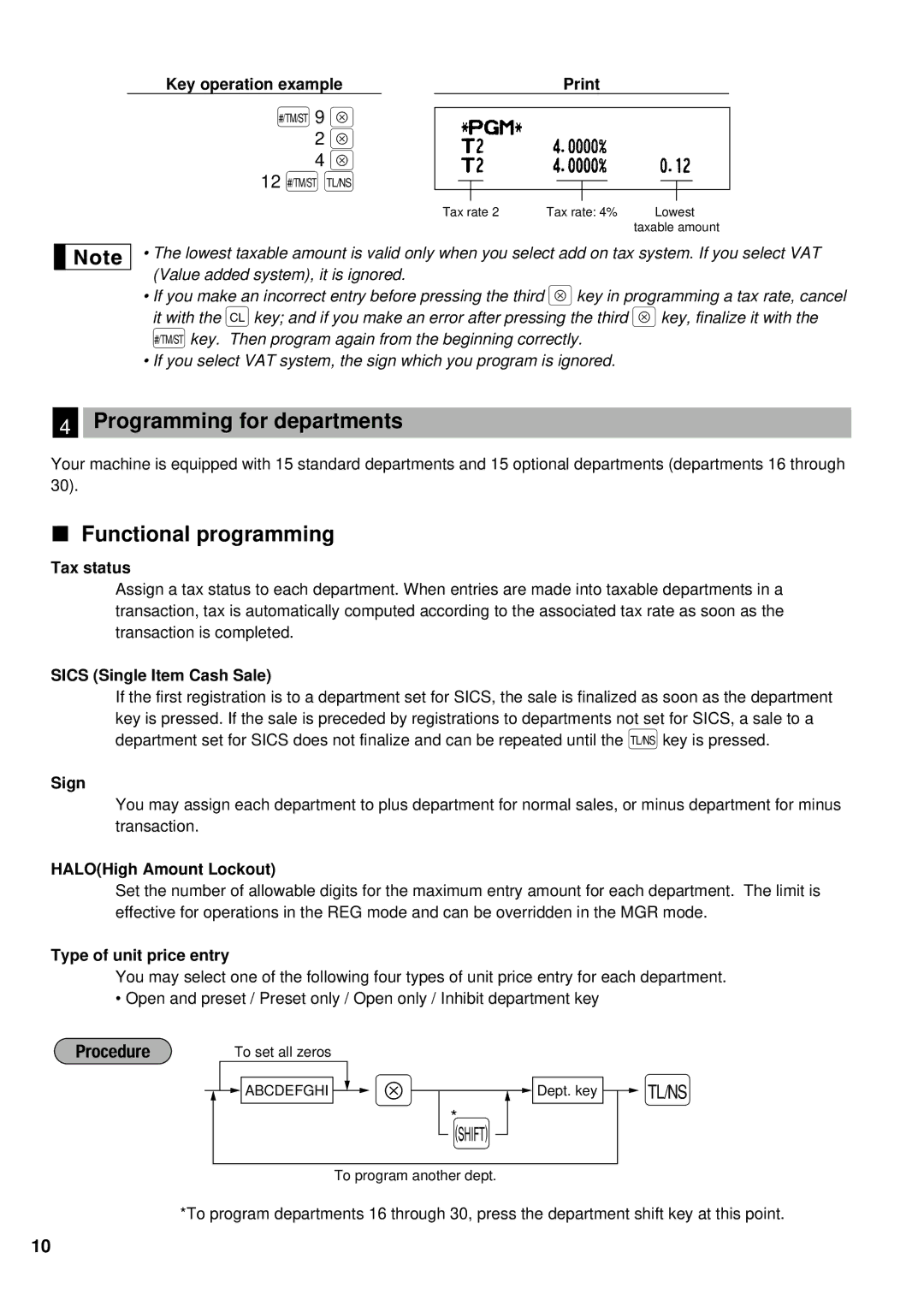

Key operation example |

|

Ñ9 ≈

2 ≈

4 ≈

12 Ñ É

Tax rate 2 | Tax rate: 4% | Lowest |

|

| taxable amount |

• The lowest taxable amount is valid only when you select add on tax system. If you select VAT (Value added system), it is ignored.

•If you make an incorrect entry before pressing the third ≈key in programming a tax rate, cancel it with the ckey; and if you make an error after pressing the third ≈key, finalize it with the Ñkey. Then program again from the beginning correctly.

•If you select VAT system, the sign which you program is ignored.

4Programming for departments

Your machine is equipped with 15 standard departments and 15 optional departments (departments 16 through 30).

Functional programming

Tax status

Assign a tax status to each department. When entries are made into taxable departments in a transaction, tax is automatically computed according to the associated tax rate as soon as the transaction is completed.

SICS (Single Item Cash Sale)

If the first registration is to a department set for SICS, the sale is finalized as soon as the department key is pressed. If the sale is preceded by registrations to departments not set for SICS, a sale to a department set for SICS does not finalize and can be repeated until the Ékey is pressed.

Sign

You may assign each department to plus department for normal sales, or minus department for minus transaction.

HALO(High Amount Lockout)

Set the number of allowable digits for the maximum entry amount for each department. The limit is effective for operations in the REG mode and can be overridden in the MGR mode.

Type of unit price entry

You may select one of the following four types of unit price entry for each department.

• Open and preset / Preset only / Open only / Inhibit department key

To set all zeros

![]()

![]() ABCDEFGHI

ABCDEFGHI ![]() ≈

≈![]()

![]() Dept. key

Dept. key ![]() É *Ó

É *Ó

To program another dept.

*To program departments 16 through 30, press the department shift key at this point.

10