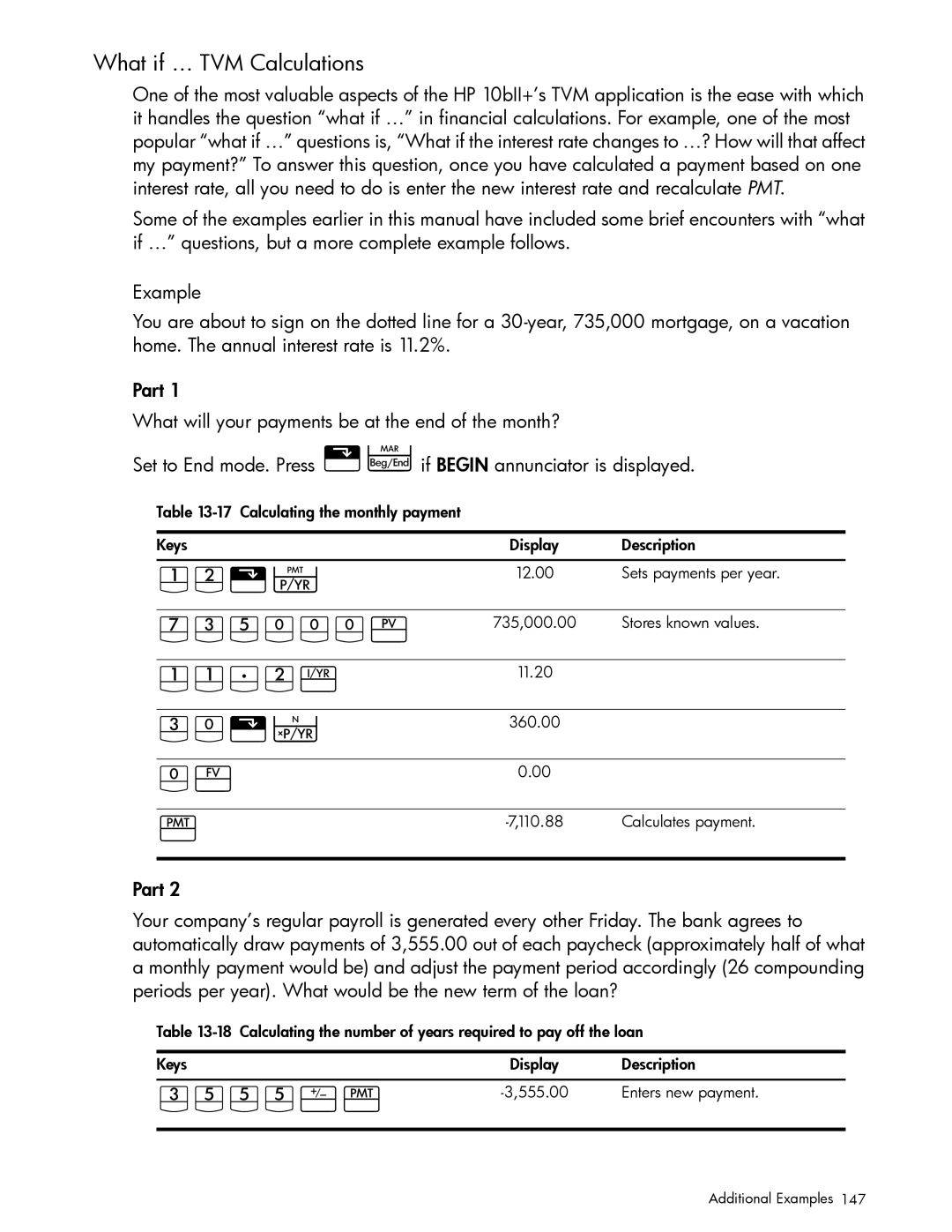

What if … TVM Calculations

JJ7GÒ

DVVVyÌ

Savings

GS\Í

PvÙ1

VÏ4

Stores effective rate as annual

Gains That Go Untaxed Until Withdrawal

Jyyù

Yòìï

DVÙ

PJV§4

Wrap-Around Mortgages

G7JjVAGg

DyÌ

Cash Flow Examples

GGVJ7GG

Cash flow diagram Wrap-around mortgage

VÌy¤

DVy¤

VÌyAjVY

GG\¥

Appendix a Batteries and Answers to Common Questions

Power and Batteries

Low Power Annunciator

Installing Batteries

Erasing the calculator’s memory

Determining if the Calculator Requires Service

Resetting the calculator

Calculator won’t turn on

Answers to Common Questions

See Determining If the Calculator Requires Service

Environmental Limits

Equations

Appendix B More About Calculations

IRR/YR Calculations

Interest Rate Conversions

Payment Mode Factor S = 0 for End mode 1 for Begin mode

Time Value of Money TVM

Amortization

Cash-Flow Calculations

For more than one coupon period to redemption

Bonds

Statistics

Depreciation

Forecasting

Tvm registers were cleared

Appendix C Messages

Memory has been erased Ch

Cashflow memory was cleared

Statistical memory and registers were cleared

Bond registers were cleared

Replacing the Batteries

Warranty, Regulatory, and Contact Information

HP Limited Hardware Warranty and Customer Care

Limited Hardware Warranty Period

Exclusions

General Terms

Modifications

European Union Regulatory Notice

Canadian Notice

Avis Canadien

Germany

Customer Care Contact Information

Perchlorate Material special handling may apply

香港特別行

Tobago Tunisia Turkey Türkiye Turks 01-800-711-2884

ไทย

Warranty, Regulatory, and Contact Information

Warranty, Regulatory, and Contact Information

Error messages Factorial

Advance payments Algebraic mode

Battery

Chain mode

Keys

In-line functions Interest

Interest rate conversions Investments

Keyboard

Operating modes Parentheses

Trigonometric functions Troubleshooting

Warranty

Modes