MA-186-100 Series

Page

Meanings of Each Symbol

Safety Summary

Safety Summary

Precaution

Table of Contents

Toshiba TEC

Introduction

Unpacking

REG

Outline of Preparation Procedure Before Operating

Offz SET

REG Offz SET

Appearance and Nomenclature

Control Lock and Control Keys

Control Keys

Control Lock

REG Key

Operator’s Display

Display

Customer’s Display

Numeric Display

Message Descriptors Triangular Lamps

ALM

OFF

Keyboard

Other Optional Keys

Standard Keyboard Layout

CID

Installing the Paper Roll

REG OFF

Duplicate Sheet Original Sheet

EO1-11115 MA-186-100 Series

Time and Date Setting

Time Setting or Adjustment

Date Setting or Adjustment

REG OFF @/FOR AT/TL SET

Date now set

04.- 15.- 9 05.- 28.- 9 00.9

Displaying the Time

Tax Table Setting

Printing the Time and Date

Setting Procedure

Setting Examples

To indicate that no breaks are entered

A single-tax area, the TX1/M key may be labeled as TX/M key

Ex Tax 1 Full Breaks

Ex Tax 1 a Break and % Rate Combination

Ex Tax 1 % Rate only

05.- 28.- 9 01.7

05.- 28.- 9 10. % 01.8

Thank you

GST/M

01.5

Non-taxable Limit Amount Setting

05.- 28.- 9 20.0 02.4

Tax 1 memory

Taxable Limit Amount programmed

Optional Key Setting

Operating Procedure

Tax Calculation Test

List of Keys

Receipt Issue Post-receipt

Department Keys 1 to

Key Installation Setting

REG OFF AT/TL SET Blind

Refer to the List Keys on the pre Ceding For the Standard

Keyboard Layout Refer to Chapter

That the setting operation is completed. No printing occurs

Plan before starting the setting procedure

Issue without entering numbers

Receipt Issue Post-receipt Key

Daily Operation Flow

Before Opening the Store

During Business Hours

After Closing the Store

Entries in Training Mode

Training

Setting Preparation of Each Key and Transaction Entries

Receipt-issue/Non-issue Selection

41.3

41.4

Combination of 6 +

No-sale Exchange

Void

Thank you ←

10.2

Received-on-Account Payment

12.5 10.3

Paid Out

Department Keys

Programming Department Keys

10.4

Programming Procedure

Department Status Programming

Be entered within one sale receipt sequence

DP Amount

Payment of electricity and gas, and donation

TX1/M TX2/M

Department Status Program Receipt Format

00.5

Department LC Program Receipt Format

Department LC Listing Capacity Programming

01.1

Department Preset Price Setting

Department Preset Price Setting Receipt Format

Last setting is effective

05.- 28.- 9 34.5 02.0

Entry of One Item

Sale Item Entries Using Department Keys

Repeat Entry

Repeat

Quantity Extension Multiplication

