ER-A410 ER-A420

For Your Records

Introduction

Precaution

Contents

For the Manager

Page

Page

Page

Front view

External View of the ER-A410

Rear view

External View of the ER-A420

Print head release lever

Printer

ER-A410 standard keyboard layout

Keyboard

000

Optional keys

ER-A420 standard keyboard layout

For ER-A410

Standard key number layout

For ER-A420

Installing the keyboard sheet ER-A420

Mode switch and mode keys

Keys and Switches

Drawer lock key

Cashier code entry key

Procedure

Receipt ON/OFF function

Operator display

Displays

Customer display Pop-up type

Preparations for entries

Prior to Entries

Receipt and journal paper rolls

Cashier assignment

Error warning

Power saving mode

Item entries Single item entries

Entries

Example

Repeat entries

UPC entries

Example Key operation Print

Multiplication entries

Successive multiplication entries

Split-pricing entries

600

Sics entries

Single item cash sale SICS/single item finalize SIF entries

SIF entries

200

Scale entries

Auto scale entries

32 Ï S 200

32 Ï S 1 Pplu

Ii Manual scale entries of refunded items

Lock shift mode

Automatic return mode

PLU level shift for direct PLU

¬ 1 2 1 a

Lock shift mode for price level

Automatic return mode for price level

PLU/UPC price level shift

Set PLU entries

Link PLU/UPC entries

300 17 a

Age verification Birthday entry

Birth

Price inquiry view function for PLU/UPCs

Mix-and-match entries

UPC learning function

Price change function for UPCs

Price change mode

Changing a price during a transaction

Changing a price during a transaction Key operation Print

Price change mode Key operation Print

Merchandise subtotal

Displaying and printing subtotals

Taxable subtotal

Including-tax subtotal full subtotal

Finalization of transaction Cash or Check tendering

500 a

Mixed tendering check + cash

1000 a

950 a

300

Cash or Check sale that does not need any tender entry

Charge credit sale

425

Food stamp calculations Food stamp tendering

1000 f

248 542 500 f 500 a

232 ˛

318 124 400 f

400 f 200 a

Food stamp status shift

800 50 †

670

Tax calculations Automatic tax

Manual tax

Automatic-tax delete

725 515

Tax status shift

400

1345 \TAX

1050 \TAX

111 n

Or a

Guest Check Pblu

New charge accounts

Additional item entries

111 u

Settlement

1400 1600

5000 5DEPO

Deposit entries

111

800

140 225

§ a

Auxiliary entries Percent calculations premium or discount

100

575

675

Discount entries

250 Ï

Refund sales mode

250

Refund entries

2300

Payment treatment Currency conversion

4650

10000 a

Paid out entries

Received on account entries

No sale exchange

12345 = 4800 r

