Registering premiums and discounts

This section describes how to prepare and register premiums and discounts.

Programming premiums and discounts

You can use the Pkey to register either discounts (percentage decreases) or premiums (percentage increases).

The following procedures let you select the operation you want for the Pkey. They also let you program the tax calculation method, the tax rounding method, and a preset rate.

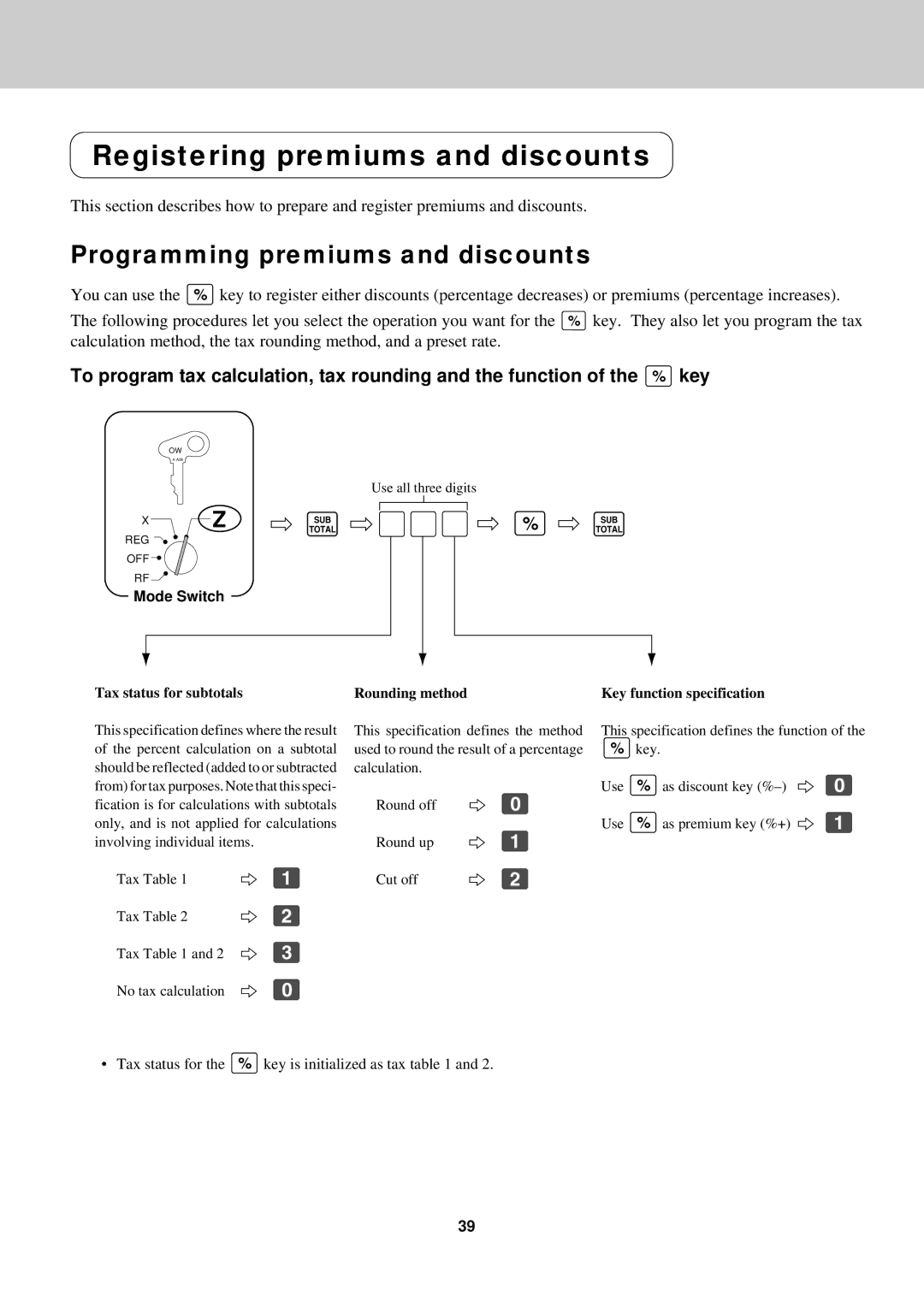

To program tax calculation, tax rounding and the function of the Pkey

OW

Use all three digits

X

REG

OFF

RF

Z s  P s

P s

Mode Switch

Tax status for subtotals | Rounding method | Key function specification |

This specification defines where the result of the percent calculation on a subtotal should be reflected (added to or subtracted from) for tax purposes. Note that this speci- fication is for calculations with subtotals only, and is not applied for calculations involving individual items.

Tax Table 1 | 2 | Ú |

Tax Table 2 | 2 | Û |

Tax Table 1 and 2 | 2 | Ü |

No tax calculation | 2 | â |

This specification defines the method | This specification defines the function of the | ||

used to round the result of a percentage | Pkey. | ||

calculation. |

|

| Use Pas discount key |

Round off |

| â | |

2 | Use Pas premium key (%+) 2 Ú | ||

Round up |

| Ú | |

2 |

| ||

Cut off | 2 | Û |

|

• Tax status for the Pkey is initialized as tax table 1 and 2.

39