Item of the Department Nos to

Split-Package-Pricing Department SPP

PLU Price-Look-Up PLU Key

Single-item Department Entry

Other Income Department Entry

10.0 10.5

Programming PLUs PLU Table Setting

Dept

PLU Table Program Receipt Format

Deleting Individual PLUs

AMT

PLU Preset Price Changing

PLU Deletion Receipt Format

05.- 28.- 9 00.7

OFF PLU #/CID

Sale Item Entries of PLUs

PLU Price Change Setting Receipt Format

PL01.1 23.4 02.1

@/FOR AMT

40.0

Listing Capacity Open

Percent Charge, Percent Discount

Single-item PLU Entry

28.- 9 PL10.1 10.7

05.- 28.- 9 10. % + 01.3

Key Preset Rate Setting or Changing

05.- 28.- 9 01.4

6.0

Key Operations in Sale Entries

15.0

Dollar Discount

Item Correct Last Line Voiding

Repeat entry is not possible using the Void key

Void Designated Line Voiding

Returned Merchandise

All Void Transaction Cancel

18.7

SET #/CID

Non-add Number Print

23.0 0 0 #

Taxable Total Read

Subtotal Read

22.9

Manual Tax Entry

Finalizing a Sale

TAX

Media Total

Post-issue Receipt

Check Cashing Cashing Non-cash Media

11.8

Bit 3 on

Tax Status Modification

TX/M

Percent Charge

Percent Discount

To exempt the sale from designated taxes

Tax Exemption

To exempt the sale from all taxes

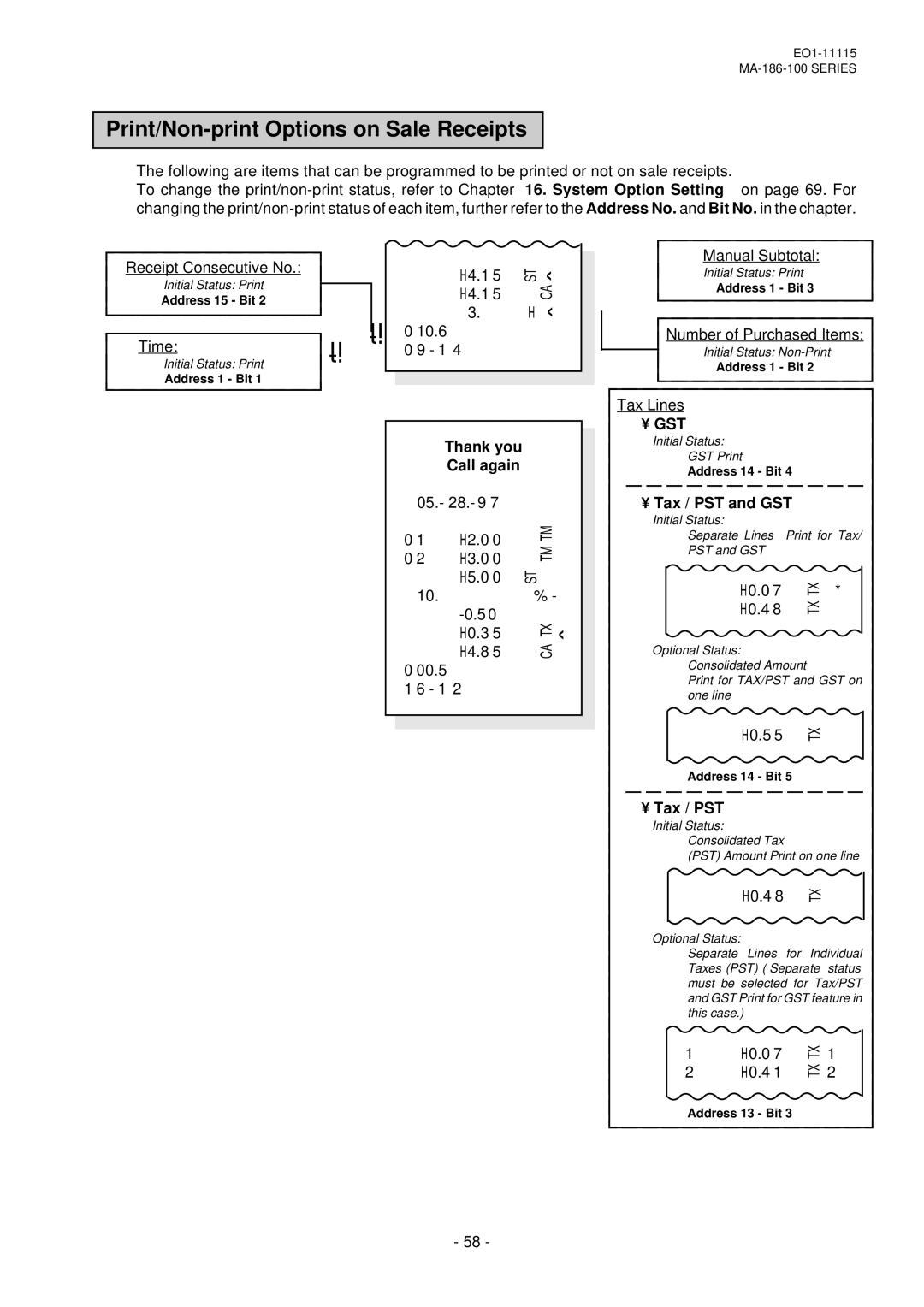

Tax / PST and GST

Print/Non-print Options on Sale Receipts

Tax / PST

Read and Reset Reports

Programming Operations Relating to Reports

Programming Hourly Range Table

Refer to Note on Condition on

Programming Example

Selecting Print/Non-print Items on Reports

05.- 28.- 9 01.0

Fundamental Concepts of Various Types of Reports

Taking Read and Reset Reports

Report Taking Operation

Daily Reports

Periodical Reports

Report Sample Format

Report Name Key Operation

05.7

Financial Read or Reset Report Daily or Periodical

05.7 42.7 31.0 12.0 75.5 10.0

00.0

14.0

20.7

Memory Balance

Grand Total

Gross Sale

Net Sale with Tax

Daily Hourly Sales Read or Reset Report

Daily PLU Read or Reset Report All or Zone

Daily All PLU Read or Reset Report Thank you Call again

Daily Zone PLU Read or Reset Report

Daily Cashier Read or Reset Report Thank you Call again

Cashier Read or Reset Report Daily or Periodical

Daily Media Sales & In-drawer Read Report

Daily Individual Department Read Report

33.4

05.0

10.0 00.0 10.0 67.1 32.2

Programming Procedure

System Option Setting

SET @/FOR

Address 1 refer to the next

05.- 28.- 9 01.2

Address

Non-print Options

Your Selection →

Vacant

Optional Functions

Disc or Void key

Supplementary Description for Address

