Welcome to NeatWorks

Getting Started What do I need to know?

Using the Quick Scan Center

Using the Inbox

Page

Page

Creating a New Folder

Choosing an Existing Folder

Working with Folders

File Selected Using NeatWorks Folders

What is a folder?

What can I do with folders?

Selecting Grid Rows

Viewing Multiple Folders Simultaneously

Editing Cells in a Folder

Adding Comments to a Folder

Deleting a Folder

Clearing Folder Rows

Splitting a Receipt Across Multiple Folders

Creating Expense Reports

Creating a New Expense Report

Moving a Split Receipt to Another Folder

For more information, see the following

Page

Page

Page

Page

How do I import and export folders?

Importing Folders

Click Continue

Emailing a Folder

To email a folder

Exporting to a NeatWorks File

Save Exporting to Excel

Creating an Excel Map

To specify an existing template file

To create a new template file in MS Office

Page

All Mappings button

Page

Exporting to an Excel Map

Exporting to CSV Comma Separated Values

Page

Exporting QIF Files to Quicken 2005 and Later

Exporting QIF Files to Quicken 2004 and Earlier

Selected Receipts radio button Click Continue

Setting Up a Cash Account in Quicken

Choose This account is not held in a financial institution

Exporting a QIF File from NeatWorks

Selected Receipts radio button

Choose File Import QIF

Tips for Working with QIF Files

Exporting OFX Files to MS Money

From the Toolbar, choose Export OFX MS Money

Exporting to QuickBooks

If you chose QuickBooks Direct

If you chose QuickBooks iif

Running Folder Reports

Using the Report Window Toolbar

Running a Report

Page

Showing and Hiding Grid Columns

Saving a Report

Can I personalize columns and fields?

Resizing Column Widths

Information Tabs

Moving Columns

Understanding and Modifying the User Profile

Modifying a Column or Field Name

From the Toolbar, choose Personalize Column/Field Names

Working With Receipts

How do I scan a receipt?

Create or Select a Folder

To Create a New Folder

To Open a Folder

Verify Data and Add a Vendor Name

Using the Image Adjuster

Step a Rotate Your Image

Step B Manually Crop the Image

Best Practice for Using the Image Adjuster

Step C Lighten or Darken the Image

Step D Save Changes to the Receipt Image

Working with Receipt Images

Zooming In or Out of a Receipt Image

Rotating the Receipt Image

Click Review and File

Viewing a Receipt in Full Screen Mode

Changing the Order of Multiple Scanned Images

Importing an Image as a New Receipt

From the Toolbar, choose Import Import as New Receipt

From the Toolbar, choose Import Image to Current Receipt

Combining Receipts

Printing a Receipt Image

Deleting a Receipt Image

Saving a Receipt as a Graphic File

Emailing Receipts

How can I work with receipt rows?

Selecting Receipt Rows

Editing Receipt Row Cells

Adding Comments to Receipts

Moving a Receipt Row to the Document Organizer

Adding a New Receipt Row

Moving a Receipt Row to Another Folder

Deleting a Receipt Row

Finding Missing Key Data in Folders and Receipts

How do I use the Search feature?

Viewing Receipts Together from Multiple Folders

To learn how to use search, see the following topics

Searching for a Keyword To search for text

Page

Receipts

Searching with the Wildcard

To conduct a wildcard search

Business Cards

Documents

Can I print, sort, and split receipts?

Printing and Clearing a Receipt Row

Selected Receipts button

Column Options

Formatting Options

Sort Receipts

Sorting Receipt Rows

Multiple Sort Order

Splitting a Receipt into Multiple Transactions

Page

How do I import and export receipts?

Importing Receipts

Page

How do I run a receipt report?

On the toolbar, select Reports Receipt Reports

Saving a Report

Can I edit vendor names and other lists?

