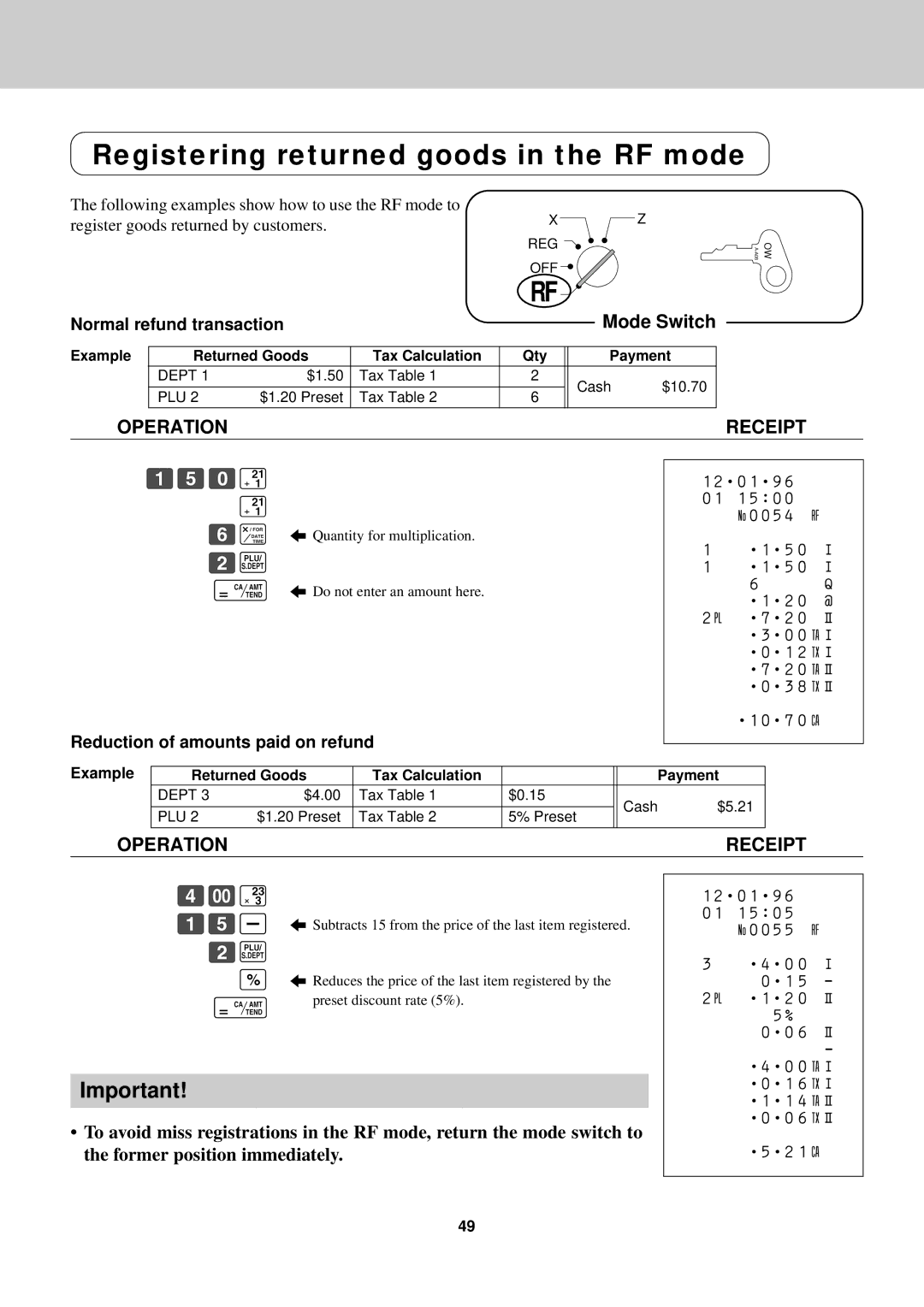

Registering returned goods in the RF mode

The following examples show how to use the RF mode to

register goods returned by customers. | X | Z |

|

| |

| REG |

|

| OFF |

|

| RF |

|

Normal refund transaction |

| Mode Switch |

OW |

Example | Returned Goods | Tax Calculation | Qty |

| Payment |

| |||

|

| DEPT 1 | $1.50 | Tax Table 1 | 2 |

| Cash | $10.70 |

|

|

|

|

|

|

|

|

| ||

|

| PLU 2 | $1.20 Preset | Tax Table 2 | 6 |

| |||

|

|

|

|

|

| ||||

OPERATION |

|

|

|

|

|

| RECEIPT | ||

ÚÞâÁ

Á

ßX 5 Quantity for multiplication.

Ûp

c5 Do not enter an amount here.

Reduction of amounts paid on refund

12¥01¥96

0115:00 n0054 r

1¥1¥50 Á

1¥1¥50 Á

6q ¥1¥20 @

2p ¥7¥20 ª ¥3¥00tÁ ¥0¥12xÁ ¥7¥20tª ¥0¥38xª

¥10¥70C

Example

Returned Goods | Tax Calculation |

|

|

| Payment | ||

DEPT 3 | $4.00 | Tax Table 1 | $0.15 |

| Cash | $5.21 | |

|

|

|

|

| |||

PLU 2 | $1.20 Preset | Tax Table 2 | 5% Preset | ||||

|

|

| |||||

|

|

|

|

|

|

| |

OPERATION | RECEIPT |

ÝÑ£

ÚÞ- 5 Subtracts 15 from the price of the last item registered.

Ûp

P5 Reduces the price of the last item registered by the

cpreset discount rate (5%).

Important!

•To avoid miss registrations in the RF mode, return the mode switch to the former position immediately.

12¥01¥96

0115:05 n0055 r

3¥4¥00 Á 0¥15 -

2p ¥1¥20 ª

5%

0¥06 ª

-

¥4¥00tÁ ¥0¥16xÁ ¥1¥14tª ¥0¥06xª

¥5¥21C

49