Register. Refer to on page 82 for

Vacant Supplementary Description for Address

Tax Status

Addresses 4, 5 are vacant

AT/TL Key Function

Total

Vacant Cashing with no purchase, using this key

CHK TND Key Function Bit Content Selective Status

Over-tendering tendering an amount larger than the sale

Reset

Chg Key Function

Prohibited

Allowed Prohibited

TL, CHK TND, Chg

Address 1

Address 12 is vacant

Separate

Line Print Lines

Your Selection

Initial SET Bit Nos

GST Options ... for Canada

Subtotal

Resettable

Taxable Total

ANY Number Only Once

Times

Cashier Signing Operation optional function

Programming Requirements

Cashier Sign on & Sign OFF

10.1

Near-Full Warning in REG Mode

Electronic Journal E.J. Print optional function

Cashier Reports

Programming Requirement

Reading of the Remaining Lines of E.J. Memory

Electronic Journal Report

Operation

OFF SET

PL20.0 10.0 18.7 12.7

10.1 10.2

32.0

Operating Procedure

Program Data Verification

Department LC and Status Read

Department Preset Price Read

66.6 01.7

PLU Table Read

Other Programmed Data Read

System Option Read

02.2

Paper Roll Replacement and Other Maintenance

Replacing the Paper Roll When used for receipt

Replacing the Paper Roll When used for journal

EO1-11115 MA-186-100 Series

Replacing the Ink Ribbon

REG7 Offz SET

Replenishing Ink to the Store Name Stamp

Allow time for ink to saturate the stamp

Manual Drawer Release and Lock

Battery Exchange

Removing the Drawer

Changing the Layout of the Money Case

Media Slot

Case of the Power Failure

Troubleshooting

Trouble concerning Power Supply Power is not turned on

Been selected. . System Option Setting, Address 2 Bit 7 on

Paper roll wrinkles

Printer prints nothing

Printing as a whole is too light

Printing gets stained

Trouble concerning Drawer Drawer does not open

Trouble concerning Display Display displays nothing

Trouble during Normal Operations

Normal operations cannot be carried out

Error tone beeps

Setting, Address 16 Bit 1 on

System Option Setting, Address 2 Bit 8 on

Bit 1 on

Operating Procedure

Status Clear and Memory Clear Operations

Status Clear

27.1

OperationX

Sales Memory Clear

05.- 28.- 9 00.1

An All Memory Clear receipt is issued

All Memory Clear

Size of Paper Roll

Specifications

Amount and Counter Totals in Report Memory

Specifications are subject to change without notice

Memory Protection

Date

Company Name Address City Country Your Name Phone ZIP Code

Toshiba TEC Model MA-186-100

Unit Price QTY Amount Stamp

EO1-11115 MA-186-100 Series

Page

Page

TEC