Overview of Vendor Names and lists

Adding an Item to a List

Editing an Item in a List

Deleting an Item in a List

Showing and Hiding Columns

From the Toolbar, select Personalize Column/Field Names

Page

Page

Understanding and Modifying User Rules

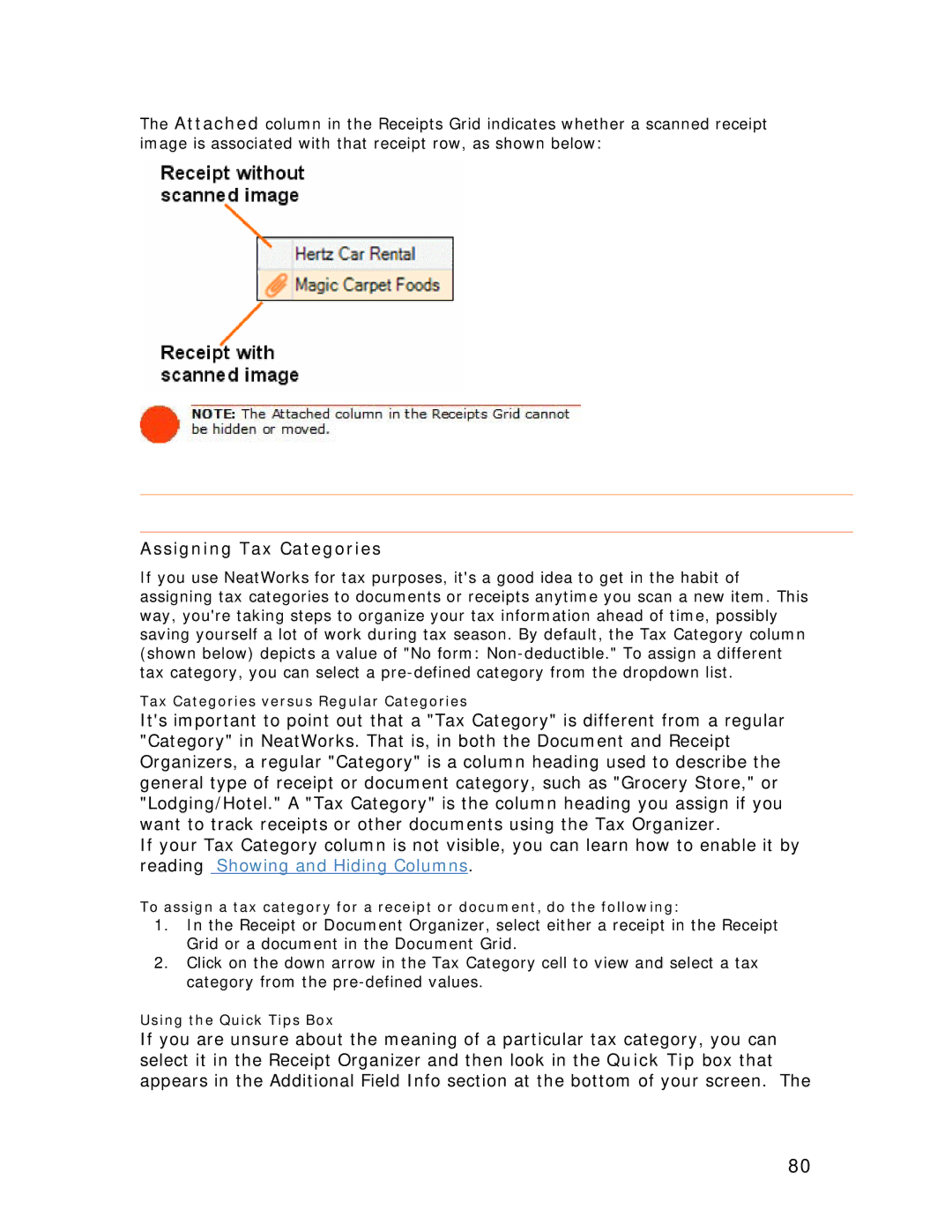

Understanding the Attached Column Icons

Assigning Tax Categories

Using the Business Card Organizer

How can I work with contacts?

Exploring the Business Card Organizer Window

How do I scan a business card?

