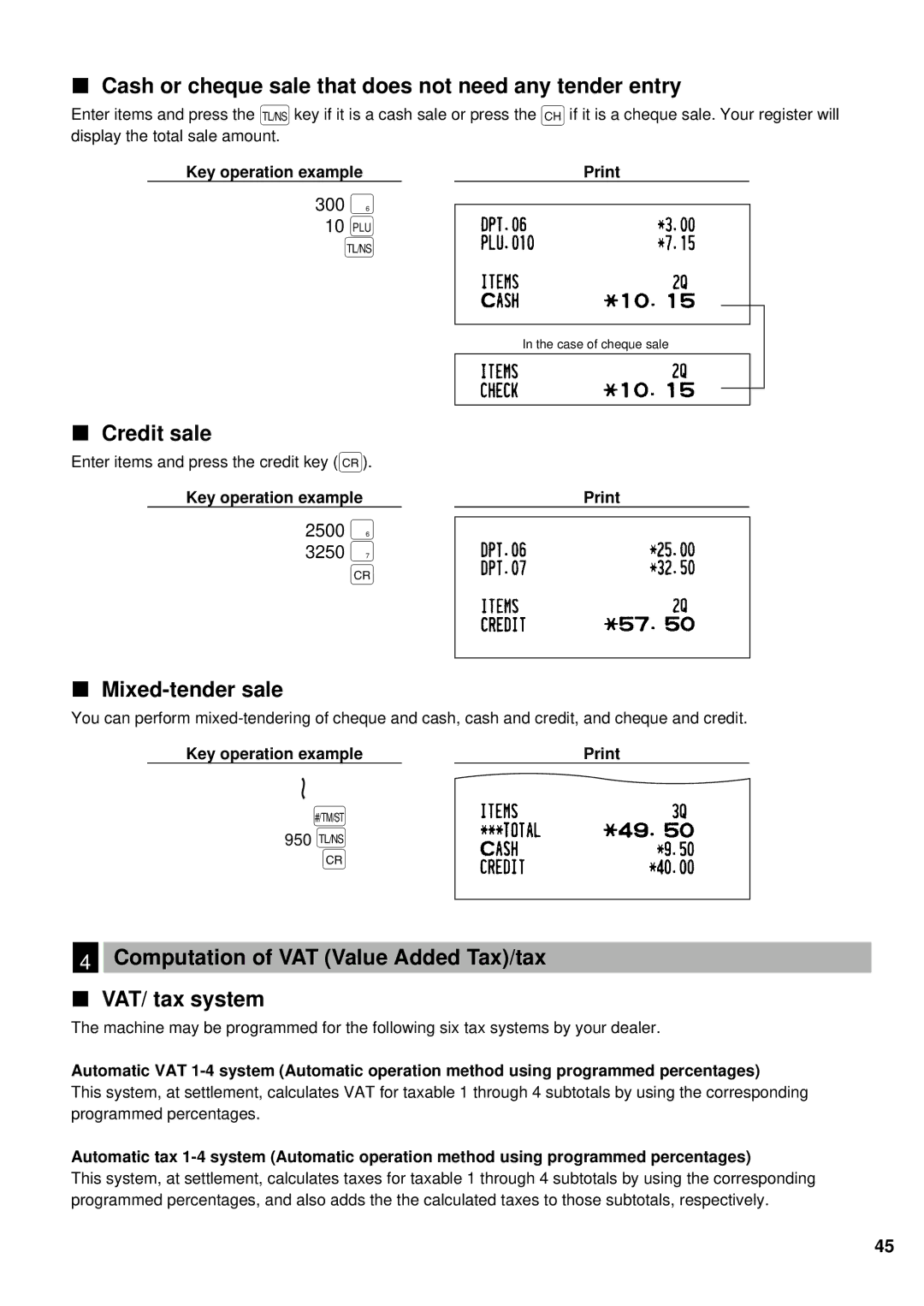

Cash or cheque sale that does not need any tender entry

Enter items and press the Ékey if it is a cash sale or press the 'if it is a cheque sale. Your register will display the total sale amount.

Key operation example |

|

300ü

10Ö

É

In the case of cheque sale

Credit sale

Enter items and press the credit key (î).

Key operation example |

|

2500 ü

3250 ä

î

Mixed-tender sale

You can perform

Key operation example |

|

Ñ

950É

î

4Computation of VAT (Value Added Tax)/tax

VAT/ tax system

The machine may be programmed for the following six tax systems by your dealer.

Automatic VAT

This system, at settlement, calculates VAT for taxable 1 through 4 subtotals by using the corresponding programmed percentages.

Automatic tax

This system, at settlement, calculates taxes for taxable 1 through 4 subtotals by using the corresponding programmed percentages, and also adds the the calculated taxes to those subtotals, respectively.

45