Programming automatic tax calculation

Important!

After you program the tax calculations, you also have to individually specify which departments (page 28) and PLUs (page 34) are to be taxed.

For this cash register to be able to automatically register state sales tax, you must program its tax tables with tax calculation data from the tax table for your state. There are two tax tables that you can program for automatic calculation of two separate sales taxes.

State Sales Tax Calculation Data Tables

State sales tax calculation data tables for all of the states that make up the United States are included on the following pages. This data is current as of October 30, 1994*. Simply find your state in the tables and input the data shown in its table.

* Some data are revised after Oct. 30, 1994.

Important!

Be sure you use the state sales tax data specifically for your state. Even if your state uses the same tax rate percentage as another state, inputting the wrong data will result in incorrect tax calculations.

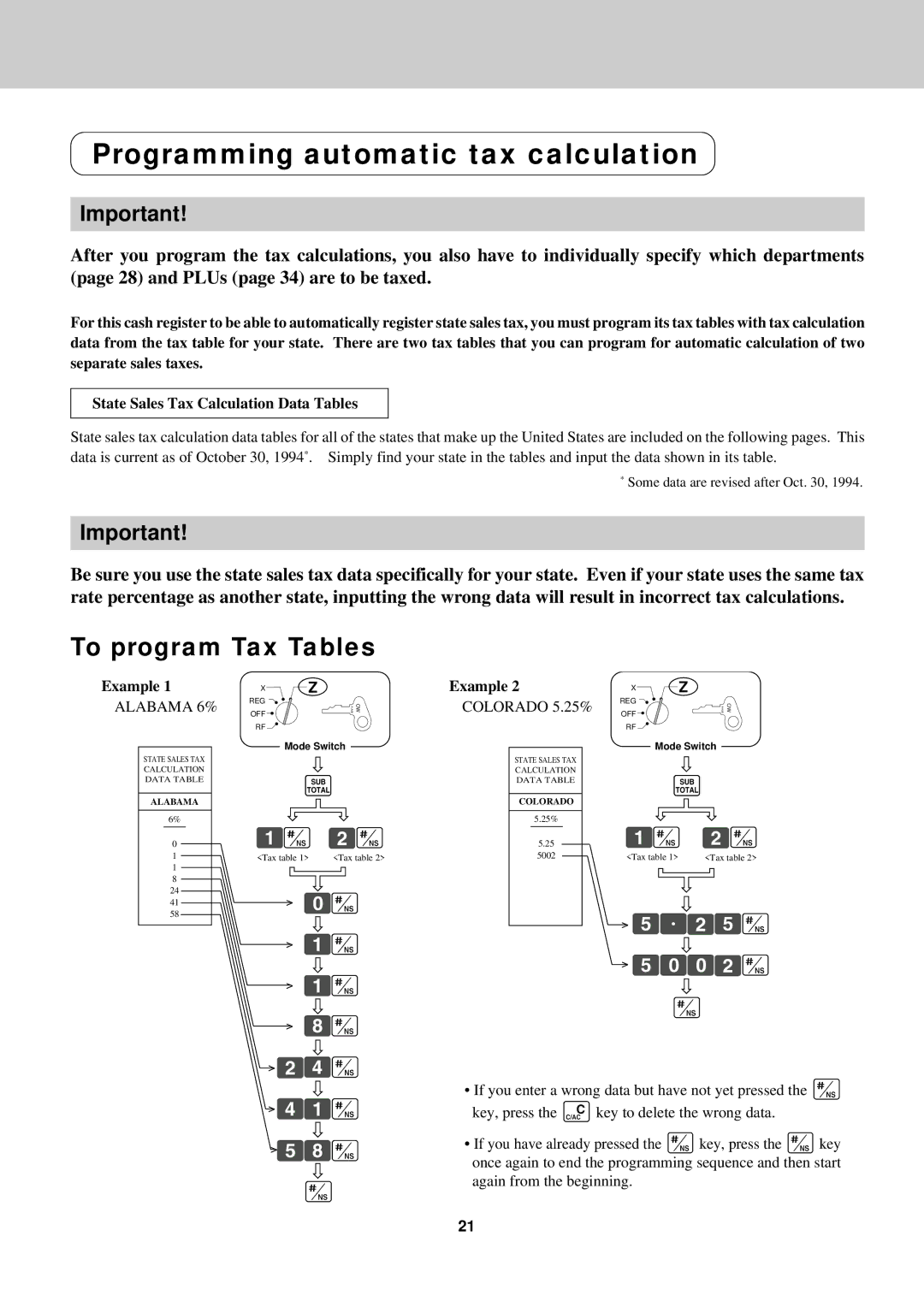

To program Tax Tables

Example 1 | X | Z |

|

ALABAMA 6% | REG |

| OW |

OFF | |||

|

|

| |

| RF |

|

|

|

| Mode Switch |

|

STATE SALES TAX |

|

|

|

CALCULATION |

| s |

|

DATA TABLE |

|

| |

|

|

|

ALABAMA

6%

0Ún Ûn

1 | <Tax table 1> | <Tax table 2> | |

1 |

|

|

|

8 |

|

|

|

24 | > | ân | |

41 | |||

58 |

|

|

|

> Ún

> Ún

> ¡n

>ÛÝn

>ÝÚn

>Þ¡n

n

Example 2 | X | Z |

|

COLORADO 5.25% | REG |

| OW |

OFF | |||

|

|

| |

| RF |

|

|

|

| Mode Switch |

|

STATE SALES TAX |

|

|

|

CALCULATION |

| s |

|

DATA TABLE |

|

|

COLORADO

5.25%

5.25Ún Ûn

5002 | <Tax table 1> | <Tax table 2> |

> Þ±ÛÞn

> ÞââÛn

n

•If you enter a wrong data but have not yet pressed the n key, press the Ckey to delete the wrong data.

•If you have already pressed the nkey, press the nkey once again to end the programming sequence and then start again from the beginning.

21