Cashing a Check

10 @

Bottle return

Automatic sequencing key ` key entries

600 328 28 9

Correction

825

Correction of the last entry direct void

Subtotal void

Incorrect receipt Cancellation receipt

Override Entries

Return the mode switch to the REG position

‹ 100 1 360

Overlapped Cashier Entry

150

100 360

850 150 1 a

Special Printing Functions

Copy receipt printing

Printing of header and footer graphic logos

Validation printing function Slip printer

Printing of arrival time Printing of departure time

Remote printer send function

Time display

Time Display and Automatic Updating of the Date

Automatic updating of the date

Date Time

Programming keyboard layout

Prior to Programming

For ER-A410

For ER-A420

Using character keys on the keyboard

How to program alphanumeric characters

Entering character codes

Alphanumeric character code table

231

Programming

Setting the date and time Date PGM

Basic instructions

Preparations for programming

Programming for departments

Time PGM

Unit price

Selection Entry

Functional selection PGM

Sign plus/minus

1000000100000317 @

PGM 1 PGM

PLU/UPC programming

Sign Function of PLU/UPC

PPLU/ 0000001003 @

Programming for discount keys Discount amount PGM 1 PGM

PLU/UPC assignment to department PGM 1 PGM

000001013 @

10 %

Programming for percent keys % Percent rate

3250 ç

000001000 @ %

13 @ r

Or π Ç

Credit Debit Check

00000000000000115 @

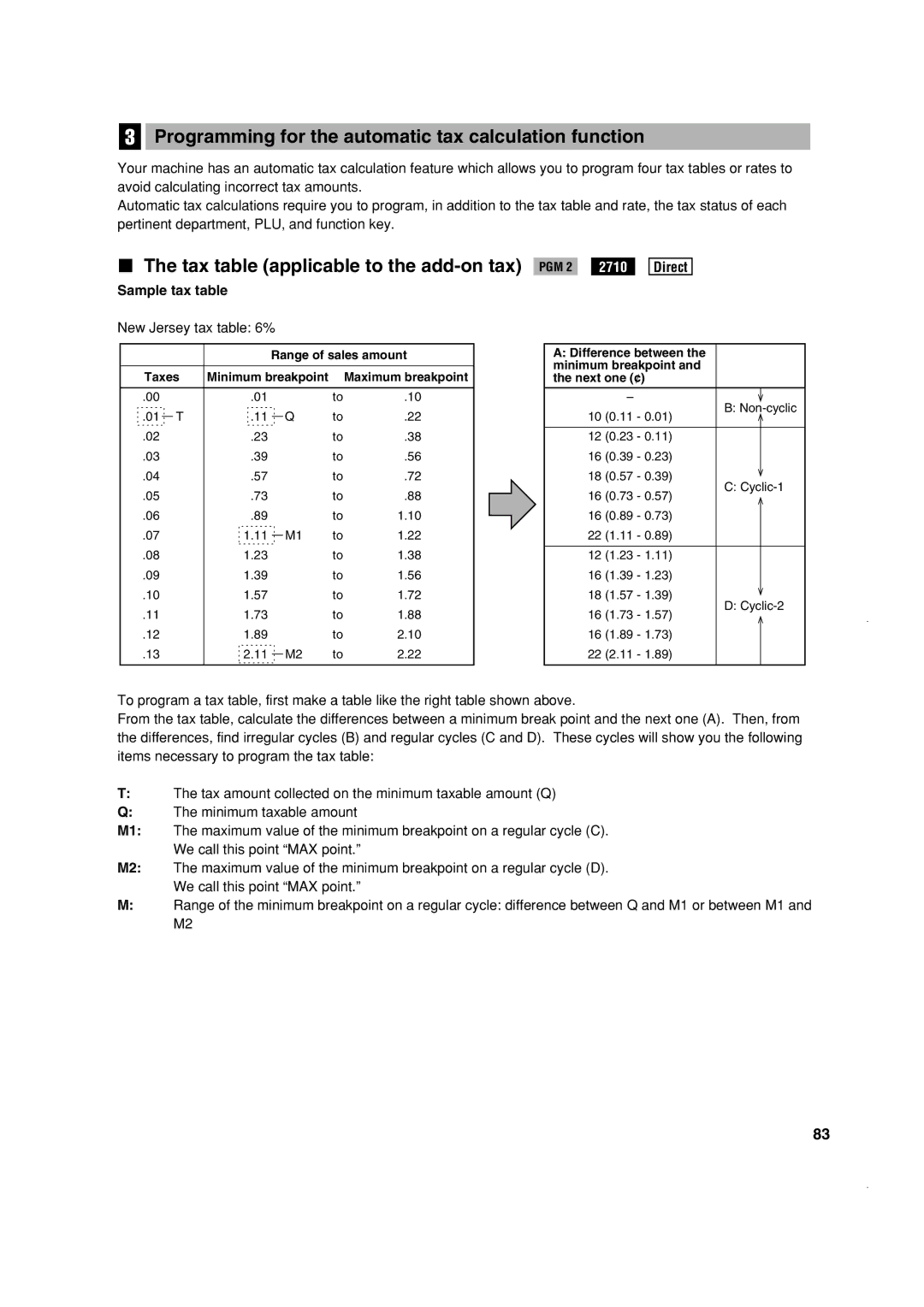

Tax table applicable to the add-on tax PGM

Programming for the automatic tax calculation function

Sample tax table

Limitations to the entry of minimum breakpoints

Tax rate → 100 First Cyclic Portion MAX point → 111

Modification of the left tax table

Sample tax table Example 8%

Setting the time PGM 2

Setting the date and time Setting the date PGM 2

2610 . @ 08262004 Ç

2611 . @ 1430 Ç

2612 . @ 123456 Ç

Setting the consecutive number PGM 2

2613 . @ 1000 Ç

Tax table applicable to the add-on tax PGM 2

First figure

2710 . @

Tax rate PGM

Doughnut tax exempt for the Canadian tax system PGM 2

12 a

2711 . @

2715 . @

Functional programming 1 PGM 2

2110 . @ @ 000003 t

2111 . @ @ 010001 t 10 @ 100000 t

Functional programming 2 PGM 2

Direct Sign plus/minus

Food stamp status

Alphanumeric characters PGM 2

Limit amount Halo of entry PGM 2

2112 . @ @ 95 t

2114 . @ @ Steak t

Commission group assignment PGM 2

@1 t

1110 . @ @ 1000 t

2115 . @

Group number PGM 2

@ 18 t

Age limitation PGM 2

2116 . @ @ 1 t

Print station assignment PGM 2

@ 1 t

Department key positioning PGM 2

2118 . @ @ 101 t

Base quantity for split-pricing entries two digits

Unit price max. six digits