To edit contact information in the Contacts Grid

Selecting a Contact Row

Editing Contact Information

Adding a Contact without Scanning a Business Card

Deleting a Contact

Working with Deleted Contacts

Sort Contacts

Printing a Contact

Adding an Action Item for a Contact

Adding a Note for a Contact

Marking a Contact as a Quick Contact

Emailing a Contact

Continue

Marking an Action Item as Complete

Saving Contact Information

Rotating a Business Card Image

Zooming a Business Card Image

Viewing a Business Card Image in Full Screen

How do I find my contacts?

Deleting a Business Card Image

Saving a Business Card Image as a Graphic File

Using Find Contacts

Page

How do I import and export contacts?

Exchanging Contacts with other NeatWorks Users

To import contacts from a NeatWorks file

From the Toolbar, choose Export Contact File

Choosing to Sync With Plaxo or MS Outlook

Syncing Contacts with Plaxo

Outlook

Contacts to Sync headings

With Plaxo

Syncing Contacts with MS Outlook

Specify the Direction of Sync

Specify the Contacts to Sync

Choose Select From Frequently Used Fields Categories

NeatWorks to Outlook Field Mappings

Exchanging Contacts Using vCards

100

101

102

Personalizing the Business Card Organizer

Showing/Hiding Contacts Grid Columns

From the Tools menu, choose Show/Hide Columns Grid Columns

Using the Document Organizer

103

104

Exploring the Document Organizer Window

Rotating a Document Image

105

What can I do with my document images?

Viewing a Document in Full Screen Mode

106

Zooming a Document Image

Importing an Image as a New Document

107

From the Toolbar, choose Import Image as New Document

Importing Additional Images into a Document Row

From the Toolbar, choose Import Image to Current Document

108

109

Deleting a Document Image

Click Delete Current Image

Saving a Document as a Graphic File

How can I work with document rows?

How do I set up document folders?

110

111

Selecting Document Rows

Viewing Documents Together from Multiple Folders

Editing Document Row Cells

Adding a New Document Row

112

Adding Comments to Document Rows

Moving a Document Row to the Receipt Organizer

113

Moving a Document Row to Another Folder

Sorting Document Rows

114

Deleting a Document Row

115

Clearing Documents Rows

Where can I find my saved documents?

116

Selected Documents button

117

Finding Missing Key Data in Folders and Documents

118

Can I personalize document columns and fields?

119

120

121

122

123

How do I import and export documents?

Sharing Documents with other NeatWorks Users

From the Toolbar, choose Export Document Folder File .ntf

124

Exporting Documents to other Format Types

Importing Documents

Using the Tax Organizer

125

126

Exploring the Tax Organizer Window

127

How do I assign receipts to Tax Categories?

128

Showing and Hiding Tax Categories

129

130

Adding Comments

Viewing Quick Tips and Additional IRS Information

How do I generate tax reports?

Zooming a Report

131

What can I do with tax reports?

Enter

132

Navigating in a Report

133

Viewing Corresponding Receipts

Click the View Receipts from report button

Viewing Corresponding Documents

134

ViewTDocuments from reportT button again

PrintingTa Selected ReportT

ExportingTor Printing Multiple ReportsT

DatabaseTBackup OptionsT

BackupsTT.TTT

135

BackingTUp and Restoring the DatabaseT

SchedulingTAutomatic Database BackupsT

136

BackingTUp the Database ManuallyT

Toolbar.TTT

From the Toolber, choose T Export Receipt Folder File.T

137

RestoringTthe DatabaseT

Check Backup File Version.TTT

ScannerTMaintenanceT

138

CalibrationTT

CalibratingTthe Neat ADF ScannerT

CleaningTT

139

CalibrateT.T

CleaningTthe Neat ADF Scanner T

140

141

To calibrate in NeatWorks, do the followingT

142

CalibratingTYour ScannerT

143

Click CalibrateT.T

144

How do I clean the scanner?

To clean with the alcohol cleaning paperT

ITlove the alcohol cleaning paper--where can I get more?T

145

AdditionalTResourcesT

ScanningTand Imaging TroubleshooterT

ExampleTT SolutionTRecalibrateT

SolutionsTT

146

DescriptionTT

147

SolutionT

WhereTcan I find support and get updates?T