Sign +

Link PLU/UPC link

Department assignment

11 @ 20 @

1200 . @ @ 2 t 5012345678900 @ 2 t

2230 . @

Base quantity PGM 1 PGM 2 1211 Direct

Unit prices PGM 1 PGM 2

1210 . @

@ 125 t

2210 . @ @ 003 t

11 @ 20 @ 003 t

2231 . @

2211 . @ @ 000001 t 010000 t

Sign +/-, food stamp status, and tax status PGM 2 2211

Direct For each PLU/UPC

000001 t

2232 . @

2214 . @ @ Milk t

2215 . @

Assigning of PLUs/UPCs to commission groups PGM 2 2215

2235 . @

100

2280 . @

Age limitation PGM 1 PGM 2 2280

2236 . @

18 t

@ 4 t

@ 10 t

Stock quantity PGM 1 PGM 2 1222 1220

102

1221 . @

Set PLU PGM 2

2221 . @ 20 @ 201 t 202 t

103

2225 . @ @ 03000500 t

Mix-and-match table PGM 2 2217

2217 . @

104

60 Ç

Delete period for non-accessed UPC codes PGM 2

Print station to PLU/UPC assignment PGM 2

105

2025 . ` 20 ` 540012 ı

Programming Non-PLU code format PGM 2

106

Link PLU/UPC link

21 @ 25 t 26 t 27 t

Programming of PLU levels and direct PLU keys PGM 2

107

Programming the rate %, ç, commission and the discount PGM

Programming for miscellaneous keys

1310 . @ @ 1000 ı 5 @ 10 ı 71 @ 1 ı

108

Currency description text programming ç

72 @ / US$ t

2334 . @

109

Limit amount Halo of entry -, †, r, p PGM 2

@ 13 ı a

+/- sign, food stamp status, and tax status %, PGM 2

2312 . @

111

2311 . @ @ 100001 ı @ 000000 ı

@ 1 ı a

@ 2 ı a

Percent entry type % PGM 2

Item% or subtotal% selection % PGM 2

Percent rate limitation % PGM 2

@ 15 ı a

Vendor or store coupon selection PGM 2 2316 Direct

113

114

2320 . @

80 @

000000000000001 ı

115

2326 . @ 80 @ 0001 ı

Tax delete PGM 2

116

High amount lockout Halo of entry for media keys PGM 2

80 @ 15 ı a

2321 . @ 68 @ 9999 ı

2322 . @

118

2328 . @ 80 @ 101 ı

Programming of function text Programming PGM 2

80 @ Visa / / / ı a

2314 . @

119

120

List of function texts

121

P T

Cashier name PGM 1 PGM 2

Cashier programming Cashier code PGM 1 PGM 2

1500 . @ @ 1111 ı @ 1014 ı

1514 . @ 1111 @ Dick ı 1014 @ Peter ı

Assigning cashiers to drawers PGM 2

OP X/Z mode availability

2510 . @ 1111 @ 1 ı

123

Journal print form

Automatic return mode for PLU/UPC price level

125

126

127

2616 . @ @ 00000010 ı

To H

Selection Entry To C

30 a

Setting the time limit for the Till Timertm PGM 2

Programming the parameter of the slip printer PGM 2

128

Scale tare table PGM 2

@ 20 ı

2618 . @

129

2614 . @

Programming of logo messages PGM 2

130

Sequence PGM 2

10 ı 13 ı

2620 . @

131

Programming of power saving mode PGM 2

Setting the time range for hourly reports PGM 2

107 a

132

Functional programming for the printer PGM 2

Pblu code programming PGM 2

2810 . @ 1000 a

2990 . @ 50 Ç

2641 . @ Entry / Error t

Programming of error messages PGM 2

134

Slip printer’s logo message PGM 2

Check validation message PGM 2

2642 . @ For / Deposit / only t

2643 . @ TEXT1 t

136

RS-232C channel assignment PGM 2

2690 . @ @ 0100 t

Barcode reader programming

2691 . @ 1110 Ç

137

Remote printer programming

@ 2 t

Second remote printer programming

138

Print format for remote printer

Remote printer name programming

3654 . @ @ KP1 t

3655 . @ @ 00000 t

3656 . @ 00000 Ç

Chit receipt format PGM 2

140

141

Programming of RS-232C interface

142

Programming the CAT interface

143

2631 . @ 1234 Ç

Operating

Programming

2900 . @ AUTO1 2 UPC 100

Setting the Auto key Automatic sequencing key X2/Z2

144

145

Training mode

Reading stored programs

Program details and procedures for their reading

146

147

@ Ç

148

Sample printouts

149

Reading of programmed set PLUs Reading in the PGM2 mode

150

151

152

153

Reading of programmed messages Reading in the PGM2 mode

154

155

UPC-A

156

Add-on code

Code entry No add-on code Digit add-on code

157

Reading X and Resetting Z of Sales Totals

158

Mode switch Job Position Key operation Code X1/Z1

159

Non-accessed UPC deleting

160

Daily sales totals General report

Sample X report Sample Z report

161

162

Cashier report

Individual cashier reading and resetting

163

164

Full cashier reading and resetting

165

Hourly report

166

Full group total report on department

167

PLU/UPC report by designated range or pick up list

PLU/UPC price category report

PLU/UPC report by associated department

PLU/UPC zero sales report

168

169

Pblu report

Cash in drawer report

Pblu report by cashier

Transaction report

X1/Z1 stacked report

171

Deleting of non-accessed UPCs

Sample X report Reading Sample Z report Deleting

General Overview

Periodic consolidation

172

X2/Z2 stacked report

Daily net report

173

174

Compulsory CASH/CHECK Declaration

Types of compulsory cash/check declarations

Individual cashier report

175

Case of power failure

Operator Maintenance

Case of printer error

Thermal printing

177

Paper specification

Installing the paper roll

How to set the paper roll How to cut the paper end

Installing the receipt paper roll

179

Installing the journal paper roll

180

Removing the paper roll

Removing the receipt paper roll

Removing the journal paper roll

181

Removing a paper jam

Print head

Cleaning the print head

182

Opening the drawer by hand

Removing the till and the drawer

183

Error message table

Before calling for service

184

185

List of Options

186

Specifications

T I C E

Sharp Electronics Corporation